Summary:

- Investors who followed my last calls on NKE could top their return at over 48% profit over the past few months.

- The stock is likely heading into more weakness while investors could wait and see if support may build up.

- In this technical article, I show important price levels and metrics that investors could consider for gaining an edge on the stock’s likely price action.

- By considering multiple outcomes and setting up an adequate contingency plan, investors are less inclined to act driven by emotions, as this could come at a higher cost.

- While I downgrade NKE to a hold position, I also discuss the eventuality of a positive scenario which could lead to further gains.

DNY59/iStock via Getty Images

Nike (NYSE:NKE) has marked a spectacular reversal, returning over 48% to investors who followed my call shortly after the bottom, but has more recently given some signs of weakness. After having discussed the company’s fundamentals, it’s time to get an overview of the stock’s situation. In this article, I discuss technical elements that underscore the increasingly high chances of seeing the stock has peaked, leading me to downgrade NKE stock to a hold position, while I also discuss a positive scenario that could be interesting for both long- and short-term investors.

A quick look at the big picture

The US consumer cyclical sector continues to perform weaker than other industry groups in the economy, reporting massive losses in the past year and seemingly being incapable of consistently recovering also in the past few weeks. Apparel manufacturers are still among the worst performers in the past year, performing poorly also in the past month, while footwear and accessories manufacturers have been performing flat on a yearly basis, despite showing some weakness in the past few weeks. The US consumer sentiment is still hovering at historically low levels with the index reading 67 in February 2023, although it has recovered from the low at 50 recorded in June 2022, and is also up from 62.80 one year ago.

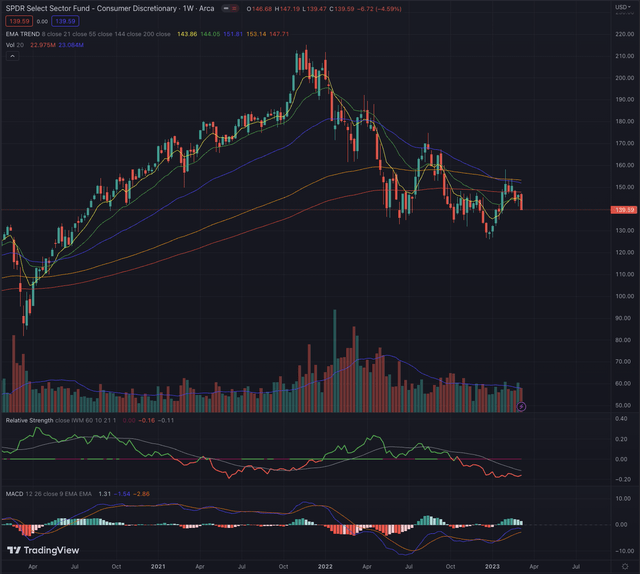

The industry reference the Consumer Discretionary Select Sector SPDR ETF (XLY) is still in its downtrend after having been particularly extended coming out from the pandemic low. Recently the benchmark failed to break out from its EMA55 for the third time since the beginning of its decline, and the benchmark got projected under its EMA200, while also reporting increasing relative weakness when compared to the broader iShares Russell 2000 ETF (IWM). The spike in positive momentum recorded by its MACD in the past few weeks seems to revert, and XLY could head into more weakness on increasingly high sell-side volume.

Where are we now?

In my article “Nike Vs. Lululemon: Which Stock Is The Better Investment?” published on October 13, 2022, I discussed the fundamentals of Nike and valued the company based on three scenarios. My analysis suggested a potential undervaluation of NKE, targeting a weighted average price target of $111.83, and in my most optimistic scenario, I expected the stock to be priced fairly at $127.68. NKE has successively reported a strong rally, leading the stock to peak at $131.31 on February 2, 2023, exceeding even my most optimistic assumption.

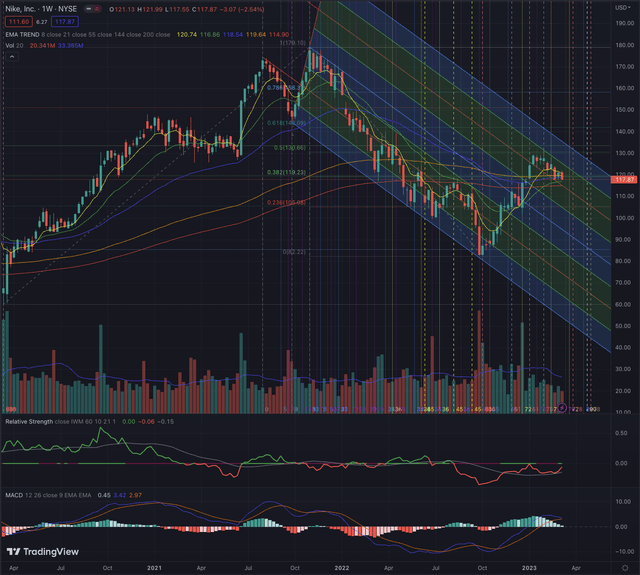

On its weekly chart, we notice how NKE has been negatively extended, reporting strong negative momentum since the beginning of 2022 while tracing the downward trend channel. The rally in the past few months has projected the stock above its EMA200 and even its EMA55 on strong accumulation days. Despite its recent great performance, the stock is still struggling to build up relative strength compared to the broader equity market (IWM), and its MACD is hinting at the likely exhaustion of the strong positive momentum.

