Summary:

- In this article, we dive into Abbott Laboratories, one of the few dividend kings with a dividend growth track record of at least 50 consecutive annual hikes.

- The company comes with a decent dividend yield and sustainable dividend growth backed by a wide-moat business model.

- While fading COVID tailwinds have paused long-term earnings growth, the company benefits from strong secular growth in key areas and an expected total sales rebound in the years ahead.

Sundry Photography

Introduction

In this article, we will do something I should have done a long time ago: discuss Abbott Laboratories (NYSE:ABT), a dividend king in the healthcare sector that finally comes with a terrific valuation.

Although the current macroeconomic and market conditions make it difficult to predict the extent of the decline in stock prices, I am of the opinion that conservative dividend growth investors will benefit from purchasing a high-quality stock such as ABT at a discounted price.

In this article, I will guide you through my thoughts and explain why ABT might be a good addition to your portfolio.

So, let’s get to it!

A Fast-Growing Dividend King

Dividend kings are companies that have raised their dividends for at least 50 consecutive years. It’s an elite club containing fewer than 50 members. While buying stocks with a terrific track record is a recipe for a low-volatility portfolio with decent long-term returns, there tends to be one major issue in some cases. Because dividend kings are often very mature businesses, some tend to have little to no long-term growth. That isn’t necessarily a bad thing if they are cash cows, but some investors (like myself) prefer to incorporate stocks with more growth into their portfolios.

That’s where Abbott comes in.

I know it sounds cliche, but it’s truly one of the best dividend-growth stocks money can buy.

Founded in 1888 in Chicago as Abbott Alkaloidal Company, the corporation has become a leader in medical devices (34% of 2022 sales), diagnostics (38%), nutrition (17%), and established pharmaceuticals (11%).

Made In Chicago Museum

With a market cap of $172 billion, the company has a very wide moat consisting of several pillars.

-

Diversified Business Model: Abbott’s diversified business model is a key strength that has helped the company maintains steady growth over the years. As we just discussed, the company has no business segment with more than 40% of total sales. It is also not dependent on a small number of products that could make or break its dividend growth streak.

-

Strong Brand Recognition: Abbott’s brands, such as Ensure and Similac in the nutrition segment, are well-known and trusted by consumers worldwide.

-

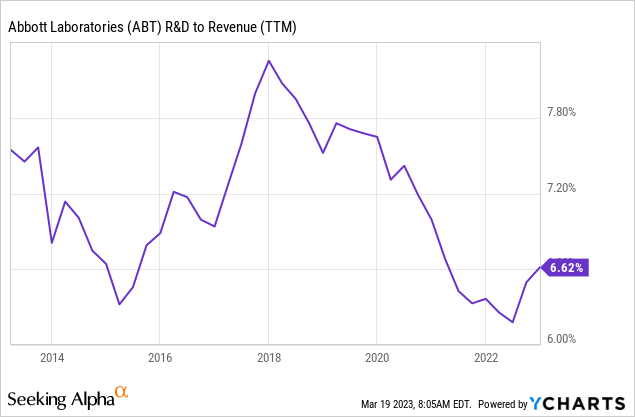

Focus on Innovation: Abbott has a long history of investing in research and development, which has resulted in the development of innovative products that address significant health needs. Over the past ten years, the company has spent between 6% and 8% of its revenues on R&D. While that is no guarantee for success, it does add to its moat. After all, not a lot of companies can compete with close to $3 billion in annual R&D!

-

Regulatory Expertise: The healthcare industry is heavily regulated, and Abbott’s expertise in navigating regulatory requirements is a key strength that has helped the company succeed. Abbott has a strong reputation for compliance, which helps it secure regulatory approvals and maintain its market position. This is also the part where trust comes in. After all, I’m not an expert on regulations. Knowing how well ABT has handled these situations increases the odds that it will stay that way.

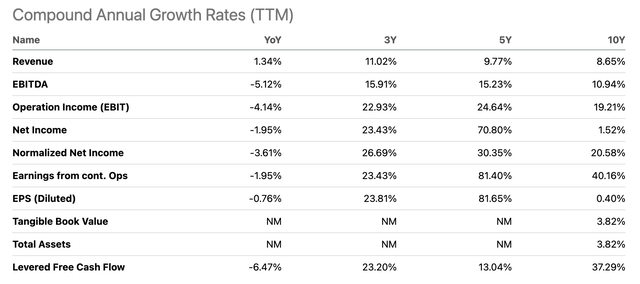

With that said, the company’s financial results show that growth is high and consistent. Over the past ten years, the company has grown its sales by 8.7% per year. EBITDA has grown by 11%. Normalized net income accelerated by 21%. That’s not bad for a company founded in 1888.

Furthermore, while growth has come down quite a bit on a year-on-year basis, this is caused by the fading pandemic. After all, ABT was a major beneficiary of the pandemic. It delivered close to 3 billion COVID tests during the pandemic years. Now, these tailwinds are fading.

