Summary:

- The S&P 500 gained 2% last week despite weak employment data and manufacturing sentiment, driven by optimism about potential Fed rate cuts.

- Abbott Laboratories, though lagging the S&P 500, shows promise with diversified growth in diagnostics, nutrition, diabetes care, and heart health.

- With a strong dividend and innovation-driven outlook, Abbott is well-positioned for long-term gains, although current high valuations suggest cautious optimism.

hapabapa

Introduction

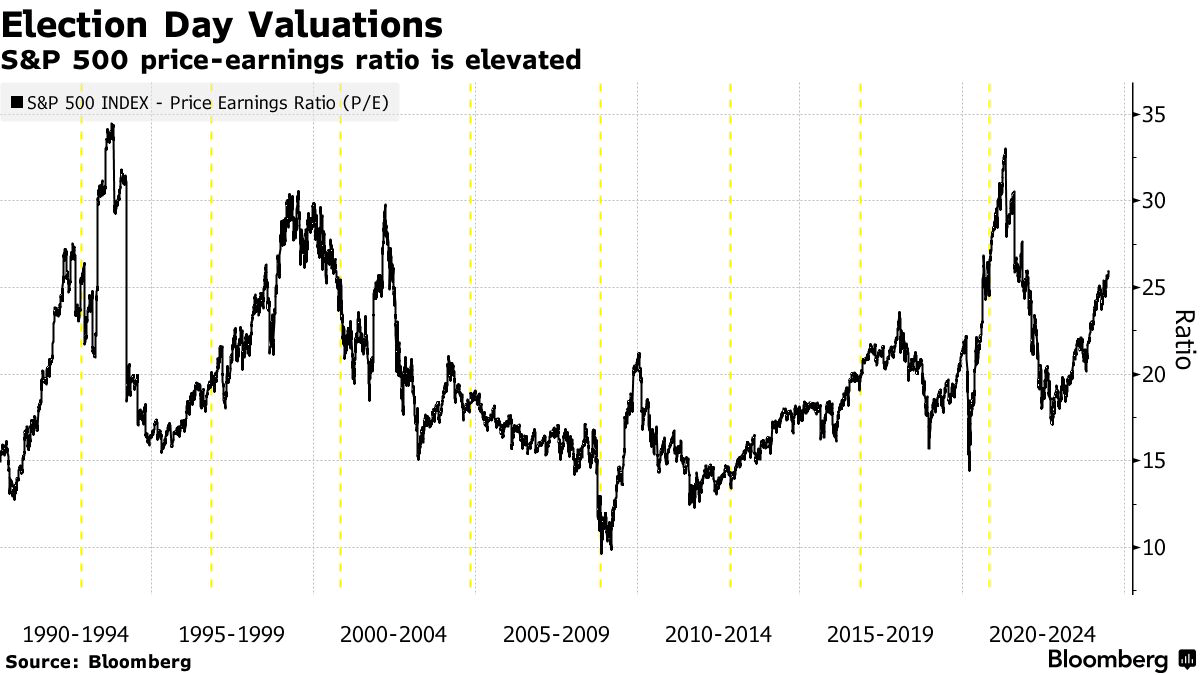

Bloomberg hit the nail on the head when it wrote: “High-Priced S&P 500 Powers Head Untroubled by Political Stress.”

Essentially, the market went back to doing what it does best, which is betting on the Fed easing rates going forward. This allowed it to ignore poor employment numbers, construction in the services industry, and weakness in manufacturing sentiment.

