Summary:

- On April 26, AbbVie published financial results for the first quarter of 2024, which pleasantly surprised me.

- Rinvoq sales were about $1.1 billion in the first quarter of 2024, up 59.3% from the previous year.

- The company’s management raised its 2024 adjusted earnings guidance from $10.97 – $11.17 to $11.13 – $11.33.

- AbbVie has a rich portfolio of experimental drugs, one of the most promising of which is Epkinly, which was developed in partnership with Genmab.

- As a result, I am upgrading AbbVie stock’s rating from ‘Hold’ to ‘Buy’.

Klaus Vedfelt

AbbVie (NYSE:ABBV) is one of the largest pharmaceutical companies in the world, holding one of the leading positions in the global autoimmune and neurological disorders therapeutics markets.

Investment thesis

Since the publication of my last article in early 2024, the company’s share price, after a brief bull run, has reached a strong support zone ranging from $157 to $160.

On April 26, AbbVie released financial results for the first three months of 2024, which pleasantly surprised me with full-year 2024 guidance, progress in developing its pipeline of experimental drugs, and maintaining a strong operating margin despite a slight decline in sales of its aesthetic products.

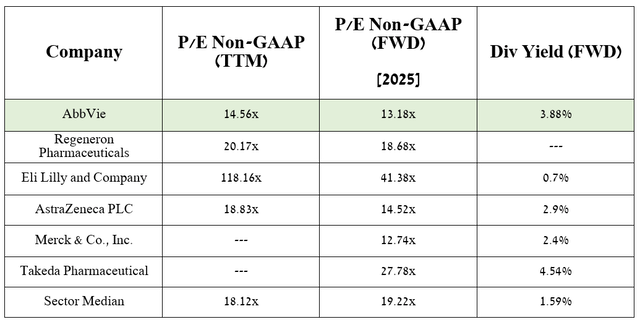

So, the company’s management raised expectations for its adjusted diluted earnings per share from $10.97 – $11.17 to $11.13 – $11.33, which represents a P/E [FWD] of 14x, indicating that AbbVie is trading at a discount not only to the pharmaceutical sector but also to its key competitors including Eli Lilly (LLY), Pfizer (PFE) and AstraZeneca (AZN).

In my assessment, in addition to the product candidates, the analysis of which will be presented later in the article, key contributors to improving the company’s financial position will also be such innovative medications as Skyrizi, Rinvoq, Ubrelvy, Elahere, and Qulipta, which will be able to offset the damage from the decline in Humira sales caused by increased competition with its biosimilars.

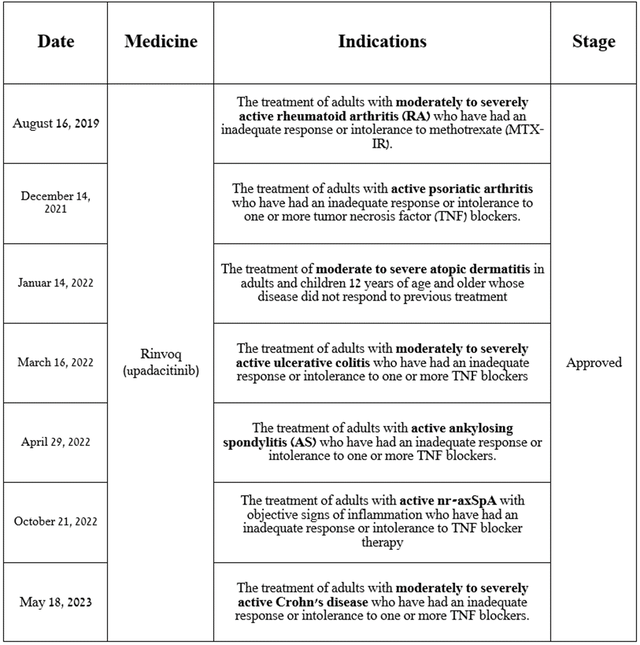

So, Rinvoq (upadacitinib) is a medication that is used to treat patients with autoimmune diseases, including active psoriatic arthritis, active ankylosing spondylitis, moderate to severe rheumatoid arthritis, Crohn’s disease, and more. According to WHO, about 18 million people worldwide live with rheumatoid arthritis, and this number continues to grow from year to year, which represents one of the key prerequisites for the continued growth of its sales.