Investors should consider that despite the recent rally which was overdue for negative extension, NKE will need to build up significant relative strength for a consistent reversal, and would likely also be reflected in the XLY and the US consumer sentiment.

NKE broke out from stage four, but the increasing weakness invites more cautiousness, and investors better be prepared for multiple outcomes in advance, instead of having to take an important decision in a critical moment.

What is coming next?

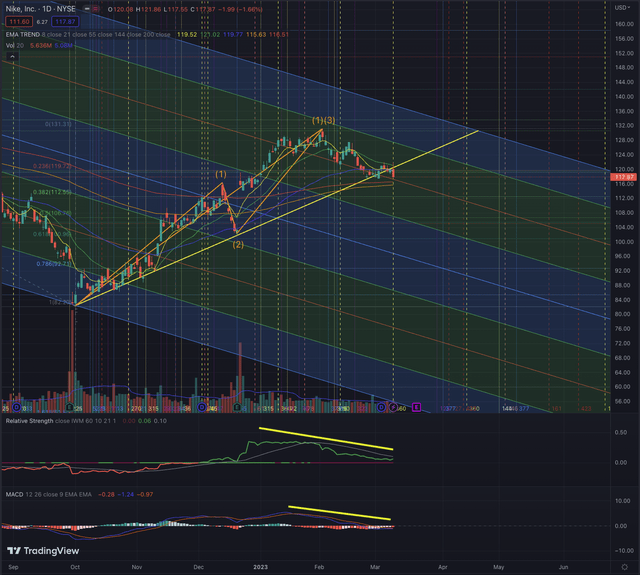

On its daily chart, NKE is hovering around its EMA55, while the EMA21 is now acting as a resistance, pushing the stock to break under the upward trend-line it was considering for maintaining my buy rating. The stock’s relative strength has significantly dropped, and the MACD is negatively oriented, all elements that cannot be ignored and lead me to update my contingency plan.

Investors who followed my call in my last analysis are in the privileged position of seeing a nice profit in their position. This profit should not be given back and should be protected. In my first scenario, I consider NKE dropping further. While the EMA200 could offer some support, it’s likely that if the market conditions don’t improve as seen in the former paragraphs, NKE will probably fall into a new downtrend, while tracing the central part of the downtrend channel or even falling more sharply. Investors could wait and see if the stock achieves to overcome again the EMA55 and the upward yellow trend line, but I would definitely not allow my position to drop significantly under the EMA200 and set my stop-loss slightly under the EMA144.

In my second scenario, this pullback is part of a bigger upward trend, and NKE would likely form wave 2 or wave 4 of a new impulse wave formation. The assumption of seeing wave 4 forming, would be invalidated if the stock falls back under $116.45, as this would invade the territory of wave 1. In that case, the stock could still form wave 2, which could be even more positive for investors, as NKE would successively form wave 3 and this would most likely lead the stock to new highs.

Despite this latter scenario sounding more promising, it’s early to call for it and I would prioritize protecting my profit and set the discussed stop-loss. Investors can always scale into the stock if the assumption of an upward impulse wave formation should be confirmed, but for the moment, I would certainly not add any exposure.

Nike is expected to publish its Q3 FY2023 earnings release on March 21, which could lead to higher volatility in the stock. All the discussed elements, and that the stock reached my price target set by my fundamental valuation model, lead me to downgrade NKE to a hold position, while I would continue to closely observe the stock and keep or even add exposure if the stock would continue in its upward trend and form its next wave.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

The consumer cyclical sector isn’t ready yet to recover from its massive sell-off and despite some industry groups performing better, most of them are still suffering from low consumer sentiment and macroeconomic headwinds. NKE has emerged from its selloff while the reversal seems to come to exhaustion and it’s time for investors to protect the achieved performance. The stock seems set for more weakness but investors could still wait for more certain sell signals, while already setting their stop-loss to avoid giving back a big share of their profits. Under the discussed technical aspects I downgrade NKE to a hold position.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: All of my articles are a matter of opinion and must be treated as such. All opinions and estimates reflect my best judgment on selected aspects of a potential investment in securities of the mentioned company or underlying, as of the date of publication. Any opinions or estimates are subject to change without notice, and I am under no circumstance obliged to update or correct any information presented in my analyses. I am not acting in an investment adviser capacity, and this article is not financial advice. This article contains independent commentary to be used for informational and educational purposes only. I invite every investor to do their research and due diligence before making an independent investment decision based on their particular investment objectives, financial situation, and risk tolerance. I take no responsibility for your investment decisions but wish you great success.