Summary:

- Abbott Laboratories will announce Q1 2023 earnings ahead of market open tomorrow, Wednesday April 19th.

- ABT stock price has been underperforming for some time – I don’t see upcoming earnings resolving that issue.

- Abbott remains under investigation for quality issues at its infant formula manufacturing plant in Michigan, and recently recalled millions of its best-selling Freestyle Libre product.

- The market knows revenues will shrink in 2023 as COVID test revenues fall.

- I am a little concerned for Abbott’s Q1 2023 earnings – the company usually outperforms, and remains a Top 10 blue chip healthcare stock, but I sense a downward correction.

Sundry Photography

Abbott Q1 2023 Earnings Preview

Abbott Laboratories (NYSE:ABT) is set to announce its Q123 earnings tomorrow ahead of market open.

Abbott is amongst the 10 largest listed healthcare stocks in the U.S., with a market cap valuation of $181.7bn at the time of writing. Had the company not opted to spin out the bulk of its pharmaceuticals business into a new company, AbbVie Inc. (ABBV), back in 2012, it may well have been the largest, given AbbVie today markets and sells the world’s best selling drug in Humira, and has a market cap valuation of $285bn.

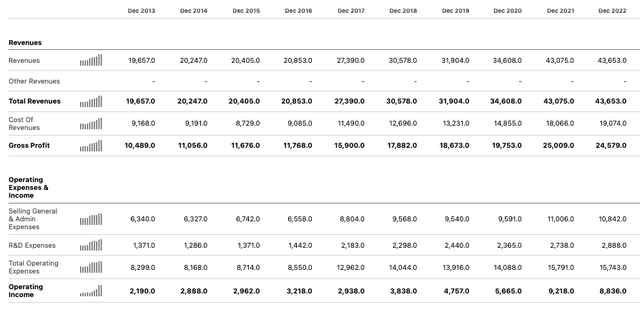

As I discussed in a note on Abbott for Seeking Alpha at the end of January, it has traditionally been a fundamentally strong company. It has an enviable track record of growing revenues and operating income in every year since the spinoff of AbbVie – that is, at least until last year.

Abbott income statements to 2022 (Seeking Alpha)

I also noted that Abbott’s share price had performed exceptionally well for shareholders between 2013 and the end of December 2021, rising in value from ~$35 per share, to an all-time peak of ~$141 – a gain of >300%, which comfortably outperforms the S&P 500 (SP500) over the same period.

Since reaching its peak share price value of >$140, however, as I noted at the end of January, the stock price has tended to drift downward, hitting lows of ~$95 in October 2022, and ~$97 in early March this year, before a slight recent bull run dragged it back up to its current value of $105.

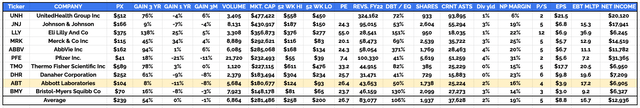

investment fundamentals – 10 largest US listed healthcare cos. compared (data sourced from TradingView, Google Finance)

As we can see in the above table, Abbott compares reasonably well to its Top 10 healthcare rivals by most investment measures, e.g., price to sales, price to earnings, dividend yield, and debt to equity, performing slightly better than average in all 4 categories.

Abbott does not have the sales volumes of some of its rivals, its net profit margins are a little lower, and the EBITDA multiple is a little higher. But most concerning, arguably, is ABT’s share price performance – Abbott is the worst performing stock over a 3-year period, and the second worst performing stock over a 1-year, and 3-months period.

In this post, ahead of the company’s announcement of its Q1 2023 earnings ahead of market open tomorrow, I’ll try to take a deeper dive look at the company, highlight where some of the problems may lie that are restricting share price growth, and highlight some issues to look out for in the latest earnings release.