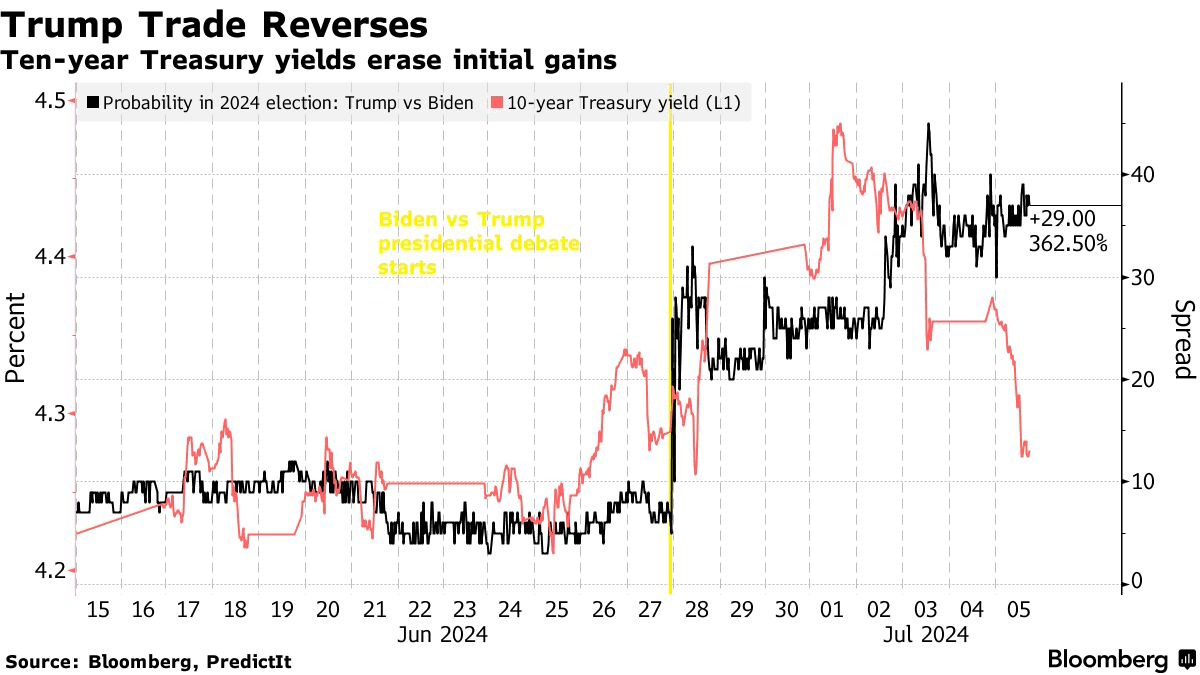

The S&P 500 gained 2% in the week, the most since April, as data showing a contraction in services industries and an uptick in the unemployment rate reinforced optimism on rate cuts. Ten-year Treasury yields, which initially spiked after Biden’s disastrous June 27 performance spurred wagers that Trump’s return to office would herald looser fiscal policy, erased the increase, as did the dollar, falling for the first week since May. – Bloomberg

Bloomberg

Don’t get me wrong. I’m not “hating.” I know I may sound incredibly bearish when I write stuff like this.

I don’t have any shorts. In fact, I don’t even have cash after my latest investment.

This is all about the risk/reward.

Although we can make the case that stock market valuations are horrible tools for market timing, the current situation hints that we may need to lower our expectations, regardless of what happens in November (or in general).

Currently, the S&P 500 trades at 26x earnings, which is higher than any election since at least 1990.

Bloomberg

Again, this doesn’t mean the market is toast – especially not because these valuations are driven by fewer than ten mega-cap “tech” stocks.

What this means is that I’m looking for opportunities elsewhere, which includes other areas with secular growth and companies that haven’t done so well recently.

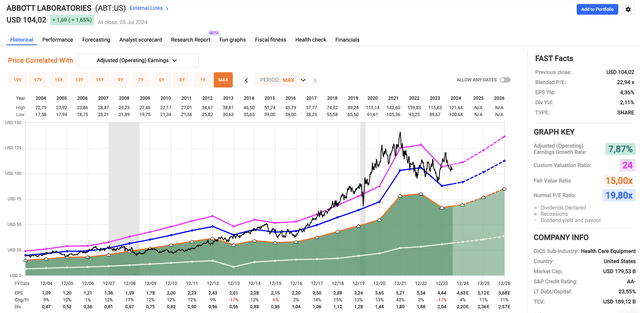

One of them is Abbott Laboratories (NYSE:ABT). The medical devices giant with a $180 billion market cap has been disappointing since its stock price peak in 4Q21. Back then, the pandemic ended, leaving COVID-19 winners in the dust.

