Summary:

- Abbott Laboratories reported solid growth across all segments in its third-quarter results, excluding its COVID diagnostics portfolio.

- The company’s medical devices business, which includes its Diabetes Care portfolio, grew almost 29% in Q3 despite fears of competition from GLP-1 drugs.

- ABT investors fled over the past month. However, I gleaned a possible long-term bottom in early October, further bolstered by Abbott’s solid earnings guidance.

- I argue why ABT’s dip buyers are likely accumulating, as ABT has not been this cheap since the lows of the COVID pandemic.

Tim Boyle

Abbott Laboratories (NYSE:ABT) is a high-quality global healthcare leader with a diversified business model underpinned by several growth drivers. Its operating performance was lifted by its COVID diagnostics segment over the past two years. However, since we have moved into the endemic phase, Abbott’s focus has shifted back toward its base business.

Accordingly, Abbott operates through four business segments: Diagnostics, Medical Devices, Nutrition, and Established Pharmaceuticals. The company recently reported its third-quarter or FQ3 earnings results, showing solid broad-based growth across all its segments, excluding its COVID diagnostics portfolio.

Abbott reported revenue of $10.14B in FQ3, down 2.6% on a reported basis. However, it increased by 13.8% on an ex-COVID or organic basis, underpinned by robust double-digit growth across all four segments. Despite that, ABT investors have suffered since it topped out in late 2021. Given the growth normalization in its COVID diagnostics business, I believe the battering is justified, helping to take the heat out of ABT’s previous overvaluation levels.

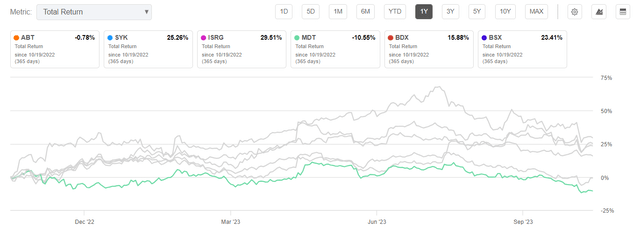

ABT Vs. Peers (1Y total return %) (Seeking Alpha)

As such, ABT has underperformed its peers listed above in the healthcare equipment industry, posting a 1Y total return of -0.8%. Accordingly, ABT fell into a bear market from its July 2023 highs, down more than 22% through its recent October lows.

The battering is likely linked to the fears over the headwinds resulting from the GLP-1 drugs from Eli Lilly (LLY) and Novo Nordisk (NVO) on Abbott’s medical devices business. Notably, the segment posted an organic growth of nearly 15% in FQ3, underpinned by its Diabetes Care portfolio, which grew almost 29% over the same period. As such, Wall Street’s fears over the competitive headwinds from the GLP-1 drugs could have been overstated.

Management took time to elucidate why the advent of the GLP-1 drugs has benefited the company. Abbott highlighted its research indicating “an increasing number of users combining Libre with GLP-1 medications as part of a companion therapy approach for diabetes management.” As such, it led to higher utilization of its FreeStyle Libre blood glucose monitor, “complementing each other in optimizing diabetes treatment.”

Management also reminded investors that it’s too early to ascertain the impact of the GLP-1 drugs on the TAM of its medical devices portfolio, which remains significant in scale. I believe Abbott has demonstrated that its Diabetes Care business hasn’t been impacted so far. Instead, it has benefited from the healthcare regime of diabetes users, which included both products. Despite that, I believe it’s clear from Johnson & Johnson’s (JNJ) recent earnings call that a further impact shouldn’t be ruled out. Accordingly, JNJ has experienced “a near-term impact on weight loss surgeries.” As a result, the company guided for a flat growth profile in procedure volumes in 2024.

Still, I concur with management that assessing the impact across the med tech industry is still too early. However, investors have likely taken the “sell first and ask questions later” approach. The market needs to reflect increased execution headwinds, which might not have been baked sufficiently into the estimates for Abbott and its peers.

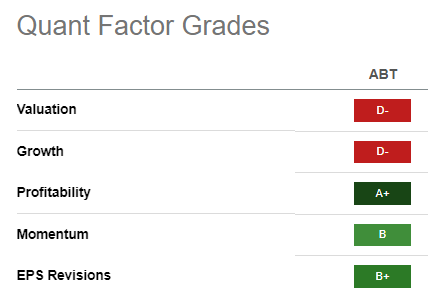

ABT Quant Grades (Seeking Alpha)

Despite that, ABT’s well-diversified business model shouldn’t be impacted markedly by the GLP-1 headwinds in the near term, underpinned by its industry-leading “A+” profitability grade.

Also, its execution has continued to surprise toward the upside (“B+” earnings revisions grade), including its recently upgraded adjusted EPS guidance for FY23. Accordingly, the company expects an adjusted EPS range of between $4.42 and $4.46, “representing an increase at the midpoint of the guidance range.”

While ABT is still priced at a premium (“D-” valuation grade) against its sector peers, I also gleaned that ABT’s forward EBITDA multiple of 16.5x has fallen toward its 10Y average of 16x. Notably, ABT has never been this cheap since it bottomed out at the 16x forward EBITDA multiple level in March/April 2020.

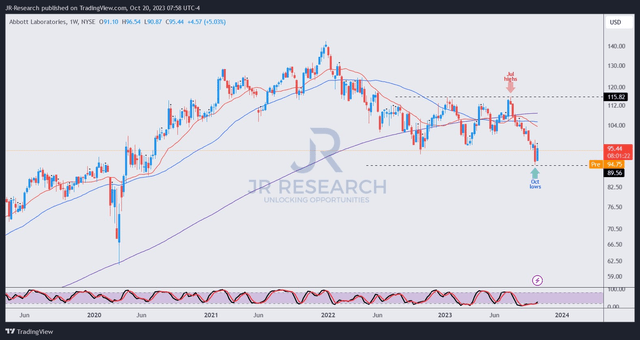

ABT price chart (weekly) (TradingView)

In addition, I gleaned that dip-buyers have attempted to support a bullish reversal in ABT’s price action since early October at the $90 level. ABT looks close to its peak of pessimism after a dramatic collapse from its December 2021 highs.

The $115 level is anticipated to be its critical resistance zone in the near- to medium-term. Despite that, the risk/reward has improved markedly, although ABT investors must remain patient.

ABT momentum buyers must eventually help recover its $115 level to return ABT into an upward bias. However, it’s deeply mired in a downtrend at the moment, suggesting investors should consider allocating their capital over time to allow for dollar-cost averaging opportunities.

Rating: Initiate Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!