Accenture: A Greener And Attractive Leader In Everything They Do

Summary:

- Despite the economic slowdown, ACN managed to generate outstanding growth in both its topline and EPS.

- It also boasts a growing booking, improved book-to-bill ratio, and a growing diamond customer base.

- The company maintains a growing operating margin, despite today’s challenging operating environment.

- It continues to improve its product portfolio suited for the fast-changing technology of today.

- ACN deleverages while improving shareholder value, making this stock attractive at today’s level.

JHVEPhoto

Accenture (NYSE:ACN) is now trading at a significant discount due to the significant drop from last year’s high. While the fear of a global recession remains in place, ACN stays strong, with no turbulence in its topline growth even at the height of the pandemic, and with positive guidance from management.

ACN’s growing top line and margin expansion are one of the key value-adding catalysts for the company, which was reassured by the management with their positive outlook for FY23. ACN has increased liquidity and has a substantial share repurchase catalyst ahead of FY23, making it attractive at today’s level.

Company Overview

Accenture is one of the leading global providers of professional IT services that assist businesses in strengthening their digital foundations, modernizing their operations, and overall boosting their operational efficiency.

When it comes to businesses who are actively working toward a sustainable future, ACN is among the frontrunners with a plan to meet net-zero by 2025. In fact, the management was able to meet 85% of their office power needs with renewable energy this year, and they are on track to achieve 100% by 2023.

Another interesting catalyst for ACN is its growing addressable market thanks to its project spotlight, where the company invests in emerging technology software to address innovation gaps. One of its interesting investments is Pixxel, a manufacturer of hyperspectral satellites for monitoring the Earth’s health. This would strengthen ACN’s position in the growing satellite market, which is estimated to reach $144.5 billion by the end of 2026.

ACN has shown its commitment towards clean energy. In fact, the management recently announced the acquisition of Carbon Intelligence, a leading carbon emissions and climate change strategy provider, positioning the company to meet growing demand in managing the carbon footprint market.

ACN is also one of the first to invest in Metaverse, which will provide the company with several prospects in a new decentralized business environment. These will strengthen its leadership over time; in fact, it now has 267 diamond clients (customers earning at least $100 million in annualized revenue) up from 202 in FY2020.

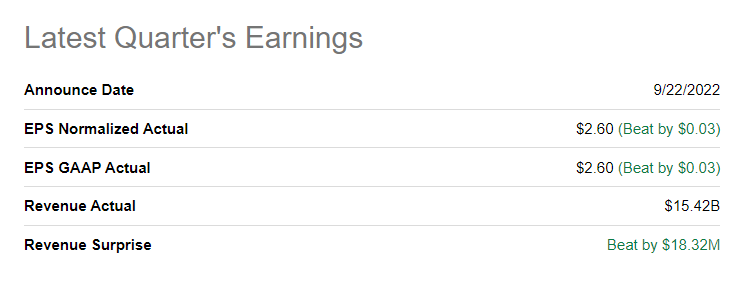

Despite today’s economic slowdown, large corporations continue to invest in digitization. In fact, despite the expected topline miss, ACN managed to outperform the consensus expectation on both its topline and profits per share.

ACN: Q4 Performance (seekingalpha.com)

