Summary:

- Abbott’s adjusted diluted EPS payout ratio is going to expand significantly from the mid-30% range in 2022 to the mid-40% range in 2023.

- Reduced demand for COVID-19 testing saw the healthcare company’s revenue and adjusted diluted EPS shrink in the first half of 2023.

- Abbott’s interest coverage ratio was just shy of 30 through the first six months of 2023.

- Shares of Abbott look to be trading at a 3% discount to fair value based on my inputs into the dividend discount model and discounted cash flows model.

- Abbott’s 2% dividend yield and high- single-digit annual earnings growth potential could produce 10% annual total returns in the years to come.

A golden crown set with jewels. MirasWonderland

If you’re reading this article, there’s a good chance, that like me, you are an investor who is focused on dividends. This means that either you are aiming to one day replace your active or working income with passive income, or you would like to at least have that option.

Maintaining financial independence depends on your ability to keep your dividend income growing at least as fast as expenses. That is because, without consistently growing dividend income, the purchasing power of your portfolio’s dividends will diminish. Fortunately, there are hundreds of publicly traded companies that have a track record of growing dividends.

Among these publicly traded companies, the Dividend Kings are the most proven, with reputations of at least 50 consecutive years of dividend growth. The diversified healthcare company Abbott Laboratories (NYSE:ABT) is one of just roughly four dozen Dividend Kings, and it looks like a buy for dividend investors. Let’s check out the company’s fundamentals, discuss its risks, and highlight its valuation to work out why.

The Dividend Remains Secure

Abbott’s 2% dividend yield is measurably higher than the 1.5% yield of the S&P 500 index. The icing on the cake is that investors are hardly sacrificing dividend growth for this higher starting income: Abbott has grown its dividend by 11.7% annually over the last 10 years. In even better news, the most recent dividend increase of 8.5% announced last December extended its dividend growth streak to 51 years straight. This decent dividend growth rate suggests that dividend growth is holding strong.

There is also reason to believe that this should persist in the years that lie ahead. Abbott recorded $5.34 in adjusted diluted EPS in 2022. Against the $1.88 in dividends per share that were paid that year, this is equivalent to a 35.2% adjusted diluted EPS payout ratio.

Due to the downtick in COVID-19 testing volumes, the analyst consensus is that Abbott will log $4.39 in adjusted diluted EPS in 2023. Coupled with dividends per share of $2.04 that will be paid this year, that works out to a 46.5% adjusted diluted EPS payout ratio. This is markedly more than it was just a year ago. But as adjusted diluted EPS grows beyond its 2022 levels by 2026 as forecasted by analysts, the payout should stay somewhere in the 40% range moving forward.

This is a viable payout ratio that should allow Abbott to hand out dividend hikes in line with adjusted diluted EPS growth over the long haul. That is why I believe a 7.75% annual dividend growth rate is a projection that Abbott can achieve in the long term.

A Business That Can Rebound

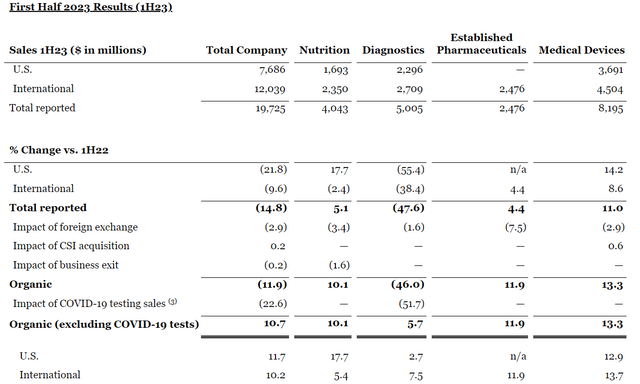

Abbott Q2 2023 Earnings Press Release

Asserting that Abbott hasn’t had the smoothest 2023 would be an understatement. The company’s total net sales for the first half of the year dropped by 14.8% year over year to $19.7 billion.

But a closer look at these results arguably tells us that things are going just fine for the healthcare giant with one notable exception. As the COVID-19 pandemic has largely waned, so has the demand for Abbott’s BinaxNOW COVID-19 test. This was the major contributing factor to the 47.9% decline in diagnostics segment revenue to $5 billion through the first half of 2023. Abbott’s three other segments of nutrition, established pharmaceuticals, and medical devices each posted net sales growth over the year-ago period. Excluding the drop-off in diagnostics segment net sales that was expected, Abbott’s organic net sales surged 10.7% higher in the first half of 2023.

The company’s adjusted diluted EPS plunged by 33.2% year over year to $2.11 for the six months ended June 30. Predictably, a slower reduction in expenses than in the net sales base resulted in a 550 basis point drop in profit margin to 18.8%. This couldn’t be entirely offset by a reduction in the diluted share count from Abbott’s share repurchase program, which is why adjusted diluted EPS fell much faster than net sales in the first half.

The silver lining for the company looking toward the future is that it has already taken the brunt of lower COVID-19 test volumes. This means the base business will play a larger role in results in the quarters ahead. That explains how analysts believe that net sales will grow by 5% in 2024, which will help to power adjusted diluted EPS higher as well.