Abbott Overview & Recent Performance – Contaminated Infant Formulas Damage Reputation

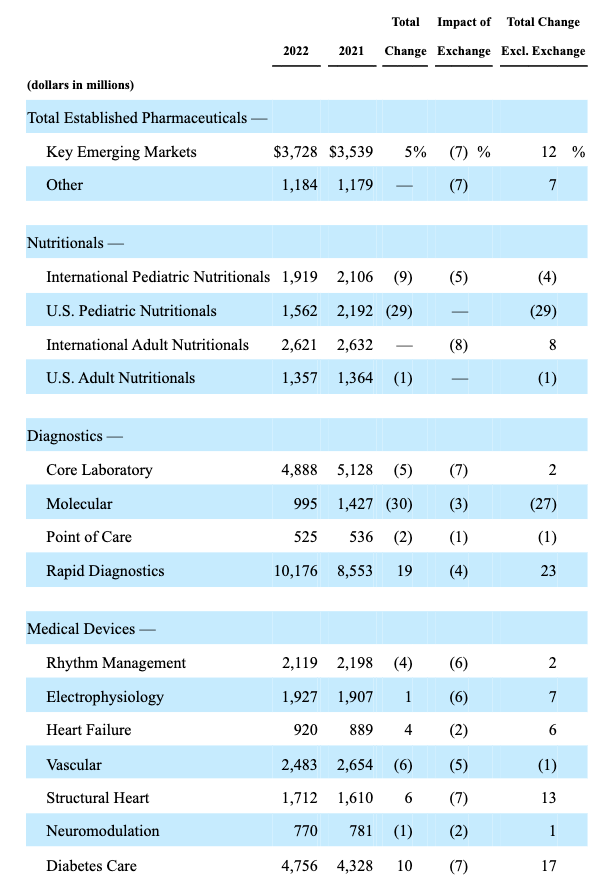

Abbott’s business is divided into 4 divisions – Nutrition, Diagnostics, Established Pharmaceuticals, and Medical Devices. First, let’s take a look at performance by division in 2022 versus 2021.

Abbott revenues by division 2022 vs 2021 (Abbott 10K submission 2022)

Established Pharmaceuticals, a division defined by Abbott as “international sales of a broad line of branded generic pharmaceutical products” performance – there does not seem to be too much to be concerned about here, and if all of Abbott’s divisions were showing currency-adjusted double-digit annual growth, the share price would likely be more buoyant.

Looking at Nutritional, however, we can immediately see that there has been a problem within Pediatric Nutritionals, which Abbott explains as follows:

The 28.7 percent decrease in U.S. Pediatric Nutritional sales in 2022 reflects the impact of the voluntary recall and production stoppage of certain infant powder formula products manufactured at Abbott’s facility in Sturgis, Michigan.

A whistleblower report drew authorities’ attention to the Sturgis plant last year, and investigators found evidence of Cronobacter sakazakii bacteria at the facility. Abbott recalled its Similac, Elecare and Alimentum products that had been manufactured at the plant, but not before 2 infants who had been using Abbott’s formulas died from cronobacter infections.

Although the Sturgis plant is back online, the product recall last year triggered a nationwide shortage of baby formula. The events have damaged Abbott’s reputation and the company remains under investigation by the Securities and Exchange Commission (“SEC”), Federal Trade Commission (“FTC”), and Department of Justice (“DoJ”). FDA commissioner Robert Califf has said the plant inspections uncovered “shocking” and “egregiously unsanitary” conditions. Lawsuits have also been filed against Abbott.

Abbott has attempted to defend itself, commenting that cronobacter strains found at the Strugis plant did not match those genetically sequenced from the sick infants, but the damage has been done – reputationally – infant formulas and the companies that make them stand accused of overly aggressive marketing campaigns and promoting their formulas over breastmilk – and in terms of market share – Abbott’s ~40% share of the infant formula market in the U.S., and likely abroad also, must surely be under threat.

COVID Testing Volumes A Double-Edged Sword?

If the Sturgis plant issues struck at one of Abbott’s core businesses, and threatens to cause long-term damage to that business, then Abbott’s experience with providing COVID testing caused a very different set of problems.

As we can see in the table above, within the diagnostics division molecular revenues fell by 27%, whilst rapid diagnostics revenues increased to >$10bn – both of these fluctuations are related to COVID testing, as discussed in Abbott’s 10K.

Molecular Diagnostics COVID-19 testing-related sales were $411 million in 2022, $891 million in 2021, and $1.0 billion in 2020.

In other words, this segments’ revenues were substantially inflated by COVID testing revenues – an area in which Abbott made a key contribution in the U.S. and abroad during the pandemic, but began to decline in 2022.