While weakness is deserved after the valuation started to run red-hot, I have become a big believer in the potential this Dividend King brings to the table.

My most recent article was written on April 22, when I went with the title: “Why I Believe Abbott Is Much Better Positioned In Today’s Rising Inflation Scenario.”

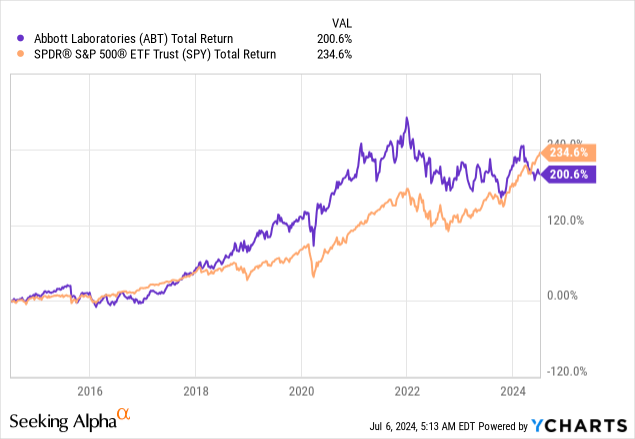

Since then, shares are down 3.2%, lagging the 11.6% return of the S&P 500 by a substantial margin. It has also allowed the S&P 500 to beat ABT over the past ten years. Including dividends, it has beaten the healthcare giant by exactly 34 points.

As we slowly approach the company’s earnings release on July 18, I’ll use this article to update my thesis and explain why I like the value ABT brings to the table.

So, let’s get to it!

Forget COVID, Abbott Is Back

I say this with the utmost respect for people who suffered from the pandemic, but it was one of the most bullish periods for healthcare companies like Abbott, who sold hundreds of millions of tests and related products.

The problem is that it pushed so much money into the industry that it took many years to unwind all of the “bullishness.”

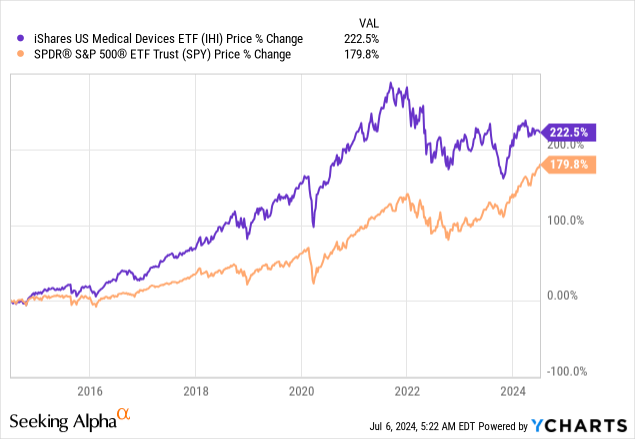

For example, the iShares U.S. Medical Devices ETF (IHI), which returned 223% over the past ten years (excluding dividends), hasn’t gone anywhere since January 2021!

This has created an extremely tough situation for investors, as it’s hard to deal with an industry that goes from sky-high growth to contraction, followed by an uncertain path of growth. That really does a number on our ability to find appropriate P/E multiples.

The good news is that 2024 seems to be the first year of elevated optimism.

