Summary:

- I analyzed Abbott Laboratories, a healthcare company with a diversified portfolio that includes pharmaceuticals, diagnostic products, nutritional products, and medical devices.

- I believe Abbott has potential growth opportunities in diabetes care and cardiovascular diseases, with significant worldwide exposure allowing for increased sales in various markets. However, the company faces risks such as declining demand for Covid tests, competition, and a high valuation.

- In my opinion, shares of Abbott Laboratories are HOLD due to their high valuation. The shares would be attractive at a P/E ratio of 16-17 or a P/E ratio of 19 once the company returns to its growth path.

Sundry Photography

Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

A year ago, I analyzed the shares of Abbott Laboratories (NYSE:ABT) and found it to be a HOLD. I was concerned about the valuation, especially when the market was bearish. Since then, shares have been down 3%, while the stock market has climbed. I believe this is an excellent time to revisit this blue chip. Abbott is in the healthcare sector, making it less sensitive to a recession. Thus, it can be a safer investment if the economic environment deteriorates.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Abbott Laboratories discovers, develops, manufactures, and sells healthcare products worldwide. It operates in four segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. The Established Pharmaceutical Products segment provides generic pharmaceuticals. The Diagnostic Products segment offers laboratory systems in the areas of immunoassay, clinical chemistry, hematology, and transfusion. The Nutritional Products segment provides pediatric and adult nutritional products. The Medical Devices segment offers rhythm management, electrophysiology, heart failure, vascular and structural heart devices for treating cardiovascular diseases, and diabetes care products.

Fundamentals

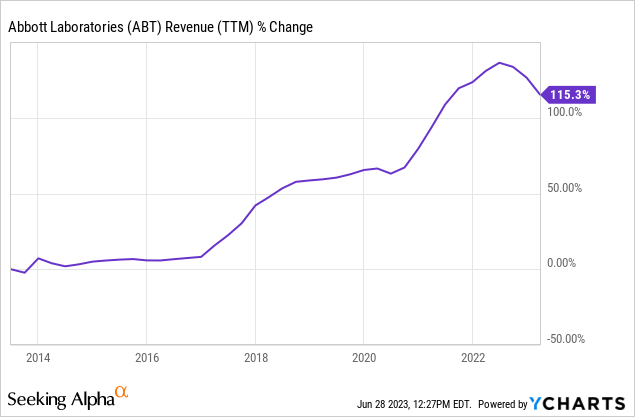

The revenues of Abbott have more than doubled over the last decade, with a 115% increase in sales. Sales growth is attributed mainly to organic growth that includes higher prices and more unit sales. The pandemic also achieved growth as the company sold popular covid test kits. The acquisition of St. Jude in 2017 also supported revenue growth. In the future, as seen on Seeking Alpha, the analyst consensus expects Abbott Laboratories to keep growing sales at an annual rate of ~1% in the medium term.

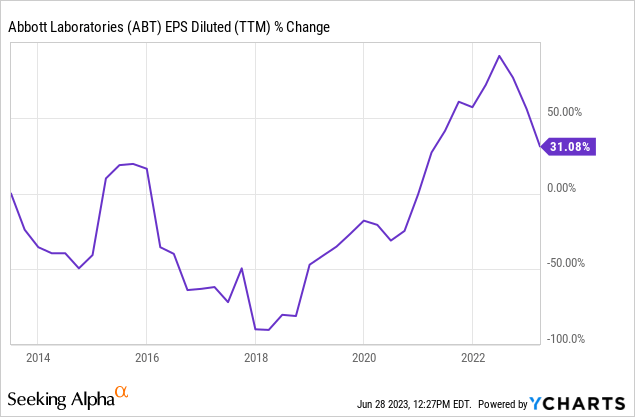

The EPS (earnings per share) has grown 31% over the last decade. This is a far lower figure than the sales growth, as these are GAAP earnings that include non-cash expenses. The non-GAAP EPS has increased by 165% over the decade. Higher EPS results from sales growth, buybacks before and after the St. Jude acquisition that diluted shareholders, and a significant improvement in the operating margin from 11% a decade ago to 20% in 2022. In the future, as seen on Seeking Alpha, the analyst consensus expects Abbott Laboratories to keep growing EPS at an annual rate of ~1% in the medium term.

