Absci: Differentiated Antibody Discovery Play

Summary:

- Absci combines generative AI with scalable wet lab technologies to improve antibody discovery, with the eventual goal of in silico drug design.

- While Absci’s stock has benefitted from AI hype in recent months, the company has substance. Its approach to antibody drug development is unique and could have advantages.

- Absci’s valuation is still reasonable given the company’s long-term potential, but the stock price is likely to be tied to AI sentiment in the near term, creating downside risk.

wildpixel

Absci’s (NASDAQ:ABSI) stock has performed strongly over the past 3 months, largely on the back of AI hype. Despite this, the company’s approach to antibody drug development is differentiated and could yield advantages relative to existing methods. Absci’s valuation is also still reasonably modest, even after the recent run up. While Absci could be an attractive long-term opportunity, it will take years to prove the merits of the company’s approach and the stock price could fall significantly in the meantime if investors sour on AI.

Market

Absci is a drug discovery company, focused on developing antibody therapeutics. It is doing this by leveraging a number of novel technologies to try and overcome some of the issues that have plagued pharma and biotech R&D efforts in recent years. For example:

- Preclinical development for biologic drugs takes 2-5 years on average and over 8 years from IND to FDA approval.

- R&D cost per product is in excess of 1.1 billion USD when including expenditures on failed trials.

- Success rates are often less than 5% from discovery through to product launch.

As a result, the ROI on R&D is currently low, and many diseases remain without effective treatment options. Advances in areas like next-gen sequencing, synthetic biology, robotics and AI are enabling new approaches to drug discovery though.

While it is still early days, and the efficacy of some of these approaches still needs to be validated, the opportunity is enormous, and includes both R&D services and therapeutic sales:

- Pharma R&D spend is expected to reach 254 billion USD by 2026.

- Global prescription sales are expected to be 1 trillion USD in 2026.

- Therapies based on biotechnology are expected to account for 37% of total prescription and OTC sales in 2026.

Strategy

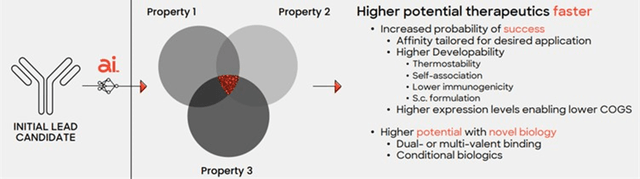

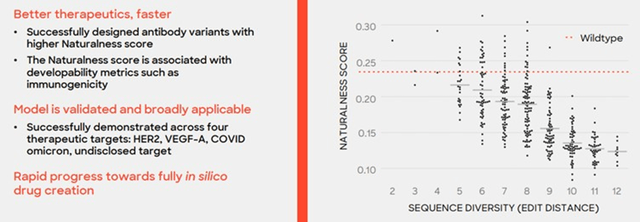

Absci is trying to combine generative AI with scalable wet lab technologies to improve antibody drug discovery efforts, with the ultimate goal of enabling in silico biologic drug discovery. Multiple drug characteristics are optimized simultaneously, which Absci believes has the potential to significantly shorten time to clinic and increase the probability of success.

Figure 1: Multiparametric Lead-Optimization (source: Absci)

Absci believes that data is currently the limiting factor on this approach. A problem that is addressed by its E. coli strain, which is capable of cost-effectively producing diverse human antibodies at scale. Assays are then performed to identify high potential antibodies and validate Absci’s algorithms.

While AI is likely to provide substantial benefits, there is uncertainty around its use in drug discovery. Specifically, whether AI can yield large gains given that it tends to interpolate between known data points and whether there is sufficient data given the complexities of biology. These problems are exacerbated by the size of the chemical universe.

Absci’s Technology

Absci uses synthetic biology and AI, amongst other technologies, to identify novel candidates and create optimized antibodies. A multiparametric optimization of antibody properties (target affinity, manufacturability, pharmacologic properties, etc.) is performed to increase the probability of program success. Drug discovery and cell line development are also integrated, which Absci believes will accelerate timelines.