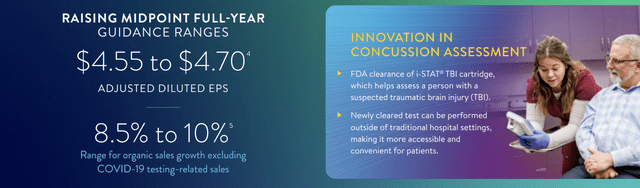

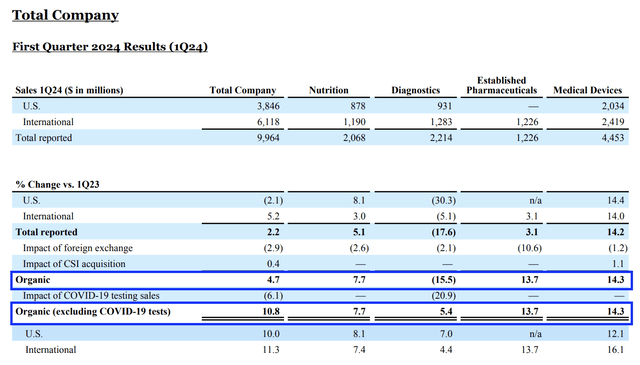

For example, in the first quarter, the company raised its full-year guidance, expecting adjusted EPS between $4.55 and $4.70. It expects organic sales growth, excluding COVID-19 testing, of 8.5% to 10.0%.

This was driven by strong underlying growth, including the achievement of ex-COVID double-digit organic sales growth for the fifth consecutive quarter, with a 14% growth rate in Medical Devices and Established Pharmaceuticals.

What makes ABT so powerful is diversification and its ability to innovate in each of its key segments.

This includes the news that it obtained product approvals and has seen major milestones in critical clinical trials in a number of key areas.

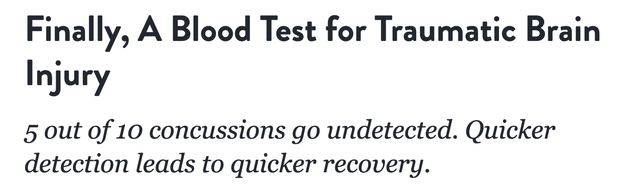

For example, in Diagnostics, Abbott received FDA approval for a point-of-care diagnostic test that can determine if someone suffered a mild traumatic brain injury or concussion in just 15 minutes, run on its i-STAT Alinity product.

As we can see below, the Diagnostics segment was the only segment with a negative impact from COVID-19. I highlighted organic growth and non-COVID organic growth in the table below.

Moreover, the company has seen 8% higher sales in its Nutrition segment, driven by double-digit growth in Pediatric Nutrition and market share gains in the U.S. infant formula business.

On top of that, the launch of Protality, which is a new nutritional shake aimed at adults pursuing weight loss, is expected to further support growth in this segment.

On a side note, this makes Abbott a winner of the current weight-loss pill trend, as its products go well with other weight-loss treatments.

Meanwhile, in Diabetes Care, FreeStyle Libre sales reached $1.5 billion in the quarter. This translates to a 23% growth rate!

FreeStyle Libre also benefited from the expansion of reimbursement coverage in major European markets like France and Germany.

