Summary:

- I reiterate a “Strong Buy” rating for Abbott Laboratories with a fair value of $135 per share due to their strong R&D pipeline and robust financial performance.

- Abbott’s recent results show 7.6% organic revenue growth, driven by medical devices and pharmaceuticals, leading to raised full-year EPS guidance.

- Despite ongoing NEC baby formula lawsuits, the financial impact is marginal, representing only 0.02% of total revenue.

- Abbott’s continuous glucose monitoring systems, Lingo and Libre Rio, are expected to drive future growth, supported by a growing CGM market.

jetcityimage/iStock Editorial via Getty Images

I reiterated a “Strong Buy” rating for Abbott Laboratories (NYSE:ABT) in my previous article published in January 2024. I discussed their strong R&D pipeline and their efforts to overcome challenges related to the COVID-19 pandemic. Abbott delivered a strong Q3 result, beating the market expectations and raising full-year EPS guidance. I reiterate a “Strong Buy” rating with a fair value of $135 per share.

NEC Baby Formula Lawsuit

Abbott is facing hundreds of lawsuits alleging the company failed to warn parents about the potential risk of necrotizing enterocolitis (NEC) disease in premature babies caused by Abbott’s Similac formula. In July 2024, a Missouri state court ordered Abbott to pay $495 million in damages to an Illinois family, as reported by the media. Abbott is still involved in the ongoing litigation, and the outcome remains uncertain at this moment.

However, the total revenue for related products is about $9 million annually, only representing 0.02% of the total. Even if the related products were discontinued in the future, the financial impact would be marginal.

Lingo & Libre Rio Launch

In June 2024, the FDA approved Abbott’s two new over-the-counter continuous glucose monitoring (CGM) systems: Lingo and Libre Rio. Abbott has been expanding their product offerings in the CGM market. Lingo will track glucose and provide personalized insights to consumers 18 years and older; while Libre Rio is designed for people with Type 2 diabetes, aged 18 and older, who do not use insulin.

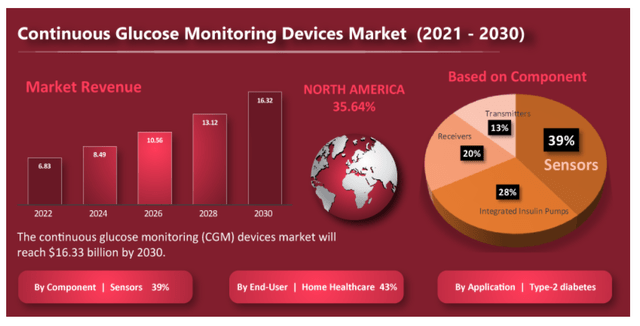

In the CGM market, Abbott competes with DexCom, Inc. (DXCM), with both companies investing heavily in wearable glucose monitoring systems recently. Strategic Market Research predicts that the global CGM market will grow at a CAGR of 11.5% from 2022 to 2030, as depicted in the slide below.

In short, I am encouraged to see Abbott continuing to invest in their CGM products. As a result, their Freestyle Libre sales have been growing by 20% over the past few quarters.

Recent Result and Outlook

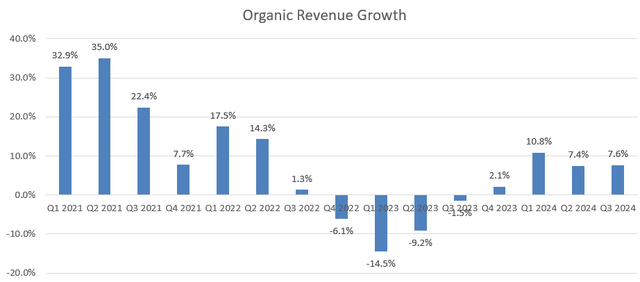

Abbott released their Q3 results on October 16th before the market opens, reporting 7.6% organic revenue growth and 7.2% adjusted net profit growth, as shown in the chart below. The strong performance was driven by strong growth in the medical device and their pharmaceutical segments, which grew by 13.3% and 7%, respectively.

My key takeaway from the quarter is Abbott’s leading position in some growth areas such as structural heart, diabetes care, and electrophysiology. The company experienced robust growth in FreeStyle Libre, Navitor, and TriClip, as well as catheters and cardiac mapping-related products. As discussed previously, I anticipate FreeStyle Libre will continue to drive the overall growth in the medical device segment.

Due to the strong performance during the quarter, Abbott raised the full year EPS guidance to $4.64 to $4.70 and maintained the organic revenue growth guidance of 9.5% to 10.0% excluding COVID-19 testing-related sales.

For the Nutrition business, I calculate the revenue will grow by 5% accounting for the potential impact of the NEC baby formula issue. It’s worth noting that the nutrition business is stable but not a high-growth area for Abbott.

Diagnostic business is being driven by increased instrument placement, consumable growth as well as menu expansions for their instruments. Abbott has been investing in their point-of-care diagnostics, which has seen strong revenue growth recently. Considering both the core lab and point-of-care market, I predict their revenue will grow by 7% annually.

Abbott has a well-established pharmaceutical franchise and focuses on international market expansions. Abbott has strong market positions in some high-growth countries, including India, Vietnam, and Brazil. I anticipate 8% organic revenue growth for Abbott’s pharmaceutical business.

Lastly, medical devices represent more than 40% of total revenue. I anticipate the segment will grow by 10%, aligned with their historical trends.

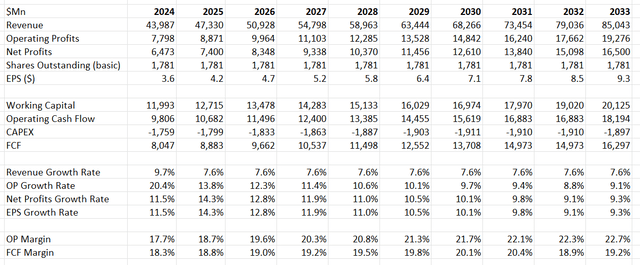

Putting together, I calculate the company’s revenue will grow by 7.6% organically from FY25 onwards. I continue to anticipate Abbott’s margin expansion to be driven by reductions in depreciation and amortization costs, and the improvement of their gross margin. I project 40bps-100bps annual margin expansion driven by 20bps gross margin improvement and 20bps-80bps from reduced depreciation and amortization costs.

The WACC is calculated to be 9% assuming: a risk-free rate of 3.6%; beta 0.8; cost of debt of 5%; equity risk premium 7%; equity $202 billion; debt $15 billion; and tax rate 14.5%. The DCF can be summarized as follows:

Discounting all the future FCF, the fair value of Abbott’s stock price is calculated to be $135 per share, according to my model.

Key Risk

Abbott has a strong leading position in their continuous glucose monitoring system with their Freestyle Libre brand. GLP-1 drugs have been rapidly adopted among patients with type 2 diabetes, with clinical research demonstrating that GLP-1 receptors are effective in controlling blood sugar and reducing body weight. While both Abbott and DexCom indicated that GLP-1 is unlikely to pose a significant risk to their CGM products, there could be some impact on the overall demand for glucose monitoring if patients can control their blood sugar and weight effectively through these GLP-1 receptors.

Verdict

I like Abbott’s leading positions in the medical device and pharmaceutical markets, which delivered a strong result during the quarter. I anticipate the company to continue growing in the continuous glucose monitoring market with its Lingo and Libre Rio launches. Therefore, I reiterate a “Strong Buy” rating with a fair value of $135 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.