Summary:

- Abbott had a visible slowdown in top line and earnings margin starting in 2022 and continued in Q1’s data.

- It is likely to have more persistent weakness in the bottom line in ’23 and ’24 to show up.

- The company continued to provide a strong pipeline of product innovation and cross-industry collaboration.

Tim Boyle

Investment Thesis

Abbott Laboratories (NYSE:ABT), although it still has a strong topline, the marginal growth is visibly slowing down, which is also reflected in its operating income and earnings margin. The market has largely caught on to this near-term weakness, judging from the current price against our fair valuation. The company kept on a fast pace in innovation with cross-industry applications. These efforts, along with secular growth in the medical service and products market, will bring continuous growth to the company. It is a buy at the current price for the long term.

Company Overview

Abbott Laboratories, an Illinois company incorporated in 1900, has a main focus on discovering, developing, manufacturing, and sale of a broad and diversified line of healthcare products. It has reportable segments in the following four categories: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices.

Strength

Abbott Laboratories has an encompassing portfolio in health and medical services. The company has an emphasis on treating ongoing cardiovascular issues, and chronic pain in neuromodulation and diabetes, as well as in preventive care of nutritional and diagnostics and quality medicines.

abt (Company 2023 Presentation)

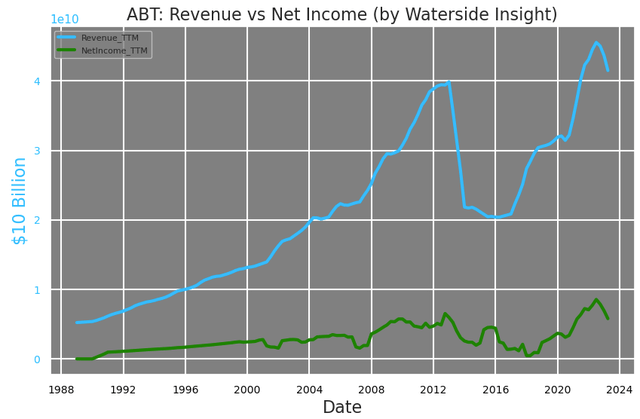

The company has struck strong momentum in revenue and net income growth. They have been elevated at their highest levels in the company’s history. The company’s current growth has come a long way since 2016, when its revenue slumped by half from its previous peak.

Abbott: Revenue vs Net Income (Calculated and Charted by Waterside Insight with data from company)

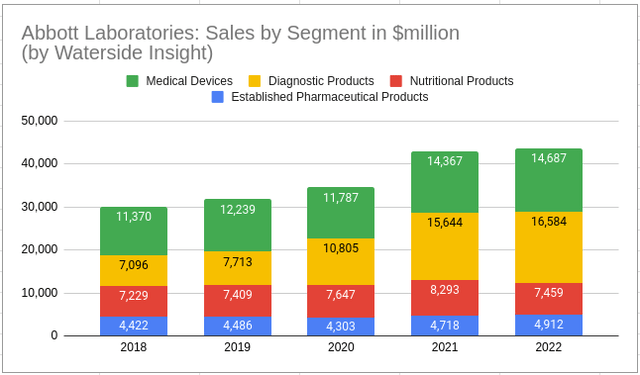

With an all-encompassing portfolio of products, Abbott’s sales growth is subject to multiple market trends and consumer dynamics. But on an aggregated level, across the segments, we can see that the strongest boost in the past five years came from the Diagnostic Product segment, which had around 40% YoY growth in 2020 and another 44% in 2021 with a single-digit growth in average years. While the Medical Devices segment had a 21% YoY growth in 2021 and a low single-digit growth on average. In 2022, most segments only grew 2-4%, while Nutritional Products fell almost 10% YoY. It is clear that pandemic-induced demand has greatly boosted the company’s sales, and that momentum has been stalled lately.

Abbott: Sales by Segment (Calculated and Charted by Waterside Insight with data from company)

Review its Q1 sales data; there are several sub-segments were trending strong. Its emerging market sales in Established Pharma Products rose 15% YoY. Its Heart Failure, Structural Heart and Diabetes Care in Medical devices all had growth in the low teens. Yet, the reported sales for all segments for Q1 were $9.7 billion, down about 18% compared to Q1 2022. Geographically, its total US sales of Q1 were down by 20% YoY, and International sales were down by 16.4%.