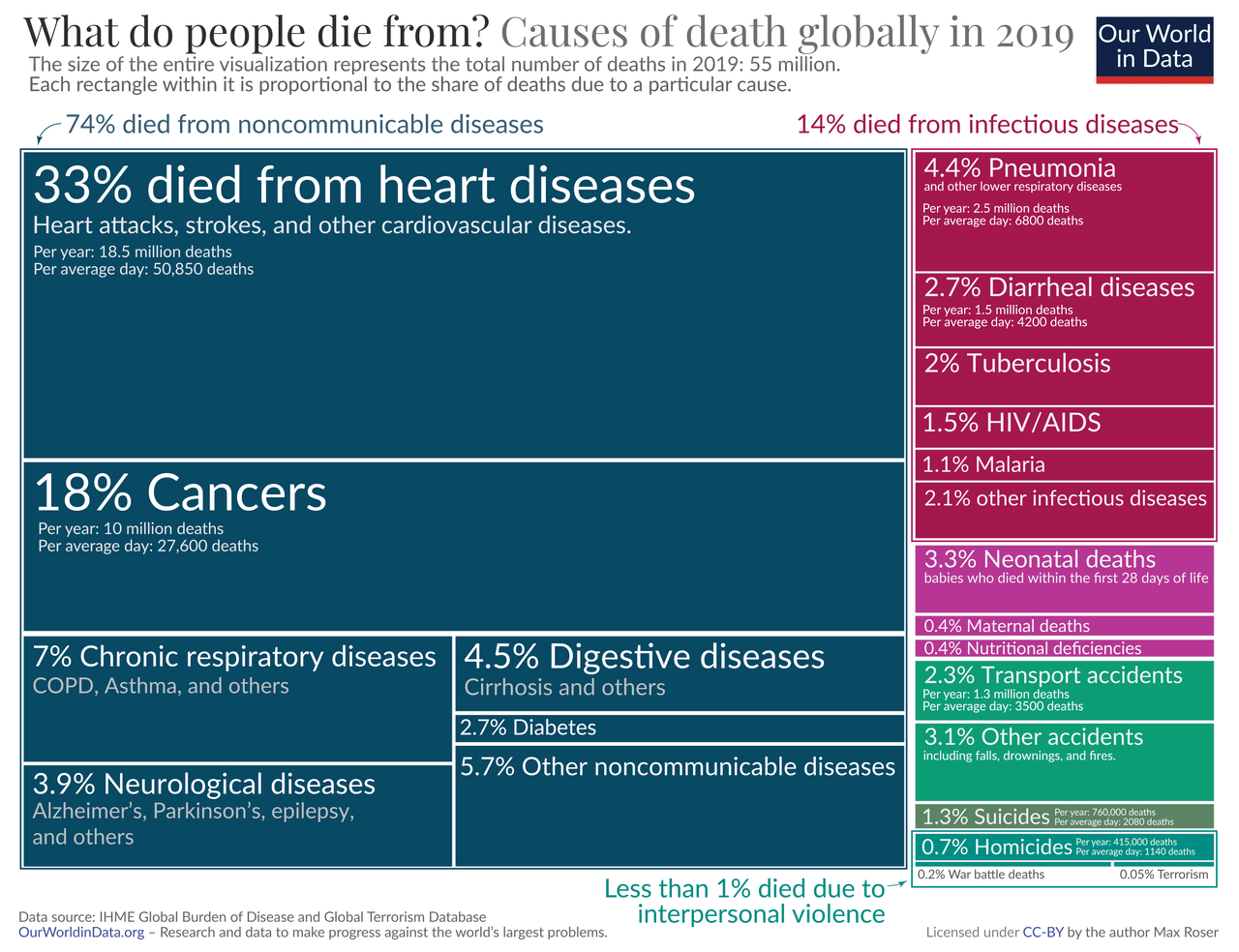

The company is also rapidly growing in heart health, which is one of my favorite areas due to heart issues being the number one death cause.

Using 2019 numbers (old but still relevant), a third of all deaths came from heart-related issues.

In Structural Heart, the company saw a 13% growth rate. This was supported by products like Navitor, Amulet, and TriClip.

Moreover, the recent FDA approval of TriClip, which is designed for treating tricuspid regurgitation, supports the company’s ability to address major demand in another fast-growing market.

Last but not least, the company saw 17% growth in Neuromodulation, supported by the launch of Eterna and Liberta, which are devices for pain management and movement disorders (like Parkinson’s) – also two important growth markets.

Where’s The Shareholder Value?

