AbbVie: With Banks In Distress, Look At Recession-Resilient Healthcare Companies

Summary:

- With the collapse of SVB Financial Group dominating the news and sending shockwaves again, we should look at recession-resilient companies like AbbVie.

- In fiscal 2022, AbbVie reported solid results, but growth slowed down.

- Although the next two years will get difficult due to Humira patent expiration and declining sales, growth will return after 2025.

- And AbbVie is interesting for its dividend yield and is at least fairly valued right now.

claffra

In my last article about AbbVie (NYSE:ABBV) published in June 2022 I saw the company being not the perfect investment, but largely recession-proof and fairly valued at that point. Now as the signs for economic distress are growing, it makes more and more sense to look at high-quality businesses and the pharmaceutical sector is always a good starting point as this sector can withstand recessions quite well.

Recession-Resilient

We start by looking at the headlines from the last few days – and at least in the financial world one piece of news item seems to dominate: The collapse of SVB Financial Group (SIVB). And while Treasury Secretary Janet Yellen made it clear, the U.S. government won’t bail out the bank – like the government did in 2008 – U.S. government is still trying to prevent ripple effects in the financial system. On Sunday, Janet Yellen, Federal Reserve Chair Jerome Powell and FDIC Chairman Martin Gruenberg Sunday informed the public that depositors at Silicon Valley Bank will have access to all their funds on Monday.

This was certainly a good and necessary move to restore confidence again. Otherwise – as Bill Ackman, CEO of Pershing square predicted during the weekend, bank runs this week are a real risk and could have catastrophic consequences in the coming weeks.

While I certainly don’t want to bash on the Federal Reserve as well as the government, they will ultimately fail in their efforts to prevent a crisis, in my opinion. Of course, I could not do a better job. The FED and government are often making mistakes, but preventing a stock market crash and deep recessions from happening seems like an impossible job – and only in hindsight do we often know how the crisis could have been prevented.

And the extreme debt levels in the United States and the recklessness and extreme risk-taking during a zero-rate environment in the last few years will create a fallout the government can’t contain, at least that’s what I feel. And in combination with high stock prices, the next crash will be worse than the Great Financial Crisis. And it seems like the next recession will not be a housing crisis as the Great Financial Crisis (although housing is extremely overvalued and could be problematic as well) but a crisis rather similar to the Dotcom bubble. The technology sector and especially cryptocurrencies is where the recklessness is happening and as SBV Financial Group was financing startups in California this is all fitting the bigger picture.

On Sunday it was also reported that the First Republic Bank (FRC) got liquidity support from the Federal Reserve as well as JPMorgan Chase (JPM). I am certainly not the first to draw this comparison, but it seems appropriate: SBV Financial Group is Bear Stearns, and we are in spring of 2008 and at some point in the next few months the “next Lehman” will arise and the crash will accelerate. And when Bear Stearns collapsed, the S&P 500 declined about 18% from the previous high; right now, the S&P 500 is about 19.5% below its previous high. JPMorgan Chase and Jamie Dimon being one of the important players in helping to stabilize the banking system is another comparison to the years 2007 and 2008.

If you are wondering why we are talking so much about banks in an article about AbbVie – a pharmaceutical company – the reason is simple. First, it never hurts to look at the bigger picture before making an investment in a single stock. Second, in times of financial distress and a looming recession and bear market we should look out for investments that might protect us – at least to a certain degree – from the potential fallout.

In my last article I already pointed out that AbbVie is an interesting pick for such times as the business is preforming well during recessions:

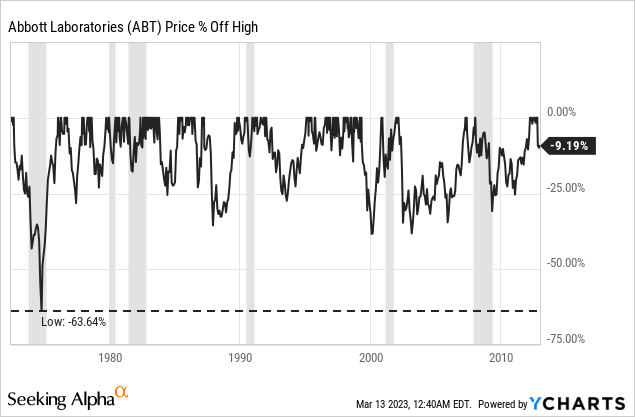

At least when looking at revenue, most recessions are hardly visible in the chart. Revenue for Abbott Laboratories only declined in the years following the recession in the early 2000s. But in every other recession for the past 40 years, Abbott Laboratories or AbbVie didn’t see declining revenue. When looking at earnings per share, the picture is a bit different, and we actually see steep declines for AbbVie as well as Abbott Laboratories following several recessions. But we can also see that the company recovered rather quickly after a recession.

And of course, AbbVie is also facing risks (we will get to that point), but the risk of a steeply declining revenue due to a potential recession probably isn’t one of them.

