Summary:

- Abercrombie & Fitch recently reported Q4 earnings that missed low expectations on the bottom line.

- ANF narrowly exceeded revenue expectations, and CEO Fran Horowitz mentioned that the company remains cautiously optimistic heading into 2023.

- Executives released guidance that didn’t move the stock, as revenue is expected to rise 1-3% next fiscal year and operating margins are forecasted to hit 4-5%.

- There were no negative surprises, but nothing about the report spells much optimism heading into the summer. I rate the stock “Hold” with a $26 price target over an 18-month period.

Justin Sullivan/Getty Images News

Introduction & Purpose

Abercrombie & Fitch Co. (NYSE:ANF) recently reported Q4 earnings on March 1, 2023 that beat low revenue expectations, but missed earnings estimates by $0.05. The company’s revenue declined ~1% from the prior year, but ANF improved its guidance for the FY2023, projecting that revenues will rise 1-3% in the year ahead. My recent forecast ahead of earnings on ANF showcased a bear view, and even with the stock holding in the high $20’s, these results reinforce my opinion. With a macro environment likely to remain challenged as rates remain elevated, and ongoing turmoil as the company looks to stay profitable, ANF isn’t well-positioned to outperform in the near term. I reiterate my “Hold” rating with a $26 price target over an 18-month timeline.

ANF Q4 Review

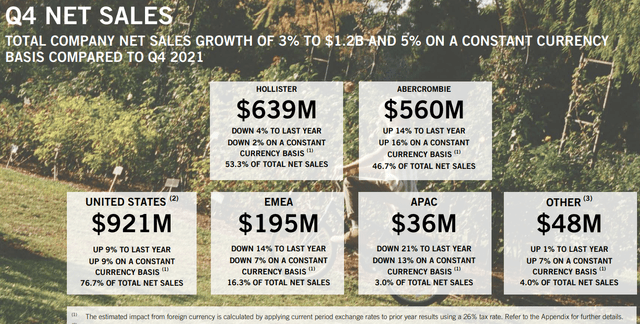

ANF announced Q4 earnings on March 1, 2023 that didn’t impact the stock, as expectations were mostly within range heading into a new fiscal year. Total revenues jumped to $1.2Bn over the holiday season, up 3% year over year. The company saw the gross margin slide to 55.7%, down 260 basis points compared to last year. The year-on-year decrease was primarily driven by ~160 basis points of higher product/cotton costs and inventory reserves more than offsetting lower freight costs and ~100 basis points from exchange rate volatility. Operating income came in at $87MM, which was sufficient enough to end the year in the black. Hollister, the largest brand by revenue within the portfolio, saw sales fall 4% year-on-year. However, there was some promise from the Abercrombie brand, which saw a 14% revenue jump, given its strength in the student demographic and with the women’s business achieving its highest quarterly sales in brand history, as noted by executives on the earnings call. The parent brand is now closing in on Hollister as the leading revenue generator, and it spells a notable shift in the sales mix.

Global sales fell significantly, highlighted by a 21% weighted drop in the European, Middle East and Asia-Pacific regions. The company was fortunately able to increase domestic sales, which grew 9% after falling in recent quarters, and it’s one of the key reasons for optimism. While the results were decent, the bar had been set so low from previous quarterly results that I’m not sure these earnings are a catalyst for the stock to have a prolonged rally. The stock has fallen 6% since earnings were released, though that is in part due to broader market dynamics, with a FED rate announcement is coming soon. The company also announced that inventory fell 4% to $506MM, which is a welcome sign, given that executives had been highlighting this as a catalyst. I mentioned in my last piece that the expectation of a revenue beat and an earnings miss was likely, given that there was self-inflicted pressure to unload inventory, which meant discounted product was a strong possibility. Overall, the quarter was decent and with a low bar being set in 2023, as I’ll touch on below, the company has the capacity to meet and exceed its projections – but will they?

Abercrombie & Fitch Q4 Presentation

FY2023 Guidance

ANF provided a detailed 2023 outlook, forecasting a 1-3% revenue increase with the Abercrombie brand leading the growth amid a cautiously optimistic demand environment. Geographically, management anticipates the U.S. to continue to outperform international and forecasts the full year operating margin to be in the range of 4-5%. Management also expects about 200 basis point margin improvements from a net benefit in product costs due to freight savings, partially offset by higher cotton raw material costs. ANF also forecasts modest deleveraging driven by the combination of inflation and increased investment related to their previously planned initiatives, notably a retail merchandising ERP upgrade.

