Abercrombie & Fitch: At This Multiple, Take The Money And Run

Summary:

- Abercrombie & Fitch contends with intense competition in retail, accentuated by a notable absence of competitive advantage, raising concerns about its long-term viability and market position.

- Trading at an elevated 42x its 3-year average FCF, Abercrombie & Fitch raises concerns about overvaluation and stagnant growth prospects.

- Economic headwinds and increasing interest rates pose formidable challenges, prompting a strategic decision to rate Abercrombie & Fitch shares as a Sell.

Michael M. Santiago

Investment Thesis

Abercrombie & Fitch has demonstrated an impressive 332% return over the last 3 years, a noteworthy feat considering its precarious state less than a decade ago. However, upon closer examination, it becomes apparent that Abercrombie & Fitch lacks a substantial competitive advantage, and despite performing adequately compared to industry peers, its failure to boost Free Cash Flow is concerning. Trading at an elevated 42x FCF raises red flags for investors. Moreover, the current economic slowdown and increasing interest rates pose significant challenges for the fashion retailer, potentially dampening consumer spending. Consequently, we recommend selling the shares and exploring alternative investment opportunities.

A bit of context

In 2016, Abercrombie & Fitch held the unenviable title of the most-disliked retailer in the US, according to the American Customer Satisfaction Index. Fast forward to 2021, and the tables have turned for Abercrombie & Fitch Co., the parent company of Abercrombie & Fitch, Hollister, Abercrombie Kids, the Social Tourist and Gilly Hicks. A recent earnings report highlighted the company’s remarkable comeback, showcasing its best second-quarter operating income and margin since 2008, and surpassing pre-pandemic sales levels.

The “Always Forward Plan”

In the second quarter of Fiscal 2022, the Company unveiled its 2025 Always Forward Plan, articulating a comprehensive strategy for long-term success and shareholder value growth. Rooted in three fundamental growth principles-implementing focused brand growth plans, driving an enterprise-wide digital revolution, and operating with financial discipline-the plan sets the stage for the company’s trajectory. Looking ahead to Fiscal 2023, the Company has identified specific focus areas to achieve sustainable long-term growth in alignment with the Always Forward Plan. These include executing brand growth plans by strategically investing in Abercrombie & Fitchbrands’ marketing and stores, optimizing Hollister’s product and brand voice, and supporting Gilly Hicks’ growth through an evolved assortment mix. The enterprise-wide digital revolution will involve completing modernization efforts on key data platforms, progressing in the multi-year ERP transformation and cloud migration journey, and enhancing the digital and app experience across critical customer touchpoints. Operating with financial discipline entails maintaining lean inventory levels for Abercrombie and Hollister, enabling agile inventory management, and striking a balance between investments, inflation considerations, and efficiency efforts to enhance overall profitability.

The company boasts a distinctive focus on the younger generation, evident in its forward-thinking mindset. A brief glance at their social media presence underscores Abercrombie & Fitch’s resonance, with a substantial 5 million followers on Instagram, surpassing Gap’s 3.1 million followers and a meager 61 posts. This discrepancy reflects Abercrombie & Fitch’s acute understanding of its clientele and adept engagement in the digital landscape.

GAP Instagram Account (Instagram.com) Abercrombie & Fitch Instagram Account (instagram.com)

Under the leadership of Fran Horowitz, the current management team has orchestrated an impressive turnaround over the past seven years, resurrecting a brand that was on the brink of obscurity.

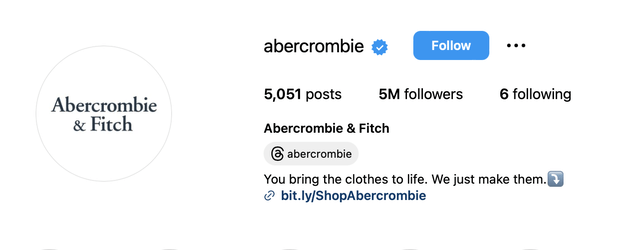

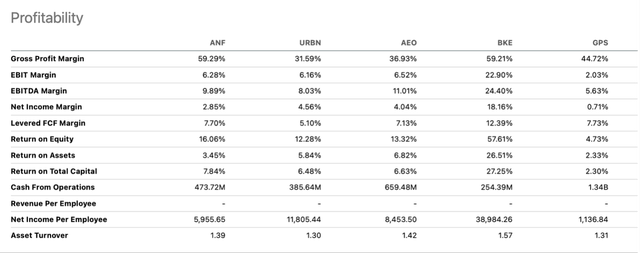

Delving into Abercrombie & Fitch’s profitability unveils intriguing insights.

Abercrombie & Fitch Profitability Grade (SeekingAlpha.com)

Over the past five years, Abercrombie & Fitch has consistently outpaced the industry average. However, there is a noticeable deceleration in both EBIT Margins and Net Income, signaling a potential slowdown in these key financial metrics.

