Summary:

- AbbVie Inc. is set to acquire drug developer ImmunoGen, Inc. for $10.1 billion, diversifying its oncology pipeline and potentially transforming its cancer care business.

- ImmunoGen’s antibody-drug conjugate, Elahere, is approved to treat ovarian cancer and may have a multi-billion dollar market opportunity.

- The deal will help AbbVie reduce its reliance on its patent-expired drug Humira and expand its presence in the oncology market.

skynesher

Investment Overview

This morning, the Illinois-based Pharmaceutical giant AbbVie Inc. (NYSE:ABBV) – the world’s fifth largest Pharma by market cap, valued at $244bn – announced it would acquire the drug developer ImmunoGen, Inc. (NASDAQ:IMGN), for $31.3 per share, valuing the company at $10.1bn. Immunogen’s last traded price prior to the announcement was $16. The transaction is expected to close in mid-2024, according to an AbbVie press release.

Immunogen secured approval for its first commercial product – the antibody-drug conjugate Mirvetuximab Soravtansine – in November 2022, in the indication of FRα positive, platinum-resistant ovarian cancer (“PROC”). Under the brand name Elahere, the drug earned $105.2m of revenues in Q3 2023, and $212.1m across the first nine months of 2023.

Richard A. Gonzalez, chairman and chief executive officer, AbbVie, was quoted in this morning’s press release, stating:

The acquisition of ImmunoGen demonstrates our commitment to deliver on our long-term growth strategy and enables AbbVie to further diversify our oncology pipeline across solid tumors and hematologic malignancies. Together, AbbVie and ImmunoGen have the potential to transform the standard of care for people living with cancer.

A further statement in the press release reads as follows:

ImmunoGen’s oncology portfolio has the potential to help drive long-term revenue growth for AbbVie’s oncology franchise. Ovarian cancer is the leading cause of death from gynecological cancers in the U.S. ELAHERE is the first targeted medicine to show meaningful survival benefits in PROC. As a fast-growing solid tumor therapy, ELAHERE provides AbbVie with a potential multi-billion-dollar on-market medicine with expansion opportunities in earlier lines of therapy and larger segments of the ovarian cancer market.

Earlier this year, another Pharma giant, New York-based Pfizer Inc. (PFE) announced it would acquire another antibody-drug conjugate (“ADC”) specialist – Seattle-based Seagen Inc. (SGEN), in a $43bn deal.

Seagen markets and sells three of the thirteen FDA-approved ADCs, ADCETRIS (brentuximab vedotin), PADCEV (enfortumab vedotin), and Tivdak (tisotumab vedotin), which alongside a fourth drug, TUKYSA (tucatinib), are expected to earn revenues of ~$2.2bn in 2023.

ADCs are amongst the most valued class of oncology drugs today. Apparently, there are almost one hundred investigational ADCs in pre-clinical and clinical studies. According to ADC Review, Journal of Antibody-drug Conjugates:

Antibody-drug conjugates represent an innovative therapeutic application that combines the unique, high specificity, properties, and anti-tumor activity of monoclonal antibodies (mAbs) that are tumor-specific but not sufficiently cytotoxic, with the potent cell-killing activity of highly cytotoxic small molecule drugs that are unsuitable for systemic administration alone.

Breaking Down The Deal – Elahere In Detail

ELAHERE is a “first-in-class ADC comprising a folate receptor alpha-binding antibody, cleavable linker, and the maytansinoid payload DM4, a potent tubulin inhibitor designed to kill the targeted cancer cells,” and it represents Immunogen’s first successful drug approval in its ~40-year history.

Via its confirmatory MIRASOL study, the drug became the first therapy to demonstrate an overall survival benefit versus chemotherapy in a Phase 3 study in PROC, demonstrating a 33% reduction in the risk of death, with a median overall survival rate of 16.46 months, versus 12.75 months with chemotherapy. The drug was additionally associated with lower rates of serious treatment-related adverse events (“TRAEs”).

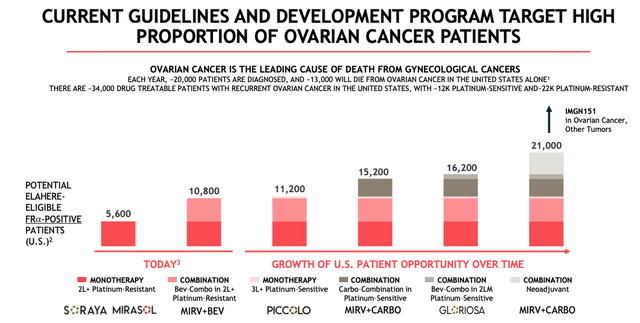

Elahere – potential market opportunity (Immunogen presentation)

As we can see from a slide recently shared in an Immunogen presentation, as a monotherapy and in combo with bevacizumab – marketed and sold by Swiss Pharma Roche Holding AG (OTCQX:RHHBY) under the brand name Avastin – ELAHERE currently addresses a patient population of ~10.8k. The drug list price is in the region of ~$22k per cycle of treatment, therefore based on ~10 cycles of therapy per annum, there could be a maximum market opportunity of ~$2.5bn in the second line setting.

The patient population could one day rise as high as 21k, Immunogen believes, if additionally used in a third-line setting, in platinum-sensitive patients, and in a neoadjuvant setting. As such, we could set a ballpark total market opportunity for the drug of ~$5bn, although a more reasonable expectation based on 50% penetration may be the $2.6bn of revenues generated by AstraZeneca PLC’s (AZN) Lynparza, for example, another drug whose main indication is ovarian cancer.

