Summary:

- Abbott’s diversified growth, driven by innovative medical devices and established pharmaceuticals, positions it well for long-term success and market outperformance.

- Despite legal challenges and post-pandemic headwinds, Abbott’s robust earnings growth and solid dividend profile make it an attractive investment.

- Abbott’s strong innovation pipeline, including advancements in CGM systems, supports its market share gains and growth outlook.

- Valuation challenges and competition present risks, but Abbott’s resilience and adaptability justify a bullish outlook.

JHVEPhoto

Introduction

One of the most fascinating things about the stock market is the number of unique companies/stocks we can pick from. Especially in the United States, there seems to be a ticker for every type of business imaginable.

However, this also comes with challenges.

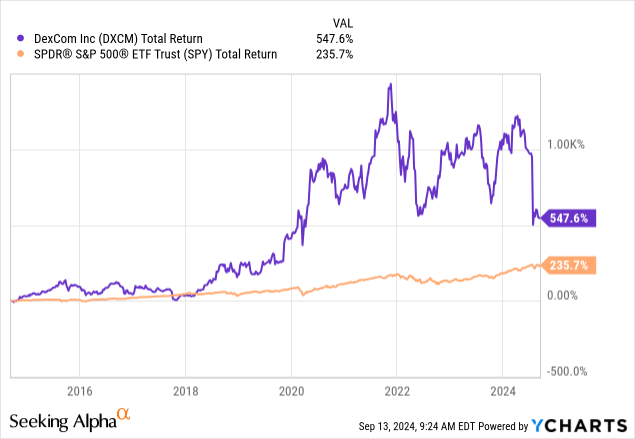

DexCom, Inc. (DXCM) is a great example of a fast-growing company that has become a disruptor in the healthcare space by offering advanced continuous glucose monitors (“CGM”). This industry is booming and resulted in a total return of roughly 550% over the past ten years – despite a 60% sell-off from its all-time high!

The problem is that a disruptor is also prone to disruption. Although I’m still bullish on DexCom, as I wrote in this article, the company has run into issues, including fiercer competition.

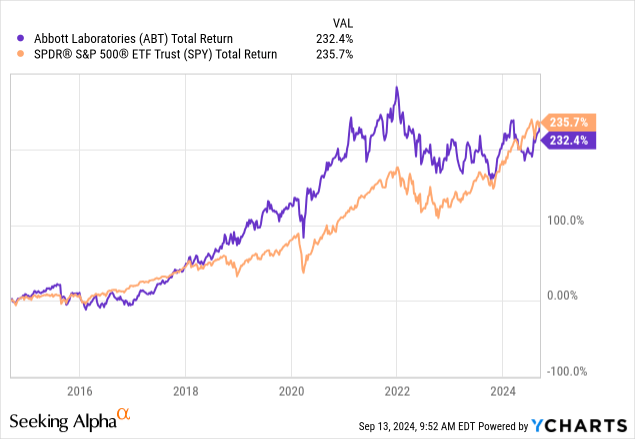

Competitors include Abbott Laboratories (NYSE:ABT), a Dividend King I covered in an article on July 7, titled “Abbott Laboratories: The Fantastic Mix Of Growth And Value – At A Great Price.”

Since then, shares have returned 13%, beating the S&P 500 by roughly 12 points.

What makes Abbott, so special is that it has become an increasingly tough competitor for DexCom. On top of that, the CGM business is just one of many products of its massive portfolio, as Abbott has become the Swiss Army Knife of the medical devices industry, with a wide range of tailwinds and anti-cyclical demand drivers.

In this article, I’ll update my thesis, using its latest earnings and a number of new developments that explain why I remain bullish on this consistent dividend grower, a company that is still a disruptor, 136 years after being founded.

So, as we have a lot to discuss, let’s get to it!

Subdued Lawsuit Risks

Abbott’s stock price has been doing well lately. Over the past three months, the stock has returned 13%, bringing the year-to-date performance to 6%.

This performance included a number of obstacles, including lawsuit risks.

On July 8, Reuters reported that Abbott faced a trial over claims that its preterm infant formula caused a dangerous disease.