On the other hand, the Rapid Diagnostics segment continued to grow in 2022 thanks to COVID testing – to >$10bn, versus $8.6bn in 2021, and only $4.4bn in 2020. The issues here for Abbott is that it is very likely that Rapid Diagnostics performance in 2023 will mimic Molecular Diagnostics in 2022 and begin to fall, as although COVID remains a global threat, far less testing is being done. Abbott’s Chairman and CEO Robert Ford admitted as much on the Q422 earnings call with analysts:

In total, we have delivered nearly 3 billion COVID tests globally since the start of the pandemic. Going forward, we expect COVID-19 to transition to more of an endemic seasonal type of respiratory virus. And with that, COVID testing, while still important, is expected to decline significantly.

As much as COVID testing revenues helped Abbott increase its total revenues from $34.6bn, to $43.1bn in 2021, and maintain the near $10bn revenue uplift in 2020, when revenues reached $43.7bn, where COVID revenues are concerned, what goes up, tends to come down. Just ask Pfizer (PFE) – astonishingly, despite Pfizer’s COVID vaccine and antiviral generating >$100bn for the company in additional revenues in 2021 and 2022, Pfizer’s share price trades at the same price today as it did in November 2018, and July 2019.

As such, as bizarre as it may seem, Abbott’s share price may be being punished for an inability to sustain the COVID testing revenue uplift long-term. Abbott provided some FY23 guidance when announcing its Q422 earnings (revenues decreased by 12% on a reported basis owing to falling COVID revenues) as follows:

- Abbott issues full-year 2023 guidance for diluted EPS from continuing operations on a GAAP basis of $3.05 to $3.25 and full-year adjusted EPS from continuing operations of $4.30 to $4.50.

- Abbott projects full-year 2023 organic sales growth, excluding COVID-19 testing-related sales, of high-single digits4 and COVID-19 testing-related sales of around $2.0 billion.

Diluted EPS in FY22 was $3.91, and adjusted EPS $5.34, so Abbott’s diluted EPS performance will decline by nearly 20% year-on-year if guidance is met, and adjusted EPS by ~17%.

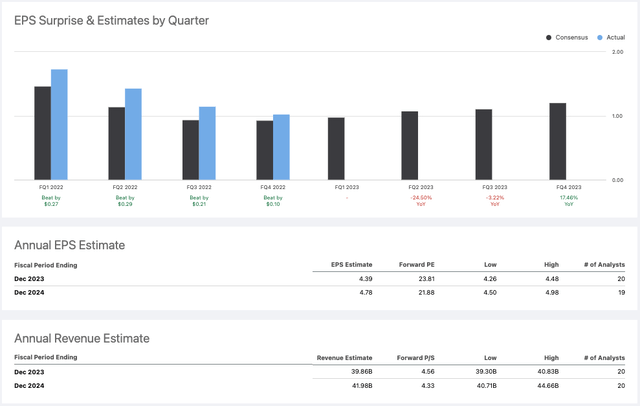

Abbott EPS and revenue consensus forecasts for 2023 (Seeking Alpha)

As we can see above, Abbott’s shareholders have been used to earnings outperformance for the past several quarters, but they have also had to put up with falling EPS, and although the high single digit growth promised ex-COVID is encouraging, COVID testing revenues were reportedly $8.4bn in 2022, and $7.7bn in 2021, meaning management believes they will fall by ~$6.4bn in 2023, meaning the organic ex-COVID growth will not nearly compensate for the falling COVID revenues, and Abbott’s top line revenues will likely shrink in every quarter this year compared to last year.

Unfortunately for Abbott shareholders, that is not a recipe for share price growth. In fact, it may take a substantial earnings beat just to keep the share price on an even keel, but my suspicion is we may see an earnings miss as the forecast COVDI revenues of $2bn looks a smidgen too high for me.

Medical Devices To The Rescue? Freestyle Libre 3 Now Abbott’s Most Valuable Asset

With problems to content with in its Nutritional and diagnostics segments, Abbott’s must look to its Medical Devices division for some help generating some positive news flow.

