Summary:

- Abbott Laboratories is a stable investment in challenging times, with an AA- credit rating and a history of surviving economic downturns.

- ABT has a well-diversified healthcare portfolio, including diagnostics, medical devices, and pharmaceuticals, positioning it to address evolving healthcare challenges.

- Despite a temporary stock dip, ABT has shown robust financial performance with impressive growth across segments, reflecting resilience and sales expansion.

Kena Betancur/Getty Images News

Introduction

We’re living in challenging times. While the situation could be a lot worse, the market is dealing with sticky inflation, elevated rates, and weakening economic growth.

For example, the latest Michigan consumer sentiment survey showed that long-term inflation expectations have hit the highest level since 2011, pressuring consumer spending plans.

Bloomberg

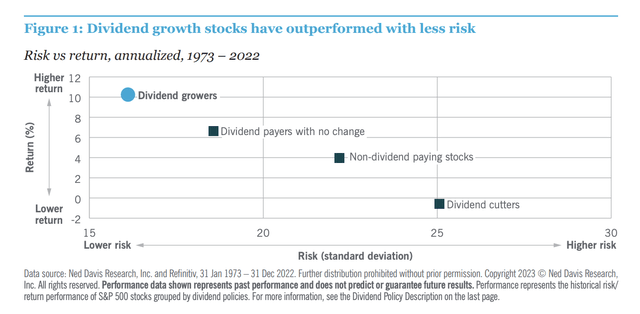

On top of that, as we can see in the chart below, the Leading Economic Index remains at subdued levels, indicating a high probability of a recession in 2024.

