Summary:

- Abbott Laboratories is a diversified healthcare supplier with a focus on medical devices, nutrition, diagnostics, and pharmaceuticals.

- The company experienced a surge in share price due to COVID-19 testing but has since stagnated.

- Abbott has demonstrated an ability to scale innovations across the globe and beat the underlying market by nearly double in many cases.

Halfpoint

I am initiating coverage on Abbott Laboratories (NYSE:ABT) following the analysis I completed for continuous glucose monitoring on a related stock.

Abbott Laboratories is a diversified healthcare supplier. Its largest business is medical devices, followed by nutrition, diagnostics, and established (generic) pharmaceuticals.

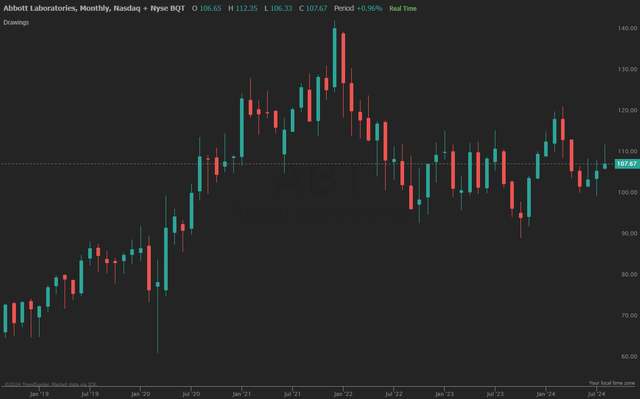

Abbott was a major beneficiary of COVID-19 testing, which drove a run-up in the share price from 2020 to 2022, but the stock has largely stagnated since then.

Abbott Price Target (TrendSpider)

Abbott’s stock has fluctuated following the decline in COVID testing, major lawsuits, and the difficulty of dissecting financials. However, digging into and normalizing the results, I see that this is a strong and growing business that is executing well on nearly every front.

The primary bear case for Abbott has been that they are not as innovative as smaller competitors in the medical tech space, without major breakthroughs. I see it differently. I see a company that develops solid tech, improving on what already exists, and then scales it globally using its sales network and industry expertise. The value is in the scaling, which has allowed them to beat the overall industry across every business.

With the above in mind and a price target of $127.50, 19% upside to today’s pricing, I rate Abbott a buy.

Long-Term Value Generation Via Scaling

Henry Ford didn’t invent the car, he improved production with the assembly line. Same with Sega and Nintendo, Indiegogo and Kickstarter, and so many others throughout time.

And that same process is the value driver behind Abbott. Developing technologies where there are often other solutions on the market, but scaling them and marketing them better. This strategy has allowed Abbott to not only drive diverse revenue streams, but to grow each one above the market.

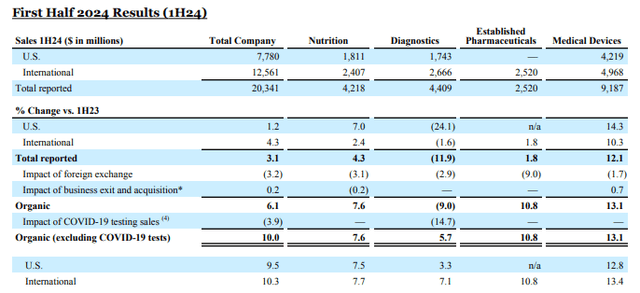

Here are Abbott’s growth rates so far for the year.

1H24 Results (ABT Investor Relations)

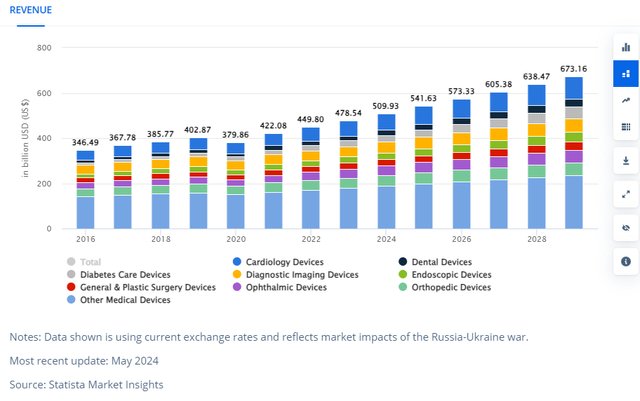

Starting with medical devices, the global industry is expected to grow at 5.7% through 2029 while Abbott’s organic growth has been north of 10%.

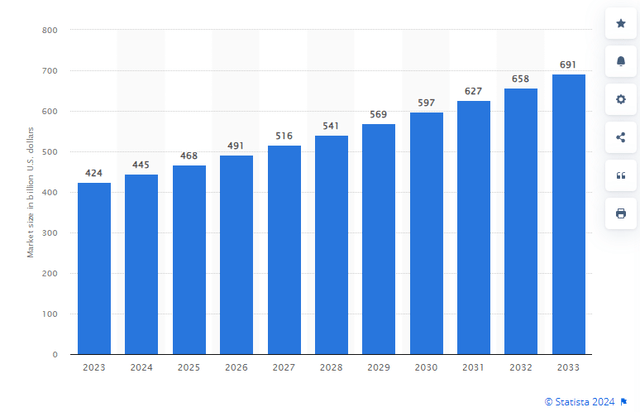

Medical Device Industry CAGR (Statista)

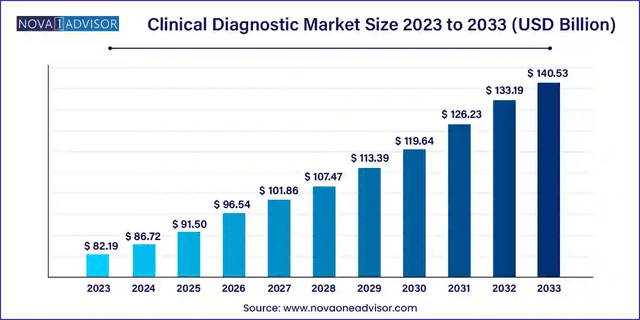

The diagnostics market is expected to grow at 6.2% through 2033 while Abbott has been growing at 5.7% excluding the impact of COVID.

