Summary:

- Abiomed is a company with a superb product in the mid-market space while what appears on the surface is an extremely high multiple.

- While the multiple appears high at first, it does actually reflect the profile of the company on a more normalised basis, where it is currently experiencing headwinds.

- The secular outlook is obviously intact, but given the high multiple and the unknown length of the medium-term headwinds, it is not an especially compelling opportunity.

Eoneren/E+ via Getty Images

Abiomed (NASDAQ:ABMD) is a specialised and leading provider of mechanical circulatory support devices seeing use in the catheter lab. Their business model revolves around obtaining PMAs, which apply to their Impella family of devices which are all Class III and maximally regulated. PMAs enable their products to be used under certain conditions for specific purposes, and the more PMAs they obtain the greater the variety of operations and circumstances involving the device for which patients will be reimbursed. They’ve been doing a great job leveraging their platform into as many cardiology applications as possible, and this has resulted in an attractive and exceptionally cash generative profile which in normal times converts from EBITDA into FCF at 100% rates. The current multiple may appear high, but the economics of the business do in principle justify it. However, medium-term headwinds mean gravity may come into effect, and there is therefore capital risk. We prefer to find good economic profiles in the lower multiple space, and will leave Abiomed to others, although do not consider it overvalued even on an absolute basis.

Secular Outlook and Q2 Report

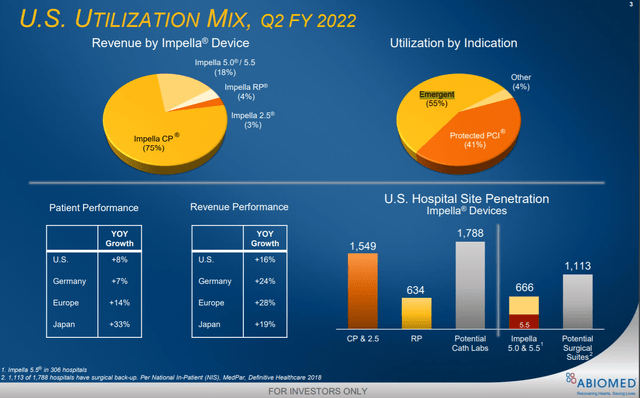

The chief market for Impella products is the large market of patients of heart disease. Impella pumps provide haemodynamic support in a relatively noninvasive way during high-risk elective or urgent PCI procedures. Exposure to the megatrend of lifestyle-related coronary heart diseases positions Abiomed well for enduring growth where its Impella heart pumps target many procedures related to these health issues. Over the entire Impella family, permission has been given through PMAs to utilise the device to improve blood ejection from the ventricle from hours to days, and in treatment of ongoing cardiogenic shock after infarction or serious surgery. Impella products are also being used with an IDE to assess whether they can reduce infarct size by unloading the ventricles.

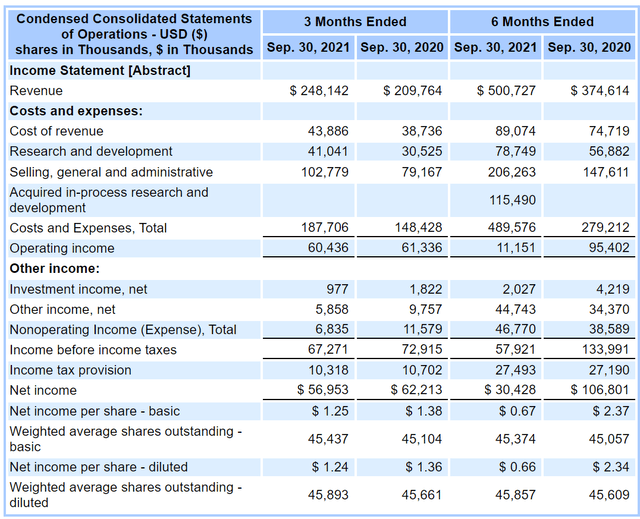

The sales have grown, but not profitably on a 6-month basis. Overall operating profitability collapsed due to the rise in SG&A and R&D costs, but those are discretionary and related to direct-to-patient marketing initiatives as well as a desire to further develop their product line. On a 6-month basis the gross profit improvement is a testament to enduring profitability with the gross margin improving as well.

However, the recent quarter recovered the situation in terms of profitability, likely the results of the discretionary marketing initiatives taken primarily in the prior quarter but mainly due to the fact that R&D was not acquired this quarter. Growth is persisting as well on the topline, although we are seeing more limited growth than expected due to the Delta variant having impacted the amount of procedures happening with severe COVID-19 cases taking precedence. With substantial exposure to Texas and Florida, where people were hit particularly hard by the surge, procedure volume growth was more stunted. Moreover, there is a labor shortage in hospitals, in particular with nursing staff, that is a headwind for the company as well. Nonetheless, 18% growth was still delivered YoY in this quarter, with operating profit remaining flat, mainly due to ballooning in marketing expenses.

Valuation

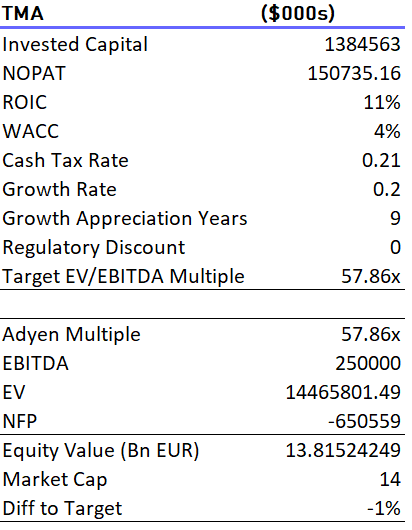

Let’s do a target multiple analysis (TMA), to understand how the cash generative profile and growth expectations can justify the current multiple over 50x. TMA is a process of determining what the fair multiple would be for a company on the basis of DCF inputs, where the EV/EBITDA multiple can be decomposed into factors that relate to cash flows and not just relative measures. Specifically, we observe the growth appreciation period, which is the period of expected outstanding returns over cost of capital. Call it the ‘competitive advantage’ period. Combined with a large spread between WACC and ROIC, we can often justify quite high multiples, since cash flow visibility ends up being quite far-out at outstanding capital return rates. Indeed, this is the case for Abiomed. Based on current prices, we find that the current growth rates of 20% are being forecast into the future by markets for a 9-year GAP assuming the current spread between WACC and ROIC. Given that Abbott Labs (ABT) is the only real competitor in heart pumps, and with PMAs and Class III designation being a massive barrier to entry, that is not unreasonable.

The Value Lab

Conclusions

With the above TMA, we see what the market implied assumptions are for ABMD to be trading at fair value. We used 2020 data for the operating profitability and NOPAT as this year is marred by exceptional expensing for R&D and marketing. On that more normalised basis, 9 years of 20% growth are expected by the market in order to justify the current multiple. While not unreasonable given the company’s profile and the secular scope for growth as well as still low penetration, it definitely indicates quite a rich multiple. Also headwinds are real. The 18% growth rate achieved may not hold up in the medium-term, even if it resumes in the long-term, because of issues like labor shortages in hospitals as well as the general declines we have seen in procedure volumes across healthcare due to the focus on COVID-19 related cases and the general scare of getting sick with the virus. Since some years of lesser cash flow growth will affect those present values of cash flows, it will have a real impact on the return profile of the company. We think that the current expectations for the stock are not unreasonable, but are optimistic, and we don’t see any special reason to be optimistic about medium-term prospects. As such, ABMD is a pass at these levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.