Wells Fargo

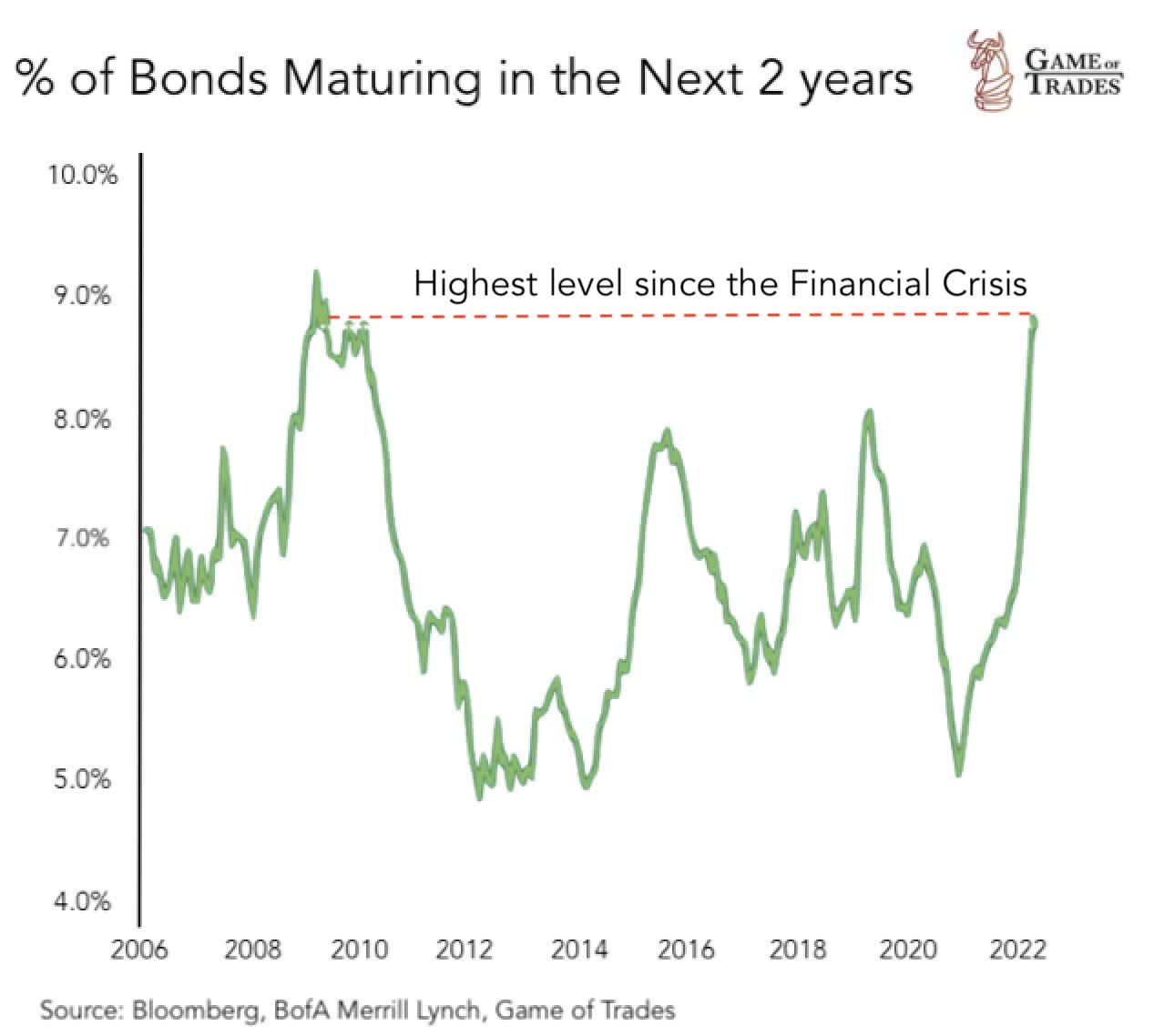

To make things worse, we’re entering a period with a lot of debt maturities (both government and corporate), which could elevate risks unless rates come down soon.

The percentage of bonds that will mature within the next two years hasn’t been this high since 2008. Even worse, most of these bonds have lower yields than current yields, meaning refinancing will be much more expensive.

Bloomberg, Game of Trades

But wait, there’s more.

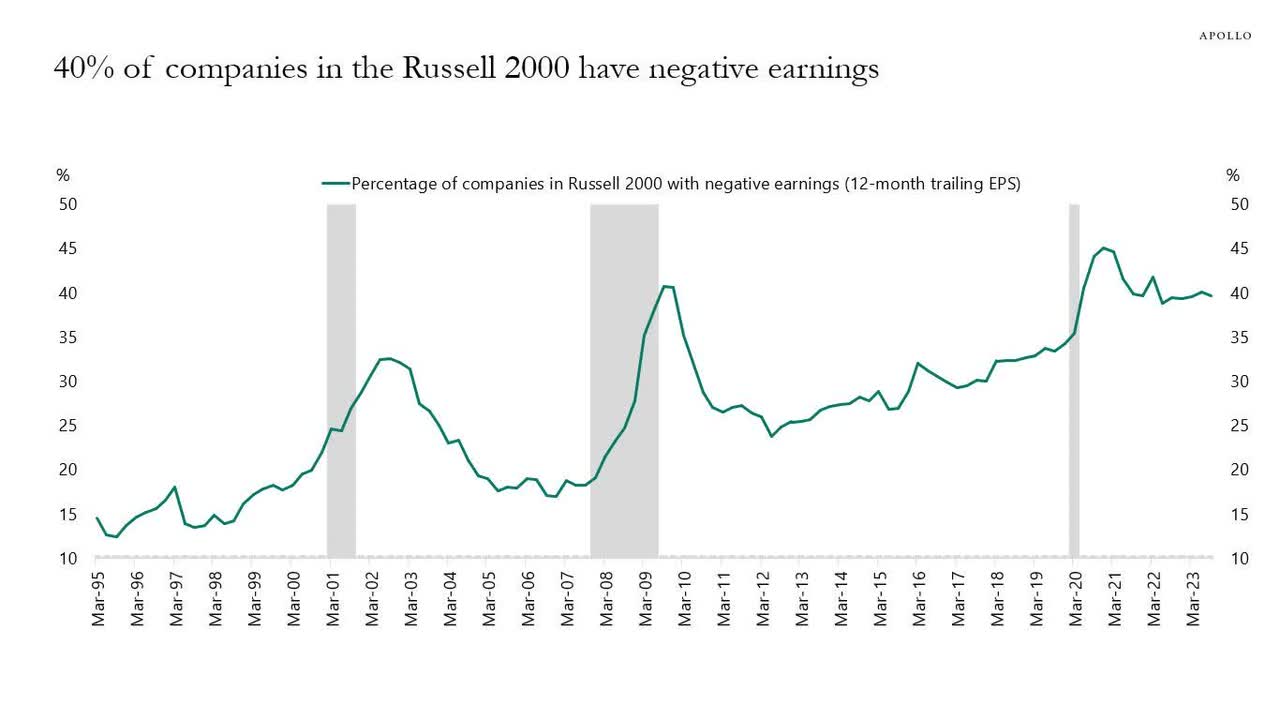

We aren’t even in a recession, and we already see that 40% of Russell 2000 companies are losing money. This is comparable to the peak of the Great Financial Crisis.

