Summary:

- Roku made a disclosure on Friday detailing the startup’s exposure to failed Silicon Valley Bank.

- In the short term, investors must expect more volatility which could create a strong buying opportunity.

- Investors should focus on Roku’s potential to achieve near-term profitability, not on deposit exposure.

Justin Sullivan

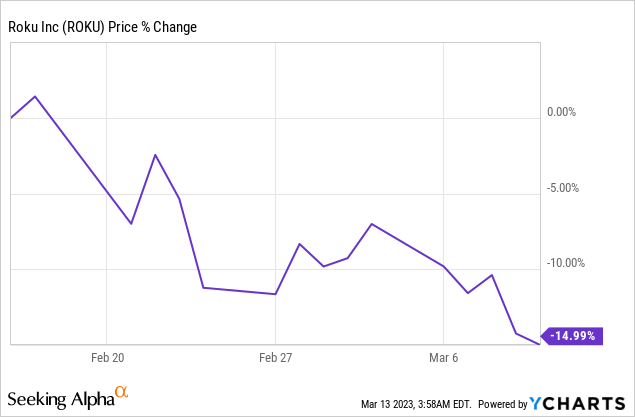

Shares of Roku (NASDAQ:ROKU) have dropped 15% since the company reported fourth-quarter results in February. However, the streaming company surprised the market by guiding for EBITDA profitability in FY 2024 which is, I believe, what matters most about Roku. Shares have trended down lately, in part because of the financial and solvency problems related to SVB Financial Group (SIVB). The group’s Silicon Valley bank holds the deposits of a lot of start-ups, including Roku, which caused concerns last week that the streaming company may not be able to access its funds. However, the Fed stepped in over the weekend and guaranteed all deposits of Silicon Valley Bank which should take pressure off of Roku’s valuation. I believe Roku’s drop is a buying opportunity as the company’s streaming business is set to keep growing!

Roku’s disclosure about its relationship with Silicon Valley Bank

Silicon Valley Financial Group is the holding company of Silicon Valley Bank (SVB) which went out of business last week as poor bets on mortgage-backed securities led to major losses and, ultimately, a storm on the bank’s deposits, causing the Federal Deposit Insurance Corporation to take over. Roku declared in a regulatory filing on Friday that it held $487M of its funds at Silicon Valley Bank. According to the streaming company’s balance sheet as of December 31, 2022, Roku had $1.96B in cash spread out over multiple accounts… and 26% of the company’s cash resources were placed with Silicon Valley Bank. However, this problem may already be resolved and investors have therefore no reason to panic.

The Fed stepped in over the weekend and assured Silicon Valley Bank’s depositors that they will receive full access to their deposits on Monday, thereby safeguarding Roku’s cash and potentially avoiding a broader deterioration of the financial system. The Fed also explicitly stated that it will protect insured and uninsured deposits which is likely to take off pressure from the start-up sector as well as Roku. The Fed’s intervention is only meant to protect depositors, not shareholders or bondholders of Silicon Valley Financial Group so the SVB saga should not affect Roku’s growth prospects or ability to pay its expenses.

Focus on Roku’s streaming platform growth and adjusted EBITDA profitability

While the SVB saga made for a distraction last week, I believe investors should not want to get sucked into a panic and focus on Roku’s long term value in the streaming market. A key benefit for Roku is that long term streaming trends are solidly in favor of the company. It was reported at the beginning of the month that major legacy Pay TV providers bled subscribers last year. Traditional Pay TV providers lost 5.8M subscribers in FY 2023, 1.1M more than they lost in FY 2022. I previously indicated that the cord-cutting trend is a major boost for streaming companies like Roku.

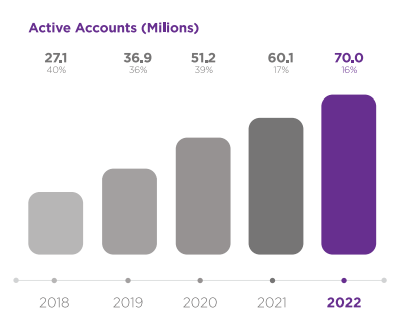

Roku is obviously benefiting from increasing streaming TV penetration and continues to attract a huge amount of subscribers to its platform. As of the end of FY 2022, the streaming company counted 70M subscribers in its ecosystem, showing 16% year over year growth. I believe, based off of current account growth rates, Roku could break through the 100M-subscriber threshold in FY 2025.