The company also anticipates an operating tax rate around 45% and CAPEX to hit $160MM as the company hones in on growth in the Abercrombie brand. Executives were grilled about the Hollister decline, but management pushed back, noting that the stage is set for a comeback and that the brand’s inventory is rightsized. Management also highlighted that they increased storefronts last year, and believe that opening smaller new format stores in more malls is a growth opportunity. Whether these openings will fit in their CAPEX budget amid tight operating margins will be something to watch. As I look at the company’s guidance and focus points, it is clear that a U.S. focus and stemming the revenue decline in Hollister are keys going forward. The declines in Asia and Europe, along with a lack of progress in digital sales (noting a 3% drop from 47% to 44% this year) tell me that right sizing inventory and efficient same store sales figures will be critical to the long term health of the company. I’m not very optimistic on these fronts, but if you have held the stock for a while, its worth watching ANF throughout the year to see if true progress will be made.

Model Shows Limited Upside

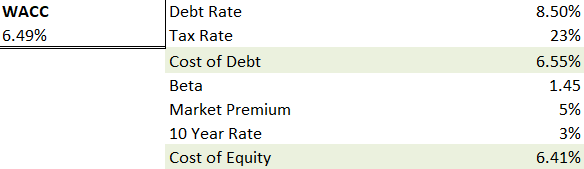

A senior note at 8.75% stings in hindsight, though ANF’s net cash of $518MM after a strong holiday season provides some impetus to potentially pay down debt. While they did buy back $8MM of their outstanding debt, given their weak performance, I anticipate the cost of capital remaining elevated at 6.5%.

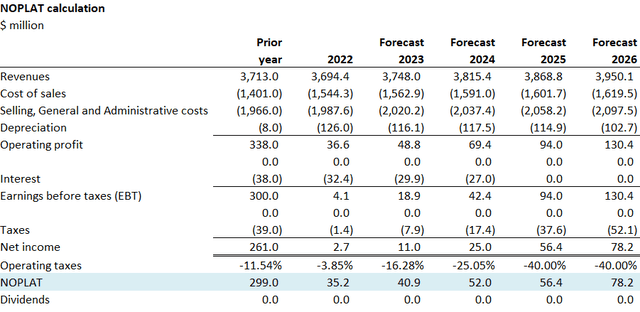

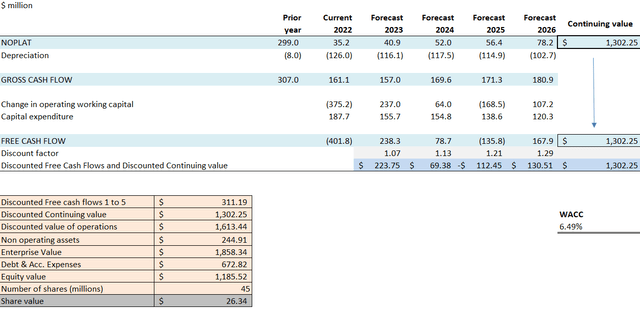

Author WACC Forecast

I forecast a continuing value of ~$1.3B, given a 1.5% revenue increase next year and blended revenue gains of ~1.75% for four years, as Hollister brand struggles continue. I hold the majority of other cost ratios equal as a percentage of revenue from the previous model, with a slight reduction in future sales costs from the roll out of a new ERP system, which is forthcoming. I also forecast that the company will hold most of their debt to maturity without refinancing, which explains the low cash flow in 2025. A $26 share price (see below) can be supported with fundamentals of a 9.9x 2024 EV-EBITDA, which is in range with peers.

Author NOPLAT Forecast Author Share Price Forecast

Conclusion

ANF mostly met expectations this quarter, but operational challenges still continue to plague the company. I believe that ANF will remain an underperformer, or at best middle of the pack. Significant challenges lie ahead with its Hollister brand and ANF still has a significant cost base with too much square footage in undesirable areas. It’s wise to hold the stock if you have had it for some time, but wait for a pull back or another positive catalyst to buy. I project a $26 price target with a “Hold” rating over an 18-month timeline.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.