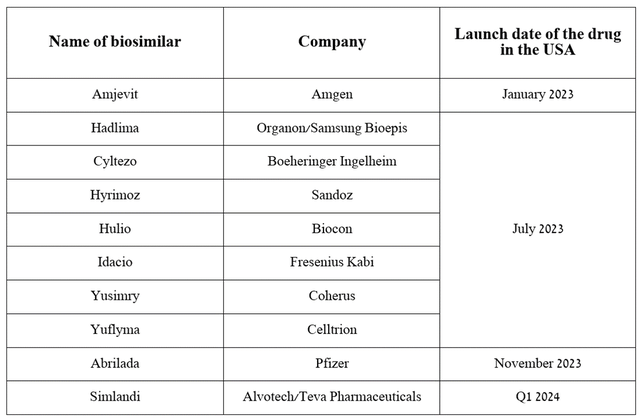

Source: table was made by Author based on AbbVie press releases

Since Rinvoq is a second-generation JAK1 selective inhibitor, it inhibits JAK1/3-induced phosphorylation and activation of signal transducers and activators of transcription, which ultimately leads to a significant slowdown in inflammation. In addition, I would like to point out that due to its ability to have minimal effects on JAK3, upadacitinib has a more favorable safety profile relative to a key competitor in the global autoimmune disease therapeutics market, such as Pfizer’s Xeljanz.

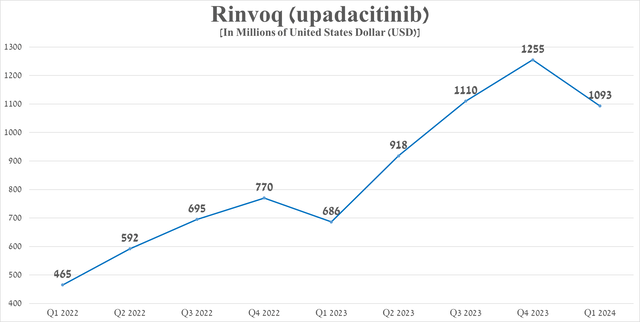

Its total sales were approximately $1.1 billion in the first quarter of 2024, an increase of 59.3% year-over-year due in part to extremely strong demand in the United States for the treatment of patients with psoriatic arthritis, as well as data from phase 3 clinical trials that demonstrated its efficacy in the treatment of patients with atopic dermatitis through 140 weeks.

Source: graph was made by Author based on 10-Qs and 10-Ks

Thanks to numerous patents that do not expire until 2036 and protect Rinvoq from the appearance of its generic versions on the market, I believe that sales of AbbVie’s blockbuster will continue to grow in the coming years, including due to the potential expansion of indications for its use.

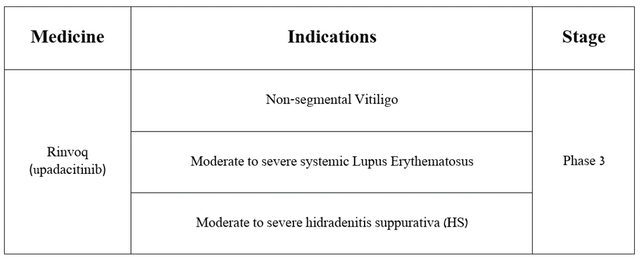

Source: table was made by Author based on AbbVie press releases

Moreover, on April 18, 2024, the company announced positive results from a pivotal clinical trial that assessed Rinvoq’s efficacy and safety profile in treating patients with giant cell arteritis.

The study met both primary and secondary endpoints, including that Rinvoq was well tolerated and that 46% of adult patients taking AbbVie’s product 15 mg experienced sustained remission, compared with 29% of patients receiving placebo. As a result, I believe it has a high chance of regulatory approval to treat patients with this autoimmune disease, which attacks the arteries of the head and can ultimately lead to aneurysm and permanent vision loss.

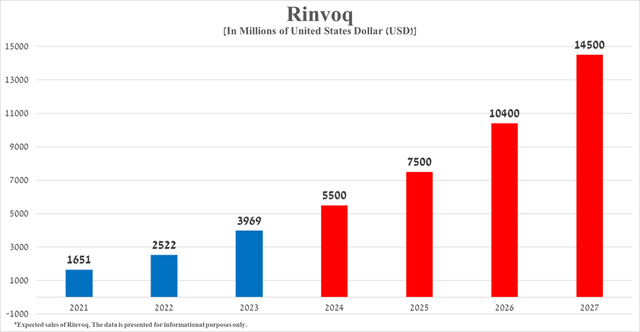

My estimate, based on Rinvoq’s historical sales growth rate, its expected label expansions over the next four years, and the release of additional results supporting its competitive advantage relative to ‘gold standards’ in the treatment of severe inflammatory diseases, its total sales will reach $14.5 billion in 2027.