Source: Roku

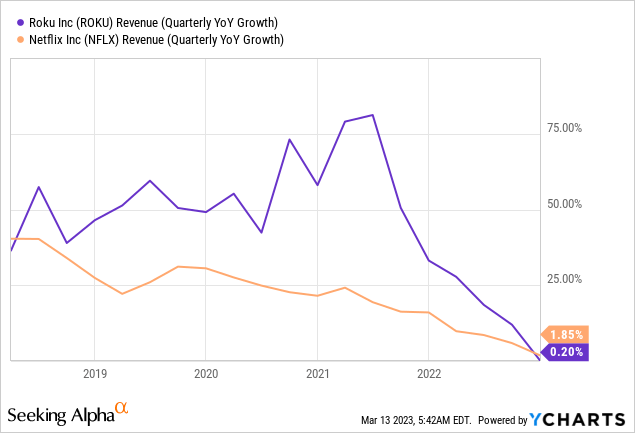

Despite a post-pandemic slowdown in the Roku’s top line growth and a deteriorating macro picture due to SVB’s shutdown, investors should focus on the company’s ability to move its business towards profitability next year. The company has said that it expects to be EBITDA profitable in FY 2024 which could reignite interest in the streaming company over time.

Revenue growth has slowed, but not only for Roku. Netflix (NFLX) has also seen a post-pandemic slowdown in its top line growth rate. Going forward, new partnerships with advertisers and growing content distribution could be catalysts for Roku to reinvigorate its top line growth.

While Roku still has way to go to turn the corner regarding its profitability, if the company achieves its profitability target in FY 2024, shares may see a strong revaluation to the upside.

Roku’s valuation is attractive as it is

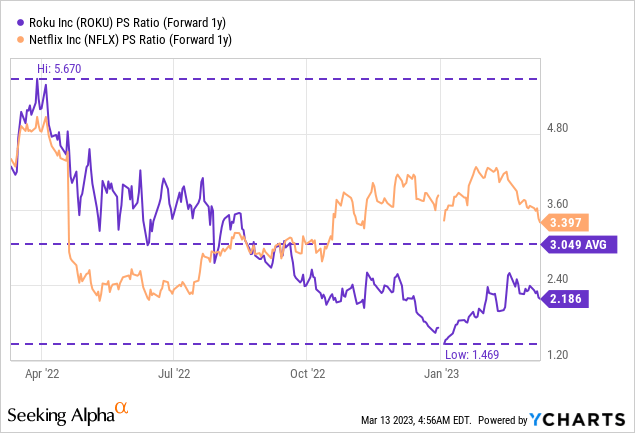

Roku’s valuation has become more attractive since the company reported Q4’22 earnings, in part because of concerns over the company’s cash assets held by SVB. Since the Fed stepped in over the weekend, I believe investors don’t have to worry about Roku’s ability to execute its business normally.

However, should Roku’s shares continue to sell off, investors may want to see this as a buying opportunity rather than an opportunity to ditch the shares. Roku is selling for a forward price-to-revenue ratio of 2.2 X compared to Netflix’s P/S ratio of 3.4 X. Roku is now also selling 28% below its 1-year average P/S ratio.

Risks with Roku

Streaming trends and growing streaming TV penetration are major positives that benefit Roku, but there are still considerable risks. One risk is that top line growth is slowing and that Roku’s important average revenue per user figure has shown signs of weakness in the fourth-quarter. Weakening user monetization may delay Roku’s ability to generate profits which could weigh on the company’s valuation factor going forward. Additionally, there is also a general risk that other financial institutions may crumble under the pressure of deposit withdrawals which could create down-ward pressure in the stock market and lead to a deterioration of the macro picture.

Final thoughts

Roku’s shares have consolidated after Q4’22 earnings and, in the short term, there may be more valuation pressure and volatility that investors may want to take advantage of. I believe that Roku’s streaming business is on a good path as its active accounts are still growing. The achievement of EBITDA profitability in FY 2024 could be a milestone event which investors may be willing to reward with a higher valuation multiplier factor. While not totally cheap, I believe that the risk profile is positive. Since the Fed also stepped in over the weekend and guaranteed Roku’s deposits at Silicon Valley Bank, I believe investors should see a market slide as an opportunity to buy Roku stock!

Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.