Abbott: Strong R&D Pipeline Continues To Drive Growth; Reiterate ‘Strong Buy’

Summary:

- Abbott Laboratories’ stock price has risen by 16.6% since October 2023, outperforming the index.

- The company achieved strong growth in FY23, excluding contributions from COVID testing businesses.

- Abbott Laboratories is providing guidance for 8-10% organic revenue growth in FY24, with a focus on overcoming challenges related to the pandemic.

JHVEPhoto

Since I initiated coverage on October 20, 2023, Abbott Laboratories’ (NYSE:ABT) stock price has risen by 16.6%, compared to the index return of 14.2%. I highlighted their robust and innovative product pipeline in the introductory article. I believe the company is successfully overcoming challenges related to the COVID-19 pandemic, and I reiterate a ‘Strong Buy’ rating with a fair value of $115 per share.

Recent Result and FY24 Outlook

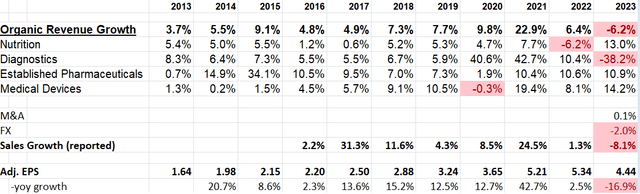

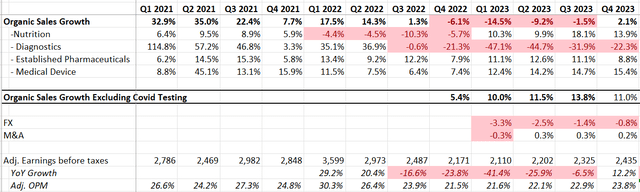

In Q4 FY23, Abbott Laboratories achieved 2.1% organic revenue growth and an impressive 11% growth when excluding the contributions from the COVID testing businesses. The adjusted earnings before taxes also showed a substantial year-over-year increase of 12.2%. Considering the exclusion of COVID testing, it appears that the company delivered a notably strong growth performance in FY23.

Abbott Laboratories Quarterly Results

For FY24, Abbott Laboratories is providing guidance for 8-10% organic revenue growth, excluding COVID testing, and an adjusted EPS in the range of $4.5-$4.7. It appears that Abbott has made significant progress in overcoming the challenges posed by the COVID pandemic over the past five quarters. During the pandemic period, the COVID-related business accounted for nearly 20% of the group revenue in FY21 and FY22.

Due to this high baseline, their organic revenue experienced a decline of 6.2% in FY23, with Diagnostics showing a notable year-over-year decline of 38.2%. However, I anticipate that they won’t face as much headwind from high comparables in FY24, considering they have navigated through such challenges for the past 4-5 quarters.

As highlighted in my introductory article, Abbott’s strong new product pipelines should be a key driver for the company, and I believe they are poised to achieve at least 7% organic revenue growth in a normalized period.

Strong R&D Pipeline Updates

The company is strategically focusing on its R&D pipeline, with over 25 new growth opportunities identified in the past two years. These opportunities include a mix of new products, new indications, and expansions in both geographic reach and reimbursement. In the structural heart business, recent launches such as Amulet, TriClip, and Navitor have contributed to the double-digit growth in this segment.

Notably, Navitor, designed to address narrowed aortic valves in individuals with severe aortic stenosis, received FDA approval in 2023. This new product positions Abbott to strengthen its competitive advantage in the Transcatheter Aortic Valve Implantation (TAVI) market, which is the largest segment within the structural heart market. According to Next Move Strategy Consulting, the global TAVI market is anticipated to grow significantly, from $4.89 billion in 2021 to an estimated $16.32 billion by 2030, registering a CAGR of 14.6% from 2022 to 2030. These innovative product launches are expected to drive Abbott’s growth and expand its profit margins.

I also highlighted the potential of the TriClip G4 Heart valve repair device, with its FDA review scheduled for February 13th. If approved, this could present another substantial growth opportunity for Abbott, further solidifying its position in the market.

Valuation

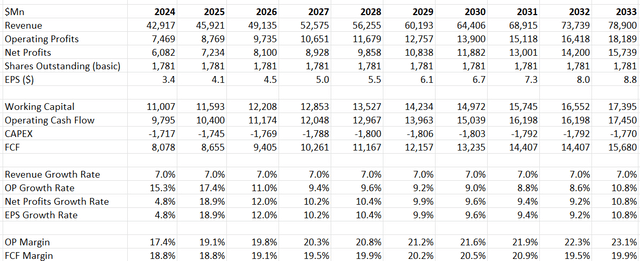

I updated the DCF model accordingly. I continue to anticipate 7% organic revenue growth driven by their innovative product pipeline. Additionally, the growth rate is in line with their long-term growth track record. Margin expansion is expected to be driven by operating leverage, new products, as well as pricing growth. According to my calculations, I estimate their margin to reach 23.1% by FY33.

Abbott Laboratories DCF – Author’s Calculations

I am using a 4% discount rate, consistent across all my models, and a 4% terminal growth rate, which is a typical level for mature healthcare companies. The calculated fair value is $115 per share. Currently, the stock price is trading at around 23 times forward free cash flow, and I don’t perceive it as expensive for a company with high-single-digit organic growth.

Near-Term Headwinds

Weak Flu Season: As revealed in the earnings call, the flu season arrived later this year compared to the previous year, resulting in increased sales pressure for Abbott Laboratories’ flu and respiratory businesses. This delay in the flu season has further exacerbated challenges for their Diagnostic business, which experienced a notable decline of 22.3% in Q4 FY23.

Foreign Exchange Headwind: The company anticipates foreign exchange to have an unfavorable impact of more than 1% on their overall revenue for FY24. Additionally, for the first quarter of FY24, foreign exchange is expected to affect revenue by 2%. Abbott generates almost 60% of its revenue outside the U.S.; thus, it could be challenging for them to manage their currency risk.

Verdict

I favor their strong R&D pipeline of new products, and their organic growth is outstanding among big healthcare companies. I reiterate a ‘Strong Buy’ rating with a fair value of $115 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.