Abercrombie & Fitch: Q1 Earnings Miss And Guidance Slash Means Pain Ahead

Summary:

- ANF reported Q1 earnings that missed badly on the bottom line and showcased concerning forward trends.

- Inventory and cost of goods rose significantly above projections.

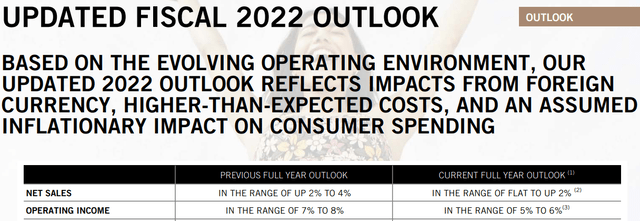

- ANF also changed guidance and said they don’t see a meaningful increase from 2021 revenues.

- The company did not adequately prepare for the supply chain crunch and fooled investors with such a drastically quick guidance reduction.

- I was wrong previously. I now have a price target for ANF of $23 and a “Hold” rating with an 18-month view.

jetcityimage/iStock Editorial via Getty Images

Purpose & Introduction

While Abercrombie & Fitch Co. (NYSE:ANF) has well-known brands, small margins and reactive management will keep the stock from soaring to its full potential. I now forecast a share price of $23 over an 18-month frame.

My previous report on this stock missed the mark. Abercrombie & Fitch Co. was founded in 1892 and is based near Columbus, Ohio. The company is a global omnichannel specialty apparel retailer for women, men and children via five distinct brands. The company operates about 730 stores across North America, Europe, Asia and the Middle East and distributes products to over 110 countries. The company is supported by several brands, but two key brand segments make up the bulk of sales; Hollister, a young adult lifestyle brand, and Abercrombie, a casual luxury brand. ANF reported $813MM in sales in Q1 but reduced their guidance to be close to flat for 2022. This report showcases a bear case for the company.

Q1 Results

ANF just reported negative earnings in Q1 of -$0.27 per share, a shock after analysts expected $0.36 per share. The company blamed the results on “higher than expected freight and production costs.”

With the war in Ukraine and long-standing supply chain issues, I am shocked at how poorly the company planned for this quarter.

Inventory also jumped to $563MM from $525MM three months earlier, forecasting a worrying trend on sell-through. ANF also downgraded their revenue forecast, from 2-4% above 2021 numbers to 0-2%. I have adjusted the model to reflect almost no growth in 2022 revenues. ANF expects higher costs to headwind throughout the year, and based on guidance it looks like net profit will plunge vs. 2021 figures.

Another worrying trend on ANF is that Hollister, its strongest brand name, had a sales drop of 3% year-over-year in the quarter. While the company’s digital evolution continues, there simply is no reason why guidance had to be pulled backward in just one quarter. As China opens up, there remains some optimism for short-term pain and long-term gain by the end of the year. However, the risks are too high now that management has not forecasted appropriately. The stock plunged in pre-market, which was reasonable.

Risks

When analyzing any fast-fashion apparel brand, there are some important risks that are inherent and cannot always be mitigated. At a high level, there is risk associated with ANF’s inability to anticipate and adapt to fluctuating consumer preferences. Additionally, there is risk associated with pricing pressure given high inflation and global supply chain woes.

A key risk regarding ANF is their ability to accurately forecast earnings. In the past, ANF released pro forma numbers and unique accounting that shied some investors away. However, given Q1’s guidance downgrade within 90 days, there is now a key risk about what management knows or how they communicate with investors. The company also only has two key brands, so the concentration risk of one brand falling out of touch can be concerning.

Model Shows Limited Upside

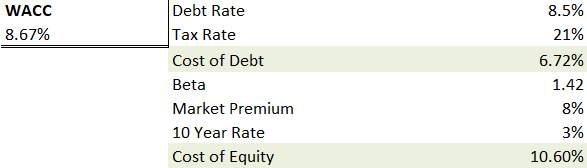

In my last article, I noted that if ANF could deliver on forecasted growth. There was optimism that the stock could rise. Now, with guidance pulled and rising costs, the company will struggle. A senior note at 8.75% stings in hindsight given the net loss, and the company’s net cash position has dropped dramatically to $468M. Given their weak Q1 performance, I anticipate the cost of debt rising to above 8% should they attempt to adjust their leverage in this environment.

Author WACC

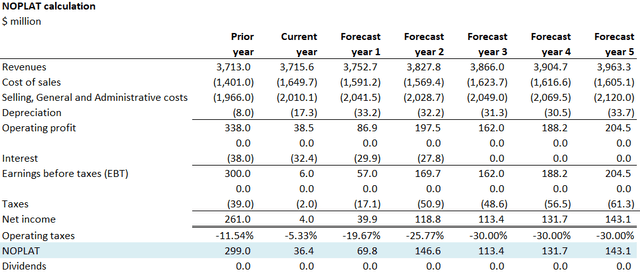

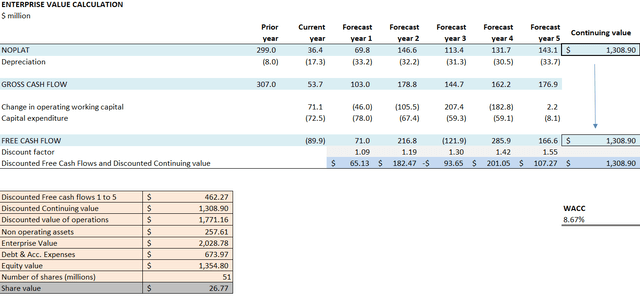

I forecast the continuing value of about $1.3B, given a 0.1% revenue increase this year and blended revenue of 1.25% for five years as supply chain woes and inflation continue. The company now forecasts 0-2% revenue growth next year, and I forecast growth at the low end of the range. I see SG&A expenses slowly remaining at about 52-53% as a percentage of revenue within a 5-year period – synergies from the digital sales won’t offset raw materials & distribution costs jumping. I hold other cost ratios equal as a percentage of revenue from 2021 figures, as there aren’t too many material differences in 2018 and 2019 figures. I forecast that the company will hold the debt to maturity without refinancing, which explains the low cash flow in 2025. As the margin dips slightly, just a $27 share price (see below) can be supported with strong fundamentals.

Author Income Statement Forecast Author EV Calculation

Conclusion

ANF came out sluggish, with a net loss and weak guidance for the remainder of 2022. The discount on shares today is warranted. I anticipate the share price multiple now contracting as the company loses investor trust with such quick guidance retraction. While the model supports $27, I make a conservative cut to $23 a share with an 18-month view, given low profit margins, brand perception risk, and incompetent management.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.