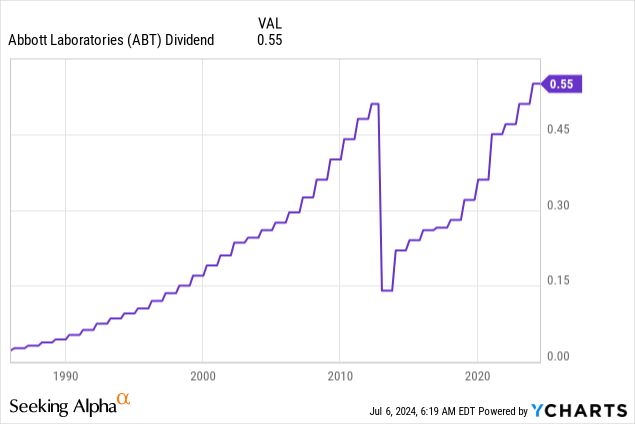

One major benefit of owning ABT stock is its fantastic dividend.

For starters, Abbott Laboratories is a Dividend King, which means it has hiked its dividends for more than 50 consecutive years. Please note that the dividend decline in 2013 was the AbbVie (ABBV) spin-off. Since then, both ABT and ABBV have raised their dividends every single year.

That said, a Dividend King title is great, but it’s not enough.

After all, when a company is mature enough to gain Dividend King status, sometimes it’s so mature that dividend growth is slow. Hence, while I respect Dividend Kings, it’s not a criterion I’m aiming for in my research.

Luckily, ABT is different. It’s a Dividend King that comes with a lot of dividend growth.

Yielding 2.1%, the company has a 48% payout ratio and a five-year CAGR of 12.1%, which is a great deal for at least two reasons:

- A 2.1% yield with double-digit dividend growth is a great combination.

- We can expect elevated dividend growth to last, as analysts are very upbeat about ABT’s future.

After what we discussed in this article so far, it may not be a surprise that analysts are upbeat.

Using the FactSet data in the chart below, analysts expect 4% EPS growth this year (including pandemic headwinds). 2025 and 2026 are both expected to see 11% growth.

As I have written in prior articles, I believe this recovery deserves a higher multiple than its long-term 19.8x average.

Looking at prior growth recoveries, the company used to trade at 24-25x earnings.

Using that number would pave the road for 12-14% annual returns in the years ahead.

That said, I don’t own Abbott. While I was looking to add it to my portfolio, I bought too many new positions this year to justify adding another one – at least for the next few months.

Instead, I decided to focus on my investment in Danaher (DHR), which has a very high correlation to ABT. So, don’t be surprised I’m not long ABT despite my bullish thesis.

Takeaway

I believe Abbott Laboratories presents a compelling opportunity due to its strong fundamentals and diversified growth across various segments.

With significant advancements in diagnostics, nutrition, diabetes care, and heart health, Abbott’s impressive dividend growth track record and innovative capabilities make it a solid long-term investment.

In its 2Q24 earnings call, I expect the company to shed more light on innovation and its ability to move beyond the challenging post-pandemic environment.

While I currently don’t hold Abbott stock, its potential for double-digit returns in the coming years makes it a fantastic long-term play.

Pros & Cons

Pros:

- Diversified Growth: Abbott excels in multiple segments, including diagnostics, nutrition, diabetes care, and heart health, which provides it with diversification and elevated growth.

- Strong Dividend: As a Dividend King with a 2.1% yield and a five-year CAGR of 12.1%, Abbott offers reliable and growing income.

- Innovation Leadership: The company’s commitment to innovation, with products like Protality and FreeStyle Libre, positions it for long-term growth and market leadership.

- Market Position: Despite recent underperformance, the company’s fundamentals suggest it is in a great position for a rebound, especially in light of optimistic growth forecasts.

Cons:

- Valuation Challenges: Short-term valuation may be affected by post-pandemic headwinds, potentially impacting short-term returns.

- Uncertainty: Related to the point above, the ongoing impact of COVID-19 on healthcare demand creates some uncertainty regarding future earnings and growth prospects. It’s hard to put a valuation on a company at this stage of the cycle.

- Competition: While ABT has proven to remain strong in light of competition, it operates in attractive markets with eager peers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.