Summary:

- Abbott Laboratories is a Dividend Aristocrat more than twice over.

- The healthcare juggernaut exceeded analysts’ expectations for both sales and adjusted diluted EPS during the second quarter.

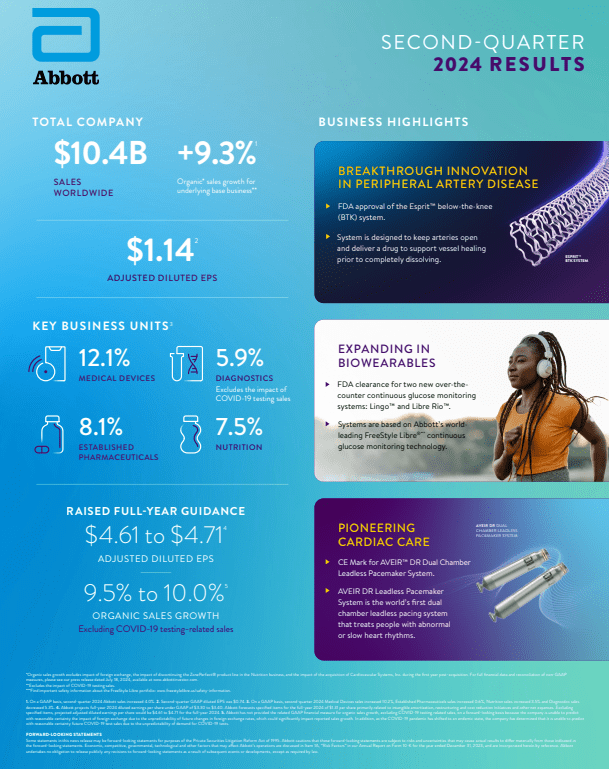

- Abbott Laboratories’ $7.5 billion net debt balance is modest for its size.

- Shares of the stock could be trading at a 5% discount to fair value.

- Abbott Laboratories is positioned to generate 25% cumulative total returns by the end of 2026.

A doctor and patient talk to each other at an appointment. Morsa Images/DigitalVision via Getty Images

In this world, financial obligations are never-ending. Another day of work also means another day of accruing self-employment taxes that must be paid quarterly. Another week means another trip (or two) to the grocery store. Another month is another month of health insurance premiums. You get the picture.

This is exactly why I crave consistency in my dividend growth portfolio. As long as I’m alive, the bills will keep on coming. As somebody trying to achieve financial independence in the next decade, I must set my portfolio up with durable and growing income to position myself for success.

Thus, my portfolio consists almost entirely of established dividend growers. They don’t come any more reliable than the Dividend Aristocrats and the Dividend Kings. The former is any S&P 500 (SP500) component with at least 25 consecutive years of dividend growth. The latter is any business that has upped its dividend for 50 years or more.

The healthcare sector conglomerate Abbott Laboratories (NYSE:ABT) is one company that meets the criteria to be both a Dividend Aristocrat and a Dividend King. When I last covered the stock with a buy rating in May, I was encouraged by the company’s continued innovation with product launches. I also liked ABT’s AA- credit rating from S&P on a stable outlook. Best of all, the stock was priced at a slight discount to my fair value estimate.

Today, I’m going to be reiterating my buy rating. On July 18th, ABT shared impressive second-quarter results. The company recorded its 12th double beat in the last 13 quarters. Recent U.S. Food and Drug Administration clearance of two over-the-counter continuous glucose monitoring systems also bodes well for ABT. The company’s balance sheet is also pristine. Finally, shares of ABT still offer some value from the current share price.

