Summary:

- Accenture has benefitted from the post-pandemic demand for business transformation consulting, but we believe growth has peaked.

- Decelerating bookings growth YoY and stabilizing employee headcount indicate a slowing outlook.

- Consensus estimate valuations are not too demanding, but the risk-reward profile is unattractive, with the dividend yield not high enough to warrant investment.

Justin Sullivan/Getty Images News

Investment thesis

We believe Accenture (NYSE:ACN) has peaked in terms of its bookings and headcount growth, pointing to a deceleration in its growth outlook. Although the share price has begun to take this into account, the valuations look too expensive given the macroeconomic backdrop pointing to a fall in consulting demand. We rate the shares as a sell.

Quick primer

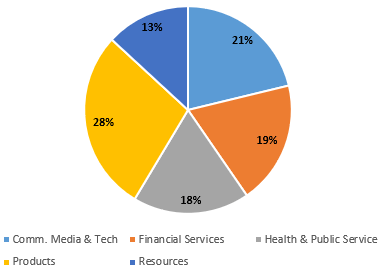

Accenture is a global professional services company employing more than 710,000 people, and its core activities are in consulting and outsourcing (with a 54%/46% split in Q3 FY8/2022). The key geographic market is North America making up around 50% of total sales, followed by Europe with around 33%. It is active in most industries, with the largest exposure in consumer goods, retail, and travel services (called ‘Products’), followed by financial services.

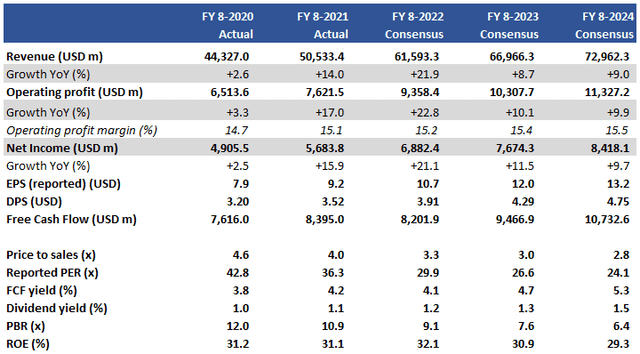

Key financials with consensus estimates

Key financials with consensus estimates (Company, Refinitiv)

Sales split by industry group, Q3 FY8/2022

Sales split by industry group – Q3 FY8/2022 (Company)

Our objectives

We note Accenture’s shares recently peaked in December 2021, and at the same time, the company reported Q1 FY8/2022 bookings that exceeded management expectations. With bookings being a key indicator of future growth, we want to assess 1) the current outlook for bookings and 2) the utilization rates of its staff which is a marker for business activity. We will take each one in turn.

Bookings appear to have peaked

The company experienced record bookings (orders) in Q1 FY8/2022 of USD16.8 billion, growing 30% YoY. This trend was repeated in Q2 FY8/2022 where bookings reached USD19.6 billion, growing 22% YoY. The Q2 book-to-bill ratio (the fraction of orders over sales for the period) reached 1.3x, which is a historically high level for Accenture.

Earnings visibility fell QoQ in Q3 FY8/2022 with the company generating USD17.0 billion in bookings, a neutral book-to-bill of 1.0x, and showing growth slowing down to 10% YoY. Whilst this is not a major negative, it nevertheless shows that the strength seen earlier in the year was not a sustainable trend.

Whilst the company does not break down where bookings are generated per industry group, our concern is from Accenture’s high exposure to consumer sectors which makes up 28% of sales. Whilst secular tailwinds such as Digital Transformation and ESG are positive to drive client demand, management comments about ‘consumer goods companies focused very much on costs as well as growth‘ (page 9) is worth reviewing.

Technology investment and consulting demand can be driven by many factors spanning from business transformation to regulatory requirements, but it is essentially spending to drive higher business returns. In the current macro environment where both businesses and consumers are experiencing significant cost inflation, the priority to spend on new and large discretionary projects will be placed under greater scrutiny, resulting in falling bookings via cancellations or delays. We believe this will be most pronounced in consumer-facing sectors such as consumer staples, travel, and retail.