Finally, Abbott is a financially healthy business: The company’s interest coverage ratio for the first half of this year was 29.3. Such a strong interest coverage ratio can help the company easily cover its debt-related expenses in just about any scenario (details sourced from Abbott Q2 2023 earnings press release).

Risks To Consider

Abbott is undoubtedly a blue-chip business. However, that doesn’t mean that it comes without risks to current or prospective shareholders.

Thanks to its innovative corporate culture, Abbott has thrived in a highly competitive space. If the company wants to have a chance to build on its success, it will have to keep taking the steps necessary to foster ingenious inventions through research and development. Otherwise, a lack of new product launches could cause Abbott to stagnate and struggle to drive further growth.

On the regulatory front, U.S. and international regulators may change regulatory requirements. That could raise compliance costs for Abbott or affect coverage or reimbursement for its products (info according to pages 12 and 13 of 114 of Abbott 10-K).

Abbott Is Sensibly Priced

Depending on the quality and growth prospects of a business, it may be okay to pay slightly more than fair value for a business. But as an investor, you should never grossly overpay for ownership of any company. To establish a fair value for shares of Abbott, here are two valuation models.

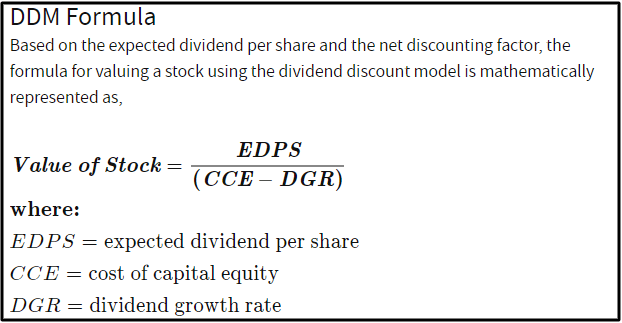

Investopedia

The first valuation model that I will utilize to appraise Abbott’s shares is the dividend discount model, or DDM. This consists of three inputs.

The first input in the DDM is the dividend per share on an annualized basis. Abbott’s annualized dividend per share is $2.04.

The second input for the DDM is the required annual total return rate. Since my personal preference is 10%, that is what I’ll be using for this input.

The third input in the DDM is the annual dividend growth rate. As noted above, I will assume 7.75% for Abbott.

Using these inputs for the DDM, I get a fair value of $90.67 a share. This represents a 12.3% premium to fair value and poses a 10.9% downside from the current price of $101.80 a share (as of September 15, 2023).

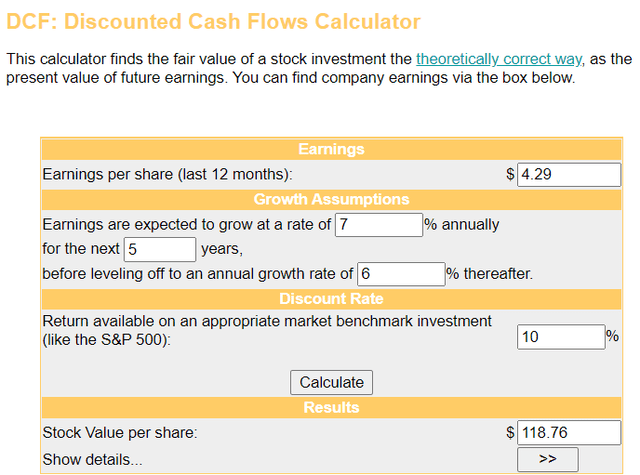

The second valuation model that I’ll employ to estimate the fair value of shares of Abbott is the discounted cash flows or DCF model. This also has three inputs.

The first input into the DCF model is the last 12 months of reported adjusted diluted EPS. Abbott has posted $4.29 in adjusted diluted EPS in the past four quarters.

The next input for the DCF model is growth assumptions. I will use a 7% annual adjusted diluted EPS growth rate for the first five years and model a deceleration to 6% thereafter.

The last input into the DCF model is the discount rate, which is simply the annual total return rate. Again, I’ll use 10%.

Applying these inputs to the DCF model, I arrive at a fair value of $118.76 a share. That suggests shares of Abbott are priced 14.3% under fair value and could have a 16.7% upside ahead of the current share price.

Averaging these fair values together, I compute a fair value of $104.72. This would mean Abbott’s shares are trading at a 2.8% discount to fair value and may offer 2.9% capital appreciation from the current share price.

Summary: An All-Weather Dividend Stock To Add To Your Portfolio

No matter what’s going on in the world around us, it’s potentially a safe bet that Abbott’s dividends will climb higher year after year. For one, the company’s dividend payout ratio is in a goldilocks zone. Not to mention that barring the temporary COVID growth catalyst and the eventual decline that stemmed from it, Abbott is a reliable business that sells highly demanded products.

With shares of the stock appearing to be slightly discounted, I believe Abbott is worth buying around or below the $100 share price mark. An entry yield of 2% paired with upper- single-digit annual adjusted diluted EPS growth should generate solid future total returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.