According to Mr. Robert Ford, Chairman and CEO of Abbott:

Over the past few months, the impact of COVID-19 on society has lessened and economies around the world are increasingly reopening. In the U.S., the U.S. dollar weakened a bit and inflation has eased somewhat and hospital-based procedures and routine testing trends continue to steadily improve in many areas. As you know, COVID testing has been a big part of our story these past couple of years and I am proud of what our team has built, a full suite of tests across several platforms and the intentionality and how we established a leading role in the world’s response to the pandemic.

Abbott Laboratories expects COVID-19 to transition to a seasonal respiratory virus, which means COVID testing is expected to decline significantly. Abbott Laboratories’ outlook for 2023 forecasts ongoing earnings per share of $4.30 to $4.50 and organic sales growth, excluding COVID testing sales, in the high single digits. COVID testing sales are expected to be around $2 billion for 2023.

That said, during the COVID peak in 2021, the company did $12.8 billion in EBITDA. This year, that number is expected to be $10.2 billion. In 2025, it is expected to be $12.1 billion.

In other words, the pandemic has created a unique situation that will cause ABT to generate flat EBITDA on a prolonged basis.

Needless to say, the company has growth markets. This includes diabetes care. In this segment, it owns products like FreeStyle Libre. This glucose monitoring system saw 40% sale growth in 4Q20 in the United States. Global 2022 sales reached $4.3 billion.

Even better, the company has fast-growing products in a wide range of segments. According to the company:

We continue to strengthen our medical device portfolio with numerous pipeline advancements and launches, including recent U.S. regulatory approvals of Aveir, our highly innovative leadless pacemaker used to treating people with slow heart rhythms, Eterna, the smallest implantable rechargeable spinal cord stimulation system currently available in the market for the treatment of chronic pain.

So, what does this mean for its dividend (after that, we’ll get to the valuation)?

The ABT Dividend & Stock Price Outperformance

During the earnings call, CEO Robert Ford was asked where he stands on share repurchases when it comes to the use of cash.

This is what he answered:

I would say if I were to kind of rank it in terms of use of cash, we are committed to growing a dividend, a strong and growing dividend. So, that’s probably number one use of cash. We announced that increase of about 9% in our dividend last year.

In other words, he immediately went to the company’s commitment to its dividend, which is great (for obvious reasons).

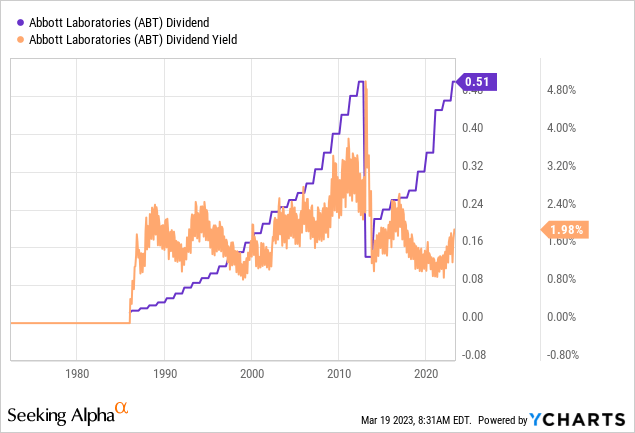

As the chart below shows, it looks like ABT cut its dividend after the Great Financial Crisis. That is NOT the case. Back then, ABT spun off healthcare giant AbbVie (ABBV), which I own. Adjusted for that spin-off, investors did not encounter a dividend cut. For what it’s worth, ABBV also has a flawless dividend growth record.

The only issue is that ABT does not have a high yield. Right now, the company’s stock is yielding 2.1%, based on a $0.51 per share per quarter dividend. That’s not a lot, but it’s close to the long-term median.

Moreover, the company has a very “green” dividend scorecard, as it scores high on safety, growth, yield, and consistency.

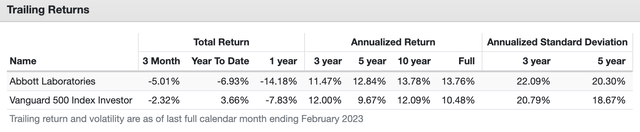

For example, over the past ten years, the average annual dividend growth rate was 8.2%. That number improves to 12.3% on a five-year basis. The most recent hike was 8.5% on December 9, 2022 (announcement date).

Moreover, the adjusted payout ratio is still just 36%.

Based on this context, we can assume that the ABT stock price delivers consistent capital gains. After all, consistently high dividend growth did not manage to push the yield far above 2%.

