Summary:

- ABBV’s Humira erosion has been well balanced by the robust growth reported by Skyrizi and Rinvoq, implying its ability to maintain a stable top/ bottom line performance ahead.

- The management has also participated in the aggressive M&A activities observed in the biotech industry, with its choice appearing to be more promising than that of its peers.

- On the other hand, ABBV’s balance sheet reveals mixed results, with its reliance on expensive capital raises likely to occur at a time when interest rates are still elevated.

- With annualized dividend obligations of $10.48B, we believe that its intermediate-term growth prospects may be limited since its recent acquisitions are only expected to be bottom-line accretive by 2030.

- These tailwinds have contributed to the baked-in premium valuations and optimistic stock rally, with us preferring to wait for a moderate pull back before buying in when the stock yields 5% or more.

Gajus

We previously covered AbbVie Inc. (NYSE:ABBV) in October 2023, discussing its mixed prospects as Humira’s revenue erosion may further worsen with the US FDA approval of two directly interchangeable biosimilars.

Combined with the stock’s sideways movement over the past few quarters, we believe that the stock offers a mixed growth/ dividend investment story until the management unlocks a new top and bottom line driver.

In this article, we shall discuss why ABBV’s M&A activities have proven to be more promising than those of its peers, attributed to the lower price tags and higher potential returns by the next decade.

While the same balance sheet headwind persists, it is apparent that the biotech company boasts a relatively robust immunology portfolio, which continues to be its top-line driver no matter Humira’s LOE.

These tailwinds have contributed to the stock’s baked-in premium valuations and optimistic stock rally, with us preferring to wait for a moderate pull back before buying in when ABBV yields 5% or more.

ABBV’s M&A Activities Show Great Promise

ABBV has done it again, by participating in the ongoing acquisition sprees observed in the pharmaceutical/ biotech industry thus far.

On the one hand, its two all-cash $18.7B deals for Cerevel Therapeutics (CERE) and ImmunoGen (IMGN) do not seem excessive. For example, CERE’s lead neurological therapies hold great promise, implying that the $8.7B valuation is cheap after all, with:

- Emraclidine for the treatment of Schizophrenia and Alzheimer’s Disease, both projected robust 2031 market sizes of $12.53B and $15.5B, respectively.

- Darigabat for the treatment of Epilepsy at $10.7B by 2030.

- Tavapadon for the treatment of Parkinson’s Disease at $10.4B by 2031.

- CVL-871 for the treatment of Dementia at $19.7B by 2031.

In addition, IMGN’s Antibody-Drug Conjugates for the treatment of cancer boast an impressive market size of up to $19.8B by 2028, suggesting that the $10B price tag is still somewhat reasonable.

This is compared to Pfizer’s (PFE) eye-watering $43B acquisition of Seagen (SGEN) for four of its approved cancer therapies, with the latter only expected to contribute approximately $3.1B in FY2024 sales.

For contrast, Merck (MRK) also recently reported a partnership worth $22B with Daiichi Sankyo (OTCPK:DSKYF) (OTCPK:DSNKY) with two particularly promising tumor candidates as discussed in our article here, implying that the sum may be fair assuming successful FDA approvals.

On the other hand, ABBV’s balance sheet reveals mixed results, with $13.29B of cash/ equivalents (+51.7% QoQ/ +11.8% YoY) and $56.06B of long-term debts (inline QoQ/ -7.7% YoY).

The aggressive M&A activities further demonstrate why the management has not been paying down its debts as it has in FY2021 and FY2022, compared to its peak debt level of $82.31B in FQ3’20.

We are fairly certain that the ABBV management may also rely on certain bridging loans, based on the extension of its 5Y revolving credit facility of $5B through March 2028, with none drawn as of FQ3’23.

We are not certain how prudent this strategy may be since variable borrowing costs remain elevated despite the cooling inflation and the potential Fed pivot by Q1’24.

Readers must also note that $15.84B of ABBV’s debts will be due through FY2025, presenting further headwinds to its dividend investment thesis.

