Summary:

- Abbott Laboratories reported impressive Q3 sales of $10.1B, driven by organic sales growth of 13.8%.

- The company’s diversified portfolio showed growth across all major business segments, including nutrition, pharmaceuticals, diagnostics, and medical devices.

- Abbott’s Q3 performance and strategic acquisitions position the company for continued success and a positive growth outlook.

PM Images

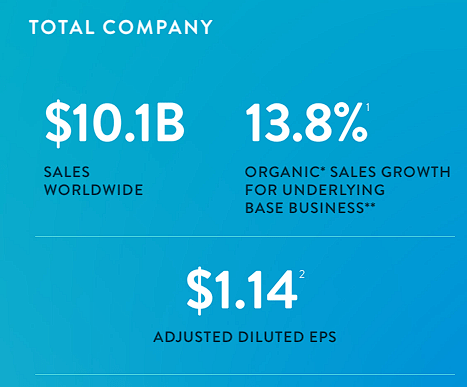

Abbott Laboratories (NYSE:ABT) recently revealed its Q3 earnings, revealing an impressive rebound in performance across all major business segments of the global healthcare behemoth. Abbott reported their Q3 sales came in at $10.1B, driven by organic sales growth of 13.8% in the underlying base business. Despite an anticipated decline in COVID-19 testing-related product sales compared to last year, Abbott’s reported sales only saw a marginal decrease of 2.6%. I believe the company’s performance showcases their resilient growth trajectory, which should bolster the ABT bull thesis during a tumultuous time in the healthcare sector.

I intend to provide a brief background on Abbott and will review their Q3 performance. In addition, I will take a look at Abbott’s recent rebound and potential to return to growth. Finally, I discuss how the Q3 earnings have impacted how I intend to manage my ABT position as we close out 2023.

Background On Abbott Laboratories

Abbott Laboratories is a global healthcare enterprise operating in over 160 countries, offering a range of trusted products. The company operates in four distinct sectors:

- Established Pharmaceutical Products

- Diagnostic Products

- Nutritional Products

- Medical Devices.

In the realm of Established Pharmaceutical Products, Abbott specializes in offering a comprehensive range of generic pharmaceuticals to address an array of conditions and diseases.

Within the Diagnostic Products category, Abbott excels in the provision of advanced laboratory systems spanning immunoassay, clinical chemistry, hematology, and transfusion. In addition, this segment provides sophisticated informatics and automation solutions tailored for laboratory applications.

Abbott Laboratories Featured Brands (Abbott Laboratories)

In the Nutritional Products sphere, Abbott specializes in the development and distribution of both pediatric and adult nutritional solutions, ensuring comprehensive support for individuals across all life stages.

The company’s Medical Devices division is at the forefront of delivering innovative solutions in rhythm management, electrophysiology, heart failure, vascular interventions, diabetes, neuromodulation, and structural heart treatments for the management of cardiovascular diseases.

By 2030, their goal is to enhance the lives of one in every three people on the planet.

Growth History

Overall, Abbott has a longstanding history of growth and beating the Street’s expectations.

Abbott Laboratories Earnings History (Abbott Laboratories)

However, the company has recently experienced a dry spell in their earnings reporting year-over-year decreases in revenue and EPS. This is largely a result of the company experiencing a roughly 36% revenue growth from 2019 to 2022. I am not suggesting that that level of growth is unsustainable, but we have to accept that a leader in several industries is going to experience choppy earnings from time to time. Keep in mind, that the company saw a nice boost from COVID-19 testing for a couple of years, and the negative impact of the Similac voluntary recall in February of 2022. So, the growth metrics are not going to paint a rosy picture for ABT. Still, considering that Abbott was pulling in around $8B per quarter in 2019 and is now pulling in around $10B per quarter… the general trend is still up for a company that reports billions of dollars in revenue each quarter and has a habit of beating the Street’s expectations by hundreds of millions of dollars.

Q3 Review

Abbott’s Q3 earnings showed that they pulled in $10.1B in sales with 13.8% growth in its core businesses, which led to a GAAP diluted EPS of $0.82 and an adjusted diluted EPS of $1.14.

Abbott Laboratories Q3 Results (Abbott Laboratories)

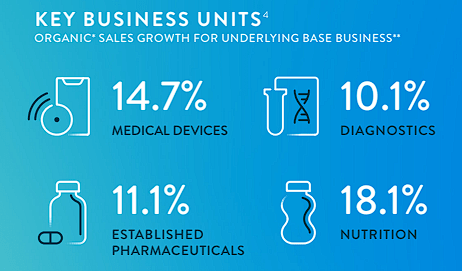

This impressive organic growth is particularly noteworthy as it spans across all four major business sectors, underscoring the company’s diversified and resilient portfolio.