Breaking Down The Deal – Immunogen’s Pipeline & AbbVie’s Longstanding Interest In ADC

AbbVie is no stranger to the antibody-drug conjugate field of drug development, having formerly invested in Seagen. It also acquired Stemcentrx in a $5.8bn deal in 2016 to gain access to an ADC targeting small cell lung cancer, which ultimately failed to make a mark in clinical studies.

On a more positive note, AbbVie announced yesterday that its in-house ADC candidate, Telisotuzumab-Vedotin, or Teliso-V for short, had “demonstrated compelling clinical benefits across key endpoints” in a Phase 2 study in patients with previously treated non-small cell lung cancer (“NSCLC”).

The c-Met protein-directed ADC achieved an overall response rate (“ORR”) of 35% and 23% across c-Met High and c-Met Intermediate patients respectively, with a median duration of response of 9 months and 7.2 months respectively.

Within Immunogen’s pipeline, Pivekimab Sunirine is an anti-CD123 ADC that has already entered a Phase 1 clinical study in patients with Blastic plasmacytoid dendritic cell neoplasm (“BPDCN”), and a Phase 1 study in acute myeloid lymphoma (“AML”), in combo with the chemotherapy Azacitidine. There are two further candidates in Immunogen’s pipeline, an Anti-ADAM9 ADC, IMGC936, addressing a variety of solid tumor cancers, and an Anti-FRA Biparatopic ADC, IMGN151, targeting endometrial cancer and potentially, other FRa-expressing cancers.

Immunogen Acquisition Helps Diversify AbbVie Away From Patent Expired Humira

For the past decade, the most valuable asset in AbbVie’s portfolio has been its all-conquering autoimmune drug Humira, which is approved in a variety of indications, including Rheumatoid Arthritis (“RA”), Psoriatic Arthritis (“PsA”), Ankylosing spondylitis (“AS”), Psoriasis (“PsO”), Hidradenitis suppurativa (“HS”), Crohn’s Disease (“CD”), and Ulcerative Colitis (“UC”).

Humira generated >$20bn in annual revenues for AbbVie in 2021 and 2022, accounting for >35% of the Pharma’s total revenues in each year, but the drug’s patents finally expired in the US this year, and with 8 generic versions of the drug expected to be competing against it by the end of the year, the drug has driven only $11.1bn of revenues across the first 9m of 2023 – down 29% year-on-year.

While AbbVie has launched 2 new drugs – Skyrizi and Rinvoq – into multiple dermatology and autoimmune markets, forecasting that they have the potential to generate ~$25bn of revenues per annum by the end of the decade, offsetting any lost Humira revenue, the market has long been concerned by AbbVie’s over-dependence on Humira.

As such, the Immunogen deal ought to help to allay the market’s concerns and diversify AbbVie away from immunology. Oncology is beginning to represent a key market for AbbVie, with the company securing FDA approval for Epcoritamab-bysp, a bispecific CD20-directed CD3 T-cell engager, in patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL), in May this year. The drug has been pegged for peak sales of ~$2.75bn. Navitoclax, in myelofibrosis, is another late-stage development, an oncology-directed asset that may have “blockbuster” (>$1bn revenues per annum) potential.

In 2022, AbbVie’s immunology division accounted for 50% of the company’s total revenues of $58bn, with oncology accounting for just 11%, through sales of blood cancer drugs Imbruvica and Venclexta. Aesthetics accounted for ~9% of total revenues, neuroscience ~11%, and eye care ~5%.

Concluding Thoughts – AbbVie Shows Itself To Be A Decisive Dealmaker Once Again As Market Reacts Positively To Deal

It would probably be fair to say that AbbVie’s deal for Immunogen has taken the market by surprise, given few rumors were circulating prior to today’s announcement.

AbbVie has proven itself to be a strong dealmaker in oncology in the past – its ~$21bn acquisition of Pharmacyclics back in 2015, giving it access to Imbruvica, proved to be a shrewd move, as Imbruvica was able to drive >$5bn of revenues per annum for the company in 2020 and 2021, and $4.6bn last year, justifying the initial outlay.

The pricing of Imbruvica has come under increased scrutiny, however, and the drug will become one of the first ten to be subject to government pricing regulations, reducing its revenue contribution significantly over time, and meaning AbbVie’s oncology division is due a revamp. In this context, and with the Humira situation putting pressure on management, this deal for Immunogen appears to have come at the right time for the company.

At the same time, Immunogen management may well conclude that a Pharma giant like AbbVie can extract the maximum benefit from a promising, commercial-stage drug like Elahere, and develop its pipeline with its incomparably larger financial and R&D resources, therefore for now is the right time to accept a deal that pays a premium of nearly 100% to the traded share price.

As such, this seems to be a deal that will suit both parties. It will give AbbVie Inc. a seat at the ADC top table, alongside rivals such as Pfizer, without such a substantial financial outlay, and a chance to build a new oncology division that can complement its established immunology, aesthetics, and eye care divisions.

Meanwhile, ImmunoGen, Inc. shareholders will likely be satisfied with a deal that gives them a substantial return on investment, without the risks of pitching Elahere into highly competitive oncology markets and attempting to grow organically into a double-digit billion market cap business.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.