Summary:

- Abbott Laboratories has experienced a slowdown in growth due to the COVID-19 pandemic ending and a decline in demand for diagnostic products.

- The company has been investing in expanding coverage for its FreeStyle Libre 2 and FreeStyle Libre 3 products, including gaining additional coverage in France for glucose monitoring devices.

- Margins have been declining, and the company’s valuation is high compared to its growth prospects, leading to a recommendation to hold the stock.

Khanchit Khirisutchalual

Investment Outline

Abbott Laboratories (NYSE:ABT) has seen a slowdown in growth as the Covid-19 pandemic is reaching its end and demand for diagnostic products is slowing. This has impacted ABT and Q2 results showed a YoY decline. Margins are not where they used to be and have entered a downturn in the last couple of quarters, down from 18.7% in Q2 of 2022.

ABT hasn’t sat idle however as demand slowed, instead, the capital expenditures have seen a steady climb to $1.8 billion in the TTM. As significant efforts are put into place to expand its coverage of the FreeStyle Libre 2 and FreeStyle Libre 3. The recent news that ABT is gaining additional coverage in France for glucose monitoring devices is yet another tailwind for the company. There is no doubt in my mind that ABT will be able to see secular growth as the medical service and products industry is growing. The fact of the matter seems to be that the company is trading quite high in regards to the rest of the sector. Right now, investors would have to pay around 24x forward earnings, something that doesn’t seem to coincide with the growth ABT has so far had. As a result of this, I am rating ABT a hold.

Recent Developments

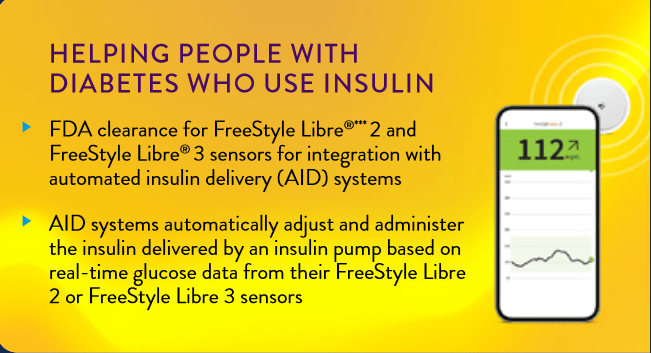

One of the recent announcements that came out regarding Abbott is the additional coverage their FreeStyle Libre 2 will have in France. France announced they are expanding reimbursement coverage for the FreeStyle Libre 2 in an effort for glucose monitoring devices to also include diabetics and basil insulin therapy.

Before the news, the FreeStyle Libre 2 was only covered for patients diagnosed with Type 1 and Type 2 diabetes who also required insulin therapy.

Company Product (Investor Presentation)

Operating in the healthcare sector, Abbott has reached a global presence as their diversified set of medical devices, pharmaceuticals, diagnostics, and nutrition products play a significant role in helping people.

Within the company there are four different segments, those being: Established Pharmaceutical Products, Diagnostics Products, Nutritional Products, and lastly Medical Devices. International sales make up the majority and medical devices are the largest contributor of revenues as $3.9 billion was generated here last quarter.

For investors interested in finding a solid distributor of dividends, then ABT looks very good. In 2023 ABT will have distributed a dividend for 100 years consecutively, as in June they had their 398th. With a yield of 1.89%, it doesn’t present itself as a strong dividend addition perhaps, but rather a stable exposure to the medical services and devices industries.

Margins

In terms of margins, I think there is certainly room for improvement here as it has been in a steady decline the last couple of quarters, despite strong innovation and expanded market opportunities for ABT.

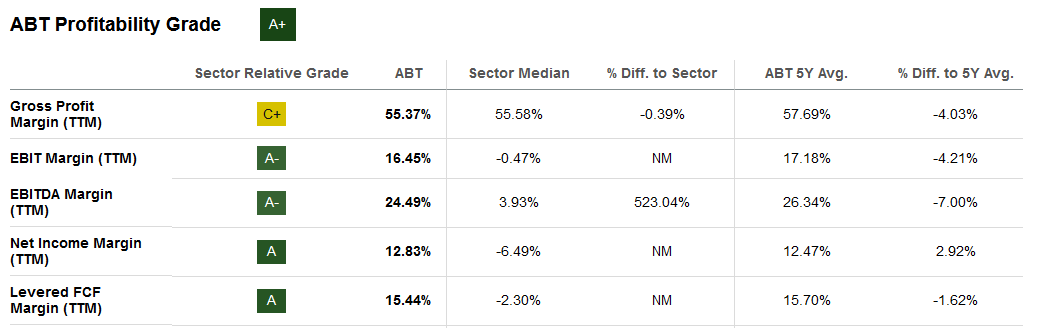

Margin Profile (Seeking Alpha)

