Summary:

- Abbott Laboratories is now a $183 billion (by market cap) healthcare titan.

- Abbott Laboratories has increased its dividend for more than 50 consecutive years. So it has the kind of dividend growth pedigree that few companies can compare to.

- The company has increased its revenue from $20.2 billion in FY 2014 to $40.1 billion in FY 2023. That’s a solid compound annual growth rate of 7.9%.

- A combination of thoughtful diversification and favorable business model dynamics bodes extremely well for Abbott Laboratories and the ability for the company to continue growing its revenue, profit, and dividend for years to come.

Sundry Photography

Abbott Laboratories (NYSE:ABT) is a multinational medical devices and health care company. Founded in 1888, Abbott Laboratories is now a $183 billion (by market cap) healthcare titan that employs more than 110,000 people.

The company reports results across four segments: Medical Devices, 42% of FY 2023 revenue; Diagnostics, 25%; Nutrition, 20%; and Established Pharmaceuticals, 13%. Nearly 60% of the company’s sales are international, while the remaining ~40% come from the US.

Abbott Laboratories is in the right business at the right time. See, healthcare is in secular growth mode across the world. It’s a case of basic demographic tailwinds blowing the company’s way. The planet’s human population is growing larger, now up to 8.1 billion (up from 6.1 billion at the turn of the century).

Since people are living longer than ever before, the global population is also growing older. And what do people often require more of when they’re older? Healthcare. A larger pool of older people who will likely demand more healthcare plays right into the hands of Abbott Laboratories.

Not only that, but there’s a third component to this. People, on average, are also becoming wealthier. More money means more access to high-quality healthcare. So it’s rising demand and rising access.

Abbott Laboratories meets this rising demand via diversified avenues ranging across devices, diagnostic tools, medicines, and nutritional products – all designed to improve health and prolong life. This combination of thoughtful diversification and favorable business model dynamics bodes extremely well for Abbott Laboratories and the ability for the company to continue growing its revenue, profit, and dividend for years to come.

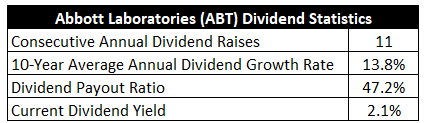

Dividend Growth, Growth Rate, Payout Ratio and Yield

Abbott Laboratories has already increased its dividend for 11 consecutive years. While that’s certainly a nice start, this number actually belies the company’s dividend growth prowess and commitment.

See, Abbott Laboratories is actually a Dividend Aristocrat. A company has to have at least 25 consecutive years of dividend increases in order to become a Dividend Aristocrat. What gives?

The discrepancy exists because Abbott Laboratories spun out certain pharmaceutical assets into a new, independent company called AbbVie Inc. (ABBV) back in 2013. This move “reset” the dividend and its growth, but shareholders of Abbott Laboratories who kept their new AbbVie shares were made whole and saw their dividend income continue to rise straight through this process.

Putting that aside, Abbott Laboratories has declared a dividend for more than 400 consecutive quarters since 1924, and the company has increased its dividend for more than 50 consecutive years. So Abbott Laboratories has the kind of dividend growth pedigree that few companies can compare to.

The 10-year dividend growth rate is 13.8%, which is very strong considering that Abbott Laboratories is technically decades into dividend growth already. The fire still burns bright.

Now, the last few years have been a bit bumpy around dividend growth, and I think that stems from the pandemic and the kind of volatility that resulted from it. But the company’s most recent dividend raise was nearly 8%, and I don’t see anything to indicate that Abbott Laboratories can’t continue to grow its dividend in a high-single digit range like that.

That belief is partially supported by a very reasonable 47.2% payout ratio, based on FY 2024 adjusted EPS guidance (at the midpoint). And one gets to layer that dividend growth on top of the stock’s market-beating 2.1% yield. This yield, by the way, is 50 basis points higher than its own five-year average.

A 2%+ yield and ~8% dividend growth sums out to a 10% annualized total return, give or take, assuming no major changes to the valuation. From one of the best Dividend Aristocrats in the game, that’s a compelling setup.