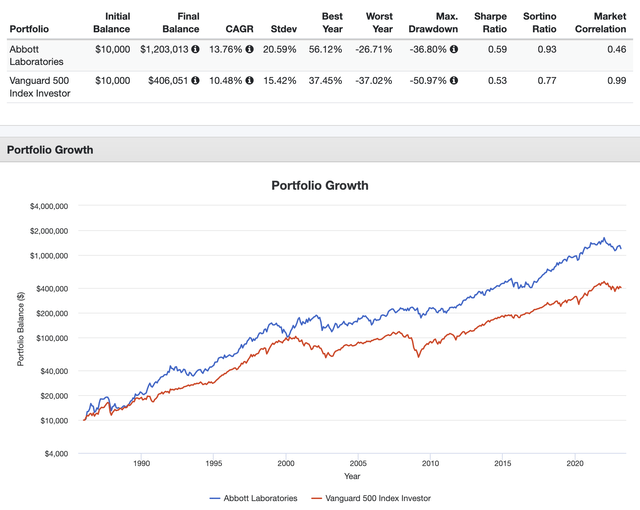

Going back to 1986, ABT has returned 13.8% per year, beating the S&P 500 by almost 300 basis points per year. Even better, it has done this with a standard deviation of just 20.6%. The market’s standard deviation was 15.4%. That’s a terrific score for a single stock.

Furthermore, the company has maintained this performance on a consistent basis. It even managed to narrow the volatility gap versus the S&P 500.

So, what about the valuation?

Valuation

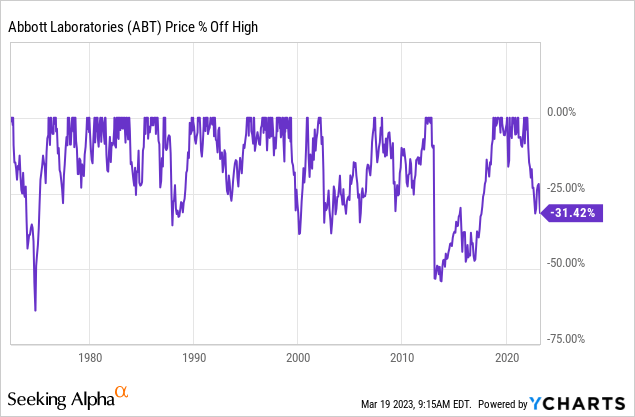

31%. That’s how much ABT shares are trading below their all-time high. This is one of the worst sell-offs since the 1980s. The massive decline after the Great Financial Crisis was caused by the ABBV spin-off. Hence, that’s not an actual decline of more than 50%.

On the one hand, sell-offs aren’t fun as they pressure our portfolios. On the other hand, who doesn’t love to buy awesome stocks at great prices? Smart buys at attractive prices are the main drivers of long-term outperformance.

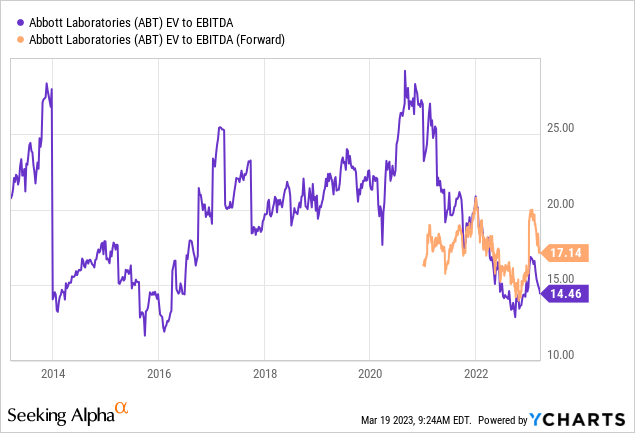

So, with that said, ABT shares are trading at 14.5x EBITDA. The forward multiple is 17x, which makes sense due to fading COVID tailwinds.

Moreover, the company is on track to do $9.3 billion in 2025E free cash flow. This would imply a 5.4% free cash flow yield.

This valuation is attractive.

Takeaway

I believe that Abbott is the perfect stock for most dividend growth portfolios. The company has a wide moat, well-established cash-cow products, and fast-growing products providing high long-term growth rates, a decent dividend yield, high and consistent dividend growth, and a very attractive valuation.

While its 2.0% dividend yield isn’t what income-seeking investors are looking for, investors buy more than a decent yield. They get a low-volatility stock with a high likelihood of long-term outperformance. Moreover, consistent dividend growth will eventually result in a high yield on cost.

If I hadn’t aggressively added to some of my holdings last week, I would be a buyer of ABT stock at these levels. For now, I placed it in one of my model portfolios and on my watchlist. I believe that ABT is the perfect fit for my portfolio in addition to my healthcare stocks AbbVie and Danaher (DHR).

Needless to say, ABT is one of my favorite dividend kings. A king among kings, so to speak.

Do you agree? Let me know in the comments!

Disclosure: I/we have a beneficial long position in the shares of ABBV, DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.