Summary:

- AbbVie is down about 8% YTD and appears undervalued at 13 times earnings.

- Dividend coverage looks strong based on both Free Cash Flow and Earnings Per Share.

- 4% yield combined with a low beta make this the perfect SWAN stock.

Michael Vi

AbbVie Inc. (NYSE:ABBV) has been my third largest healthcare holding behind Johnson & Johnson (JNJ) and Pfizer (PFE) for a while and it has been a terrific albeit under-rated performer for me. Although the capital appreciation has been sweet over the years, I primarily hold the stock for its dividend. Hence, this article takes a deep-dive at the company’s dividend coverage and whether it is a buy here.

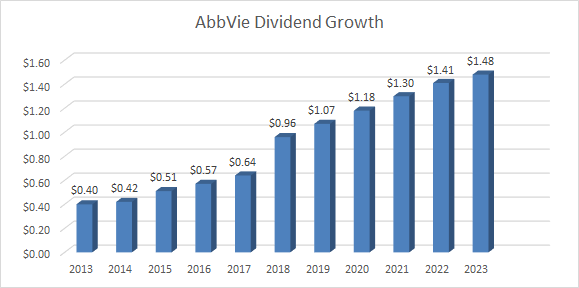

First, let’s look at the company’s dividend history.

- AbbVie has paid dividends since 2013, its first full year as a stand-alone company.

- During this time frame, AbbVie has almost quadrupled its dividend, going from 40 cents a share to $1.48.

- In October of last year, the company increased its dividend for the 9th consecutive year as Seeking Alpha covered here. Unless something drastically hampers the company in the next 6 months, I fully expect the company to join the prestigious list of dividend achievers.

ABBV DG (Author, with data from Seeking Alpha)

Free Cash Flow and EPS Evaluation

Readers of my article know I prefer using Free Cash Flow (“FCF”) over Earnings Per Share (“EPS”) due to FCF’s robustness.

- Total Shares Outstanding: 1.769 Billion

- Current Quarterly Dividend Per Share: $1.48

- Quarterly Free Cash Flow required to cover dividends: $2.618 Billion (that is, 1.769 Billion times $1.48)

- AbbVie’s average Quarterly FCF over the last 5 years: $4.429 Billion

- Payout ratio using 5 year quarterly FCF: 59% (that is, $2.618 Billion divided by $4.429 Billion. That comforts me as a long, as the company is both rewarding me generously while having enough room for further increases in the future.

- Using the typical EPS metric, AbbVie’s forward payout ratio stands at 53% based on current forward EPS projected at $11.08.

- Since pharmaceutical companies’ FCF ebbs and flows as they go through periods of striking gold with new products before generic versions may get approved (typically six years), I tend to look at the worst case scenario with these stocks. AbbVie comes on top here as well, with only two quarters since 2018 ($2.526 Billion in March 2018 and $2.349 Billion in June 2019) registering FCF levels below that of the current dividend commitment.

- Overall, AbbVie’s dividend coverage looks solid in terms of both FCF and EPS.

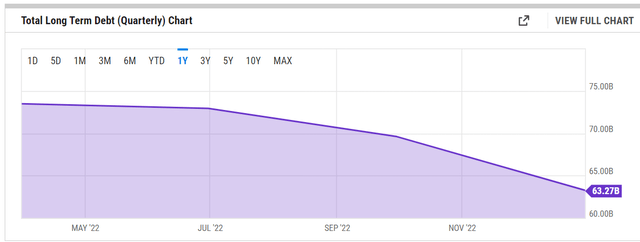

Debt and Cash in Hand

AbbVie’s long term debt level of $63 Billion appears a tad high for a company with about $250 Billion market cap. The good news for investors is that since 2020, the company has retired about 30% of its debt or ~$25 Billion. The slightly worrying thing is the high debt-to-equity ratio of 3.42.

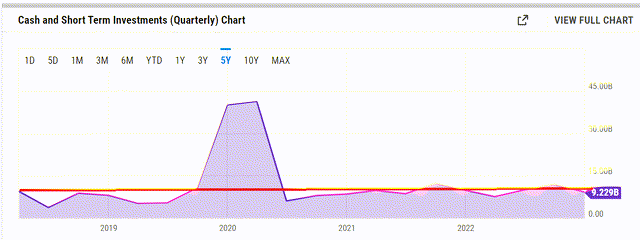

AbbVie has always maintained a sizeable cash and short-term investment allocation over the years as shown in the chart below, with the current level being a bit less than the 5 year average but still being sizeable enough.

ABBV Cash On Hand (YCharts.com)

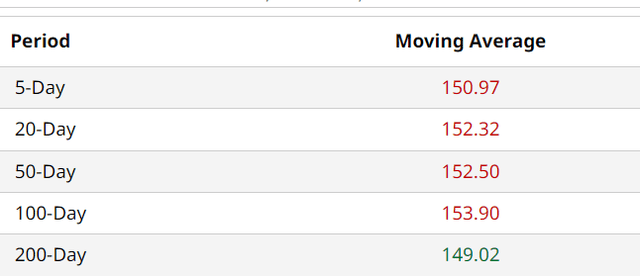

Technical Indicators

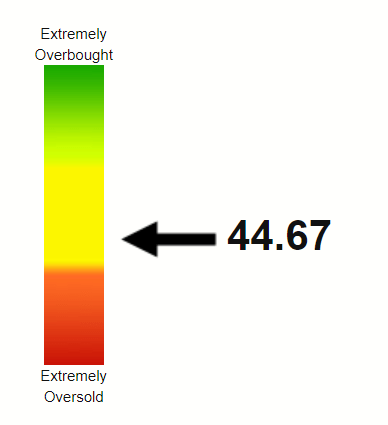

The stock is trading at about $150, which is a hair’s distance from almost all the commonly used moving averages as shown below. This tells me the stock is trading at a massive support level currently and if the market recovers from its general weakness, one can expect the stock to go up. AbbVie’s Relative Strength Index (“RSI”) is somewhat in the middle as well, with a slight bent towards being oversold than overbought.

ABBV Moving Avgs (Barchart.com) ABBV RSI (Stockrsi.com)

What’s Next?

I won’t pretend to know as much about pharmaceutical pipeline as I do about studying financial statements. However, it is impossible to provide a rounded picture about a pharmaceutical stock without talking about its cliffs and patents.

- The company’s Humira cliff is well known and is definitely priced in at this point.

- AbbVie has recently raised its outlook for both Skyrizi and Rinvoq, two critical drugs it built to offset the Humira loss. These two drugs are expected to exceed $21 Billion by 2027.

- The company’s pipeline is as strong as ever as can be seen on its website.

- At the end of the day, your trust in the company’s management and its abilities is of paramount importance. While AbbVie maybe just 10 years old as a stand-alone company, do not forget its lineage with and as Abbott Laboratories (ABT). I find this analogous to the Altria Group (MO) and Philip Morris International (PM) situation where the spun-off Philip Morris has maintained its Altria lineage by rewarding shareholders with increasing dividends each year since the spin-off in 2008.

Conclusion

With the stock down nearly 8% YTD and the market looking increasingly choppy favoring risk-off names, AbbVie is a name that should be on everyone’s watchlist. With a forward multiple of 13, the stock remains undervalued enough to warrant your attention. The stock’s beta of 0.60 should also be in its favor should the market remain under pressure, making it the perfect Sleep At Well Night (“SWAN”) night stock with a safe 4% yield.

Disclosure: I/we have a beneficial long position in the shares of ABBV, MO, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.