Revenue and Earnings Growth

As compelling as it may be, though, some of these dividend metrics are based on what’s happened in the past. However, investors must be anticipating what could happen in the future, as the capital of today is being risked for the rewards of tomorrow. Thus, I’ll now build out a forward-looking growth trajectory for the business, which will come in handy when the time comes later to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top line and bottom line growth. I’ll then reveal a professional prognostication for near-term profit growth. Measuring the proven past against a future forecast like this should give us what we need to assemble a reasonable idea of where the business might be going from here.

Abbott Laboratories increased its revenue from $20.2 billion in FY 2014 to $40.1 billion in FY 2023. That’s a compound annual growth rate of 7.9%. Very solid. I like to see at least a high-single digit top line growth rate from a mature business like this, and Abbott Laboratories more than delivered. The last decade is a post-AbbVie decade for the company, too, so it gives us a very fair picture of what the business looks like.

Meanwhile, earnings per share grew from $1.49 to $3.26 over this period, which is a CAGR of 9.1%. A great result. Hard to complain about this kind of growth from a company that’s nearly 140 years old.

The company has had wide divergences between GAAP numbers and adjusted numbers in recent years, but I’m using straight GAAP here.

A big margin expansion story has played out over the last decade, but it’s been somewhat offset by steady dilution.

Looking forward, CFRA projects an 8% CAGR in EPS over the next three years for Abbott Laboratories. This would represent an ever-so-slight slowdown in growth, but I think CFRA is right to be a bit cautious.

Because of a spike in demand for diagnostics and testing supplies during the pandemic, as well as a post-pandemic collapse in demand for these same products, recent revenue and profit figures from Abbott Laboratories have been super-volatile, which I touched on earlier.

Abbott Laboratories is currently guiding for FY 2024 EPS to come in at $3.35 (at the midpoint). This would be only 2.8% YOY growth. Ordinarily, I’d be somewhat taken aback by this, but the lumpiness is not unusual.

Overall, when stretching things out over longer periods of time, Abbott Laboratories is reliably putting up high-single digit EPS growth. If we take CFRA’s forecast as our base case, that positions the dividend for similar growth. That circles back around to that 8% dividend growth figure I remarked on earlier. And again, you’re pairing that with the 2%+ starting yield.

It’s not exactly lighting the world on fire, but that’s an easy path to very respectable returns over the coming years.

Financial Position

Moving over to the balance sheet, Abbott Laboratories has a great financial position.

The long-term debt/equity ratio is 0.4, while the interest coverage ratio is over 15. As good as these numbers are, they actually don’t do full justice.

I say that because cash offsets half of all long-term debt, putting net debt at about $7 billion – a tiny amount for a company of this size. This balance sheet should offer plenty of reassurance.

Profitability is also really good. Return on equity has averaged 16.1% over the last five years, while net margin has averaged 13.9%. The returns on capital here aren’t the highest out there, but it’s hard to not be satisfied by this kind of ROE – especially considering the fact that there isn’t much leverage used.

Overall, what we have here is a high-quality Dividend Aristocrat firing on all cylinders. And with economies of scale, IP, R&D, entrenched sales relationships, technological know-how, regulatory expertise, and barriers to entry, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry. I see all three of those risks as elevated for this particular business model relative to a lot of other business models.

Litigation, in particular, has been a rising risk, as evidenced by recent judgments related to the company’s baby formula.

On the other hand, high regulatory hurdles, especially around medical devices, are barriers to entry which stave off new competition.

Being an international business, Abbott Laboratories has exposure to different jurisdictions and currency exchange rates.

Product recalls are a constant risk.

There’s execution and product quality risk, and the company’s issues with baby formula production is leading to ongoing ramifications.

The introduction of new weight loss drugs in the marketplace may reduce demand for some of the company’s various offerings.

The company faces some technological obsolescence risk, especially around medical devices.

I actually see above-average risks here, but Abbott Laboratories is running a business of above-average quality.