A Solid Quarter And More Promise Ahead

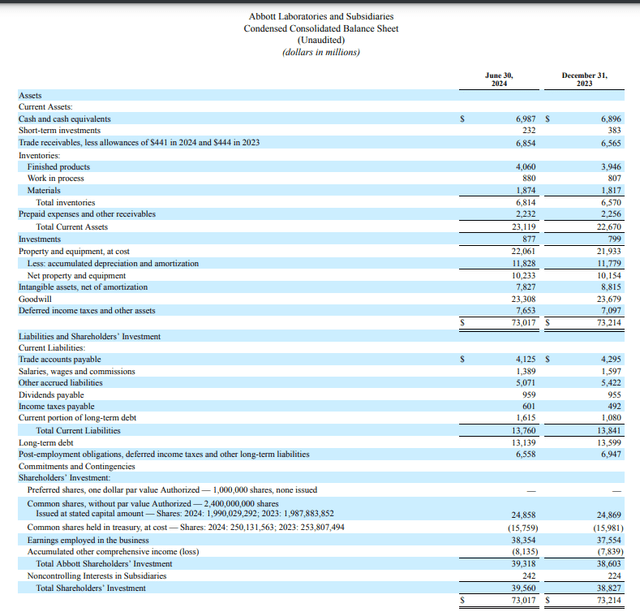

ABT Q2 2024 Infographic

In my view, ABT had a great second quarter. The company’s sales grew by 4% over the year-ago period to $10.4 billion during the quarter. That topped Seeking Alpha’s analyst consensus by $30 million. Excluding foreign currency exchange headwinds, this growth would have been 7.4% for the quarter.

As has been the case in past quarters, this growth was due to strength in ABT’s Medical Devices, Nutrition, and Established Pharmaceuticals segments.

ABT’s Medical Devices segment sales surged 10.2% (and 12.1% organically) to $4.7 billion in the second quarter. Growth in the segment was led by 18.4% growth in FreeStyle Libre sales to $1.6 billion during the quarter. That was made possible by continued market share gains for the CGM franchise and growth from recently launched products like TriClip, Amulet, and Navitor.

ABT’s Nutrition segment posted almost $2.2 billion in net sales for the second quarter, which was a 3.5% year-over-year growth rate (and 7.5% organically). This topline growth was the result of market share gains of Ensure and Glucerna, as well as its infant formula business.

ABT’s Established Pharmaceuticals segment recorded $1.3 billion in net sales in the second quarter. For context, that was a 0.6% growth rate (and 8.1% organically). Substantial foreign currency challenges were more than neutralized by growth in its cardiometabolic, gastroenterology, and pain management therapeutic areas.

The Diagnostics segment was again ABT’s only segment that didn’t record topline growth. The segment’s sales declined by 5.3% over the year-ago period to $2.2 billion during the quarter. This was because of a 61.2% plunge in worldwide COVID-19 testing sales to just $102 million.

Factoring out diminished COVID-19 testing sales and unfavorable foreign currency exchange, ABT’s global diagnostics revenue grew by 5.9% organically. That was thanks to the Alinity family of diagnostic systems. This includes the point-of-care diagnostic blood test used to diagnose concussions called iSTAT Alinity approved in April, which I discussed in my previous article.

ABT’s adjusted diluted EPS rose by 5.6% year-over-year to $1.14 for the second quarter. That came in $0.04 ahead of Seeking Alpha’s analyst consensus in the quarter.

Disciplined cost management helped ABT’s non-GAAP net profit margin expand by 30 basis points to 19.3% during the second quarter. This is how adjusted diluted EPS growth outpaced topline growth for the quarter.

ABT has its share of elements that could be catalysts in the years to come. The Protality nutrition shake launched in January that I noted in my last article is one. This product can help patients on GLP-1 medications to keep muscle mass while they lose weight.

The aforementioned iSTAT Alinity concussion test is another. Each year, millions of people go to the emergency room to check for concussions. This product could make the process smoother and more efficient than it has been in the past.

Lastly, the FDA cleared over-the-counter CGMs, Lingo and Libre Rio in June. The former is meant for consumers who want to improve their overall health. The latter is designed for adults with type 2 diabetes who don’t use insulin and manage diabetes via lifestyle modifications, per CEO Robert Ford’s opening remarks during the Q2 2024 Earnings Call.

The markets in the U.S. and Western Europe comprise an adult population of around 400 million people. Ford estimates that even a single-digit penetration rate and a few censors a year would represent a multi-billion-dollar opportunity alone. Even for a company like ABT, that’s a meaningful growth market.

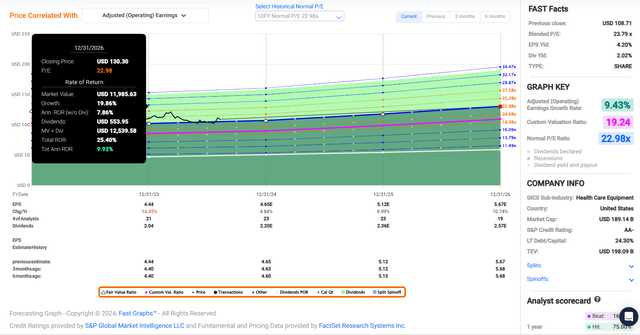

This is why after 4.8% growth to $4.65 in adjusted diluted EPS in 2024, growth is expected to ramp up. For 2025, the FAST Graphs analyst consensus is that adjusted diluted EPS will rise by 10% to $5.12. In 2026, another 10.7% growth to $5.67 is anticipated.