Abbott Laboratories Q3 Results By Units (Abbott Laboratories)

Segment-wise, Abbott’s nutrition segment emerged as a powerhouse, exhibiting an astounding 18% surge in sales during the quarter. The segment’s total sales reached $2.07B in the U.S. and $1.21B internationally. This represents a substantial 25.4% increase in the U.S. and 9.3% internationally compared to the same period last year. This exceptional growth was propelled by the U.S. market with 41.8% growth, driven by a strong rebound in infant formula sales. On the international stage, global pediatric nutrition sales surged by an impressive 20.9% on a reported basis and 24.9% organically. Meanwhile, the adult nutrition segment also demonstrated significant growth, with global sales up by 10.8% reported and 12.4% organic with their Ensure brand leading the way.

The company’s established pharmaceuticals segment also demonstrated strong growth with a remarkable 11% surge in sales. Particularly noteworthy is the segment’s double-digit growth in critical areas such as cardiometabolic, women’s health, and CNS pain management, highlighting Abbott’s far-reaching impact in these pivotal healthcare sectors. Abbott’s Established Pharmaceuticals segment reported an increase of 3.2% in sales. Notably, sales in Key Emerging Markets demonstrated promising growth, increasing by 8.8% organically.

Abbott’s diagnostics segment exhibited a commendable 10% organic sales growth. This segment’s performance underscored its pivotal role in Abbott’s overall success. Core lab diagnostics emerged as a key driver, experiencing double-digit sales growth. This was attributed to exceptional performance both in the U.S. and on the international stage. A significant milestone was the successful recovery of the blood transfusion testing business, following a period of reduced plasma donations during the COVID-19 pandemic. The diagnostics segment faced challenges due to a decline in COVID-19 testing-related sales, resulting in an overall decrease of 32.7% in total reported sales. However, when excluding COVID-19 tests, the segment achieved a commendable 10.1% growth on an organic basis.

The medical devices segment delivered an outstanding performance, with sales surging by an impressive 15%. This figure includes double-digit growth both in the U.S. and international markets, emphasizing the segment’s global resonance. Within diabetes care, FreeStyle Libre sales reached a staggering $1.4B, marking a phenomenal 28% growth, exemplifying Abbott’s pioneering role in transforming diabetes management. The Medical Devices segment displayed robust growth, reporting a 16.6% increase in sales. This growth was primarily driven by double-digit organic growth in several product lines including structural heart, diabetes care, electrophysiology, and neuromodulator products. For diabetes care, their FreeStyle Libre sales witnessed an impressive 30.5% growth, while their electrophysiology international sales grew more than 20%.

Abbott Laboratories Updated Guidance (Abbott Laboratories)

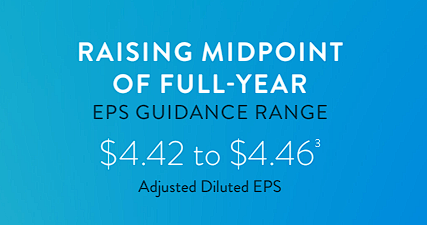

As a result, Abbott narrowed their full-year 2023 EPS guidance and now projects a full-year diluted GAAP EPS to be in the range of $3.14 and $3.18, and an adjusted diluted EPS to be in around $4.42-$4.46, which was an increase at the midpoint of the guidance range.

Potential Return To Growth

So far in 2023, the earnings reports suggest the company is showing some weakness following the surge from COVID-19 revenues, but you will also see that Abbott has been able to generate encouraging growth trends.

For the three quarters of 2023, Abbott’s Nutrition segment reported sales of $6.12B in the U.S. and $3.56B internationally. Notably, this segment exhibited remarkable growth in both pediatric and adult nutrition. Pediatric was up 32.8% in the U.S., and 10.6% internationally. Adult nutrition grew 13.5% in the U.S. and 8.8% internationally.

As for the pharmaceuticals segment, its sales amounted to $3.84B for the first three quarters of the year with an organic growth rate of 10.0%. Diagnostics reported total sales of $7.45B. After accounting for the impact of COVID-19 testing sales, the organic growth was a notable 7.2%. Looking at the Medical Devices segment, Abbott reported total sales of $12.44B over the first three quarters. Notably, diabetes care and electrophysiology experienced organic growth rates of 22.3% and 21.9% respectively.

Admittedly, some of this growth is related to a rebound in sales, including the pediatric nutrition segment due to the aforementioned Similac recall. However, one has to be encouraged by the company’s organic growth thus far in 2023 and should be optimistic about the company’s return to growth.

