Summary:

- Abbott Laboratories offers a compelling investment opportunity due to its resilience, consistent growth, and strong dividend record despite challenges in its COVID-19 diagnostic products and nutrition sector.

- The technical analysis reveals a bullish outlook for Abbott, with a potential breakout above $113, supported by an inverted head and shoulders pattern and a bull flag formation.

- Investors should consider market risks, including decreased demand for COVID-19 diagnostic products, competition, and potential stock price volatility, before making a decision.

Sundry Photography

In the complex landscape of investment opportunities, Abbott Laboratories (NYSE:ABT) has recently emerged as an intriguing prospect. Despite facing a series of challenges, from a downturn in demand for its COVID-19 diagnostic products to internal issues within its nutrition sector, Abbott’s resilience and consistent growth have shone through. This article delivers a technical analysis of Abbott’s stock price to forecast its future path. It has been observed that the stock is presently trading close to the point of breakout, and any upward movement from this level could trigger a potent market rally.

Financial Performance of Abbott

Despite some recent headwinds, Abbott offers a compelling case as a potential buy in the current market environment. Central to this is its esteemed status as a Dividend King, a feat accomplished through consistently raising payouts for over half a century. While the stock has experienced recent downturns due to a slump in demand for its COVID-19 diagnostic products and internal issues within its nutrition sector, these challenges are contextually set against a backdrop of a global pandemic, a situation that has upended many financial profiles across industries. Digging deeper into Abbott’s figures unveils positive signals of a rebound. Its Q1 report exhibited a significant 10% YoY growth in organic sales, discarding the influence of the COVID-19 diagnostics segment. As the global scenario edges towards a post-pandemic reality, the temporary distortions in Abbott’s financials should dissipate, showcasing the company’s inherent business resilience and strength.

Furthermore, Abbott possesses potent growth opportunities, particularly in the diabetes care segment. The company’s FreeStyle Libre franchise, a frontrunner in continuous glucose monitoring, illustrates its innovative approach and commitment to addressing patient needs. Other promising areas include structural heart and heart failure management. With its inventions secured by patents, Abbott is well-positioned to reap long-term benefits from these sectors. Abbott’s uninterrupted dividend growth, now in its 51st year, makes it an appealing choice for dividend investors. Recent progressions, such as the expanded reimbursement coverage for its FreeStyle Libre 2 device in France, have further bolstered Abbott’s standing in the diabetes care market. This development increases the potential user base and paves the way for more revenue streams.

However, potential investors should also factor in Abbott’s modest growth rate amidst its various successes. Bright spots like an 8.5% growth in its medical device segment, fueled by a 16.6% growth in sales, contrast with the relatively lackluster 3.7% growth in its pharmaceutical arm. The robust 50% U.S. revenue growth for its FreeStyle Libre brand does stand out, but overall, the company’s growth trajectory does not seem sufficient to validate its current valuation.

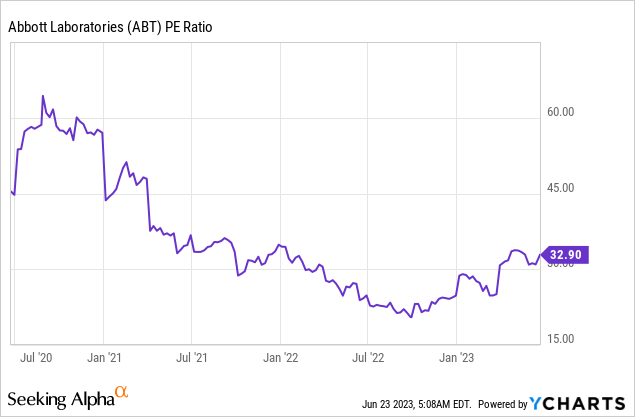

This valuation concern is underscored by the company’s stock price. The projected diluted earnings per share for this year fall within a range of $3.05 to $3.25. At a midpoint of $3.15, the resulting P/E ratio is around 34, based on the current share price of $108, a hefty premium compared to the healthcare sector’s average. In the face of bearish market trends, Abbott’s valuation is gradually declining. However, investors must remember that its prior high valuation was achieved during a period of strong demand for COVID-19 tests. With these factors in mind, the gradual decline in Abbott’s valuation, juxtaposed with its consistent growth and resilience, suggests that this could be an opportune time to consider purchasing Abbott stock.

Bullish Price Development

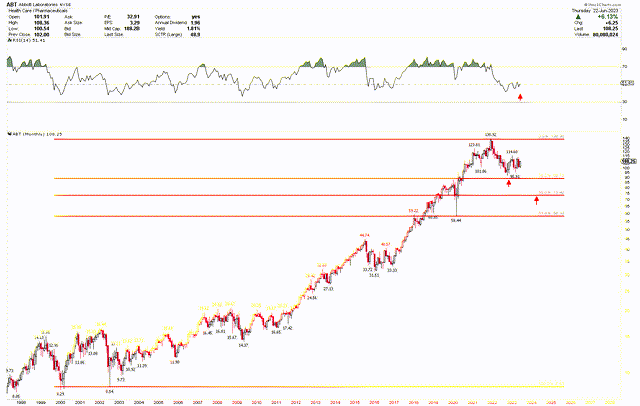

Fundamental analysis signals a bullish future for Abbott’s stock, which is further affirmed by the technical price action on the charts. The stock has followed a strong upward trend from 2002, moving from a low of $8.54 to a 2021 high of $138.92. The downturn from $138.92 to the 2022 low of $92.37 created a base from which the price has started to robustly recover. The bounce-back from $92.37, happening at the 38.2% Fibonacci retracement level of the previous upswing, supports a bullish outlook. The price has bounced back to higher levels, suggesting possible upward continuity. However, should the 38.2% retracement level of $88.73 break, we could see a further drop toward $72.43, where another strong buy signal may appear for long-term investors. The RSI’s support at the 50 levels also speaks to the market’s bullish potential.

