Summary:

- While we’re long-term bulls on Nvidia Corporation, we do not believe the stock’s latest rally on management’s optimism for 2H recovery and recent AI momentum is sustainable.

- Considering expectations for further economic deterioration as Fed tightening continues, Nvidia’s near-term fundamentals remain at risk of succumbing further to the grip of an industry-wide cyclical downturn.

- Returning risk-off market sentiment will likely undercut Nvidia stock’s recent rally as well.

BING-JHEN HONG

Nvidia Corporation (NASDAQ:NVDA) has been one of market’s biggest gainers in recent months, staging the strongest rebound across all of its peers in the Philadelphia Semiconductor Index (SOX), tech-heavy Nasdaq 100 (QQQ / NDX), and S&P 500 (SPY / SP500). Riding on the coat-tails of recent AI momentum and upbeat earnings, the Nvidia stock has gained as much as 66% this year. Specifically, stronger-than-expected fourth quarter results and a solid guidance for reacceleration across all of its core operating segments in the current fiscal quarter have raised optimism that the worst of impacts from cyclical weakness have past.

We have been waiting for a pullback to make a more timely call given the surge in the stock, but with weaker numbers out of the way, we aren’t sure that pullback is going to come.

Meanwhile, Nvidia’s market leadership in enabling AI innovations has been another primary driver of the stock’s outperformance.

Nvidia takes 95% of the market for graphics processors that can be used for machine learning, according to New Street Research. The A100 is ideally suited for the kind of machine learning models that power tools like ChatGPT, Bing AI, or Stable Diffusion.

Source: CNBC News.

Yet, considering the shaky macro backdrop, we are becoming incrementally cautious about the optimism recently priced into the stock. Specifically, management’s confidence in a recovery in the second half of calendar 2023 could potentially prove premature based on the latest economic data that points to further weakness ahead, prolonging the inventory digestion period in PC end-markets while also slowing demand in enterprise cloud / IT spending segments. With management and market’s expectations likely not sufficiently de-risked for near-term macroeconomic uncertainties that remain skewed to the downside, we await better entry opportunities ahead to capitalize on Nvidia’s longer-term growth story.

Weaker Numbers Are Not Yet Fully Out Of The Way

Nvidia has exited the fourth quarter ending January with better-than-expected results and a solid guidance that implies a sustained forward trajectory of sequential re-acceleration across its core operating segments. Specifically, management has guided $6.5 billion in fiscal first quarter revenues, which would represent q/q growth of 7%, driven primarily by a sequential increase in sales across all of its core operating segments. Management was especially bullish on data center sales, predicting re-accelerated sequential growth going forward as AI adoption approaches an inflection point:

The opportunity is significant and driving strong growth in the data center that will accelerate through the year…We expect sequential growth to be driven by each of our four major market platforms led by strong growth in data center and gaming. Revenue is expected to be $6.5 billion, plus or minus 2%…When we think about our growth, yes, we’re going to grow sequentially in Q1 and do expect year-over-year growth in Q1 as well. It will likely accelerate there going forward…AI adoption is at an inflection point. Open AI’s ChatGPT has captured interest worldwide, allowing people to experience AI first-hand and showing what’s possible with generative AI.

Source: Nvidia F4Q23 Earnings Call Transcript.

But macro conditions appear to be slated for further deterioration, with the Fed fixed on further monetary policy tightening to ensure demand slow sufficiently to bring inflation back to its target 2% range. Despite the recent jump in unemployment rate from 3.4% in January to 3.6% in February, it remains in a multi-decade low. Meanwhile, the deceleration in wage growth to 0.2% m/m (or 4.6% y/y) remains far from sufficient to quell concerns over the “still-tight job market”, which supports the Fed’s consideration to keep rates “higher for longer.” Incremental considerations over SVB Financial Group’s (SIVB) recent collapse also warrants caution for greater risk-off sentiment in the near-term as markets digest “potential signs of stress [in the] financial system.” Taken together, market risks remain skewed to the downside, potentially reversing recent optimism over Nvidia’s recovery prospects in the near-term.

Cautious Optimism Over Data Center

This is further corroborated by the disconnect between management’s optimism for sustained re-acceleration in data center sales when hyperscalers – Nvidia’s core end-market and key go-to-market partners – have been cautioning of a slowdown in enterprise IT / cloud spending amid looming macroeconomic uncertainties.

At this point through December earnings we look to what we’ve heard from leading software companies as well as the hyperscalers as we continue to urge conservatism with guidance in the face of essentially in-line, and largely not as bad as the market initially feared, Q4 results.

Source: RBC Capital Markets Weekly Software Recap (February 5, 2023)

However, as you heard from Satya, we are seeing customers exercise caution in this environment and we saw results weaken through December. We saw moderated consumption growth in Azure and lower-than-expected growth in new business across the standalone Office 365, EMS and Windows commercial products…In Azure, our per-user business should continue to benefit from Microsoft 365 suite momentum, though we expect continued moderation in growth rate given the size of the installed base.