Although there are no definitive indications of softening demand, we note that Product sales in Q3 FY8/2022 grew 31% YoY, a slight decline from the growth seen in Q2 (+34% YoY) and Q1 (+34% YoY). We believe this is a sign of weakness to come.

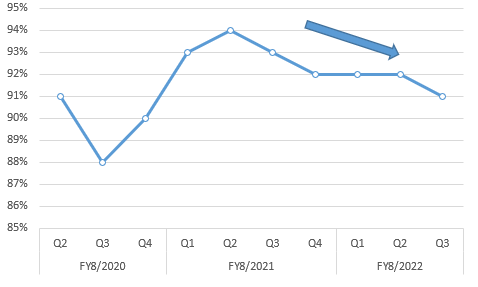

Zone of utilization

A consultancy business drives revenues by the following means – a high utilization rate, increasing pricing (charge-out rates), and increasing headcount. Accenture had been experiencing high rates of employee utilization from Q1 FY8/2021 at 94%, which fell to 91% in Q3 FY8/2022.

Quarterly employee utilization rate trend

Quarterly employee utilization rate trend (Company)

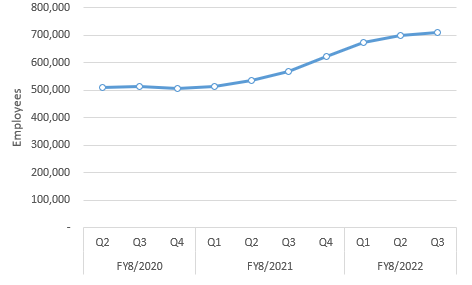

Demand has been high which has meant headcount has risen 25% YoY in Q3 FY8/2022. There appear to be no more steps to increase employee resources further, and voluntary attrition rates are rising which means management is making less effort to keep people on.

Employee count

Employee count (Company)

Management says that 91% is the zone of utilization that they like to be in (page 14) – this is unlikely given no comments were made about utilization rates being too hot previously. Falling utilization rates combined with falling headcount will mean (at the very least) weaker growth expectations going forwards. Consensus estimates seem to be aware of this, with topline growth expected to slow down in FY8/2023.

We believe falling utilization and flattening headcount are signs of slowing growth.

Valuations

On consensus estimates, Accenture shares are trading on PER FY8/2023 (on adjusted reported EPS) of 26.6x, and a free cash flow yield of 4.7%. Whilst these valuations do not look hugely demanding, they no do not indicate a major undervaluation either.

Accenture is a high-quality business, but not an easily scalable one as growth is tied to recruitment and resultant fixed costs. Operating margins are in their high teens, but other technology businesses are generating much higher returns. At this current juncture where the demand outlook could soften, the risk-reward profile is not that attractive, and the prospective dividend yield at 1.3% is not high enough to warrant sticking around.

Risks

Upside risk comes from a major escalation in booking growth, driven by clients making major investments in business transformation. This could come about due to a disruptive environment brought on by the war in Ukraine and cost inflation, such as in the natural resources sector.

The business is well-capitalized with net cash, and consequently, shareholder returns could be improved which may attract investors. This could be in the form of a large share buyback.

Downside risk comes from a continued deceleration of booking growth YoY, followed by signs that the workforce is becoming less utilized.

A major weakening of the USD will be negative as half of the total sales is derived from overseas markets, as well as having a local currency cost base.

Conclusion

Accenture has ridden the wave of post-pandemic business transformation occurring at a global scale, notably driven by spending in consumer-related markets. With the massive change in the global economic outlook, we believe previous pockets of growth will weaken, and other sectors such as public services and financial services will begin to cut back. With this backdrop and taking into account valuations, we do not believe that the shares are attractive. We rate the shares as a sell.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.