Summary:

- Abercrombie & Fitch is recommended as a sell due to its high valuation and uncertainty in predicting fashion trends.

- ANF has seen strong growth momentum, with same-store sales increasing and gross profit outperforming revenue growth.

- The company’s international growth strategy and potential for further acceleration in sales could support its growth, but there are concerns about sustainability and meeting expectations.

jetcityimage

Investment summary

My recommendation for Abercrombie & Fitch (NYSE:ANF) is a sell rating, as the valuation is trading at a very high level that seems to be incorporating too much optimism in ANF’s ability to sustain the current growth momentum. My belief is that accurately predicting the next fashion trend is never a guaranteed process, and if ANF mis-predicts or mis-executes, growth would very well revert back to historical levels, driving down margins as well as valuation multiples. Even if ANF does meet consensus expectations, there is likely no attractive upside.

Business overview

ANF is a leading specialty retailer with Abercrombie & Fitch, Abercrombie, Hollister, and Gilly Hicks brands. This is very much an American-origin brand, with 81% of FY24 revenue coming from the Americas and the rest from EMEA (16%) and APAC (3%). In the recently reported 4Q23 quarter, ANF saw very strong growth momentum that caught my attention. For the quarter, same-store sales [SSS] for Abercrombie brands sequentially accelerated to 28% from 26% in 3Q23, 23% in 2Q, and 14% in 1Q, a tremendous performance. What was even more notable is that this strong growth is organic, and via heavy discounts, 4Q23 gross profit actually outperformed 4Q23’s 21% total revenue growth (16% SSS growth contribution) by 1600 bps, supported by full-price selling, reduced promotions, and freight/raw material cost tailwinds.

Momentum seems to have continued into FY24

The strong performance of SSS has driven ANF to a strong rally in the share price, and it appears that the momentum has continued into FY24. According to management, they saw a strong start across both A&F and Hollister, which supports 1Q24 low-double-digit growth guidance. Even better, management’s comments offered potential for further acceleration as they called out that the spring business has had great product reactions and ANF’s procurement teams are chasing inventory for the spring. I believe this guidance has high credibility as it was provided on March 6th, which means management already has ~5 weeks’ worth of 1Q24 data. Suppose 1Q24 were to follow 4Q23 SSSG performance of 16%; this implies that ANF needs to only print 4% revenue growth for the rest of FY24 (2-4Q24) to meet the 4 to 6% growth guidance, a fairly low hurdle to beat if the momentum continues.

Another area of focus that could support ANF in meeting this FY24 guide is the successful execution of its international growth strategy. After establishing local teams and reestablishing the foundation in product pricing and inventory, management will place a greater emphasis on expanding the EMEA and APAC regions, as mentioned during the call. Management plans to raise marketing expenditures in the EMEA region to raise awareness of the brands’ repositioning and new product offerings, as well as strategically expand stores in China and Japan across important cities to increase brand density and visibility. The international side has not been performing well in recent years; thus, blended revenue growth will accelerate significantly if management can turn things around and drive growth to the same level as the Americas.

Not certain if ANF can continue to meet expectations

However, my concern about ANF is that growth might not last as long as the market expects. Let me remind the readers that ANF is a retail brand, and historically, revenue growth has averaged out to be 2% between FY10 and FY21, and gross margin has averaged out to be ~61%. Currently, consensus is that growth is expected to be 6% in FY23 and 4.5% in FY26, with gross margin sustaining at ~64%, both metrics above the historical average. This tells me that a lot of expectations are embedded in the stock. The thing about fashion is that there is no structural way to predict the next upcoming trend, and while data analysis helps, it is not a guaranteed way. This is a major area for potential misses in expectations, as ANF could end up predicting the wrong trend and thereby see demand normalization return to 2% growth. The problem doesn’t end here. When that happens, ANF will likely need to go through a series of promotions to clear inventories, and this hurts gross margin, making it harder for AFN to meet the 64% expectations.

Valuation is very demanding

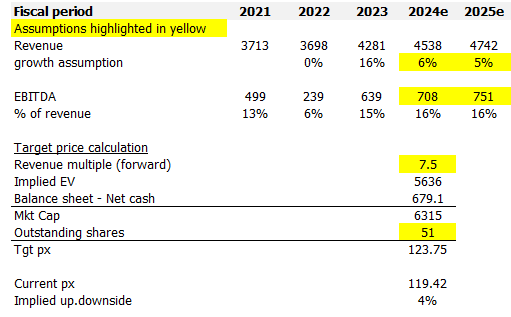

Redfox Capital Ideas

Lastly, valuation is definitely not cheap. Using consensus figures and the current very elevated forward EBITDA model, I believe ANF is worth $123, which is just 4% above the current price level. My model assumes ANF to grow 6/5% in FY24/25, which is followed by a 100-bps EBITDA expansion in FY24 to 16% and a flattish EBITDA margin in FY25. I take this as the upside case, where ANF meets expectations.

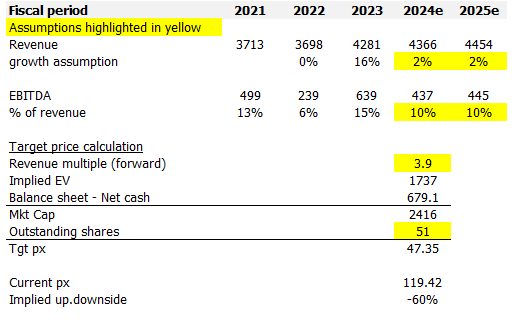

Redfox Capital Ideas

However, in the bear case, the potential downside is huge. Assuming ANF misses the next trend, growth reverts back to its historical level of 2%, and EBITDA margin follows the same trend, reverting back to 10% (the historical average is 9%, but I give some benefit to ANF that with a larger base, they should see more operating leverage), the market is very likely going to price ANF back to its historical EBITDA multiple of 3.9x. This implies a share price decline of ~60% (share price of $47). You might think that a 60% downside is too aggressive, but let me remind you that ANF was trading at $47 just a few months ago, and the stock saw a strong rally from the low $20s to $120 in less than a year. As such, a lot of investors are sitting on huge profits, which I expect them to sell the moment ANF shows any signs of weakness.

Risk

ANF could continue to sustain this strong momentum by constantly making the right assumptions about the next trends. If that happens, the market is most likely to continue attaching this premium multiple as they are convinced that ANF growth has been structurally improved.

Conclusion

My view for ANF is a sell rating due to its demanding valuation. While the recent growth momentum is impressive, historically, ANF performance has been cyclical (averaging a 2% growth). My main concern is that predicting future fashion trends is uncertain, and a miss could lead to ANF growth reverting to historical averages and a significant decline in profitability. Even if ANF meets expectations, the current price already reflects this upside in my opinion. The potential downside, however, is substantial if growth falters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.