Don’t get me wrong, I’m not saying this to scare anyone.

I have zero short positions. I have not been a net seller of any stocks, and I’m not planning on investing less in the future.

I’m bringing this up to highlight why I have become way more careful.

As we could be in a prolonged period of elevated rates, higher interest payments, and elevated default risks, I’m only buying top-tier companies that have a history of surviving recessions and a high likelihood of doing well in my hypothetical scenario.

This brings me to the star of this article, Abbott Laboratories (NYSE:ABT).

Abbott is a well-diversified healthcare company that produces medical devices and related products. It has an AA- credit rating, which is one of the best ratings in the world, and more than 50 consecutive annual dividend hikes, making it a special pick in that area as well.

In this article, we’ll discuss all of this and more as I explain why ABT is such a sleep-well-at-night pick.

So, let’s get to it!

Abbott Is Where It’s At

My most recent article on Abbott was written on July 31, when I wrote an article titled Abbott: This Dividend King Is Ready For Takeoff.

In that article, I highlighted some of the reasons why investments in healthcare (healthcare capabilities) are so important.

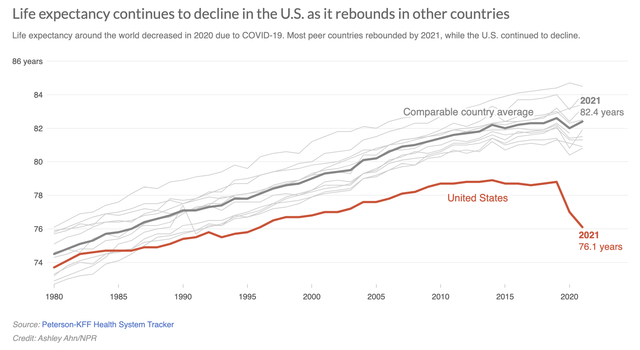

For example, earlier this year, NPR published an article titled Live free and die? The sad state of U.S. life expectancy. In that article, it used the chart that can be seen below.

Peterson-KFF Health System Tracker

As we (in general) get older and new healthcare threats emerge, it becomes key to address issues like heart disease, cancer, and chronic disease (among others) as effectively and efficiently as possible.

After all, costs are a huge factor!

My healthcare payments in 2024 will likely rise by 18%, as all of these issues are a financial burden on “the system.”

Having said that, Abbott is well-diversified and in a great spot to help solve the healthcare challenges of the future.

Roughly 38% of its revenue comes from diagnostics, followed by medical devices, nutritional products, and pharmaceutical products.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Diagnostic Products |

15,644 | 36.3 % | 16,584 | 38.0 % |

|

Medical Devices |

14,367 | 33.4 % | 14,687 | 33.6 % |

|

Nutritional Products |

8,294 | 19.3 % | 7,459 | 17.1 % |

|

Established Pharmaceutical Products |

4,718 | 11.0 % | 4,912 | 11.3 % |

|

Other |

52 | 0.1 % | 11 | 0.0 % |

Despite all of this, ABT shares are down almost 9% since my July article.

The problem is that Abbott ran too hot during the pandemic. Like most of its peers, it is dealing with slower post-COVID sales.

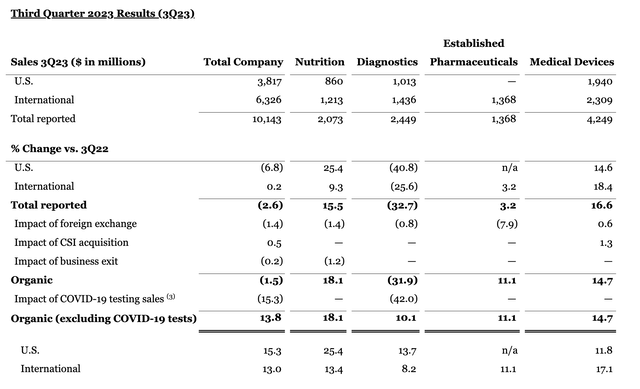

In the third quarter, sales decreased by 1.5% on an organic basis, primarily due to the anticipated decline in COVID testing-related sales.