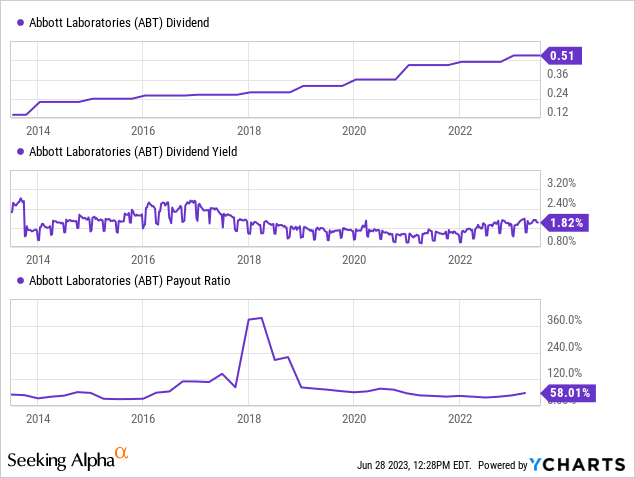

The dividend is one of Abbott’s crown jewels. The company is a dividend king that has raised the dividend payment yearly over the last 51 years. The spin-off of AbbVie (ABBV) kept the combined dividend whole, and since then, the company has increased the payment almost to its pre-spinoff amount. The current dividend is safe as the payout ratio is 58%, even when GAAP EPS is used. However, as the company struggles to grow due to the EPS and sales decline resulting from the end of the pandemic, the dividend growth will be low to maintain a comfortable payout ratio.

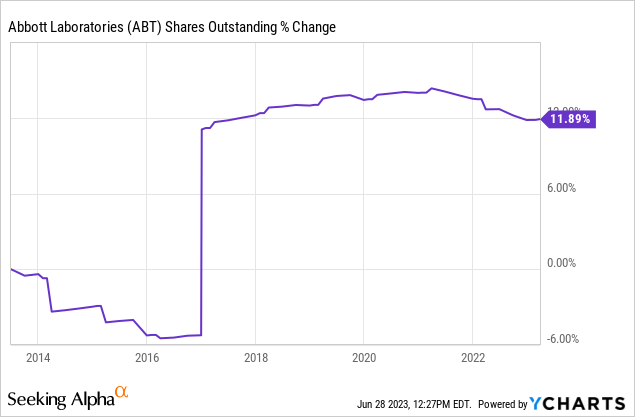

In addition to dividends, companies, including Abbott Laboratories, return capital to shareholders via buybacks. Buybacks support EPS growth as they decrease the number of outstanding shares. Over the last decade, the outstanding shares have increased by 12% despite the share repurchases. This increase is the result of the St. Jude acquisition. The buybacks during that decade decreased the dilutive effect, and as the company continues to buy back, it will support EPS growth.