Clinical Diagnostics (Nova 1 Advisor)

The established pharmaceutical market is expected to grow at 5%, while Abbott has been delivering 10.8% growth.

Established Pharmaceutical CAGR (Statista)

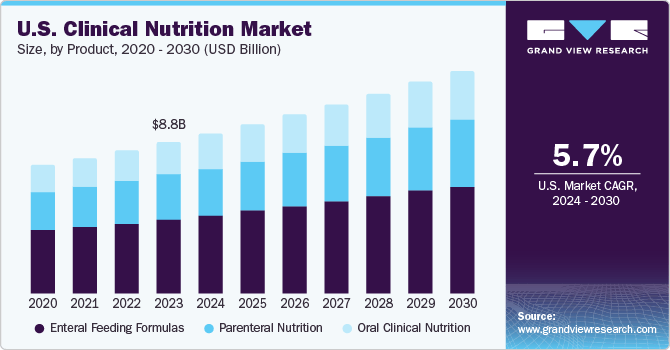

The Clinical Nutrition market is expected to grow at 5.7% through 2030 while Abbott has been growing the business at 7.6%.

Clinical Nutrition CAGR (Grandview Research)

Even if Abbott were to just grow with the market, this would be a 6-7% growth business. However, their scale allows them to tap in to each part of the market and leverage the best opportunities, which, I believe, will continue to drive outsize growth for the business.

Valuation

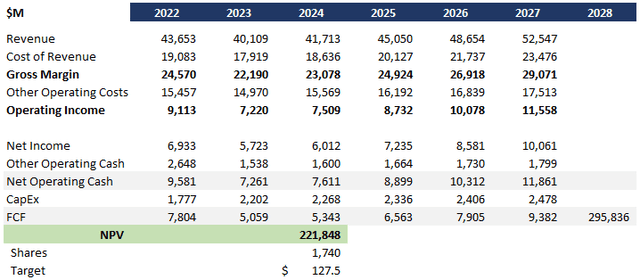

I ran a DCF analysis on Abbott to generate a fair price target. I made the following overall assumptions:

- 8% near-term revenue growth at the low end of management guidance

- 4% near-term cost growth based on the healthcare industry cost forecast, backed off by 2ppt to account for the lower mix of physicians/nurses relative to the industry

- 8.33% discount rate based on Abbott’s estimated WACC

- 5% long-run growth rate based on blended long-term growth rates shown above, hedged back for scale and cost base

This DCF analysis generates a price target of $127.50, 19% upside from today’s prices.

Abbott DCF Analysis (Data: SA; Analysis: Mike Dion)

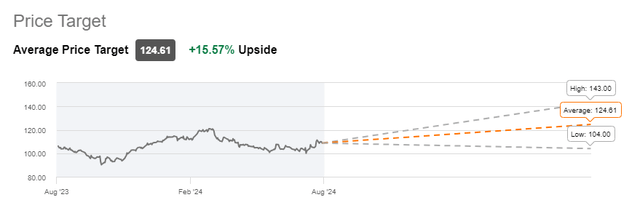

Wall Street analysts are also bullish, with an average price target of $124.61, a 16% upside from today’s prices. The overall range of $104-143 suggests the current price is near the bottom.

Wall Street Rating (Seeking Alpha)

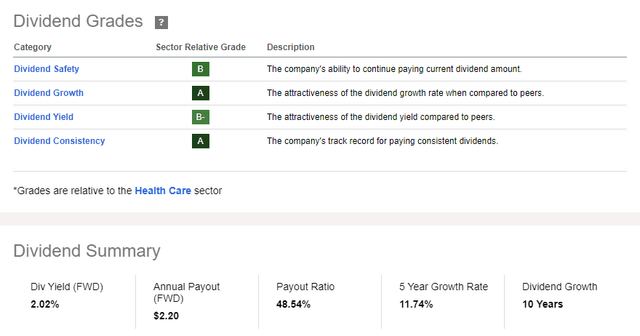

Abbott also boasts a solid dividend that has grown for 10 years and adds another 2% to the return potential for the stock. The dividend is also safe by nearly every metric.

Dividend Grade (Seeking Alpha)

Downside Risk

The biggest downside risk for Abbott is the formula lawsuits impacting the nutrition business. Lawyers have been actively soliciting patients, and news about settlement amounts have spanned from $200 to 400 million or more.

Abbott Formula Lawsuit Ad (Hughes & Coleman Injury Lawyers)

While current reports suggest the lower end of the settlement, Abbott has the potential for some additional litigation and claims in this slightly risky business that needs to be considered as part of the risk profile. Were it not for this risk, I would be leaning heavily towards a strong buy rating.

Verdict

Abbott Laboratories is an extremely well-diversified business that has leveraged its scale to drive growth well above the market across nearly its entire portfolio. The business has a stable dividend that has grown annually for 10 years. The primary risk to the business is lawsuits related to the medical nutrition business, although margin of safety covers a substantial portion of this risk.

I believe Abbott will continue using its large R&D investments to deliver and scale new technologies across the globe and continue giving outsize performance. With a DCF generated price target of $127.50 (supported by Wall Street at $124.61), I rate Abbott a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.