ABT is also a financially vibrant business. As of June 30, the company’s net debt position (cash and cash equivalents plus short-term investments minus the current portion of long-term debt and long-term debt) was $7.5 billion. Annualizing ABT’s first-half EBITDA gives a figure of $9.5 billion. That is a net debt to EBITDA ratio of just 0.8. This strong leverage ratio is why ABT possesses an AA- credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to ABT’s Q2 2024 Earnings Press Release, ABT’s Q2 2024 Infographic, and ABT’s Q2 2024 10-Q Filing).

Fair Value Is Closing In On $115 A Share

Since my prior article, shares of ABT have edged 4% higher versus the 1% gains of the S&P. Even so, I believe there is still enough value to warrant a continued buy rating.

ABT’s shares are trading at a current-year P/E ratio of 23.2, which is right around the 10-year normal P/E ratio of 23 per FAST Graphs. Moving forward, I believe that the company’s fair value multiple remains around 23.

This is because ABT’s three-year forward annual adjusted diluted EPS growth outlook is 9.4%. That’s in line with the 10-year average of 8% annually. This suggests that ABT’s growth prospects are intact.

After this week concludes, the calendar year 2024 will be nearly 64% complete. That means 36% of 2024 and another 64% of 2025 is yet to come in the next 12 months. This is how I weighed the 2024 and 2025 analyst consensus to arrive at a forward 12-month adjusted diluted EPS input of $4.95.

Applying my fair value multiple to ABT, I compute a fair value of $114 a share. This implies that the stock is priced 5% below fair value. If ABT meets the growth consensus and returns to fair value, it could produce 25% cumulative total returns through 2026.

Dividend Growth Shouldn’t Stop Anytime Soon

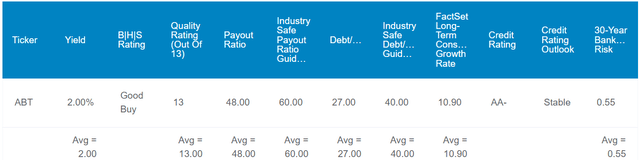

The Dividend Kings’ Zen Research Terminal

ABT’s 2% forward dividend yield is moderately above the healthcare sector median forward yield of 1.5%. This is sufficient for a B grade from Seeking Alpha’s Quant System for forward dividend yield.

On top of this above-average starting income, ABT boasts a 51-year dividend growth streak. If that wasn’t enough, the company’s payout has grown at an admirable rate. In the past three years, the dividend has compounded by 8.1% annually. That’s better than the sector median of 5.7% per the Quant System.

In the years to come, the Quant System anticipates 7.6% annual dividend growth. That would again be above the projected sector median of 5%. This is enough for ABT to earn a B+ for forward dividend growth.

That dividend growth can be supported by a conservative payout ratio. ABT’s payout ratio for 2024 should be in the high-40% range. This is below the 60% payout ratio that rating agencies view as desirable for the industry according to The Dividend Kings’ Zen Research Terminal. That’s why I’m confident ABT has promising dividend growth in its future.

Risks To Consider

ABT’s product launches are helping it to get out of its post-COVID lull and to revitalize growth. However, the business isn’t free from risk.

ABT operates in highly competitive industries. Although research and development is necessary to drive innovation, R&D itself isn’t a guarantee of innovation. Spending around 7% of its sales on R&D, ABT is showing the commitment needed to keep thriving. If innovation can’t keep pace with competitors, though, ABT’s growth could still come up short.

Another risk to the company is the potential for a major legislative overhaul in key markets like the United States. If that happened, ABT’s profit margins could be adversely impacted. This could harm the company’s overall fundamentals.

One last risk to ABT is that 61% of its 2023 net sales were derived outside of the United States (page 15 of 239 of ABT’s 10-K Filing). At any time, unfavorable foreign currency translation could be a headwind. Any geopolitical unrest in major markets could also cause disruptions to the business.

Summary: A Reasonable Price To Pay For Quality

ABT is a premier dividend growth stock. It is just one of just four dozen other stocks that qualify as a Dividend King. The trifecta of strength from existing products, recent product launches, and the clearance of its two over-the-counter CGMs are all reasons for optimism. ABT’s balance sheet positioning is also enviable.

Even with all these things going for it, shares look to be reasonably valued. Together, this yields a high probability of double-digit annual total returns in the years ahead. That’s why I’m maintaining my buy rating here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.