Close to 1,000 lawsuits have been filed against Abbott, Enfamil formula maker Reckitt Benckiser or both in federal or state courts alleging that cow’s milk-based formula products for premature infants caused NEC. More than 500 are centralized in an Illinois federal court, with others pending in Illinois, Missouri and Pennsylvania. – Reuters

Essentially, there are two reasons why this headline did not cause more damage than a brief stock price decline.

- According to Reuters, analysts from JPMorgan and Barclays believe the ultimate liability is “likely to be small.”

- Abbott is very upbeat about its products.

During its second-quarter earnings call, the company made clear that it believes its products are safe. For example, there has been no increase in the rates of NEC – not even after lawsuit headlines started to pop up and lawyers started to use TV ads to find more plaintiffs.

Moreover, its products account for just $9 million of total revenue and are critical in the neonatal intensive care unit.

If these products were no longer available, physicians would be deprived of the vital food that is needed in the NICU. This would create a public health crisis affecting every state across this country, and we believe it’s important for all who have an interest in the health of preterm infants to recognize the need for these products and to take action accordingly. – ABT 2Q24 Earnings Call

Although lawsuit risks make me nervous, I am very upbeat about Abbott’s position and do not believe that this will turn into anything like the situation Johnson & Johnson (JNJ) encountered when talc powder lawsuits popped up.

There’s A Lot Of Value In Abbott

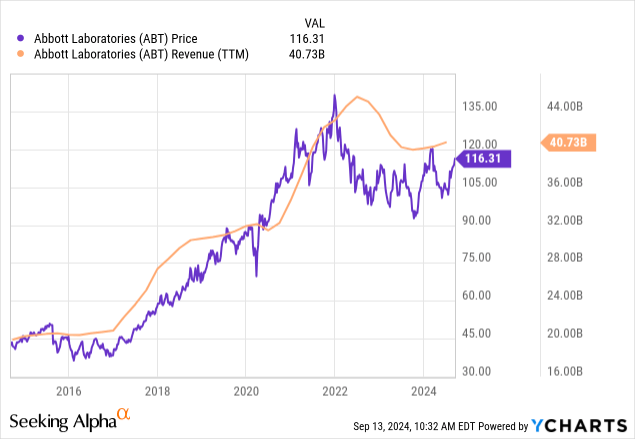

Abbott is one of the companies that benefitted from the pandemic, as it sold COVID-19 testing kits and a wide range of other products that came in handy while we waited for things to go back to normal.

Unfortunately (financially speaking), the end of the pandemic caused demand for related products to implode, making it impossible for Abbott to grow its revenue. The same applied to many other companies, including healthcare technology suppliers like Danaher Corporation (DHR) and Thermo Fisher Scientific Inc. (TMO).

This also made putting a valuation on Abbott tricky – but more on that later.

Now, the company is seeing accelerating growth.

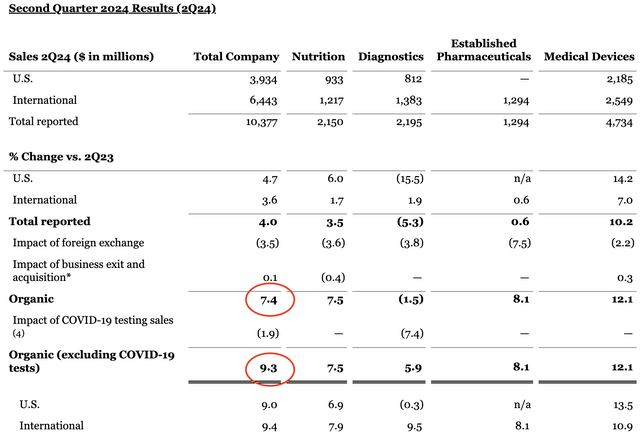

In the second quarter, organic revenue growth adjusted for COVID-19 was up 9.3%. Even including pandemic-related products, organic growth was up 7.4%. I highlighted these numbers in the table below.

These growth rates allowed the company to grow its earnings per share to $1.14, 16% higher on a sequential basis.

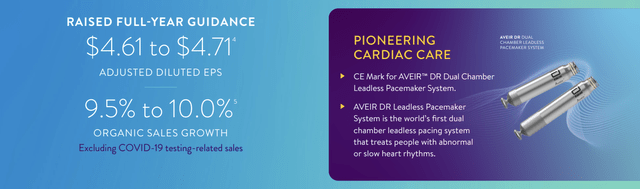

This performance also gave the Chicago-based company the confidence to raise its full-year guidance, expecting organic sales (adjusted for the pandemic) of at least 9.5% and EPS in the range of $4.61 to $4.71.

