Summary:

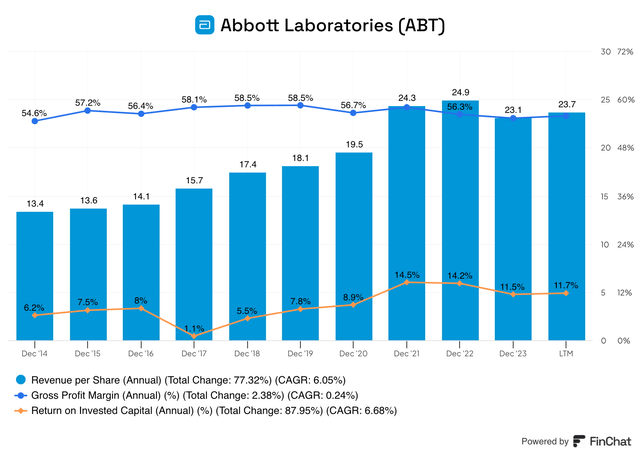

- Abbott has a very stable gross profit margin, while the company’s revenue and return on invested capital could be more consistent.

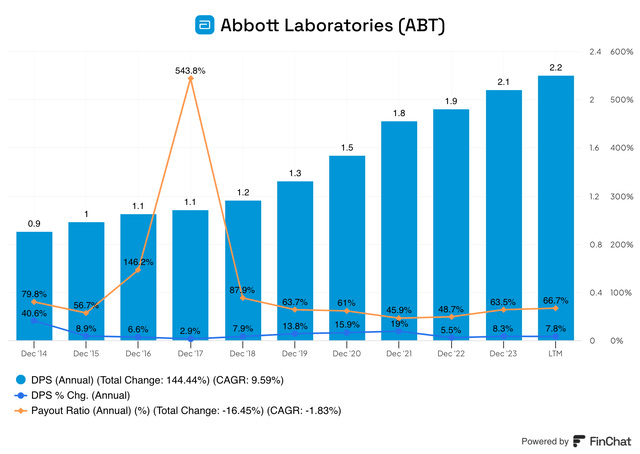

- The company has increased their dividend for more than 50 years and should announce their 53rd dividend increase in December.

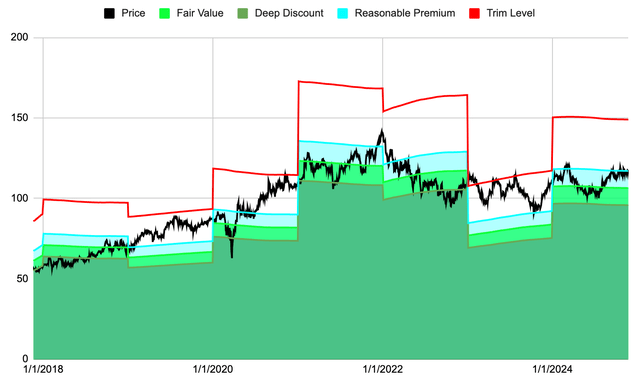

- Considering ABT is trading for a slight premium and has a long-term expected rate of return of 8%, potential investors will need to be patient.

JHVEPhoto

Company Description

Abbott Laboratories (NYSE:ABT) manufacturers and sells medical and healthcare related products in more than 160 countries. Originally started by Dr. Wallace Abbott as a means of developing high-quality, easy to administer medications, the company has since grown by leaps and bounds, with a market cap of more than $200B, while employing more than 100,000 people. Since 1990 the stock has returned a little more than 1,250% or about 7.75% per year, trailing the average market return by a decent margin.

Quality

I generally look for three fundamental trends to determine if a business is of high-quality. They are a growing revenue stream, a healthy profit margin and a solid return on invested capital.

ABT’s revenue per share has grown at a clip of about 6% per year, but it has not been a smooth ride. From 2014 through 2016, there was very minimal change, with this metric rising only 2.1% from 2014 to 2015 and 3.5% in the subsequent year. In 2017 and 2018, ABT saw a jump in revenue per share of more than 11% and 10%, respectively, which can be attributed to, at least in part, the acquisitions of Alere and St. Jude Medical. Revenue expanded in 2019 only 3%; while 2020 and 2021 had more impressive increases of 8% and 24%. More recently, this metric has struggled, with only a 2.6% rise in 2022 and an uncharacteristic 7.6% drop in the most recent fiscal year. The company’s revenue is trending upwards; however, the decline in 2023 is something to monitor should this become a trend.

The gross profit margin has changed very minimally over the past decade, and has remained above 50% for the entire time. A steady and predictable gross profit margin is always a positive sign for investors. It indicates the company has a firm grasp on its production costs relative to its sales, which can lead to investors having confidence the company has a sustainable business model.

The company’s return on invested capital struggled for an extended period of time. From FY 2014 through FY 2020 this metric never exceeded 9%, and actually reached a paltry 1.1% in FY 2017. Beginning in 2021, the ROIC improved to 14.5% and remained close to this level in 2022. Finally, in 2023, the return on invested capital declined materially to 11.5%.

In summary these metrics are decent, the revenue per share is trending higher but has labored more recently. The most encouraging and stable metric is the gross profit margin, while the ROIC has struggled but also improved from its lows. Ultimately, I would like to see more consistency from a couple of these metrics moving forward to give me more confidence in ABT long-term.