Dividend

And although we can describe AbbVie as rather recession-resilient, in a stock market crash and severe bear market almost every stock is declining – and AbbVie probably will be no exception. When looking at AbbVie – and its predecessor Abbott Laboratories (ABT) from which the company was spun off about 10 years ago – we see the stock also declining during recessions (and bear markets). However, the stock performed usually better than the overall market and declined only about 30% to 35%. Only during the recession in the early 1980s, the stock declined 64%.

In such a scenario it might be interesting for investors to get at least dividend payments as long as the stock is in the red. And right now, AbbVie is paying a quarterly dividend of $1.48 resulting in an annual dividend of $5.92 and a dividend yield of 4.0% at the time of writing. While we certainly can find stocks with a higher dividend yield, it is certainly solid. Additionally, AbbVie increased the dividend with a high pace: While the last dividend increase was only 5% from $1.41 to $1.48, the dividend growth rate in the last five years was 16.92%. And AbbVie – and its predecessor Abbott Laboratories – is a dividend aristocrat increasing the dividend for 50 years in a row.

Of course, when comparing the annual dividend of $5.92 to GAAP earnings per share of fiscal 2022 (which were $6.65) we get a payout ratio of 89%. However, when looking at non-GAAP, adjusted earnings per share of $13.77, we get a payout ratio of only 43%, which is certainly acceptable. Finally, we can also compare the amounts of dividend AbbVie paid in the last twelve months ($10,043 million) to the generated free cash flow in the same time ($24,258 million) resulting in a payout ratio of 41%. I already mentioned in a past article that the discrepancy between GAAP and non-GAAP ratios is a little concerning, but I would consider the dividend as safe as rather look at the payout ratios around 40%.

Annual Results

But for the dividend to grow in the years to come, AbbVie must grow its top and bottom line and although fiscal 2022 results are still solid, growth is slowing down.

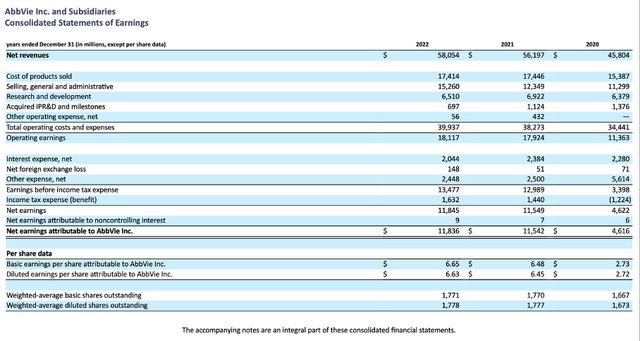

Net revenue could still increase from $56,197 million in fiscal 2021 to $58,054 million in fiscal 2022 – resulting in 3.3% top line growth. Operating earnings could also increase slightly from $17,924 million in fiscal 2021 to $18,117 million in fiscal 2022 – resulting in 1.1% YoY growth. And finally, diluted earnings per share grew 2.8% year-over-year from $6.45 in fiscal 2021 to $6.63 in fiscal 2022.

While revenue and GAAP EPS grew in the low single digits, adjusted earnings per share increased 16.4% year-over-year from $11.83 in the previous year to $13.77 in fiscal 2022. And free cash flow increased from $21,990 million in fiscal 2021 to $24,258 million in fiscal 2022 – an increase of 10.3% YoY.

Guidance 2023

And when looking at the guidance for fiscal 2023, AbbVie is expecting its adjusted diluted earnings per share to be only in a range between $10.70 and $11.10 – and therefore much lower than in the previous year. And while the guidance is also including declining Humira sales, management is pointing towards higher levels of uncertainty but is indicating actual results might be a bit better than in the current forecast.

By the way, AbbVie already mentioned during the earnings call that earnings per share in fiscal 2024 will not be lower than $10.70 – the lower end of fiscal 2023 guidance.

Humira Patent Cliff

The huge problem is the Humira patent cliff, which will happen in 2023. Due to competition from direct biosimilars, Humira sales will decline about 37% in the United States. And although this would be at the lower end of the company’s previous erosion projection of 35% to 55%, a 37% decline would still result in losing $6.9 billion in sales compared to fiscal 2022. And Humira losing patent protection is a huge problem as the drug generated $21,237 million in sales in fiscal 2022 – almost 37% of the company’s total sales. In fiscal 2022, sales for Humira could still grow 14.4% year-over-year and in the fourth quarter of fiscal 2022 revenue increased 4.6% YoY.