Source: graph was made by Author

As a result, I am upgrading AbbVie’s rating from ‘Hold’ to ‘Buy’.

Prospects for AbbVie’s business development in 2024

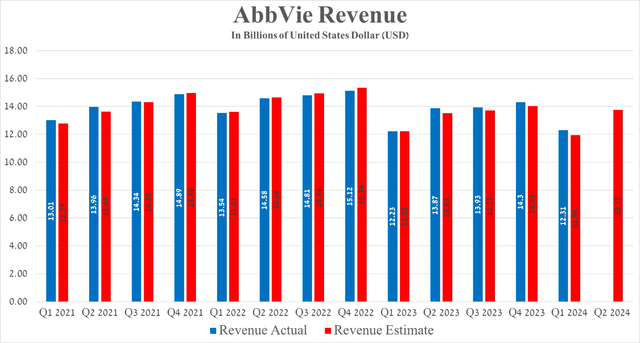

AbbVie’s revenue for the first quarter of 2024 was $12.31 billion, not only up slightly year over year, but also beating analysts’ expectations by $370 million.

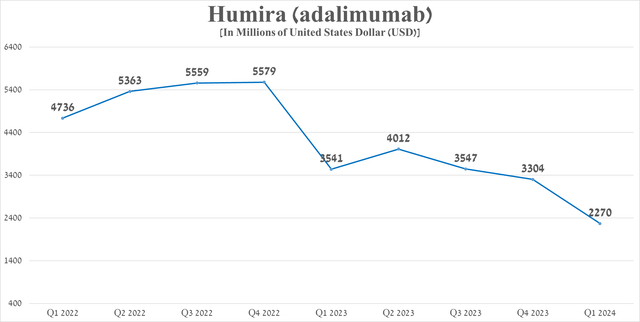

In my assessment, the main culprit for the minor increase in this financial metric is the sharp drop in sales of Humira (adalimumab), the company’s flagship drug, which is experiencing increased pressure from its many biosimilars, which have significantly lower prices with similar efficacy and safety profiles.

Source: table was made by Author based on press releases from companies and Cardinal Health

So, its sales amounted to $2.27 billion in the first three months of 2024, which is 35.9% less than the previous year. On the other hand, based on historical data, as well as seasonal changes in demand for it, I expect Humira sales per quarter will fluctuate in the range of $2.1 billion to $2.4 billion, thereby not posing a significant threat to AbbVie’s financial position.

Source: graph was made by Author based on 10-Qs and 10-Ks

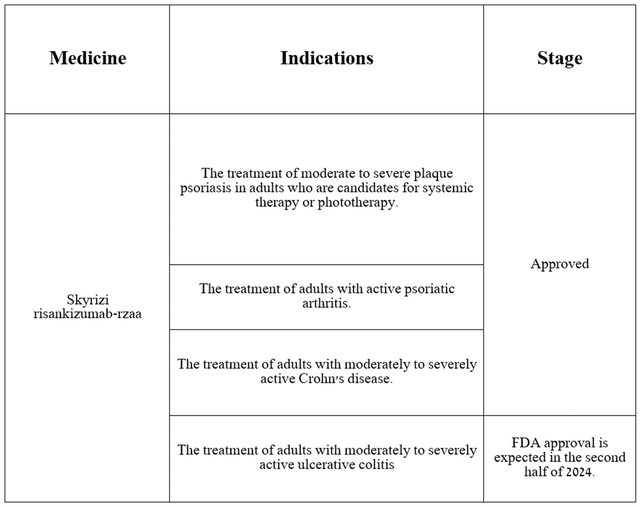

Mitigating the damage from the drop in Humira sales is primarily entrusted by the company’s management to Skyrizi (risankizumab), which is approved by the FDA for the following indications.