Plus, the stock has a below-average valuation…

Valuation

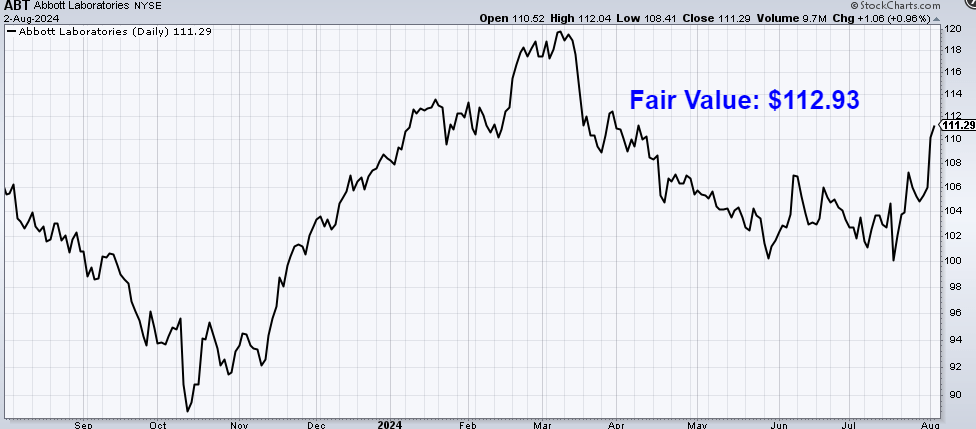

The P/E ratio of 33 looks high on its face, but I already noted earlier how the company’s GAAP results have been all over the place. And because of that already being factored into the stock for years now, the stock’s own five-year average P/E ratio is 34.9. We’re currently below that right now.

Furthermore, based on midpoint guidance for this year’s adjusted EPS, the forward P/E ratio drops to 22.5 – a reasonable earnings multiple for a high-quality Dividend Aristocrat.

If we look at the P/S ratio, which hasn’t been impacted by the ongoing adjustments, it’s at 4.5. That’s decently below its own five-year average of 4.9.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis. I factored in a 10% discount rate and a long-term dividend growth rate of 8%. That 8% rate is as high as I’ll go, but Abbott Laboratories is one of those businesses that deserves it.

The 10-year EPS CAGR is slightly above this level, and the near-term forecast for EPS growth is right at this mark. Also, recent dividend growth has been in this area.

With the payout ratio being where it’s at, along with the business still chugging along nicely, I think high-single digit dividend growth will persist for years to come.

The DDM analysis gives me a fair value of $118.80. The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth. It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today. I find it to be a fairly accurate way to value dividend growth stocks. From my point of view, the stock looks modestly undervalued.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at. This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system. 1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value. Morningstar rates ABT as a 3-star stock, with a fair value estimate of $104.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line. They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a Strong Sell and 5 stars meaning a stock is a Strong Buy. 3 stars is a Hold. CFRA rates ABT as a 4-star “Buy”, with a 12-month target price of $116.00.

I’m very close to where CFRA is at. Averaging the three numbers out gives us a final valuation of $112.93, which would indicate the stock is possibly 7% undervalued.

Bottom line

Abbott Laboratories has a business model that’s in the right place, at the right time. Its diversified lineup across healthcare is experiencing secular growth, benefitting from massive demographic tailwinds. With a market-beating yield, double-digit dividend growth, a reasonable payout ratio, more than 10 consecutive years of dividend increases, and the potential that shares are 7% undervalued, this Dividend Aristocrat is a prime candidate for long-term dividend growth investors who are looking to increase their exposure to healthcare.

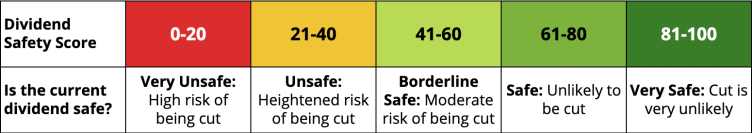

Note from D&I: How safe is ABT’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 90. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, ABT’s dividend appears Very Safe with a very unlikely risk of being cut.

Disclosure: I’m long ABT.