Source: Microsoft F2Q23 Earnings Call Transcript

Starting back in the middle of the third quarter of 2022, we saw our year-over-year growth rates slow as enterprises of all sizes evaluated ways to optimize their cloud spending in response to the tough macroeconomic conditions…Our customers are looking for ways to save money, and we spend a lot of our time trying to help them do so…As we look ahead, we expect these optimization efforts will continue to be a headwind to AWS growth in at least the next couple of quarters.

Source: Amazon 4Q22 Earnings Call Transcript

It’s clear that after a period of significant acceleration in digital spending during the pandemic, the macroeconomic climate has become more challenging…In Q4, we saw slower growth of consumption as customers optimized GCP costs, reflecting the macro backdrop.

Source: Google 4Q22 Earnings Call Transcript

Their cloud computing businesses are still getting bigger, but not as quickly as they once were. The rate of growth for each of the three market leaders in the fourth quarter fell at least 10 percentage points from the previous nine months. That’s partially because a shaky economy means “every dollar is being inspected” at existing customers…

Source: Bloomberg News.

Although AI has captured significant attention in recent months thanks to the viral sensation brought forth by ChatGPT, we are not confident that there will be sufficient demand for related hardware / software offered by industry leader Nvidia in the immediate-term to overcome the cyclical slowdown that hyperscalers are warning of. Let’s take a page from Amazon’s (AMZN) recent earnings commentary – despite the growing AI sensation, management from the largest public cloud service provider has instead focused on acknowledging the increase in customer calls for cloud optimization (i.e. do more with less), as boardroom executives are now “talking pennies, not millions,” with costs being the “much bigger focus within almost every company” amid mounting macroeconomic uncertainties.

This leads us to believe that the AI hype will inevitably normalize in the coming months as focus returns to currently stifled demand under the current macroeconomic climate, which could temper optimism over a structural recovery that has been recently priced into the Nvidia stock. Until cyclical tailwinds return, it will be difficult for optimism on longer-term AI-driven secular growth trends to prevail as a structural driving force in valuations.

Prolonged Weakness In Gaming

Acute weakness observed over the past year in Nvidia’s core gaming segment, which currently accounts for about a third of the company’s consolidated sales, has been a relatively sore spot. Significant declines in gaming sales that began in the second quarter in fiscal 2023 have yet to reverse, which is in line with the cyclical PC market downturn that has only worsened through calendar 2022. While Nvidia’s gaming segment eked out sequential growth in the fiscal fourth quarter, partially helped by “strong reception of [its] 40 Series GeForce RTX GPUs based on the Ada Lovelace architecture” which started shipping in November, related sales of $1.8 billion remain subdued at only slightly more than half of the figure observed in the same quarter in fiscal 2022. Even if management’s optimism for continued sequential growth in the segment’s current quarter revenues materialize, they are still long ways from returning to the previous demand environment, as the broader PC TAM remains in contraction, especially with lingering macroeconomic deterioration.

The story is further complicated by growing inventory that has been sitting on Nvidia’s balance sheet. The figure has almost doubled from $2.6 billion as of January 30, 2022 to $5.2 billion as of January 29, 2023. Although management struck a tone of confidence that “channel inventory correction [is] largely behind us,” impending recession risks could reverse that optimism, with Nvidia’s lofty inventory balance being a cause for concern over potential future write-offs or downs.

Recall from results during the second quarter of fiscal 2023, when Nvidia saw a substantial decline in gaming revenues, the company had “implemented pricing programs with gaming channel partners to address challenging market conditions,” which reduced gross margin. With mounting macroeconomic uncertainties – spanning persistent inflation, rising interest rates, intensifying geopolitical tensions, and risks of recession – still in a fluid state, it may be too soon for industry to conclude expectations for a return of cyclical tailwinds in PC demand in the second half of the year. Not only does this put Nvidia’s gaming sales growth at risk still, but related profit margins also remain vulnerable to further compression if its inventory balance needs to be revalued for obsolescence and sales discounts.

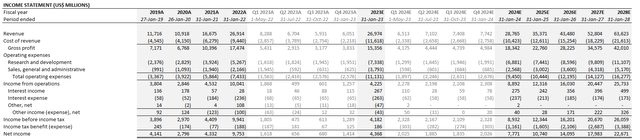

Nvidia Financial Forecast (Author)

Nvidia_-_Forecasted_Financial_Information.pdf.

The Bottom Line

While we remain bullish on Nvidia Corporation’s longer-term growth prospects, buoyed by the critical role it plays as the backbone and enabler of key next-generation technologies, recent optimism for a near-term recovery that has been priced into the stock admittedly lacks structural support. Considering the current macroeconomic backdrop, which has led to a cautious near-term demand environment for Nvidia’s offerings, it does not appear that management’s optimistic commentary shared in the latest earnings call has been sufficiently de-risked for what is to come.

Considering Nvidia Corporation stock’s latest rebound is once again ballooning its valuation premium to peers with a similar growth profile, while support from underlying fundamentals in the near-term remain weak in the face of protracted macroeconomic headwinds, we await for better entry opportunities in the coming months to optimize returns on Nvidia’s longer-term growth story.

Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!