With that in mind, these fantastic growth expectations rely on an even more fantastic business model, including fast-growing products with secular tailwinds.

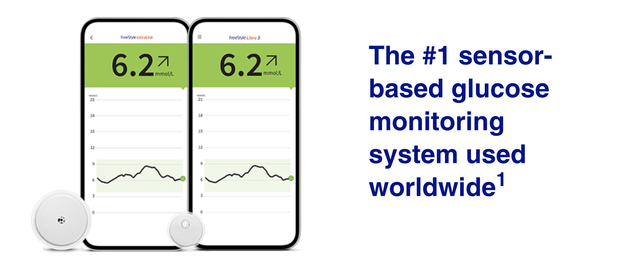

This includes double-digit growth in its Medical Devices segment, as we can see in the table above. Growth in this segment was fueled by innovations like the FreeStyle Libre CGM system, which generated $1.6 billion in quarterly sales. This product competes with DexCom and generated 20% year-over-year growth.

It also helps that the company received approval for two new over-the-counter CGM systems called Lingo and Libre Rio, which are based on Libre’s glucose technology.

Although over-the-counter is new for the company in the U.S., it has more than a decade of experience selling OTC products in international markets, which bodes well for further market share gains.

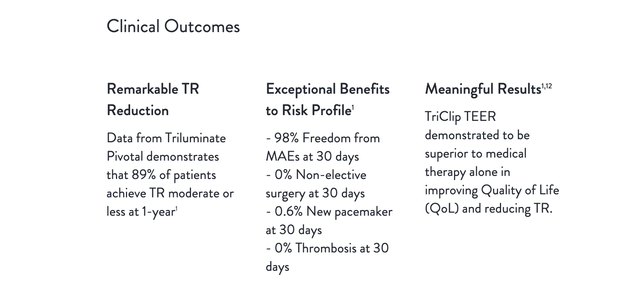

On top of that, the company is innovating aggressively in key areas like electrophysiology, structural heart devices, and vascular treatments, including the TriClip tricuspid repair devices and the Esprit dissolvable stent.

Abbott Laboratories (TriClip G4 System)

These products are the reason why I am such a big fan of the Medical Devices segment.

Moreover, in its Established Pharmaceutical Division, the company achieved 8% growth, benefitting from its unique branded generic strategy in emerging markets and its expansion into the fast-growing biosimilar market focused on oncology, women’s health, and autoimmune diseases.

This is what the company wrote in 2017 (it’s still valid):

With 100 percent of its business in emerging markets, Abbott’s branded generics business – or established pharmaceuticals – is well-positioned for above-market growth in some of the largest and fastest-growing pharmaceutical markets in the world. In 2016, Abbott’s pharmaceutical business saw 10.5% operational sales growth and a total of $3.9B in sales. – Abbott

In the Nutrition segment, the company benefits from weight loss drugs, as these tend to go well with nutritional foods. According to Abbott, its international Adult Nutrition segment has achieved a compounded annual growth rate of more than 10% over the past five years, benefitting from an aging population and rising health consciousness, especially in emerging markets.

This includes brands like Ensure, which have put Abbott in a great spot to capture growth in this market.

This bodes well for its dividend.

