Summary:

- Accenture plc had strong fiscal first quarter results, including revenue, operating income, and EPS growth.

- Accenture has a promising outlook for 2023, despite the potentially challenging macroeconomic environment. EPS has been upwards revised by the firm.

- Accenture plc has shown a strong commitment to retuning cash to shareholders, both through dividends and share buybacks programs.

- We rate Accenture plc stock as “buy.”

noel bennett

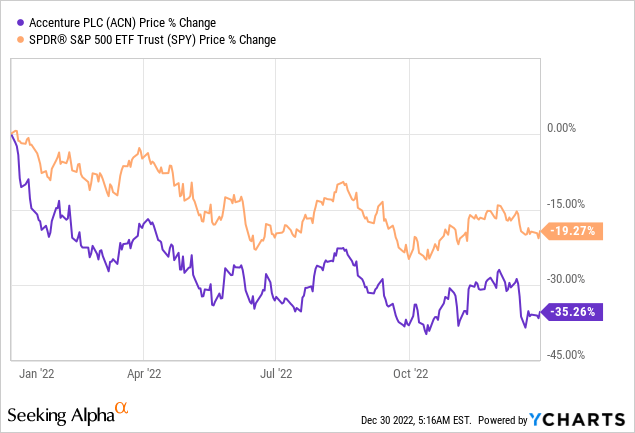

Accenture plc (NYSE:ACN), a professional services company, provides strategy and consulting, interactive, industry X, song, and technology and operation services worldwide. The firm has lost more than one third of its market value in 2022, substantially underperforming the broader market.

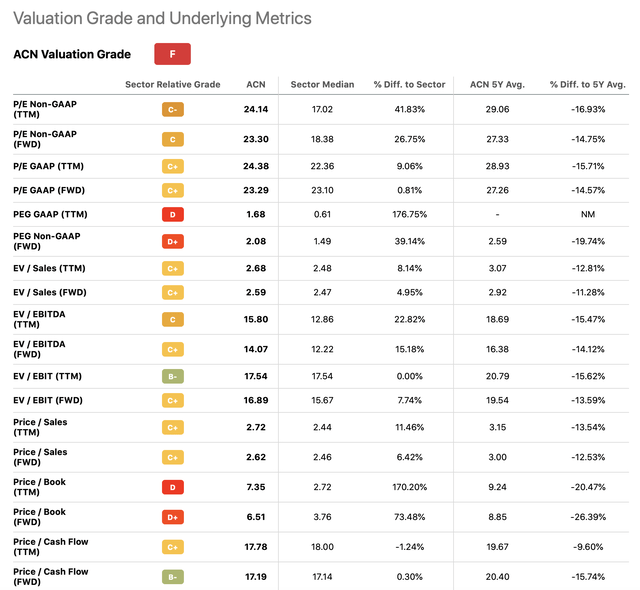

In today’s article, we are going to highlight several reasons, why we believe that Accenture plc’s stock could be an attractive choice for investors at the current price levels. While the price multiples are still relatively high compared to the sector median, the first fiscal quarter results and the guidance for the next fiscal year look promising, which may justify the premium.

Valuation metrics (Seeking Alpha)

Let us take a closer look at Accenture plc. We find the firm currently attractive.

First fiscal quarter results

In the first fiscal quarter of 2023, Accenture reported an increase in revenues and EPS along with an expansion of the operating margin compared to the year-ago quarter.

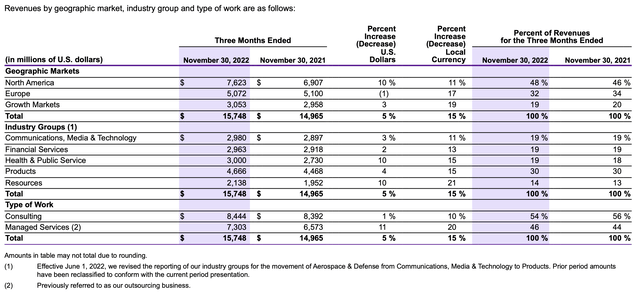

Revenue has totaled in $15.7 billion, equivalent to an increase of 5% in USD (or 15% in local currency). In North America, this growth has been led by the U.S., and by multiple segments, including: Public Service, Consumer Goods, Retail & Travel Services, Industrial and Health. In Europe, Germany, the United Kingdom, Italy and France have been leading the growth. The main contributing segments have been: Banking & Capital Markets and Consumer Goods, Retail & Travel Services. In the growth markets, Japan has been the primary contributor to the revenue increase, led by the Banking & Capital Markets, Public Service and Chemicals & Natural Resources segments.

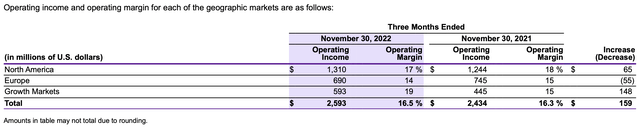

Operating margin has expanded by 20 bps reaching 16.5%, resulting in an operating income increase of 7% to $2.59 billion.

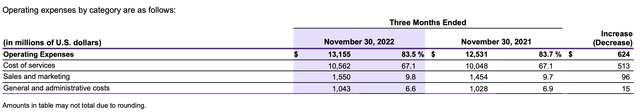

The cost of services is the largest contributor to the operating expenses. It has increased by $513 million year-over-year, but as a percentage of revenue it has remained flat. The gross margin has been primarily impacted by higher labor costs, including increased compensation costs, offset by a decrease in non-payroll costs compared to the same period in the prior year.

Sales and marketing expenses have increased by 7% year-over-year and have also increased by 0.1% as a percentage of revenue.

