Abercrombie & Fitch: We Are Not Buying The Recent Rally

Summary:

- Abercrombie & Fitch stock has rallied more than 80% in the second half of 2022.

- At the same time, the return on equity, together with the profit margin and the inventory turnover, has been declining.

- While we expect the macroeconomic environment to improve and positively impact ANF’s business, company-specific risks remain, e.g. related to inventory management.

- For now, we maintain our bearish view.

jetcityimage

Abercrombie & Fitch Co. (NYSE:ANF), through its subsidiaries, operates as a specialty retailer. The company operates in two segments, Hollister and Abercrombie.

In today’s article, we will be discussing ANF’s profitability and efficiency measures, and their developments over the past years. Our analysis will be primarily focusing on the company’s return on equity (ROE) measure, and its components, namely the net profit margin, the asset turnover and the equity multiplier. We will be also highlighting some macroeconomic trends, which are likely to have direct impact on ANF’s financial performance in the coming months.

We have published an article on the stock back in September 2022, rating the stock as “sell”. The main reasons for our bearish view have been:

Declining sales, elevated freight and raw material costs, increasing inventory, declining demand for the Hollister brand and capital allocation decisions are all raising concerns.

Since then, the share price has increased by as much as 88%, so we will be also discussing, whether we believe that this bounce in the second half of 2022 is justified or not.

So let us start by analyzing the return on equity (ROE).

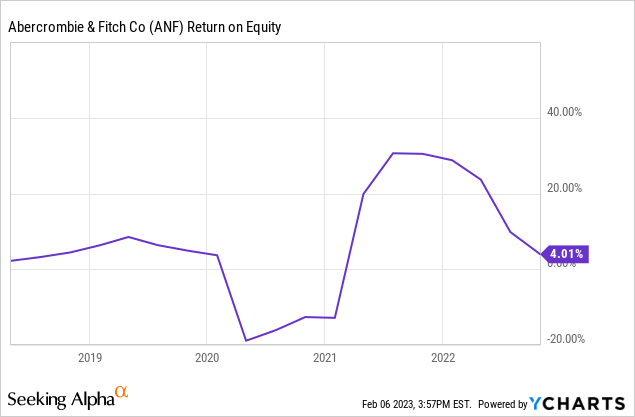

Return on equity

Return on equity measures the rate of return on the money invested by common stock owners and retained by the company from previous profitable years. It indicates a company’s ability to generate profits from shareholders’ equity (also known as net assets or assets minus liabilities). In general, investors would like to see a stable or improving ROE over time.

ANF’s ROE has not changed drastically over the past 5 years, however it has been quite volatile, fuelled by the pandemic in 2020 and by the challenging macroeconomic environment in 2022.

Our task here is to try to understand what to expect going forward. Is it likely that the recent decline continues or is it more plausible to assume that the trend changes?

To answer this question, we have to decompose the ROE measure, and understand the primary drivers behind the changes.

ROE decomposition (investopedia.com)

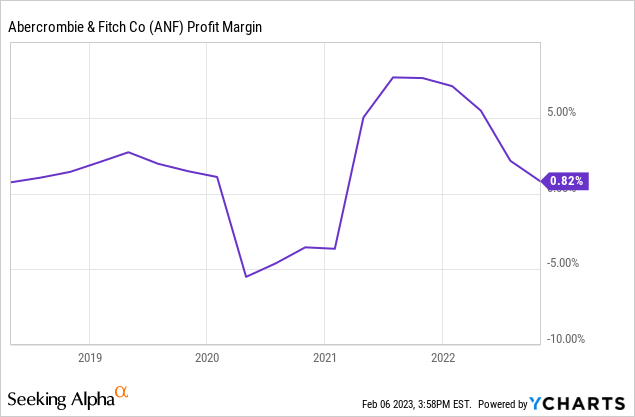

Net profit margin

Profit margin represents the percentage of revenue that a company keeps as profit after accounting for fixed and variable costs. It is calculated by dividing net income by revenue. Just like with the ROE, we would like to see this measure staying stable or improving over time.

Net profit margin has been just as volatile as the return on equity itself. To indicate how low this 0.82% is, we have to compare this figure with the industry median of 4.9%.

Going forward, we do not see a rapid improvement of this measure in the first half of 2023. On one hand, the macroeconomic environment is improving. Energy prices are declining, consumer confidence is improving and inflationary pressures are somewhat easing. All these factors are likely to have a positive impact on the firm’s financial performance from the second half of 2023 onwards.

On the other hand, there are certain company specific factors, which are likely to keep negatively impacting ANF’s financial results, especially the margins. We would like to highlight here the inventory and the inventory turnover.