The same has been highlighted in the Seeking Alpha Quant, with a stable TTM Interest Coverage ratio of 8.63x but a deteriorating TTM Dividend Coverage Ratio of 1.88x, compared to its 5Y average of 8.43x and 2.20x, respectively.

With annualized dividend obligations of $10.48B, we believe that ABBV’s intermediate-term growth prospects may be limited indeed, since its recent acquisitions are only expected to be bottom-line accretive by 2030, with the stock likely to continue trading sideways as it has since December 2021.

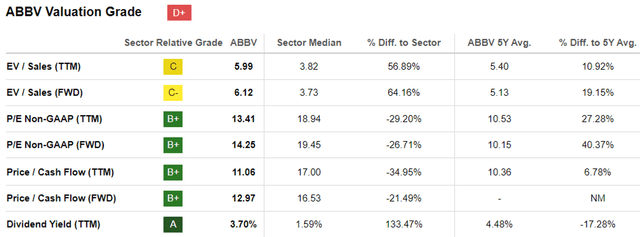

ABBV Valuations

For now, ABBV’s FWD P/E valuations of 14.25x and FWD Price/ Cash Flow valuations of 12.97x appears to be elevated compared to its 1Y mean of 13.22x/ 10.3x and 3Y pre-pandemic mean of 11.44x/ 12.1x, though lagging behind the sector median of 19.45x/ 16.53x, respectively.

The Consensus Forward Estimates

Perhaps part of the optimism is attributed to ABBV’s double beat FQ3’23 earnings call, with revenues of $13.92B (+0.4% QoQ/ -6% YoY) and adj EPS of $2.95 (+1.3% QoQ/ -19.3% YoY).

While its global Humira net revenues hit a new low at $3.54B (-11.7% QoQ/ -36.2% YoY), this is well-balanced by the growing sales for Skyrizi at $2.12B (+12.7% QoQ/ +52.5% YoY) and Rinvoq at $1.11B (+20.9% QoQ/ +59.7% YoY).

As a result, while there may be further Humira sales erosion from the CVS (CVS) transition to biosimilars from April 01, 2024, onwards, it appears that ABBV’s near-term prospects remain decent for so long that the two other therapies are able to maintain the high growth ahead.

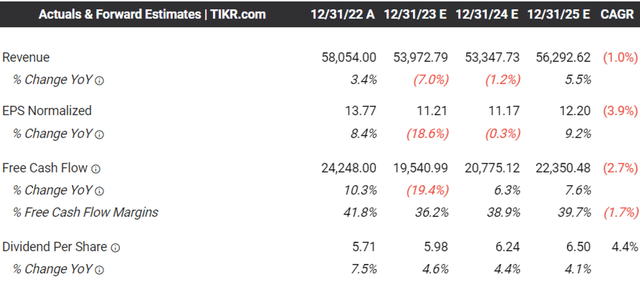

The same has been observed in the consensus forward estimates, with the biotech company expected to generate a minimal decline in its top/ bottom lines through FY2025, with a robust FCF generation that allows it to fund its M&A activities, deleverage, and shareholder returns ahead.

So, Is ABBV Stock A Buy, Sell, or Hold?

ABBV 1Y Stock Price

As a result, we can understand why ABBV has rapidly broken out of its 50/100/200-day moving averages while rallying by +15.9% since the November 2023 bottom, with it currently retesting its previous resistance levels of $160s.

Perhaps part of the optimism is attributed to the great mix of FQ3’23 double beat, promising M&As, and the lifting market sentiments as we head into a soft landing in 2024.

Does it mean that ABBV is a buy here? Not quite.

While ABBV has recently raised its quarterly dividend by +4.7% to $1.55, the recent rally also triggered its lower forward yields of 3.86% compared to the 4Y average of 4.29%.

Therefore, while we may have missed the boat since our previous two Hold articles, we do not believe in chasing dividend yields, especially when the US Treasury still offers relatively decent yields of between 3.89% and 5.39%.

While long-term ABBV shareholders may continue dripping, we prefer to maintain our Hold rating here. Patience may be a more prudent choice, with us recommending an entry point when ABBV yields 5% or more, implying an entry point at approximately $120s.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.