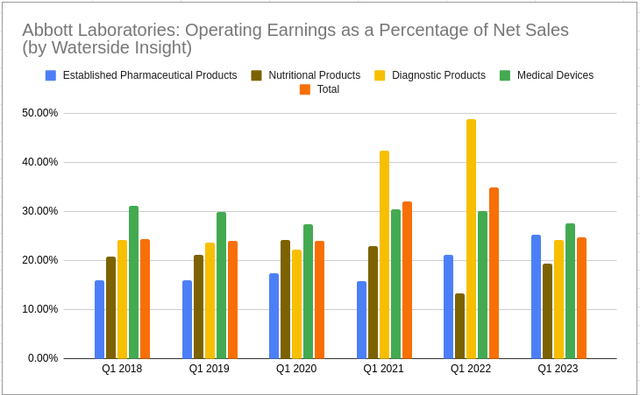

If we compared only the first quarter’s operating earnings as a percentage of the quarterly net sales in the past five years, it revealed a similar and more updated trend. Diagnostics Products provided the highest operating earnings margin for Abbott in the past two years, and this trend is slowing back down to its average level before the pandemic boom. Its Established Pharma Products segment has had a good margin growth consistently in the past two years, although it is the smallest segment in terms of sales. While its third-largest segment, Nutritional Products, has experienced weakness in growth and has a lower margin than before the pandemic. On top of its voluntary recall of infant formula products, the ongoing potential collusion investigation will also be an overhang for this segment in the near term.

Abbott: Operating Earnings vs Net Sales (Calculated and Charted by Waterside Insight with data from company)

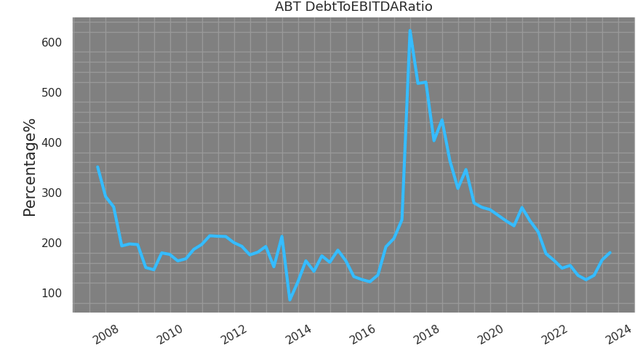

Continuing debt reduction has helped Abbott to be in a better position compared to where it was five years ago. Although the debt ratio itself is still high at 1.68x of EBITDA, it is at the historical average before 2016. Given the environment we are in, the management would be wise not to accumulate much higher debt from here.

Abbott: Debt To EBITDA Ratio (Calculated and Charted by Waterside Insight with data from company)

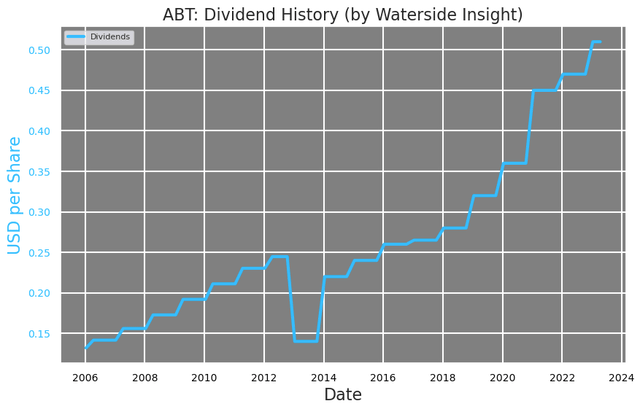

The strong dividend history shows that Abbott has increased its dividend to almost 4x where it was ten years ago, especially during the past three years. It cut from 2013-2014 but rebounded and resumed growth since. We believe the company will at least maintain the current level dividend level in the near term.

Abbott: Dividend History (Calculated and Charted by Waterside Insight with data from company)

Looking ahead, there are several cross-industry or leading innovative developments that Abbott has been undertaking that could emerge as new growth engines in the medium term. For example, the company is to integrate its EnSite X EP System with Stereotaxis’ Robotic Magnetic Navigation systems to provide the next-gen ablation catheter. Its AVEIR™ DR i2i™ IDE, a large-scale study to assess the world’s first dual-chamber leadless pacemaker, showing that the leadless pacemaker met its three prespecified primary endpoints for safety and performance. Also, it is Abbott-Real Madrid Innovation Lab is going to take its medical expertise to the competitive areas of sports physiology. These are all organic growth that plays into the strength of the company’s services. The broader strong medical care demand combined with company-specific innovation by Abbott will underpin its continuous growth.

Weakness/Risks

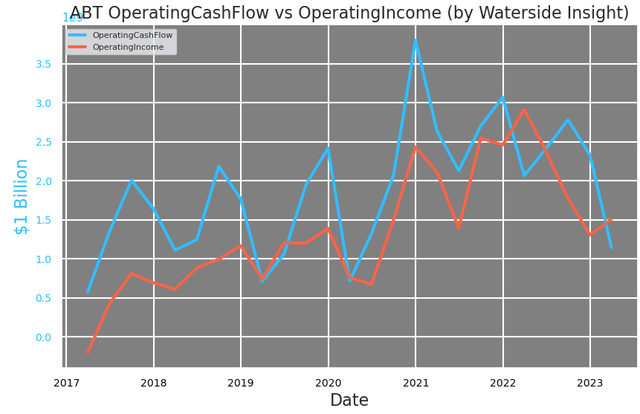

Weakening operating cash flow and operating income have become more entrenched with Abbott’s growth lately. They have fallen back to the average level of the past five years.