On a 5-year average comparison, the margins have certainly had improvements. Net margins for example sit over 1% higher. Where I see an argument that indicates stronger margins ahead is the softening of price increases for materials, which has negatively impacted the margins of companies like ABT. Looking at 2024 and beyond it seems that companies in the sector will be able to catch up with price increases and match the increase that raw materials have had. The sector is still facing some issues, and margins expansion won’t be visible until early 2024 at most I think as costs come down. This will affect investors as shares of ABT perhaps will be downgraded due to potential margin reductions in the coming quarters. Q2 2023 had ABT generated net margins under the TTM of 13.98%. I view this as a sign that more pain is ahead and investors should prepare for lower share prices. Lacking margin expansion suggests that the company is still struggling somewhat at overcoming higher costs and passing that down to customers. I don’t see a sudden rebound, but rather a more prolonged one from here though, which I think is still more positive to the negative of course. In terms of overall margins for 2023, I think it’s not unlikely we dip below 12%, which would mean an EPS of around $2.85. This number is based on that ABT continuously growing its top line and revenues land at just shy of $40 billion and a 12% net margin is achieved. With $5 billion in net income, dividend by around 1.7 billion outstanding shares, we land at an EPS of about $2.85. That is a fair bit below the estimated $4.4 for 2023, which would equate to a net margin of around 19%. I find this highly unlikely, as costs remain high and aren’t likely to come down in the short term.

Valuation

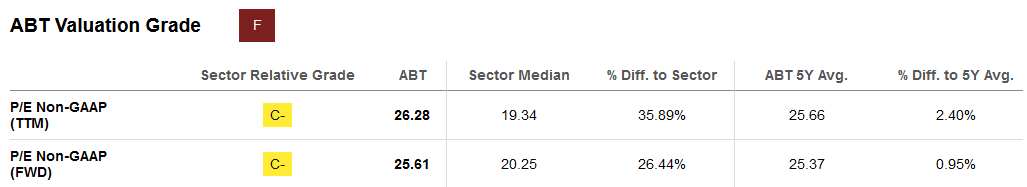

In terms of valuation, I think that the historical p/e of ABT has been quite high, likely a result of the business having solid fundamentals and a history of always distributing a dividend. That sort of consistency gets rewarded with a higher multiple. But in the face of challenging cost maintenance, I think paying 24x forward earnings is quite frankly too much. Even though it’s under the 5-year average of 25x.

Company Valuation (Seeking Alpha)

I view a multiple around 18 – 19 as more reasonable, as ABT is unlikely to post EPS growth that would justify such a high multiple. The dividend yield is barely under 2% and also doesn’t constitute a higher valuation in my opinion. There are plenty of other companies with stronger growth potential and a higher yield that also trades on lower multiples. Some of these could be Johnson & Johnson (JNJ) and Elevance Health (ELV) which both operate in the health care industry and offer strong dividends and buyback programs, but also lower valuations. As I am anticipating lower margins for the remainder of 2023 I think we will see a lower share price and better entry opportunities for investors interested in the company and sector.

Risks

Abbott’s recent growth has witnessed a persistent decline in operating cash flow and operating income. These metrics have regressed to levels similar to the average of the past five years. The substantial decrease in EBITDA margin has contributed to this regression, bringing it down to its 2018 level. As mentioned earlier, this decline is connected to the operating earnings margin in relation to net sales.

As seen in the last report as well from ABT. the inventories they have is steadily increasing. This does worry me as a larger inventory level hasn’t coincided with stronger revenues. Now the inventories make up a larger portion of revenues, which I would equate to a softer pricing environment. The revenue/inventory in 2022 was 6.94 as opposed to 2020 levels of 6.9. This steady decline upward I think has taken a toll on margins and caused them to slide recently.

Investor Takeaway

Abbott has made it out to be a very strong dividend addition for a long-term portfolio. I don’t doubt the usefulness of having ABT in a portfolio, however, I don’t think right now is the best of times to be starting a position or adding onto an existing one. The share price is trading at 24x which is in line with its 5-year average, but I can still make the case that it’s a bit high given the quite frankly, lacking growth prospects that would justify such a high valuation.

I view the coming quarters as challenging for ABT, as costs remain high and aren’t likely to go down until early 2024 as the industry catches up. As a result of my views on the company, I think the most suitable rating is a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.