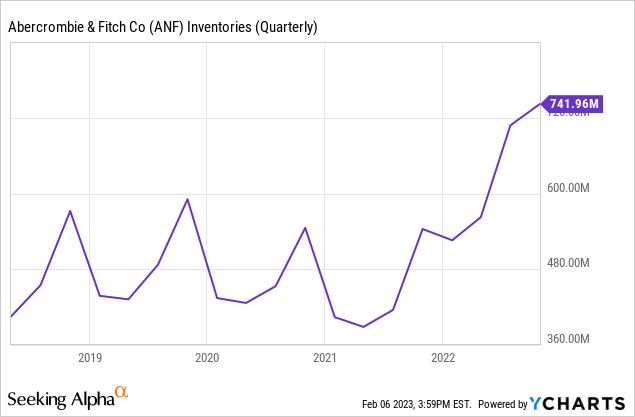

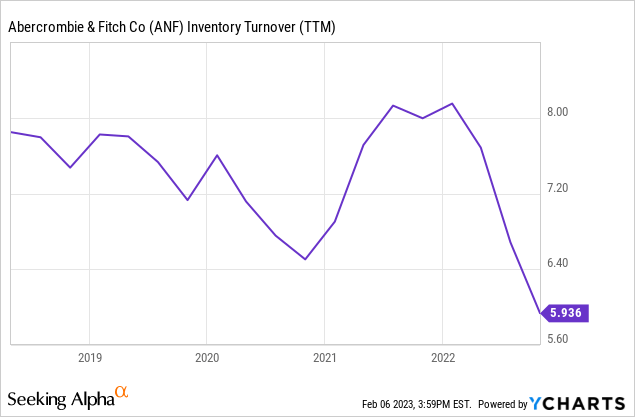

While the level of inventory shows strong seasonality, in 2022 inventory levels have skyrocketed. At the same time, inventory turnover has plummeted.

Increasing inventory levels, combined with declining turnover can indicate that the demand for the products is not as high as anticipated before. This could lead to excess/obsolete inventory. Many retailers, including Walmart (WMT) and Target (TGT), have been struggling with inventory management in 2022, which lead to the need for substantial promotional/discounting activity. We believe that the same may happen in ANF’s case, which could lead to further contraction of the margins in the near term.

All in all, despite the improving macroeconomic environment, in the near term we maintain our bearish view.

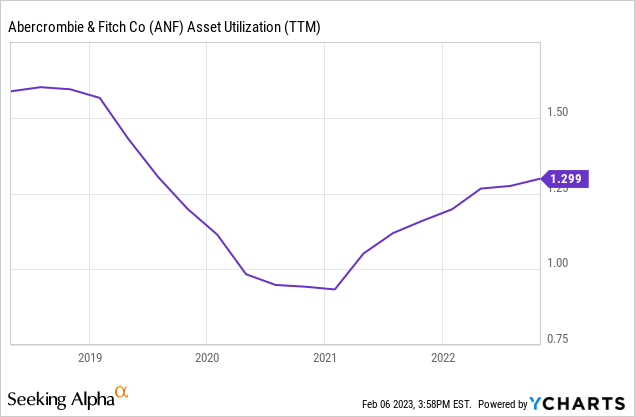

Asset turnover

The asset turnover (or asset utilization) ratio calculates the total revenue earned for every dollar of assets a company owns. It indicates how effectively the company is using its assets to generate sales. While the measure is indicating an improvement since the pandemic lows, the efficiency has still not reached pre-pandemic levels. We would like to see this measure further improving, in a sustainable way, before we would consider upgrading the stock from our current “sell” rating.

To put this figure into perspective, in the apparel retail industry, the asset turnover ratio ranges between 0.82 and 2.12.

One may ask, why we are not happy with the improvement that has already happened since the pandemic?

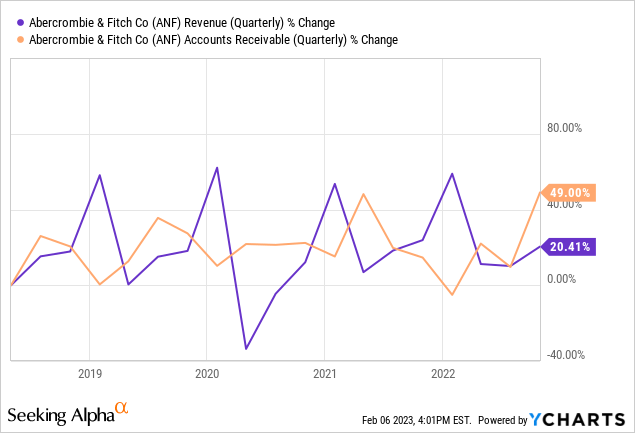

When we look at the change of revenue and accounts receivable, we can see that the latter has increased at a much higher pace. It could be an indication or warning sign that ANF started using more aggressive accounting practices, or selling more on credit, to maintain its sales levels. However, such actions are not sustainable and likely to hurt future financial figures.

In short, we would like to see the growth in accounts receivable slow.