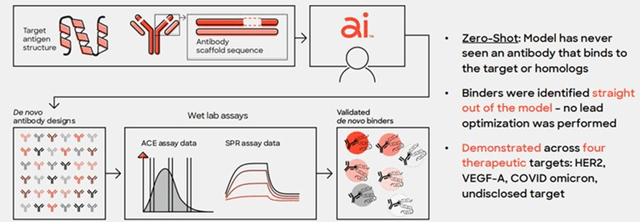

Figure 2: Drug Creation Using “Zero-Shot” Generative AI (source: Absci)

While Absci’s background is more in synthetic biology, AI is increasingly at the heart of the company. Absci acquired Denovium in 2021 for its Denovium Engine, a deep learning model built to predict the function of proteins. The integration of the Denovium Engine with Absci’s protein production capabilities supports the eventual goal of in silico design. The platform has been trained on functional data from more than 100 million proteins, using over 700,000 descriptive parameters. While the approach is still nascent, Absci believes that generative AI can be used to produce diverse antibodies with high binding affinity, that are also suitable for use as therapeutics.

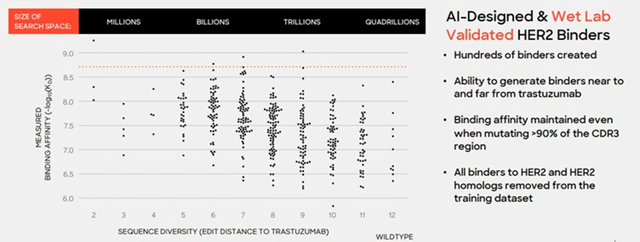

Figure 3: Illustration of AI Model Generating Diverse and Effective Binders (source: Absci) Figure 4: Illustration of AI Model Generating Diverse and High Potential Therapeutics (source: Absci)

A large amount of high quality and diverse training data is needed to fuel this approach though, which until recently has been a bottleneck. Antibody discovery is typically performed using:

- Mice hybridomas

- Phage display libraries

- Transgenic mice

- B cells from humans

While antibodies from mice and humans can have high binding affinity and be suitable for use as therapeutics, scientists have no control over the antibodies produced. The phage display method has a relatively poor track record and only finds the part of the antibody that binds, causing potentially important information to be lost.

Absci’s background is in cell line development and over the course of a decade, the company developed SoluPro, an E. coli platform that enables the production of antibodies at scale. This is difficult because antibodies are complex proteins that require special cellular machinery to ensure they are correctly assembled and folded, and E. coli normally lacks the post-translational apparatus to produce functional antibodies. Absci’s E. coli cell lines are bioengineered for production of mammalian proteins and site-specific incorporation of non-standard amino acids.

E. coli is used for a range of reasons, including:

- rapid growth

- ease of editing

- high production

- established protocols

SoluPro enables Absci to validate millions of designs a week versus 1,000s to 10,000s using mammalian cells. SoluPro offers shorter production cycles (1-2 days versus 20-24 days) and higher titers compared to CHO mammalian systems, which could eventually lead to dramatically lower production costs. While this has manufacturing applications, Absci is currently focused on using SoluPro to create training data for its algorithms.

High-throughput single-cell assays are used to evaluate fully constructed protein scaffolds for target binding affinity, protein quality, and production level. Absci’s ACE assay evaluates and sorts cells to find those with the most potential. This data is used to train AI models.

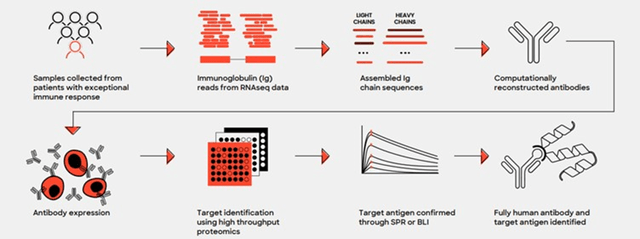

Absci also has the ability to use human immune responses to identify novel antibodies and their therapeutic targets, which came through the acquisition of Totient in 2021. To date Totient has reconstructed more than 4,500 antibodies from over 50,000 patients and has de-orphaned a collection of promising antibodies by identifying and validating their target antigens. This business is supported by a network of health care institutions which provide access to patient data.

Figure 5: Workflow for Identifying Antigens (source: Absci)

Programs

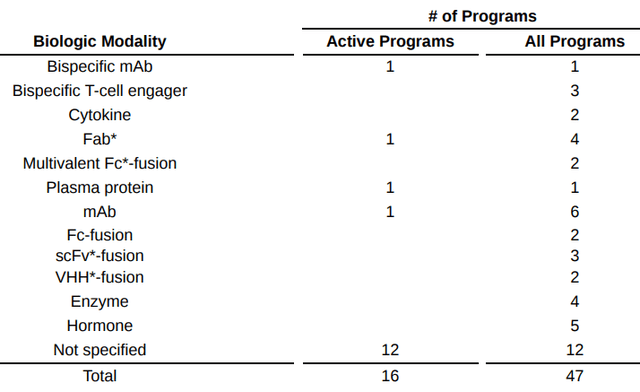

At the end of 2022, Absci had 16 active programs across 5 partners. Monetization through a combination of licensing, milestones and royalties. Absci is also performing development activities for 31 additional molecules, which are a combination of internal programs and programs with third parties to demonstrate Absci’s capabilities.