ACN Continues To Be A Leader

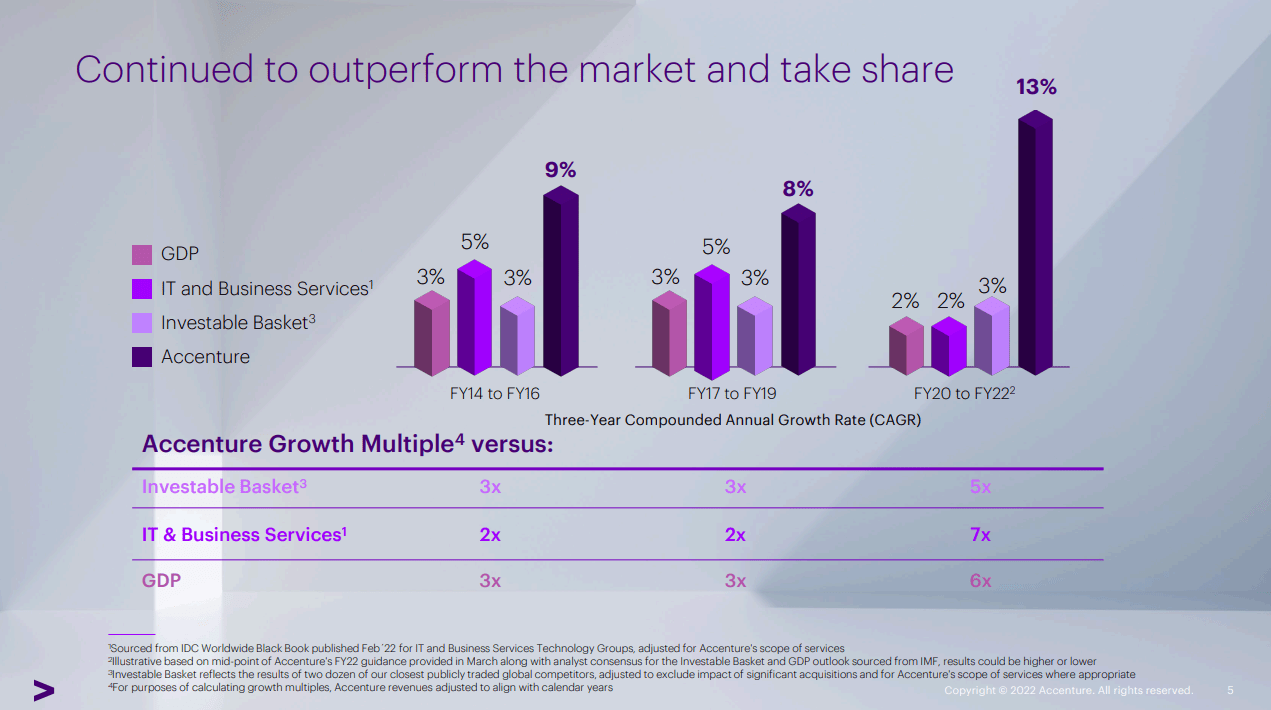

One of the interesting catalysts of the company is its outstanding performance compared to its peers, as shown in the image below.

ACN: Leader (2022 Investor Presentation)

This extends to ACN’s growing topline amounting to $61,594.3 million, up 21.89% year over year. According to the management, they generated their second-highest quarterly record this Q4 2022 amounting to $18.4 billion, up from $15 billion year over year with an improving book to bill ratio of 1.2 better than 1.1 recorded in Q4 2021 and this implies a stronger demand than last year.

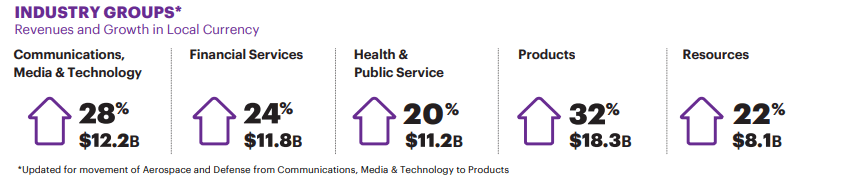

ACN: Growing Revenue (Data from Q4 2022 Earnings Call Presentation)

This resulted in a growing top line in each of its different industry focus areas, which is still expanding by double digits year on year.

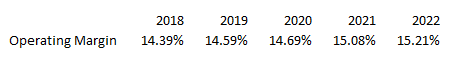

ACN: Improving Margin (Data from Seeking Alpha. Prepared by InvestOhTrader)

Additionally, ACN is one of the few companies who managed to expand its margin despite today’s challenging operating environment and ended this FY22 with 15.21% operating margin. This also indicates how good ACN has been in integrating all of its acquisitions; in fact, the management expects its operating margin to increase to roughly 15.3% to 15.5% in FY23.

Slowing Global Economy

ACN is not invincible in today’s slowing economy and according to the management, the latest GDP is expected to be lower than 2022. This may put pressure on the company’s EPS, in fact, the management provided a slower YoY growth in its EPS of between 4% to %7 in FY23, than today’s performance of 16.98% YoY. On top of this, it is facing unfavorable currency translation headwinds. ACN has 53% of its total revenue generated outside its North America region.

It’s Getting Attractive

ACN was trading at about 40x earnings before a significant drop in last year’s high, and its trailing P/E of 24.46x today shows a huge discount. Comparing it to its 28.97x 5-year average P/E, we can also see a considerable discount. With improving operating metrics mentioned above, I believe this drop unlocks a buying opportunity with a bonus of a better yield of 1.71%. I think a conservative target price of $311 by the Street is well within reach during the next year.