Excluding COVID-tested sales, the underlying base business organic sales growth was a significant 13.8% for the quarter, which is a truly fantastic number.

Even better, the company saw growth across the board.

- Nutrition: Sales in the Nutrition segment increased by 18%, driven by substantial growth in Pediatric Nutrition (25%) and Adult Nutrition (12%). The U.S. infant formula business regained a leadership position, and international growth was well-balanced.

- Established Pharmaceuticals: Sales in this segment increased by 11%, with double-digit growth in various markets and therapeutic areas, including cardiometabolic, women’s health, and CNS pain management.

- Diagnostics: Excluding COVID testing, Diagnostics experienced 10% organic sales growth. Core Lab Diagnostics, in particular, saw double-digit growth, driven by strong performance in the U.S. and internationally. Rapid Diagnostics benefited from increased demand for respiratory tests.

- Medical Devices: Sales of Medical Devices grew nearly 15%, with notable growth in both the U.S. and international markets. Key highlights included significant growth in Diabetes Care, Cardiovascular Devices, and Neuromodulation.

With that in mind, Abbott made some significant progress in key areas.

For example, sales for FreeStyle Libre were $1.4 billion, with a 28% growth rate. This is the company’s glucose sensor.

The global Libre user base exceeded 5 million, with a substantial increase in the U.S. market. Users combining Libre with GLP-1 (weight loss) medications showed higher compliance, indicating a complementary relationship between the two products.

Abbott Laboratories

In other words, the company benefits from the GLP-1 trend, which takes away a lot of fear from the market that weight-loss drugs could erode Abbott’s market.

The company also saw tremendous progress in cardiovascular devices.

Sales in this segment grew 10%, led by double-digit growth in Electrophysiology and Structural Heart. Notable products contributing to growth included MitraClip and Navitor, the latest generation TAVR valve.

Earlier this year, a report showed the extreme effectiveness of these products:

“In patients with heart failure and severe secondary [mitral regurgitation] who remain symptomatic despite optimal medical therapy, [transcatheter edge-to-edge repair] with the MitraClip was safe, reduced the rate of heart failure hospitalizations and improved survival during 5-year follow up. These outcomes were consistent across all prespecified subgroups regardless of patient age, sex, [mitral regurgitation] severity, [left ventricular] function and volume, cardiomyopathy etiology and surgical risk.”

Furthermore, Rhythm Management saw double-digit growth in pacemaker sales, driven by Aveir, a leadless pacemaker.

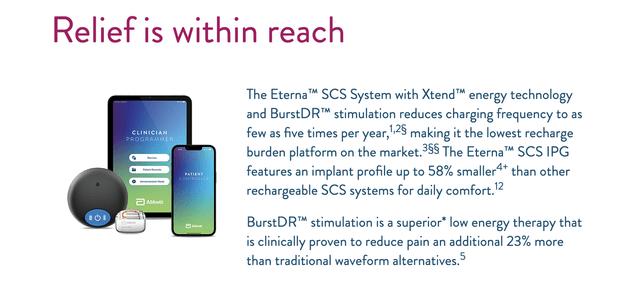

In Neuromodulation, sales grew 19%, fueled by the launch of Eterna, a rechargeable neurostimulation device for pain management.

As a result of these developments, the company narrowed the full-year EPS guidance range.

The company forecasts ongoing earnings per share of $4.42 to $4.46 for the full year. That’s up from the prior range of $4.30 to $4.50.

The guidance midpoint has gone from $4.40 to $4.44.

This includes year-to-date results and ongoing earnings per share guidance of $1.17 to $1.21 for the fourth quarter.

The outlook for the fourth quarter includes an expectation of total underlying base business organic sales growth in the low double digits, excluding COVID testing sales.

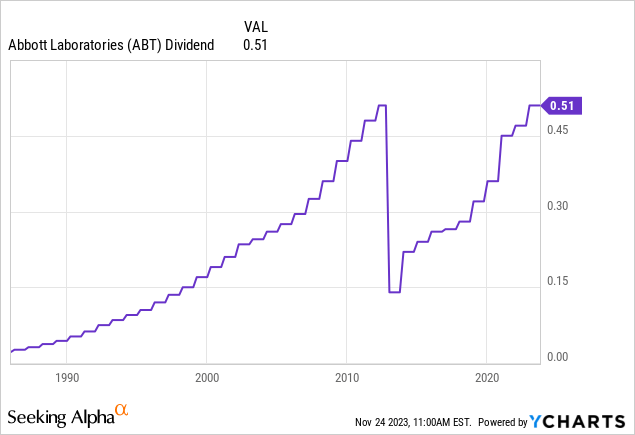

Not only is Abbott back on track, but it also delivers consistent dividend growth.

