Summary:

- The production cuts are putting a floor on crude oil prices, which explains why XOM trades with a significant premium, with a projected EPS CAGR of 19.9% through FY2024.

- XOM may also deliver excellent doubled earnings and cash flow by FY2027, as previously guided by the management, compared to FY2019 levels.

- Combined with the excellent operating efficiencies and lower break-even cost price thus far, it is no wonder that XOM has recorded a massive 1Y stock gain of 78.1%.

- Therefore, we continue to iterate the minimal margin of safety for those who choose to add XOM here, against our moderate price target of $105.55.

Andrii Zorii

The Oil Investment Thesis

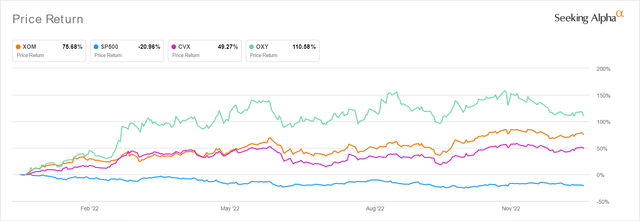

XOM 1Y Stock Price

Since our last Hold ratings on Chevron Corporation (NYSE:CVX) and Occidental Petroleum Corporation (NYSE:OXY) in early December 2022, the conventional energy market has continued to trade sideways. The global oil/gas supply-demand outlook remains uncertain in the intermediate term, with Russia’s Baltic oil exports potentially reduced by up to -20% for December 2022. The situation is further worsened by the country’s plan to cut oil output in response to G7’s price cap of $60 on its oil exports.

The US Energy Information Administration projects the world’s oil consumption to be at 99.82 Mb/d in 2022. Despite the estimated 99.93 Mb/d of global production at the same time, Russia notably produced 10.9 Mb/d in November, while also exporting 12.1 Mb/d for the month. The country has tentatively planned to cut the equivalent of 0.70m Mb/d from 2023 onwards, significantly worsened by OPEC+’s reduced output by 2 Mb/d per day since November 2022.

Perhaps that is why the US West Texas Intermediate [WTI] crude oil prices continue to be well-supported at $78.62 at the time of writing, rising by 10.7% from $71.02 since mid-December. While this number represents a moderation of -36.4% from its peak price of $123.70 in March 2022, we must also highlight the notable expansion of 31% from the pre-pandemic average of $60.

Furthermore, the SPR stockpile is rapidly depleting to 1983-lows, with the last three months declining by a total of -55.43M to 378.62M barrels at the time of writing, at a rate of -3.95M barrels weekly. While the US government has also expressed an interest in replenishing the stockpile by 3M barrels, we are still looking at a massive -36.2% shortfall from 2021 ending levels of 593.68M and -40.3% from 2019 ending levels of 634.96M. Therefore, we concur with the EIA that the oil supply remains exceeding tight, with Brent crude oil prices potentially staying elevated at $95 for 2023, against the $83.97 recorded at the time of writing.

XOM May Expand Profit Margins, While Improving Shareholder Returns Through 2027

XOM’s management expects to tremendously expand its profitability by FY2027, with the guidance of doubled upstream earnings to approximately $28.88B and nearly tripled Product Solutions earnings to approximately $8.74B against FY2019 levels. Assuming a similar annual corporate and financing segment at -$2.98B over the past three years, we may see optimistic total annual earnings of up to $34.64B by FY2027, suggesting an excellent CAGR of 7% from FY2021 levels of $23.04B, or 11.6% from FY2019 levels of $14.34B.

Furthermore, XOM expects to deliver approximately $9B in cost savings by the end of FY2023, compared to FY2019 levels. It is no wonder since the company has been aggressively improving its operating efficiencies with lower expenses of $62.38B over the last twelve months [LTM], declining by -1.3% from FY2021 levels of $63.26B and -4.7% from FY2019 levels of $65.52B. This strategic plan has led to its expanded GAAP EBIT margins of 16.1% over the LTM, compared to FY2021 levels of 9.6% and FY2019 levels of 6%, significantly aided by the record high oil/gas prices thus far.