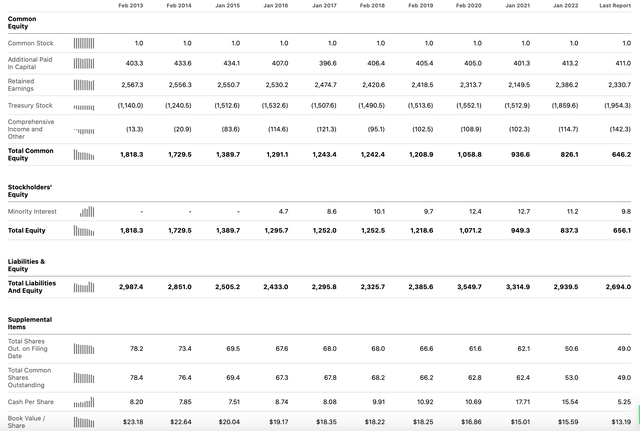

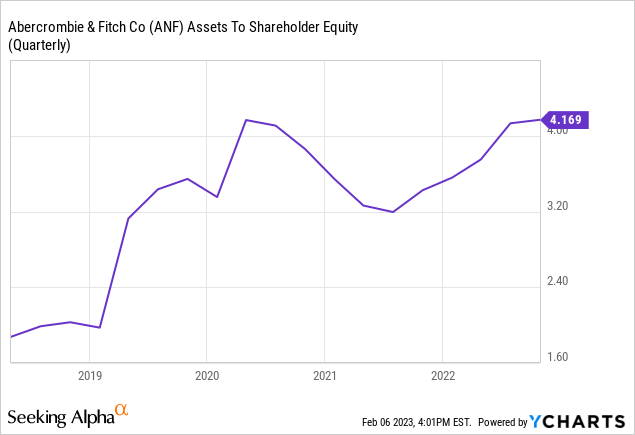

Equity multiplier

The last part of the three step decomposition of the ROE is the equity multiplier, which is simply the ratio of assets to shareholder equity. Basically, it shows the ratio between the total assets of the company to the amount on which equity holders have a claim.

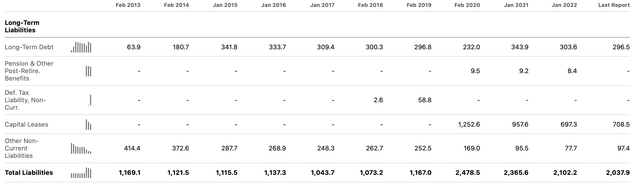

There has been a substantial jump in this figure in 2019, which has been a result of the more than 100% increase in total liabilities, driven by the capital leases line item.

Long term liabilities (Seeking Alpha)

At the same time, total equity has been also decreasing. Over the past decade, the firm has purchased back significant amounts of its common shares outstanding, therefore returning value to its shareholders. There is often a debate among investors, whether share buybacks are good or not. On one hand, it is a form of shareholder return, and it could indicate that the management believes that shares are undervalued. On the other hand, it may indicate that the firm has not enough attractive investment options, and therefore they buy back shares instead.

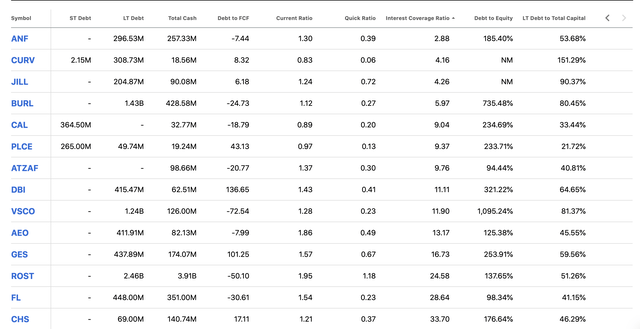

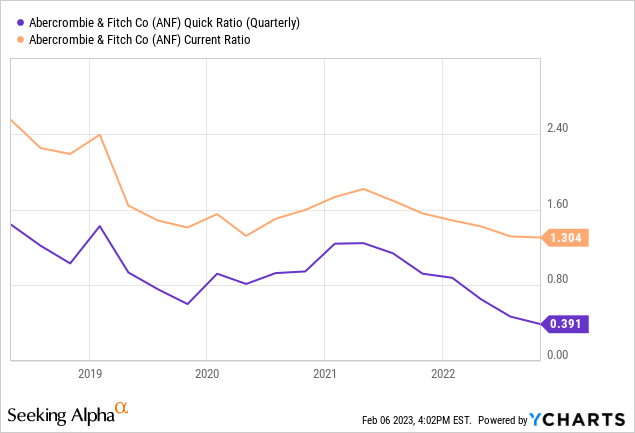

Further, when we compare how healthy ANF’s business appears to be from a debt point of view, we are also not particularly impressed.

Compared to the industry peers, ANF has the lowest interest coverage ratio. The firm’s liquidity ratios, e.g. the quick- and the current ratio also do not appear to be particularly promising, especially as they have been gradually declining over the past years.

All in all, we would like to see the firm improving its liquidity going forward. One solution, for example, may be to reduce debt and interest burden, instead of buying back shares.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.