Abbott’s Shareholder Distributions

As I already briefly mentioned, Abbott is a dividend king. It has hiked its dividend for more than 50 consecutive years, which is truly special.

The only reason why its dividend history shows a steep decline is the spin-off of AbbVie (ABBV). That’s not technically a dividend cut.

While being a dividend king is great, there’s one aspect I dislike about dividend kings (in general): most are so mature that dividend growth rates have come down.

That is not the case at Abbott!

- Abbott is yielding 2.0%.

- This yield is protected by a sub-50% payout ratio.

- The five-year dividend CAGR is 12.7%, which beats a lot of mature dividend growth stocks.

- The most recent hike was on December 9, 2022, when the company hiked by 8.5%.

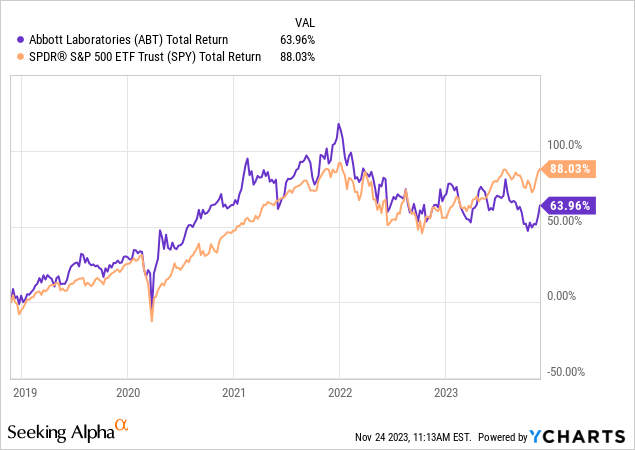

Another major benefit of consistent dividend growth and a safe, anti-cyclical business model is that investors tend to reward this with outperformance.