Dividend & Valuation

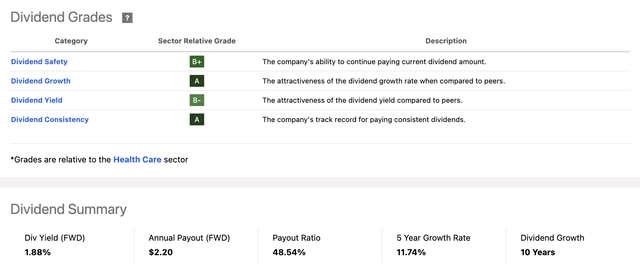

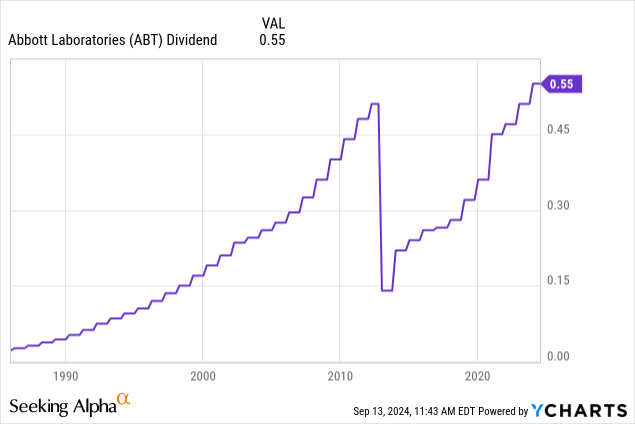

Abbott is one of the few companies that is both mature and benefitting from strong (secular) growth. This is very unique, especially for a company that has Dividend King status, indicating at least 50 consecutive annual dividend hikes.

The only reason why the dividend history has a big decline is because of the spin-off of AbbVie Inc. (ABBV) in 2012. Since the spin-off, AbbVie has raised its dividend every single year, which keeps the dividend growth streak alive for investors who held on to their ABBV shares.

Furthermore, what’s cool about Abbott’s dividend growth is that even on an unadjusted basis, the dividend made a new high after the pandemic!

Currently, ABT yields 1.9%. This dividend has a 49% payout ratio and a five-year CAGR of 11.7%.

I expect dividend growth to remain elevated, as earnings growth is expected to remain in double-digit territory.

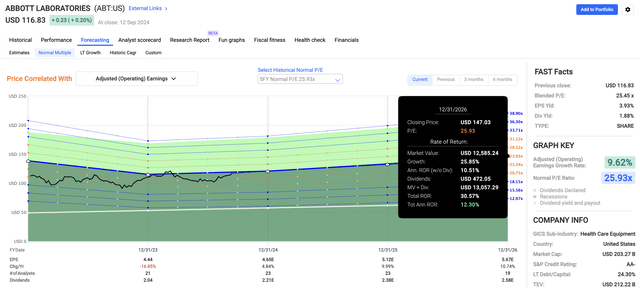

Using the FactSet data in the chart below, analysts expect 5% EPS growth in 2024, potentially followed by 10% and 11% growth in 2025 and 2026, respectively. All of these numbers include pandemic-focused products.

Using the company’s five-year average P/E ratio of 25.9x, we get a fair stock price of $147, 26% above the current price.

On a longer-term basis, I expect the valuation multiple to drop. However, for the time being, Abbott is seeing improving growth, success in key products, and fading pandemic-related headwinds. It also benefits from an AA- credit rating, one of the best ratings on the market – across all sectors.

As such, I remain bullish on the company and expect it to outperform the market in the years ahead.

Takeaway

Abbott’s resilience and adaptability continue to impress me.

Despite legal challenges and post-pandemic headwinds, the company remains an impressive player in the healthcare sector, driven by its diverse and innovative product portfolio.

With solid growth across key segments like Medical Devices and Established Pharmaceuticals, Abbott is in a great spot for long-term success.

Meanwhile, the company’s commitment to innovation supports my bullish outlook.

With an attractive dividend profile, robust earnings growth, and a fair valuation, I believe Abbott is set to deliver elevated long-term returns, potentially beating the market.

Pros & Cons

Pros:

- Diversified Growth: Abbott’s product portfolio, including medical devices, diagnostics, and established pharmaceuticals, provides multiple growth drivers, often with secular tailwinds.

- Strong Innovation Pipeline: With advancements in CGM systems and other medical technologies, Abbott is in a great spot to capture market share and drive growth.

- Solid Dividend Profile: As a Dividend King, Abbott offers consistent dividend growth, supported by a healthy payout ratio and a strong growth outlook.

Cons:

- Valuation Challenges: Short-term valuation may be affected by post-pandemic headwinds, potentially impacting short-term returns.

- Uncertainty: Related to the point above, the ongoing impact of COVID-19 on healthcare demand creates some uncertainty regarding future earnings and growth prospects. It’s hard to put a valuation on a company at this stage of the cycle.

- Competition: While ABT has proven to remain strong in light of competition, it operates in attractive markets with eager peers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.