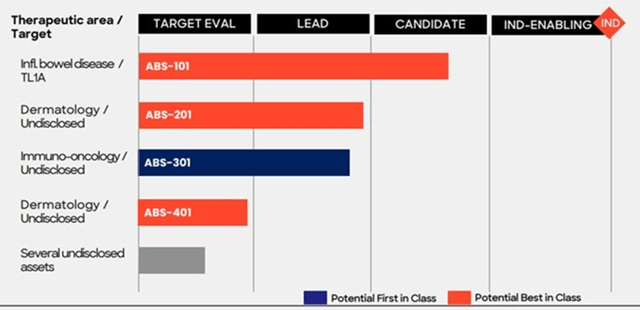

Absci recently commenced IND-enabling studies for ABS-101, an anti-TL1A antibody designed using gen AI. Absci expects to submit an IND for ABS-101 in the first quarter of 2025. Assuming clearance, Phase 1 studies would commence shortly after.

Figure 6: Absci Programs (source: Absci) Figure 7: Absci’s Internal Pipeline (source: Absci)

Partnerships

Absci has a number of partnerships, most of which are discovery programs. Partners include Merck, EQRx, Almirall and Astra Zeneca.

- Almirall and Absci recently announced a partnership that will involve developing therapeutic candidates for two dermatological targets. Almirall is a global biopharmaceutical company focused on dermatology. In total, Absci will be eligible for up to 650 million USD in upfront fees, R&D, and milestone payments, in addition to royalties.

- Absci and Caltech are working together on a HIV vaccine after receiving a grant from the Bill & Melinda Gates Foundation.

- Absci and the University of Oxford’s Kennedy Institute of Rheumatology have partnered to develop immunotherapies for chronic inflammatory and musculoskeletal conditions. The Kennedy Institute will provide its genomics datasets which Absci will use to identify novel antibodies from patients with exceptional immune responses to inflammatory bowel disease.

- Absci recently announced a deal worth up to 247 million USD with AstraZeneca to develop an antibody-based cancer therapy. Compensation will be in the form of upfront fees, R&D funding, milestone payments and royalties on product sales.

- Absci also has a number of programs focused on developing production cell lines for partners. Two of these programs are for preclinical assets and one is for a drug candidate in Phase 3 trials.

Conclusion

AI-driven drug discovery is an area with enormous potential, but it is a relatively new approach that will likely take years to fully demonstrate its value, due to the length of drug development timelines. For example, Absci is targeting 2 years to IND versus a 4 to 6-year industry average and expects to spend 14-16 million USD to reach IND versus a 30 to 50 million USD industry average.

It is difficult to place a concrete value on Absci’s business given how early it is, but there is clearly value, even if is just developing production cell lines for partners. This, along with the company’s existing partnerships more than justify Absci’s current valuation, assuming a moderate amount of clinical success. The platform and the potential for in silico drug design could provide significant additional upside.

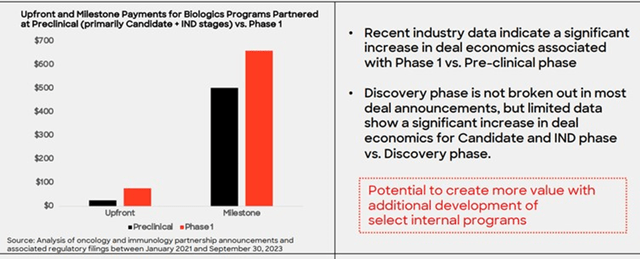

Figure 8: Illustrative Deal Economics (source: Absci)

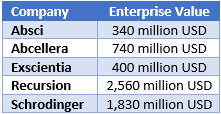

Relative to other companies operating in the space, Absci’s valuation also looks low. While these companies all have vastly different approaches, I don’t think there is anything that makes Absci inferior, and its antibody production method may provide an advantage, to the extent that data is important.

Table 1: AI-Driven Drug Discovery Company Enterprise Values (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.