Abbott Monthly Chart (stockcharts.com)

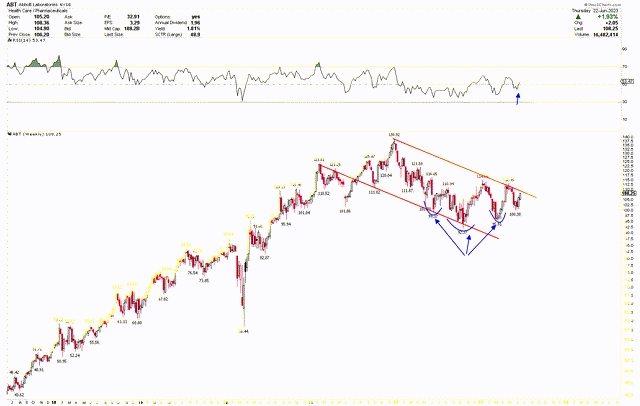

Diving deeper into the weekly chart for Abbott helps to elucidate this monthly picture. The stock price has found support at the 38.2% Fibonacci retracement level, giving rise to an inverted head and shoulders pattern marked by blue curves—a bullish formation. This pattern gains strength from the emergence of a bull flag delineated by red trend lines. The flagpole of this formation could be the trendline originating from the 2002 bottom at $8.52. With the RSI also finding support at the midway point of 50, the bullish outlook solidifies further.

Abbott Weekly Chart (stockcharts.com)

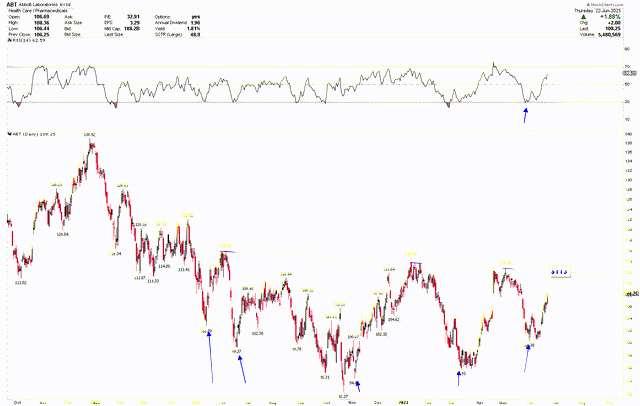

Shifting to a shorter timeframe, Abbott’s daily chart displays a blue trendline serving as a short-term resistance. Each time the price drops, as highlighted by blue arrows, a potent rebound ensues, pushing the price higher. The stock is nearing short-term resistance at $113, where a likely breakout could stimulate further price ascension. Investors are poised to buy either at the current level or following a downward correction. The stock also presents a buying opportunity if a breakout above $113 occurs.

Abbott Daily Chart (stockcharts.com)

Market Risk

The impact of the global pandemic on Abbott’s financial performance has been significant, primarily through the key role its COVID-19 diagnostic products played in boosting the company’s valuation during the pandemic’s peak. As we inch towards a post-pandemic world, the normalization of operations may decrease these products’ demand, leading to lower revenues and potentially affecting Abbott’s overall valuation. The company’s competitive landscape presents another layer of complexity. Operating in a vibrant market where numerous companies are constantly innovating in areas like diabetes care, structural heart, and heart failure management, Abbott faces continuous pressure. Any changes in market dynamics or groundbreaking advancements by competitors could cast a shadow over Abbott’s anticipated growth trajectory.

In addition to these factors, a technical analysis of Abbott’s stock price reveals potential volatility. Currently, the price trajectory appears strongly bullish. However, if the stock price were to break below the critical support level at the 38.2% Fibonacci retracement of $88.73, it could potentially drop to around $72.43, introducing a degree of uncertainty into the market. This uncertainty could intensify if the stock fails to break through the short-term resistance level at $113, as it could then be subject to further fluctuation, increasing the chances of a further drop.

Bottom Line

In the diverse and intricate arena of investment, Abbott offers a captivating case as a prospective investment choice. Although the company has navigated through a host of challenges, including a downturn in demand for its COVID-19 diagnostic products and issues within its nutrition sector, Abbott has demonstrated admirable resilience and consistency in its growth. With a noteworthy record of dividend growth and an upward trajectory in selected sectors, Abbott is certainly an attractive proposition for investors. The technical examination points to a robustly positive setup, as demonstrated by the emergence of an inverted head and shoulders pattern and bull flag indications. A surge beyond the $113 mark would likely trigger a significant uptrend in the market, while a dip below $88.73 could temporarily counteract the bullish perspective, paving the path toward the $72.43 mark—where a compelling buying opportunity arises. Investors may view Abbott as a prospective acquisition, with expectations of an upward breakout above $113 aiming for substantially higher market positions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.