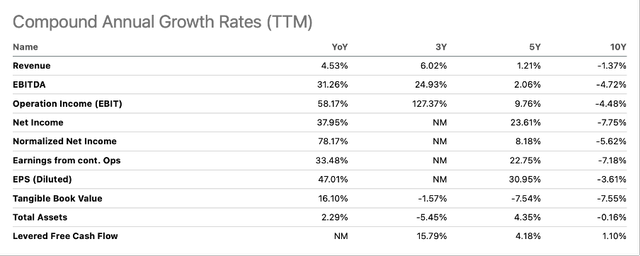

Abercrombie & Fitch Compound Annual Growth Rates (SeekingAlpha.com)

A look at the compound annual growth rates above presents a different narrative, suggesting that the company’s growth is, in fact, on an upward trajectory and accelerating.

What truly catches my attention is the 5-year average of Free Cash Flow (FCF), which stands at just $1.81 per share, while the 3-year average is even lower at $1.52. Considering the current stock price of $65, this 3-year average translates to a substantial 42x times FCF, emphasizing the significant valuation challenge at hand.

Peer Profitability Comparison (SeekingAlpha.com)

When juxtaposed with its competitors, Abercrombie & Fitch appears to perform admirably. However, it’s noteworthy that BKE seems to outshine even Abercrombie & Fitch in terms of performance and overall effectiveness.

In my recent article discussing BKE, I conducted a comprehensive analysis of the industry, so I won’t go into length again here.

In essence, the industry proves to be fiercely competitive. What captures my attention is the limited market share held by industry giants such as Nike, Lululemon, and Under Armour, each commanding no more than 3%. This fragmentation underscores a market teeming with alternatives, compelling even the leaders to contend for market share and dramatically reducing profit margins.

According to IBIS World, there are a staggering 178,366 clothing brands in the USA alone, equating to one brand for every 1,860 Americans. In this saturated landscape, companies find themselves compelled to go beyond competing solely on price and quality, instead focusing on cultivating distinctive brand recognition and fostering customer loyalty. The abundance of choices necessitates constant innovation and a commitment to enhancing customer experiences as brands strive to stand out in this crowded marketplace.

Valuation

With a current GAAP P/E of 31x, Abercrombie & Fitch appears significantly higher than the average of 24x. What adds an intriguing layer is that Abercrombie & Fitch is priced at 31x earnings, surpassing Apple, which is currently priced at 28.8x.

P/E Gaap with Peers (SeekingAlpha.com)

DCF Valuation

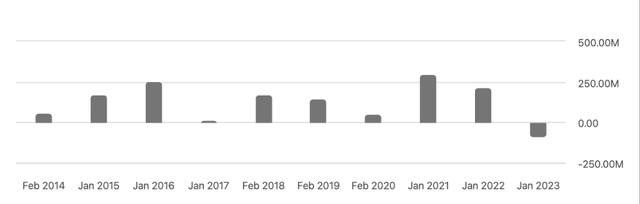

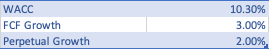

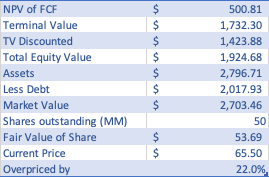

Estimating growth in a company like Abercrombie & Fitch, especially with the FCF like the one below, can be challenging. One approach I took was to calculate the average value of its FCF over the last 10 years and then assume that this value will be adjusted for inflation. This assumption implies that the company would be able to increase its prices based on inflation with minimal growth, specifically at a rate of 0.5%.

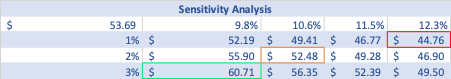

FCF of Abercrombie & Fitch (SeekingAlpha.com) DCF Main Inputs (Authors Work) DCF Calculations (Author Work) Sensitivity Analysis (Authors Work)

Based on the DCF analysis, it appears that Abercrombie & Fitch is currently overpriced by 22%. A more realistic valuation would be around $53 per share. At this price point, with the current earnings, Abercrombie & Fitch’s price-to-earnings ratio P/E would be 25x, aligning closely with the previously calculated average P/E of 24x.

This analysis instills confidence in suggesting that a realistic price for Abercrombie & Fitch should fall within the range of $50 to $55.

Abercrombie Risks

Abercrombie & Fitch confronts substantial risks within the retail sector, primarily stemming from the dynamic nature of consumer preferences and fierce competition in the fashion industry. Adapting to and predicting trends is crucial for maintaining market share. Supply chain disruptions pose a significant threat, with potential delays or disasters adversely affecting stock availability and sales. Economic fluctuations, particularly downturns, may curtail discretionary spending, impacting Abercrombie & Fitch’s profitability. The company is also vulnerable to market risks, such as changes in interest rates affecting investment income and securities’ value. Operational challenges, encompassing both physical stores and online platforms, including data breaches or reduced foot traffic, have the potential to detrimentally affect Abercrombie & Fitch’s performance and reputation.

Conclusion

In conclusion, Abercrombie & Fitch, Inc. is recognized for its youth-focused fashion offerings, and potential expansion opportunities may be adequately priced. However, considering the evolving economic landscape and intense competition, it seems prudent to capitalize on current gains and divest the position. The high P/E valuation and the lack of robust growth in its Free Cash Flow lead me to believe that shareholders may face challenging times ahead. Therefore, my recommendation would be to sell the shares and explore other investment opportunities.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.