Valuation

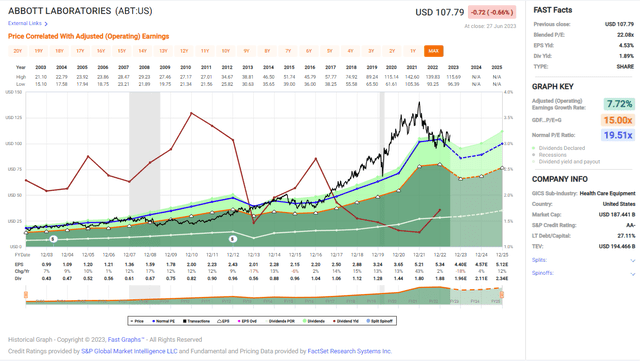

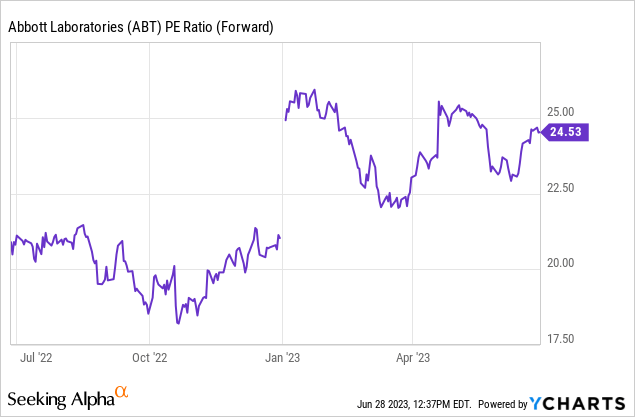

The P/E (price to earnings) ratio of Abbott Laboratories stands at 24.5 when using the EPS estimates for 2023. This is a high valuation for a company that struggles to grow due to sales decline following the pandemic. This valuation is high compared to the valuation over the last twelve months, and despite being a quality company, it will be hard to justify such a premium for a CAGR of 1% in the medium term.

The graph below from Fast Graphs also shows that the shares of Abbott Laboratories are overvalued right now. Over the last twenty years, the company’s average P/E was 19.5, which is not low, but still far lower than the current P/E ratio. During that period, the company has grown its EPS by a CAGR of 7.7%, higher than the current forecast for the medium term. Therefore, shares of Abbott are trading for a significant premium.

Opportunities

The first key to growth is the company’s diversification. The medical devices market in the U.S. is mature, and while there is room to grow and innovate there, the company is leaning towards international exposure and growth. 60% of the company’s sales come from outside the United States. One of its business segments, the established pharmaceuticals segment, is only active abroad selling generic drugs. Significant worldwide exposure allows the company to increase sales in different markets and business segments when an opportunity arises.

Diabetes care is another opportunity for the company. Over 500M people worldwide have diabetes, and the company is among the leaders in the segment. Diabetes care accounts for roughly a quarter of the medical devices sector, growing by 16% YoY. The company launched new devices last quarter and got FDA clearance for FreeStyle Libre 2 and FreeStyle Libre 3 sensors for integration with automated insulin delivery systems.

Another promising business is the company’s cardiovascular, which, together with the Structural Heart segment, accounts for roughly another third of the medical devices sales. Cardiovascular diseases are the leading cause of death in the United States. The company is a leading innovator, and sales were over $1B in the last quarter alone. The company already leads as it published that new data show the superiority of the TriClip device compared to medical therapy for tricuspid regurgitation, significantly improving quality of life. Moreover, the acquisition of Cardiovascular Systems also supports future growth.

Risks

The Covid pandemic effect is wearing down, and the hangover is painful for Abbott. The company expects a 17% decline in sales and a 9% decline in EPS in 2023. The diagnostics segment has seen in Q1 a 49% decrease in sales as the demand for Covid tests plummeted. It will take to recover from this loss of revenue, and any inability to execute might postpone it even more. Walgreens is suffering from the same challenge as it struggles to replace the sales of its vaccination services.

Moreover, the healthcare business, and especially the medical devices business, is very competitive. The company competes with specialized medical devices companies like Medtronic (MDT) and Becton, Dickinson, and Company (BDX). They also have offerings in diabetes and cardiovascular. It also competes with a giant like Johnson & Johnson (JNJ). Harsh competition may hinder growth in key segments and make replacing the lost diagnostics sales harder.

The most significant risk, in my opinion, is the lack of margin of safety. The current valuation makes no sense. The P/E ratio is 20% higher than the average P/E ratio, while the growth rate is low and the interest rate is high. The current earnings yield is below the short-term risk-free interest. Therefore, there is a significant risk of capital depreciation if the company fails to execute flawlessly. With such slow growth, this may take very long to recover if it happens.

Conclusions

To conclude, despite what is likely to be a temporary lack of growth, Abbott Laboratories is an excellent company. It has a long track record of top-line, bottom-line, and dividend growth. It also has promising growth opportunities in highly lucrative businesses around diabetes and cardiovascular diseases. Moreover, the competition risk is one that the company has been dealing with for decades, and the lost pandemic sales are a unique one time-risk.

Still, I believe that shares of Abbott Laboratories are a HOLD at the current market condition. The company trades for a high valuation when the interest rates are high, and it grows slowly. When selling for 24.5 times earnings, the shares of Abbott are not attractive. I will find them attractive at a P/E ratio of 16-17 or a P/E ratio of 19 once the company returns to its growth path.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, ABT, JNJ, MDT, BDX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.