General and administrative costs have increased by 1%, but decreased as percentage of revenue to 6.6%. This decrease has been caused by lower non-payroll costs as a percentage of revenues compared to the same quarter in the prior year.

The following table summarizes the operating income for each of the geographic regions:

Operating income and operating margin (ACN)

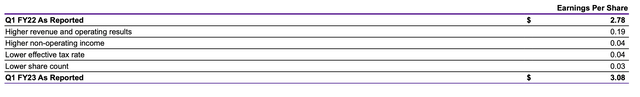

EPS has reached $3.08, representing an increase of 11% year-over-year. Four factors have been contributing to this increase, including: higher revenue and operating results, higher non-operating income, lower effective tax rate and lower share count.

Taking the current macroeconomic environment into account, we believe that these results are particularly strong. Growing EPS, expanding operating margin and growing revenue all signal that the firm is well-positioned to perform well even during times of downturns.

Expectations for fiscal 2023

If the economic situation keeps deteriorating, Accenture plc’s clients may decide to cut back on certain services, which could negatively impact ACN’s financial performance. But, ACN’s offerings cover a wide range of industries and topics (including, but not limited to: “application services, including agile transformation, DevOps, application modernization, enterprise architecture, software and quality engineering, data management, intelligent automation comprises robotic process automation, natural language processing, and virtual agents, and application management services, as well as software engineering services; strategy and consulting services; data and analytics strategy, data discovery and augmentation, data management and beyond, data democratization, and industrialized solutions comprises turnkey analytics and artificial intelligence (AI) solutions; metaverse; and sustainability services”). These are not likely to be impacted by the macroeconomic environment to the same extent, therefore this diversification provides safety to a certain extent.

Unlike firms in the consumer discretionary segment, ACN is not directly impacted by the weak consumer confidence. Even if consumer confidence further declines, ACN’s financial performance is not likely to be hurt in the near term.

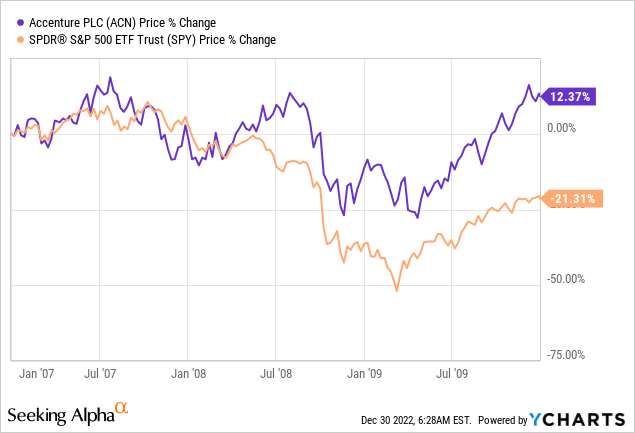

While history may not always be a good predictor of future performance, taking a look back how ACN’s stock performed during the financial crisis in 2008-2009 could also give us an indication what to expect.

Between 2007 and 2010, the firm substantially outperformed the broader market.

Also, the firm has actually updated its business outlook for fiscal 2023, raising EPS expectations:

Accenture updates business outlook for fiscal 2023; raises EPS to $11.20 to $11.52; continues to expect revenue growth of 8% to 11% in local currency; and now expects foreign-exchange impact of negative 5%.

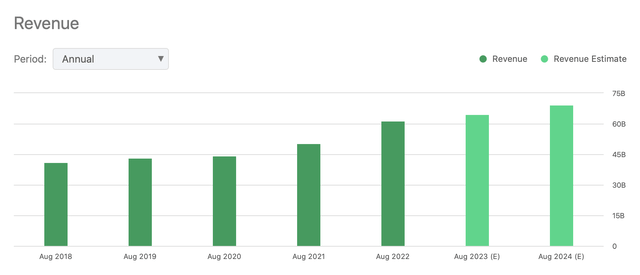

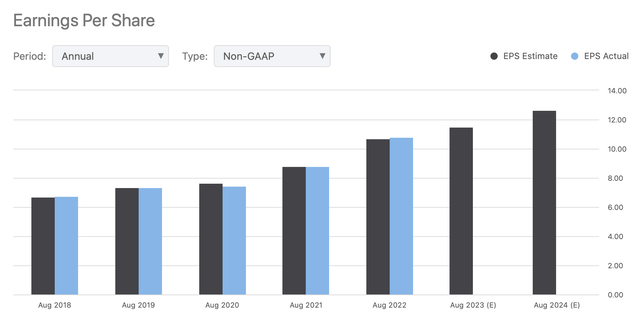

Analysts are also expecting both revenue and EPS growth for the coming years.

Revenue estimates (Seeking Alpha) EPS estimates (ACN)

Return to shareholders

Last, but not least we have to mention the firm’s commitment to returning value to its shareholders, both through dividend payments and share buyback programs.

Dividend

The firm has recently declared a quarterly dividend of $1.12 per share, equivalent to an annual yield of 1.59%. This dividend also appears to be safe and sustainable, taking into account that the payout ratio is only about 38%, and that the EPS is expected to increase in the years to come.

Share repurchases

In the fiscal first quarter, ACN has bought back shares for $1.4billion. The firm’s total remaining share repurchase authority at Nov. 30, 2022 has been estimated to be $4.9 billion. To put this figure into perspective, the firm’s current market cap is about $170 billion.

Key takeaways

Strong fiscal first quarter results may be an indication of the robustness of the business. Revenues, operating income and EPS have all increased, despite the challenging macroeconomic environment.

While Accenture stock may be trading at a premium compared to the sector median, the expected growth and the commitment to return cash to shareholders may justify this premium.

For these reasons, we rate Accenture plc’s stock as “buy.”

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.