Source: table was made by Author based on AbbVie press releases

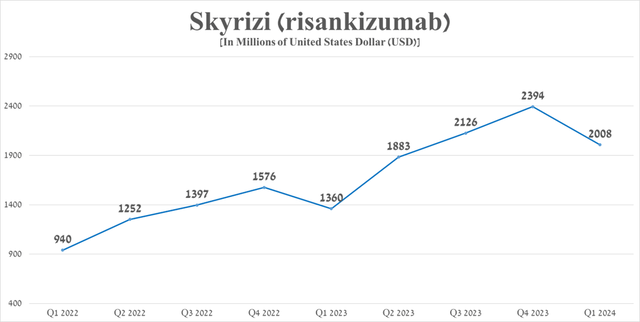

Its total sales were approximately $2 billion in the first quarter of 2024, an increase of 47.6% from the first quarter of 2023, including through data published on February 19, 2024 demonstrating its extremely high efficacy in the treatment of moderate and severe Crohn’s disease, as well as its competitive advantages over blockbusters such as Johnson & Johnson’s Stelara (JNJ), Bristol-Myers Squibb’s Sotyktu (BMY), Novartis’ Cosentyx (NVS), Johnson & Johnson’s Remicade and AbbVie’s Humira. Ultimately, these benefits are reflected in the increased demand for Skyrizi in the United States and the European Union.

Source: graph was made by Author based on 10-Qs and 10-Ks

Considering Seeking Alpha’s data, AbbVie’s revenue for the second quarter of 2024 is anticipated to range from $13.5 billion to $14.2 billion, which is about 15.2% more than the previous quarter.

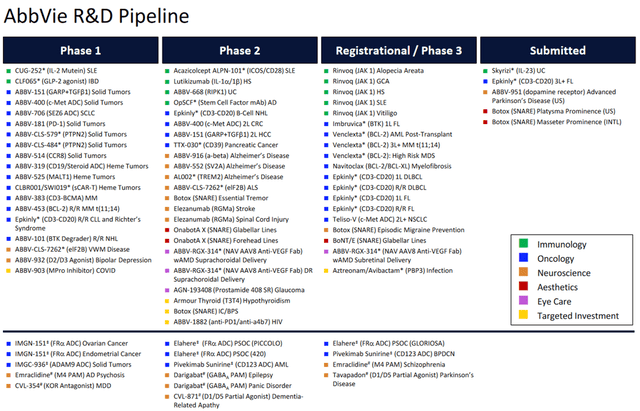

In addition to growth in sales of well-known brand-name products, I believe that another factor that will have a positive impact on the recovery of AbbVie’s EBITDA and revenue growth rates is continued high R&D spending, the goal of which is to develop the next generation of medications that can become gold standards in the treatment of cancer, neurological and inflammatory diseases.

One of the most promising drugs is Epkinly (epcoritamab-bysp), which was developed in partnership with Genmab (GMAB). This bispecific antibody received its first FDA approval in mid-May 2023 for the treatment of certain patients with relapsed or refractory diffuse large B-cell lymphoma. Currently, AbbVie is evaluating its efficacy in the treatment of follicular lymphoma, chronic lymphocytic leukemia, diffuse large B-cell lymphoma, and more.

Risks

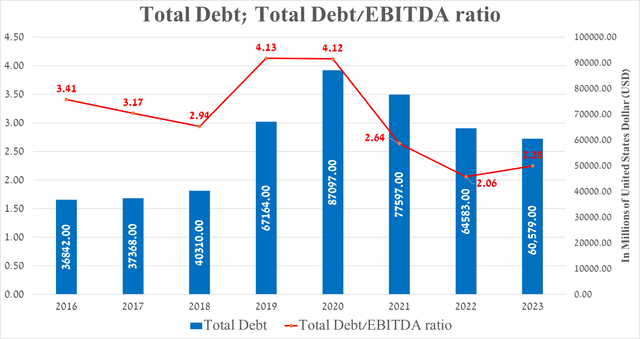

Before moving on to the conclusion, I would like to note the following financial risks that may affect the price of AbbVie shares in the medium term. These risks include an accelerating rate of decline in Humira’s share of the immunology drugs market, declining sales of Imbruvica due to increased competition from more effective Bruton’s tyrosine kinase inhibitors, and the company’s continued increased debt load due to the acquisition of several pharmaceutical companies.

Author’s elaboration, based on Seeking Alpha

Takeaway

In recent months, AbbVie has continued to make significant progress in developing its rich pipeline of experimental drugs, and I expect its revenue and net income growth to begin accelerating again from late 2024 with its acquisitions of ImmunoGen, Landos Biopharma, and Cerevel Therapeutics.

According to my estimate and analysts’ expectations, thanks to FDA-approved drugs, as well as elezanumab, darigabat, and label expansions for Rinvoq, the company’s EPS will reach 13.18x in 2025.

Source: table was made by Author based on Seeking Alpha

As a result, this suggests that the company is trading at a discount to many of its peers, and with its dividend yield of 3.88% year over year, AbbVie is an attractive asset for long-term investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.