Securing Growth

Abbott’s Q3 performance showcases a resilient and forward-thinking company, capitalizing on opportunities in the evolving healthcare landscape.

One of these growth opportunities comes from Abbott’s acquisition of Bigfoot Biomedical in September. This deal is a significant step forward in developing advanced insulin management systems thanks to Bigfoot’s unity system. The Bigfoot Unity Diabetes Management System represents a groundbreaking solution designed to offer real-time guidance on insulin dosage. The system integrates continuous glucose monitor data with instructions from healthcare providers to provide insulin dose suggestions for individuals with diabetes who administer multiple daily injections of insulin.

Abbott also expanded their collaboration with mAbxience to commercialize a number of biosimilar drugs, with the aim of improving access to these therapies in emerging markets. These biosimilars are projected for 2025, with additional launches contingent on completing clinical development and registration.

With a strong foundation and strategic acquisitions, Abbott is poised for continued success in the years to come.

Addressing GLP-1 Risk

The introduction of Novo Nordisk’s (NVO) GLP-1 inhibitors, a popular therapy for weight loss, has sparked concerns about their potential impact on Abbott’s diabetes care systems. During the Q3 earnings call, Abbott’s management addressed these concerns, emphasizing that an increasing number of patients are adopting a combined approach, using both CGM and GLP-1 medications to manage their diabetes. They do not perceive these GLP-1 drugs as extensive pressures on their FreeStyle line.

The company’s position makes sense to me because regardless of how well the GLP-1 drugs work, diabetics are still going to need to monitor their glucose levels.

Our Takeaway

Despite what the growth metrics indicate, Abbott still has plenty of signs of a positive growth outlook permeating from all business segments and is poised for a resounding conclusion to the year, setting a promising tone for the start of 2024. In the long term, I am relying on Abbott’s formidable market position and the company’s strategic shrewdness in navigating a complex and dynamic global healthcare landscape.

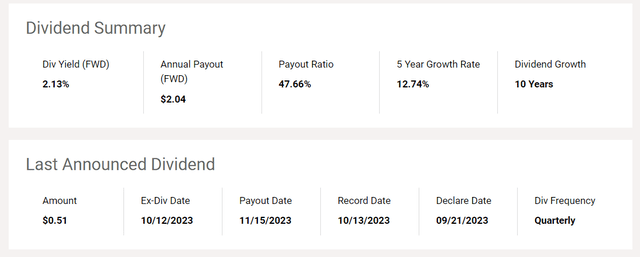

Moreover, ABT offers a healthy dividend with a forward annual payout of $2.04 at a 2.13% yield. Admittedly, this is not a very attractive dividend at the moment, however, Abbott has 10 years of growth at a 12.74% 5-year growth rate.

ABT Dividend Summary (Seeking Alpha)

As a result, ABT will remain in the Compounding Healthcare “Healthy Dividends” Portfolio and will maintain a conviction level of 4 out of 5.

My Plan

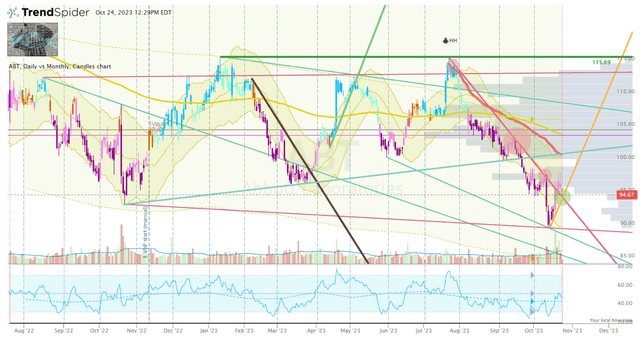

ABT is currently trading below my Buy Threshold of $100 but is still trading above my Buy Target 1 of $90 per share. So, I am going to need a conviction reversal setup before clicking the buy button.

Looking at the Daily Chart, we can see that ABT has experienced relentless selling pressure over the past couple of months after the ticker hit a double-top in July. Thankfully, the ticker was able to break that downtrend ray and has acquired a low-conviction uptrend ray after a strong bounce off the lows following a bullish divergence in the share price.

Although this is a nice reversal set-up, we are still looking at a bearish rating on the Go-No-Go indicator, and the share price is still trading below the anchored VWAP from the July high. Therefore, I am going to hold off on clicking the buy button at this time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT, NVO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Want to capitalize on the next big medical breakthrough?

Tired of missing out on some of the healthcare sector’s multi-baggers?

Join Compounding Healthcare where we employ data analytics in combination with technical analysis and clinical data breakdown in order to manage a position in numerous potential multi-bagger investments that can grow into a comprehensive healthcare portfolio.