Considering that XOM’s Upstream segment delivered an excellent net income margin of 21.9% in FY2021, we are not surprised by the management’s decision to maintain its FY2023 production to 3.7 Mb/d based on a $60 per barrel Brent price. This number suggests a notable decline of -6.3% from FY2019 levels of 3.95 Mb/d and is in line with FY2021 levels of 3.71 Mb/d.

On the other hand, XOM also made the strategic choice in expanding its upstream production by 13.5% to 4.2Mb/d through 2027. This may also deliver improved returns of over 10% due to the lower projected cost price of $35 per barrel, compared to FY2021 levels of $41 and FY2020 levels of $45. Considering the management’s focus on high-return, low-cost-of-supply assets in the Upstream and Product Solutions businesses over the next few years, we concur with market analysts’ aggressive projection of 15.3% in EBIT margins by FY2025.

XOM’s upgraded share-repurchase program of $50B through 2024 may also further moderate its share count by -9.7% to 3.7B of outstanding shares moving forward, assuming reasonable executive and employee compensation at the same time. In addition, the company guided that annual cash flow may double by FY2027, with its annual capital expenditure maintained between $20B and $25B. Therefore, we may likely witness expanded dividend payouts ahead, with market analysts projecting raised dividends of up to $4.45 by FY2026, representing a speculative yield of 4.1% against its 5Y average of 2.5%. These would suggest impressive shareholder returns over the next few years indeed, despite the uncertain macroeconomic outlook and oil/gas volatility.

So, Is XOM Stock A Buy, Sell, or Hold?

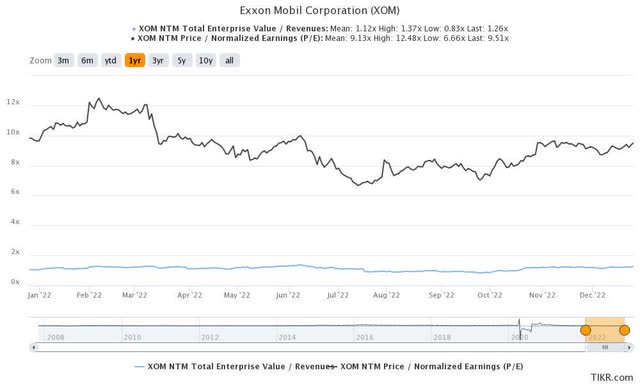

XOM 1Y EV/Revenue and P/E Valuations

XOM is currently trading at an EV/NTM Revenue of 1.26x and NTM P/E of 9.51x, higher than its 1Y mean of 1.12x and 9.13x, respectively. Based on its projected FY2023 EPS of $11.17 and current P/E valuations, we are looking at a moderate price target of $106.22. This number somewhat mirrors the consensus price target of $119.90, suggesting a minimal 10.63% upside potential from current levels.

While we are convinced of XOM’s outperformance through FY2027, it is evident that most of the premium is already embedded in its P/E valuations. The same is observed with its peers, such as CVX and OXY, trading above their 3Y and 1Y P/E means as well. This comes as no surprise, since they are projected to similarly deliver robust revenue growth at an average CAGR of 5.4% and EPS CAGR of 23.2% through FY2024. With such high expectations, XOM has naturally recorded an impressive 1Y stock gains of 75.6%, with CVX and OXY similarly achieving 49.2% and 110.58% (notably aided by the Buffett premium, discussed in-depth here). That is impressive indeed, against the S&P 500 Index at -20.9% at the same time.

Combined with the abovementioned factors, we continue to rate the XOM stock as a Hold for now. Do not chase the rally, due to the minimal margin of safety. Inversely, anyone who chooses to add at these levels must also size their portfolios accordingly, since XOM may remain highly volatile over the next year.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.