AbbVie JPM Healthcare Conference Presentation

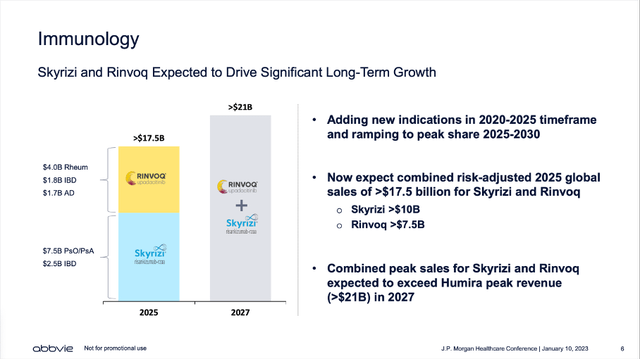

But as I have also pointed out in my last articles, AbbVie is already working hard to replace the Humira sales and with Skyrizi and Rinvoq it has the two products to probably replace the sales. In fiscal 2022, Skyrizi generated $5,165 million in sales – resulting in 76% year-over-year growth – and Rinvoq generated $2,522 million in annual sales – 53% year-over-year growth. As laid out during the last earnings call, management is expecting the two drugs to generate a revenue of $11.1 billion in fiscal 2023. In fiscal 2025, sales from Skyrizi and Rinvoq are expected to be around $17.5 billion and in fiscal 2027 combined peak sales for the two drugs are expected to exceed Humira peak sales.

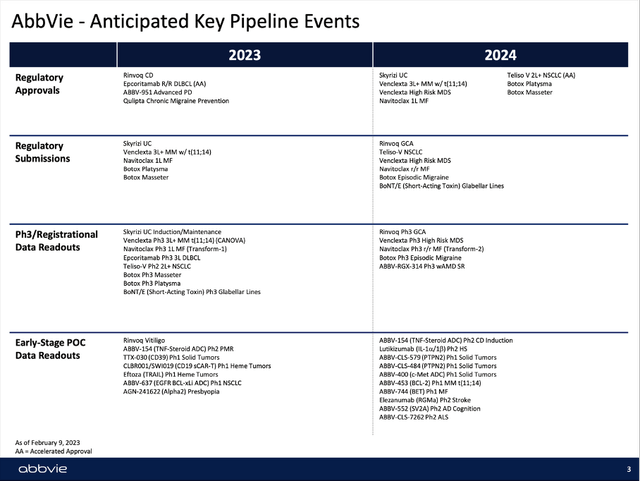

And as already mentioned in my last article, management is expecting a high-single digit CAGR from 2025 till the end of the decade as growth might not just stem from Immunology, but the other segments as well with several key pipeline events in the next two years.

Intrinsic Value Calculation

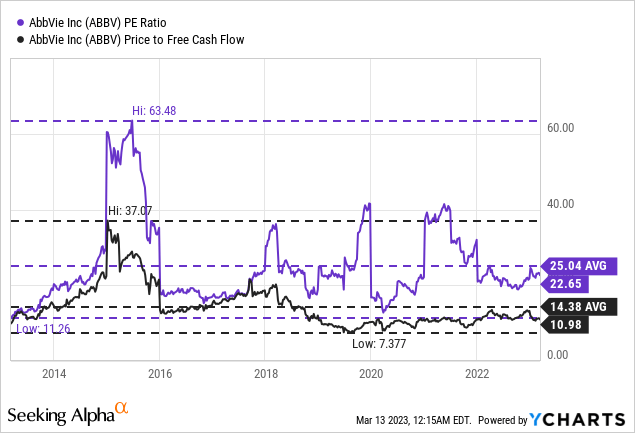

In my last article I claimed that AbbVie was probably fairly valued. And today, I would back up that claim – AbbVie is still fairly valued (or maybe even slightly undervalued). Once again, AbbVie seems rather expensive when looking at the price-earnings ratio as it is trading for a P/E ratio of 22.7. And although this is below the average P/E ratio of the last 10 years (which was 25.04), it is still not painting the picture of a bargain.

However, when looking at the price-free-cash-flow ratio, AbbVie is trading only for 10.98 times FCF. And this is not only below the 10-year average of 14.38, but also it is certainly cheap and indicating a bargain.

But as we all know, the P/E ratio or the P/FCF ratio are imperfect. Not only are they calculated based on past earnings or the free cash flow of the last 12 months, they also don’t reflect growth assumptions. Instead, we can use a discount cash flow calculation to determine an intrinsic value for AbbVie. And for starters we must expect a lower free cash flow in fiscal 2023. Management is expecting non-GAAP EPS to decline about 20% and I would expect a similar decline for free cash flow resulting in $19.4 billion in FCF in fiscal 2023. For fiscal 2024, I am expecting a similar free cash flow. And to be fairly valued (assuming a 10% discount rate), AbbVie has to grow its free cash flow about 3% annually from 2025 going forward. This seems to be an achievable target, and therefore I would call AbbVie at least fairly valued right now. And the potential for higher growth remains (as management is expecting a high single digit growth rate after 2025) which would make AbbVie undervalued.

Conclusion

And while AbbVie is probably not the best investment one can find right now, I would call AbbVie a “Buy” in relation to many other stocks and sectors as the downside risk for pharmaceuticals is rather limited and the ABBV stock is trading for an extremely low free cash flow valuation multiple. And as signs for a recession increase, it makes sense to pick companies within sectors that can withstand an economic downturn quite well.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.