Going back to our revenues table, we can see that the Diabetes Care segment generates the largest revenues. As Abbott explains in its 2022 10K submission:

The 2022 and 2021 growth in Diabetes Care sales was driven by continued growth of FreeStyle Libre, Abbott’s continuous glucose monitoring system, in the U.S. and internationally. FreeStyle Libre sales totaled $4.3 billion in 2022, which reflected a 22.4 percent increase, excluding the effect of foreign exchange, over 2021. FreeStyle Libre sales totaled $3.7 billion in 2021, which reflected a 36.8 percent increase, excluding the effect of foreign exchange, over 2020 when sales totaled $2.6 billion.

What should we expect from Freestyle Libre in 2023? The outlook appears quite positive, given that in early March the Centers for Medicaid and Medicaid Services (“CMS”) opted to expand coverage for continuous glucose monitoring (“CGM”) devices. That is obviously a bonus for Abbott’s major rival in this space, DexCom, Inc. (DXCM), which markets and sells a pricier, but arguably more sophisticated version of the Freestyle Libre, but nevertheless ought to help Abbott drive another year of >20% revenue growth from this source.

In March also, the FDA cleared both the Freestyle Libre 2 and 3 versions for integration with automated insulin delivery (“AID”) systems, allowing Abbott to take a step closer to providing the complete “artificial pancreas” package. Again, this can only be a positive for Abbott, providing of course there are no issues with product safety. More good news is that research suggests the CGM market could reach >$31.5bn in value by 2031.

Abbott’s CEO has declared that Freestyle Libre is a double-digit billion selling product in waiting, and research appears to back that up, although, as I noted in January, double digit billion revenues:

would see the user base increase from ~4.5m today, driving $1k of revenue each, to >10m, presumably. Given that there may only be 8.4m Type 1 diabetics worldwide, however, that may be too ambitious a target.

Although, at one stage Abbott may have envisaged that its CGM devices could find a market in Type 2 diabetics, the emergence of drugs such as Novo Nordisk’s (NVO) and Eli Lilly’s (LLY) Mounjaro – both forecast to drive >$25bn in annual revenues from Type 2 diabetics – may restrict Freestyle’s ability to grow in this market.

It’s certainly true that not everyone is a fan of CGMs, and even though Freestyle Libre 3 is 70% smaller than the previous version, wearable devices are not traditionally popular and if alternative solutions are available, consumers will certainly consider them. This suggest to me that the device will not necessarily become a $10bn per annum home run in a few years’ time.

Furthermore, in April, Abbott was forced to recall >4m Freestyle Libre products due to an issue with the readers. It’s another sign of poor execution at thee company that only underlines the fact that medical devices can pose a safety threat and are not always reliable.

Freestyle Libre remains a critically important product for Abbott, however, as does the Structural Heart division, which is the fastest growing division alongside Diabetes Care, while there is plenty more progress that could be made in cardiac rhythm management, vascular care, neuromodulation and electrophysiology. Abbott is a major – if the not the major, given Medtronic plc (MDT) generates double the revenues that Abbott does in medical devices – player in these spaces, although a company that has a hard won reputation for reliability is beginning to look a little frayed around the edges.

Conclusion – Optimism Not Exactly Abounding Ahead of Abbott’s Q1 2023 Earnings – Could There Be A Significant Correction In The Offing?

Frankly, having reviewed Abbott and its 4 main businesses in some detail for the second time in the past 3 months, I find that the same problems I highlighted last time – falling COVID revenues, problems within nutritional, and an over-dependence on a product in Freestyle Libre that could come back to bite Abbott – still remain.

In fact, things may have gotten slightly worse. The Freestyle product recall is another stain on Abbott’s reputation for operational excellence, and some of the markets in which Abbott has been dominant for so long look in need of fresh thinking.

Abbott has been around for 130 years, has 113k staff, and is operational in 160+ countries, according to a relatively recent investor presentation. Reviewing the company and its operations, however, gives me a slight sense that the company’s best days may be behind it. I wonder if that sense is pervasive, and whether the company – and its share price – could meet with something of a backlash when earnings are announced tomorrow.

Of course, I may be very wrong – COVID testing is likely to have its best quarter revenues wise in Q1 2023, production may be back up to full speed at the Sturgis plant, and Abbott may beat the market’s estimates as it usually does. When your P/E and P/S ratios are drifting outward and you have just been forced to recall 4m of your best product, however, perhaps some share price punishment is to be expected from Abbott Laboratories.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, BMY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.