Trading Near Support

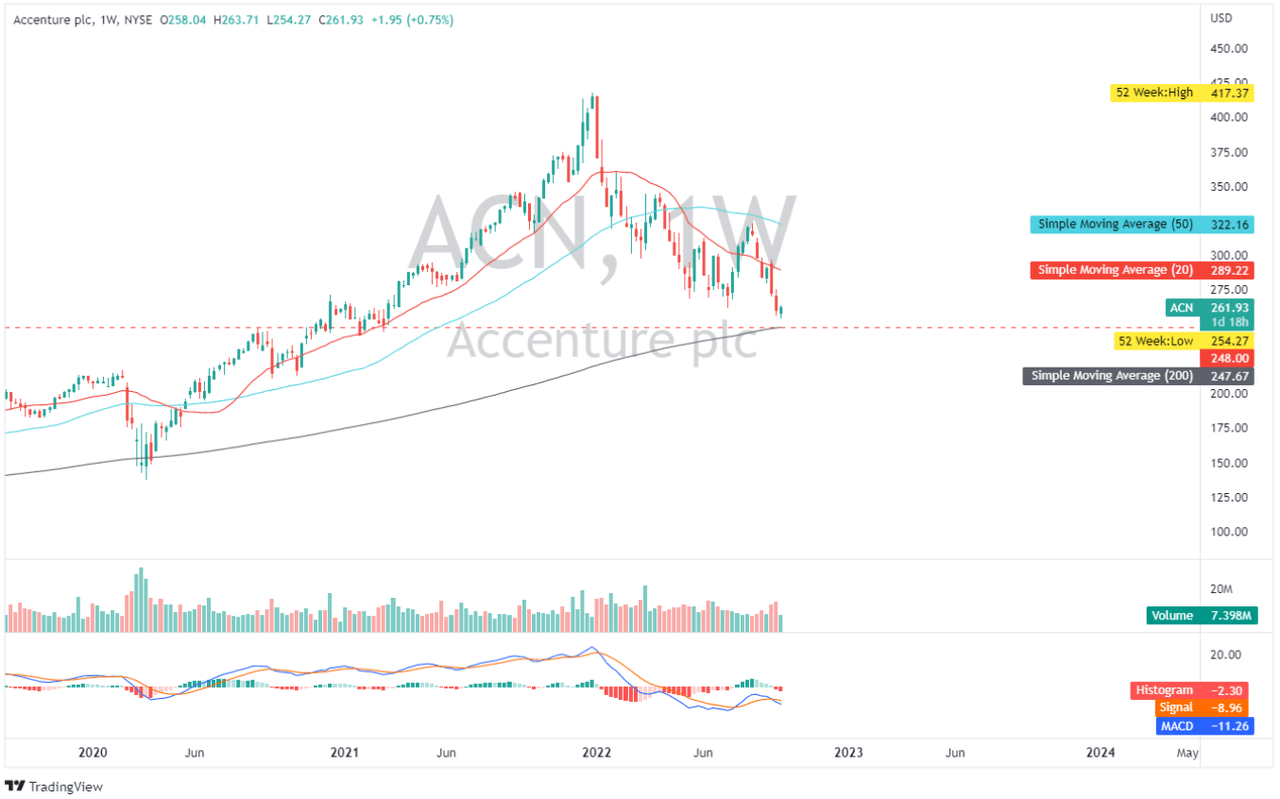

ACN: Weekly Chart (TradingView.com)

Looking at the chart above, we can see that ACN is trading below its 20- and 50-day simple moving averages, signaling bearish momentum; however, I think that momentum will fade, particularly when it approaches its 200-day simple moving average support zone. If the price falls below its 200-day simple moving average, like it did in March 2020, it will present a good entry opportunity to monitor.

Conclusive Thoughts

ACN maintains its profitability as mentioned earlier, and on top of this, the company also deleveraged its balance sheet. ACN ended its Q4 2022 with a lower debt level amounting to $3,325.8 million, down from $3,506.6 million recorded in FY21 and from $3,485.5 million in FY20. This translated into its improving debt to equity ratio of 14.6%, better than its 18.65% 2-year average.

Lastly, on top of its improving balance sheet, ACN continues to improve its shareholder value through dividends and share repurchases, as quoted below.

…our Board of Directors declared a quarterly cash dividend of $1.12 per share to be paid on November 15, a 15% increase over last year. And approved $3 billion of additional share repurchase authority. Source: Q4 2022 Earnings Call Transcript

To sum it up, I believe ACN is trading at an attractive level with sustainable profitability and an improving balance sheet, making this stock a good buy candidate.

Thank you for reading and good luck!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ACN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.