Abbott: Operating Cash Flow vs Operating Income (Calculated and Charted by Waterside Insight with data from company)

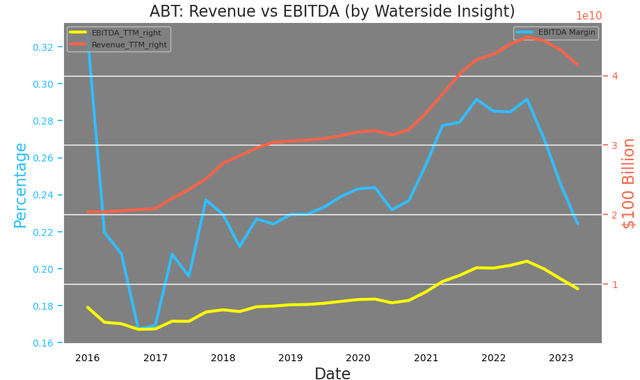

The steep decline in EBITDA margin has dragged it down to its level in 2018. This gets back to the operating earnings margin with respect to the sales we alluded to earlier. The operating margin weakening is the direct cause of weaker earnings margin.

Abbott: Revenue vs EBITDA (Calculated and Charted by Waterside Insight with data from company)

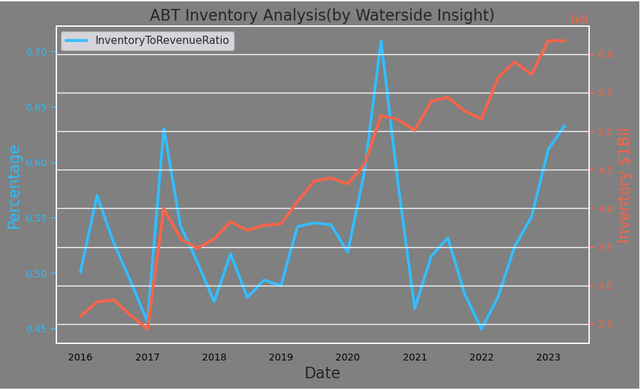

In the meantime, inventory buildup has reached a recent high. As a percentage of revenue, this has gone up from a low 45% to now about 63%. The rise in inventory and slowdown in sales both contributed to it.

Abbott: Inventory (Calculated and Charted by Waterside Insight with data from company)

Overall, we see the weakness came about from operation to earnings. If the first quarter’s results are any indications of the whole year’s performance, there could be a more visible slowdown coming for Abbott in 2023.

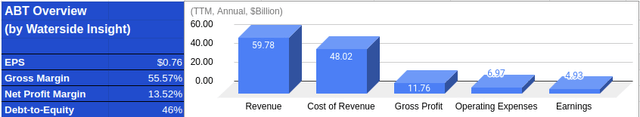

Financial Overview

Abbott: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

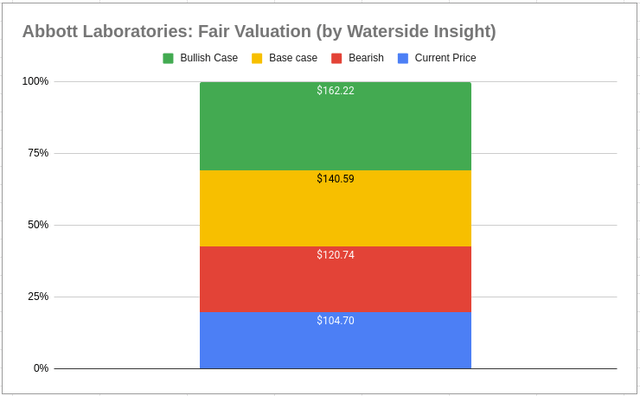

Valuation

Based on our analysis above, we use our proprietary models to make a ten-year projection forward to assess Abbott’s fair value. We used a cost of equity of 5.59% and a WACC of 5.81%. In our bullish case, the company took near term hit in its growth for ’23 and ’24 but rebounded strongly in high double digits growth; it was valued at $162.22. In our bearish case, it had a deeper slowdown in ’23, and with larger volatility in the longer term, it was valued at $120.74. In our base case, it also had a visible slowdown in ’23 and ’24, but the growth was seen as stronger and smoother later on compared to the bearish case; it was valued at $140.59. The market price currently stays below our bearish scenario.

Abbott Laboratories needs to overcome near-term challenges. The slowdown it had in Q1 this year could be an indication of a weak 2023, and if a recession hits, 2024 could also be challenging. However, we believe the market has not only priced it in, but is also too bearish on its longer-term growth. We lean towards the valuation between our bearish and base case, given the challenges ahead.

Abbott: Fair Value (Calculated and Charted by Waterside Insight with data from company)

Conclusion

The lower topline growth has started to impact the company’s earnings margin, and sales could expect to slow down further in ’23 and ’24. However, we could argue that the market has priced it in and more. The company’s long-term growth, underpinned by innovation and a secular boom in medical and healthcare products and services, will have several pockets of strength to carry the company through the challenging times. There are multiple sectors in which the company is currently exploring potential products. Those could turn into stronger growth engines in the medium term. Although we share the near-term concerns for the company’s growth, it is a buy at the current prices for long term investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.