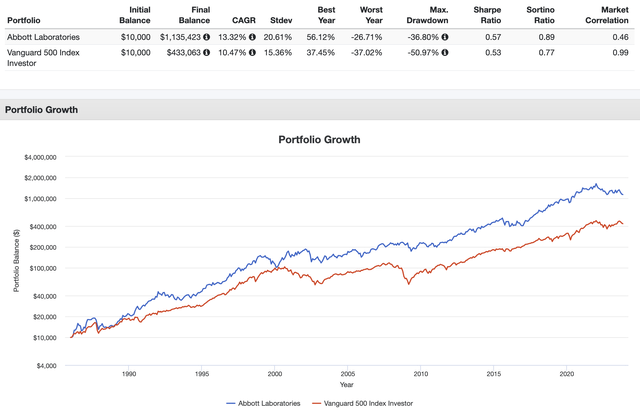

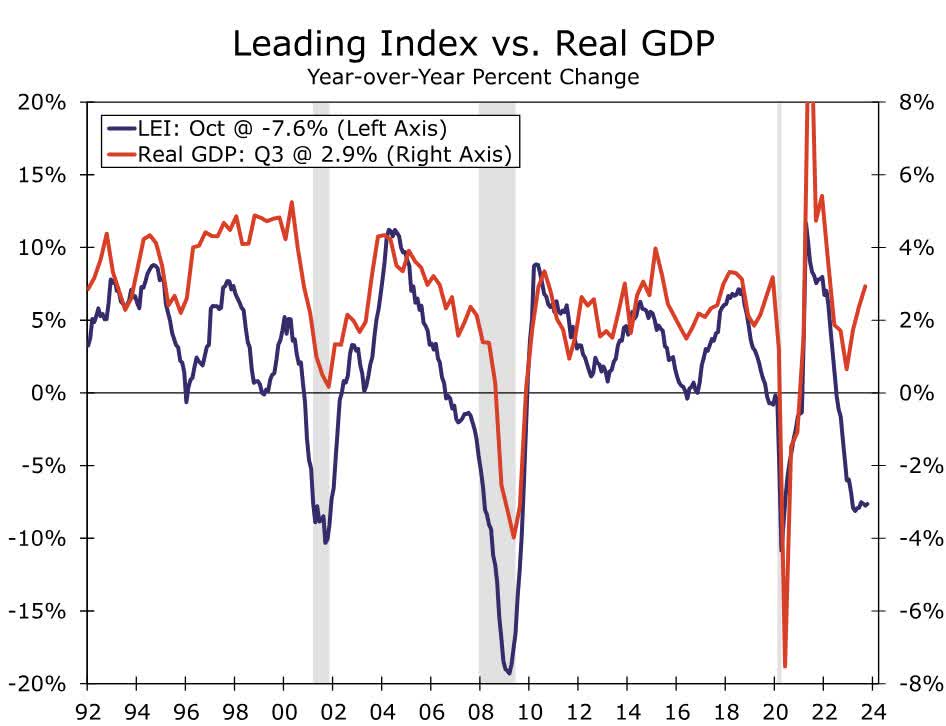

Looking at the data below, we see that between 1973 and 2022, dividend growers have shown above-average returns and below-average volatility!

Abbott numbers confirm this.

- Going back to 1986, ABT has returned 13.3% per year, outperforming the 10.5% CAGR of the S&P 500.

- During this period, ABT had a 20.6% standard deviation, which is very impressive. The S&P 500 had a 15.4% standard deviation.

- Over the past ten years, ABT has returned 12.1% per year with a similar standard deviation. The S&P 500 returned 11.0% per year during this period.

Over the past three years, ABT has failed to outperform the S&P 500, which is caused by its poor post-pandemic performance.

The good news is that ABT’s valuation is good.

Valuation

Because ABT is in this somewhat unusual post-COVID period, putting a valuation on it is a bit tricky.

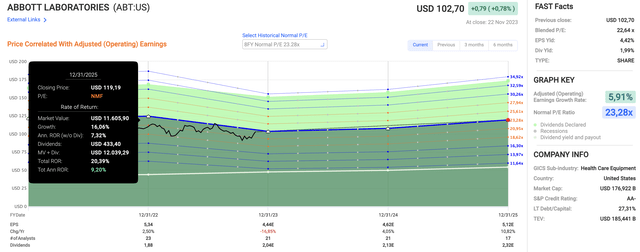

Using the data in the chart below:

- ABT is trading at a blended P/E ratio of 22.6x.

- Its eight-year normalized multiple is 23.2x. Normally, I go with the 20-year multiple. However, I believe that 23.2x earnings is a fair valuation for the company’s growth potential.

- This year, EPS is expected to decline by 17% (post-pandemic effect).

- Next year, EPS is expected to grow by 4%, followed by 11% growth in 2025.

- After 2025, I believe that ABT can maintain high-single-digit to low-double-digit annual EPS growth.

- Based on a 23.2x earnings multiple and expected EPS growth, the company has the potential to return 9.2% per year through 2025.

Although there are stocks with higher potential returns on the market, I believe there’s a high likelihood that ABT will continue to outperform the market with 9-12% annual returns.

I currently do not own Abbott because I have aggressively bought Danaher (DHR), which is a highly correlated company.

Nonetheless, I’m looking to make ABT a holding of my portfolio, as I truly believe it’s a perfect sleep-well-at-night pick.

Takeaway

In the face of economic uncertainties, I remain cautiously optimistic, strategically investing in resilient companies.

Abbott Laboratories emerges as a beacon in the healthcare sector, boasting a diversified portfolio and a solid track record.

ABT’s robust performance, particularly in diagnostics, medical devices, and pharmaceuticals, indicates resilience.

With a history of consistent dividend growth and a secure yield, ABT stands as a compelling long-term investment, poised for steady returns amid fluctuating market conditions.

Reasons To Be Bullish

- Stability Amid Economic Challenges: ABT’s AA- credit rating and history of surviving economic downturns make it a stable investment in challenging times.

- Diversified Healthcare Portfolio: With a well-diversified range of products, including diagnostics, medical devices, and pharmaceuticals, ABT is strategically positioned to address evolving healthcare challenges.

- Robust Financial Performance: Despite a temporary stock dip, ABT has shown impressive growth across segments, reflecting resilience and sales expansion.

- Dividend King Status: As a dividend king with over 50 consecutive years of hikes, ABT offers a reliable income.

- Historical Outperformance: ABT has consistently outperformed the market, returning 13.3% per year since 1986.

I believe the biggest risk is competition risk, which seems to be under control. ABT is also subject to general market movements, which is something to keep in mind.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.