Dividend

Abbott has grown its dividend for more than 50 years, making it a Dividend Aristocrat, Dividend Champion, and Dividend King. During the month of December, I expect Abbott to announce the company’s 53 dividend increase. Over the past three years, ABT’s dividend increases have averaged a little less than 7%, pretty solid for a company with such a long dividend history. Moreover, the company’s 5 and 10-year dividend growth rates are even better at 11.4% and 9.6%, respectively. Digging a little deeper, you can see on the chart the dividend increases have varied quite a bit, with a low in 2017 of less than 3% to a high in FY 2014 of more than 40%. The payout ratio has oscillated quite a bit as well, with some alarming high percentages in the early part of the last decade, thankfully Abbott has been able to stabilize this metric and reduce it to a more reasonable level, leaving an adequate amount of room for future dividend increases.

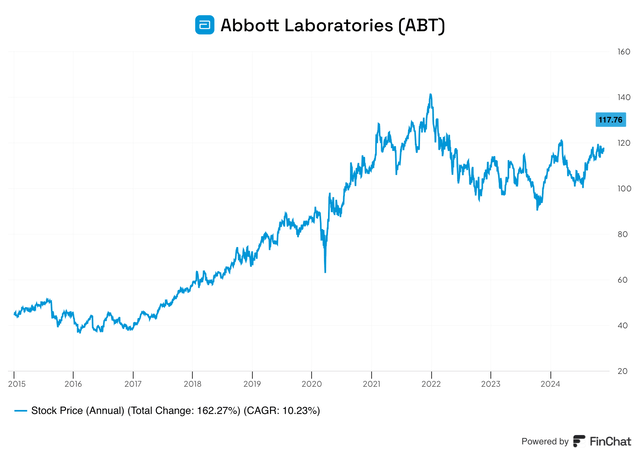

Past Performance

As previously mentioned, ABT has returned a modest amount annually since 1990. However, Since 2015, the stock has appreciated more than 10% annually or about 160% overall. During that time, the stock has only had two down years, 2016 and 2022, where the price dropped 12.32% and 20.69%. What’s unique about the company is that during the five years between 2016 and 2022, the stock price appreciated by at least 20% every year, including an increase of more than 50% in 2017 alone. More recently, ABT’s stock price has struggled, with a return of just 2.26% last year and 5.07% through October of this year. Looking ahead, it’ll be interesting to see if the stock can rebound from their recent struggles.

Recent Earnings

About a month ago, Abbott released their quarter 3 earnings with a double beat, revenue was up almost 5% from the prior year to $10.64B (beat by $90M), while Non-GAAP EPS was $1.21 which beat by $0.01. The market was rather muted with the release of the earnings report, with no major share price change in either direction.

Let’s examine some of the numbers by segment to get a better idea of where the company is having success and where it may be struggling.

The Nutrition segment saw a minor decrease in total revenue of less than a half of a percent. The US market had sales of $950M, an impressive 10.4% increase from 2023, while the International portion decreased nearly 8% to $1.1B, led by unfavorable exchange rates.

Revenue for the Diagnostics segment decreased by 1.5%, with the International section retracting 3.8% from 2023 and the US section climbing just 2%. This part of the business struggled due to a decline in Covid-19 related testing, which was $265M last year, compared to $305M during the same time period this year.

The third segment, Established Pharmaceuticals, only has international sales as of early 2015 when the company sold its developed markets branded generics pharmaceuticals line to Mylan, now part of Pfizer (PFE). At that time, management saw the emerging markets as a key to driving growth through increased access to healthcare in developing nations. This portion of the business grew revenue by 2.7% in Q3 2024 to $1.4B, but similar to the other segments felt the impact of exchange rates.

Medical Devices is the final segment of ABT to discuss, and it saw the biggest gains both domestically and internationally. Sales for the US portion were slightly more than $2.2B, an increase of 14% from the same time period a year ago, while the International part grew nearly 10% to $2.5B. Collectively, revenue rose more than 11%, due to double-digit growth in the following sub-segments: Diabetes Care, Structural Heart, Heart Failure and Electrophysiology.

Additionally, management expects Q4 GAAP earnings per share of $0.96 to $1.02, with adjusted EPS expected to be in the range of $1.31 to $1.37 as a result of expected intangible amortization, restructuring and cost reduction initiatives.

Finally, full-year 2024 guidance was provided, which included GAAP EPS of $3.34 to $3.40 and adjusted EPS of $4.64 to $4.70 due to the previously mentioned cost reduction plans and restructuring costs.

The full earnings release can be read here.

Valuation

The last consideration is to determine if ABT is trading for an attractive valuation, and to do so, let’s look at it from a FCF perspective.

The custom valuation tool suggests Abbott Laboratories is trading for a reasonable premium to its fair value. Starting in 2018, the company began the year trading at a healthy discount, but by the end of the year was slightly above its fair value estimate. In 2019, the FCF for ABT slipped almost 9%, while the stock price rose considerably. For 2020 and 2021, there was a dramatic increase in FCF of 27% and 51%, and the stock consequently surged 28% and 30%. By the end of the following year, ABT was trading for a very attractive valuation, as the stock declined more than 20%, while the FCF dipped a moderate 8%. Recently, the FCF has fluctuated quite a bit with a decline of 34% in 2023, followed by an increase of 28%, while ABT’s stock has been fairly flat. At this time, the conservative fair value price for Abbott is $106, with an expected long-term rate of return of almost 8%.

The components of that potential RoR include a dividend yield of 1.87%, a -2.11% return to fair value discount and an expected earnings growth rate just above 8%. Typically, I aim to find companies with an expected rate of return that exceeds 10% and that are trading for reasonable valuation. At this time, ABT just barely misses on both of these targets, and while I think the stock is a HOLD right now if you own it, any potential investors should wait for a pullback before adding this stock to their portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.