Summary:

- Accenture’s customers include over 75% of the Fortune 500 and 89 of the Fortune 100.

- The company reported strong financial results for Q1 FY23 as it beat both revenue and earnings growth forecasts.

- Accenture announced a huge $1.4 billion buyback of 5.2 million shares in Q1 FY23, which is a positive sign.

Just_Super

Accenture (NYSE:ACN) is a leading consultancy firm that specialises in I.T. and digital services. The company is poised to benefit from the growth in the “Digital Transformation” of enterprises, with a specific focus on the Cloud. The cloud market is forecast to grow at a rapid 17.9% compounded annual growth rate [CAGR] and be worth over $1.24 trillion by 2029. So far, Accenture has been executing exceptionally and the company recently beat both its top and bottom line growth estimates. The company has also been on an “Acquisition spree” during 2022 and 2023, acquiring over 40 companies, with many helping bolster its Cloud first division. In this post, I’m going to break down its financial results, discuss its tailwinds from the cloud and its acquisition strategy. Before revealing my intrinsic valuation model for the company, let’s dive in.

Improving Financials

Accenture reported solid financial results for the first quarter of the fiscal year 2023. Its revenue was $15.75 billion, which beat analyst forecasts by $154 million, despite increasing by just 5% year over year. This may not seem like a tremendous growth rate, but if we adjust for foreign exchange rates, growth was 15% in local currency.

The company also reported earnings per share [EPS] of $3.08, which beat analyst forecasts by $0.18 and increased by 11% year over year. This was driven by improved operating leverage in its SG&A expenses which reduced as a portion of revenue from 16.6% in Q1 FY22 to 16.5% by Q2 FY23 or $2.59 billion.

Breaking down the revenue, its largest segment Consulting contributed to 54% of total revenue or $8.44 billion, up 1% year over year to 10% in a constant currency basis.

This is a positive sign overall, as it means clients are still finding value in the “trusted advisor” service even during tough economic times. Since 2020, we have seen an acceleration in Digital Transformation and the need for companies to become more “data-driven”. This makes complete sense as when the outlook is “foggy”, organizations must become more analytical and also more agile. One of the best ways they can do this is by moving their workloads to the cloud. This enables companies to only pay for the computing and storage power they need while outsourcing a lot of the complex I.T. systems. Many studies such as this survey by Accenture indicate that 46% of low adopters believe “lack of skills” is a barrier to adoption of the cloud.

Therefore, Accenture is poised to benefit from the aforementioned industry growth across the cloud as the cloud migration partner, organizations are looking for. In fact, back in 2020, Accenture announced a staggering $3 billion investment over three years, to help organizations move toward the cloud. Its “Cloud First” framework and multi-service department fill the skills gap in the market, organizations are looking for.

Acquisition Spree

Accenture has also been on an acquisition spree to bolster its “Cloud first” offering. Previous acquisitions include Infinity Works, a U.K.-based AWS consulting firm, in addition to Microsoft Azure consultancy Olikka and Imaginea, an Argentinean-based development firm.

More recently, in 2023, the company has acquired Inspirage, an Oracle Cloud specialist and SKS Group, a Germany based SAP consulting specialist.

These acquisitions highlight a couple of points. Firstly, Accenture is building its expertise across the “Hybrid cloud” and not just sticking to a single infrastructure partner such as Google Cloud, AWS or Azure. I believe this is a great strategy given 86% of IT leaders surveyed Indicate Hybrid cloud as the best option. Hybrid cloud is a popular environment for a few reasons, from mitigating single vendor “lock in” to helping solve Data sovereignty issues.

In February 2023, Accenture also announced the acquisition of Morphus, a Brazil based cybersecurity company. Given 45% of “moderate cloud” adopters indicate “Security” as a main barrier to moving to the cloud, this acquisition is aligns perfectly.

Managed Services Growth

Accenture reported strong Managed Services revenue of $7.30 billion, which increased by 11% year over year or a rapid 20% on a constant currency basis. This was driven by its “Song” department which was formerly known as Accenture Interactive before a rebranding in 2022. This has been dubbed as the world’s largest Digital Agency, after acquiring over 40 smaller digital agencies over the years. Accenture Song effectively competes with other digital agency giants such as Omnicom and Dentsu. Some analysts criticise this business as being irrelevant to its core I.T. consulting. However, its clients are usually the same (enterprises) and “Digital Transformation” can include everything from I.T. to brand, marketing and the customer experience. Thus although the skillsets are different, there is a method in the madness and the results speak for themselves. Even if I analyse my own position, I founded a Digital Marketing Consultancy (Social Genie), but we ended up helping businesses solve all their problems from improving payment systems to raising capital. Given all businesses want to drive revenue growth and reduce costs, the methodology for achieving this is diverse.

Valuation and Forecasts

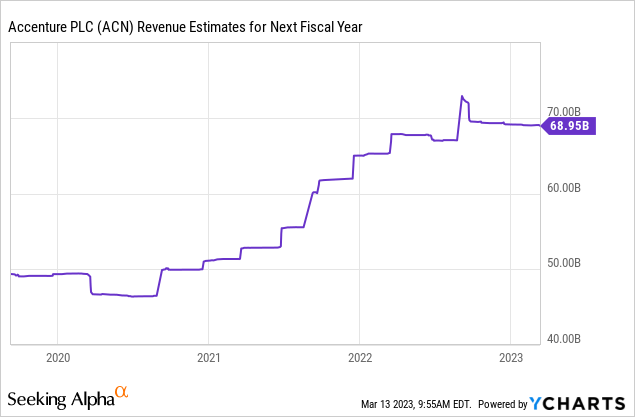

In order to value Accenture, I have plugged its latest financial data into my discounted cash flow model. I forecast 9% revenue growth for “next year” or the next four quarters in my model. This is driven by management’s guidance of between $15.2 billion to $15.75 billion or a 6% to 10% YoY growth rate for Q2 FY23 in addition to its full year guidance growth rate of between 9% and 11%. Keep in mind, this includes a negative 6% impact from foreign exchange rate fluctuations. In years 2 to 5, I forecast a faster growth rate of 15%.

I forecast this to be driven by improving economic conditions, as well as a correction in the currency market which tends to be cyclical by nature. In addition, I expect continued growth in Accenture’s core consultancy business, driven by digital transformation tailwinds while its Digital Agency business [Song] should grow faster as the advertising market rebounds. To put things into perspective, the 15% growth rate is fairly conservative, given the company grew its revenue at nearly 22% in FY2022.

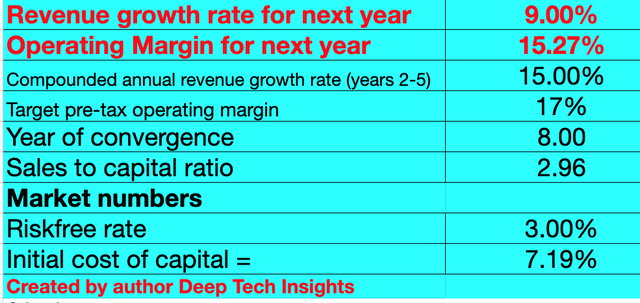

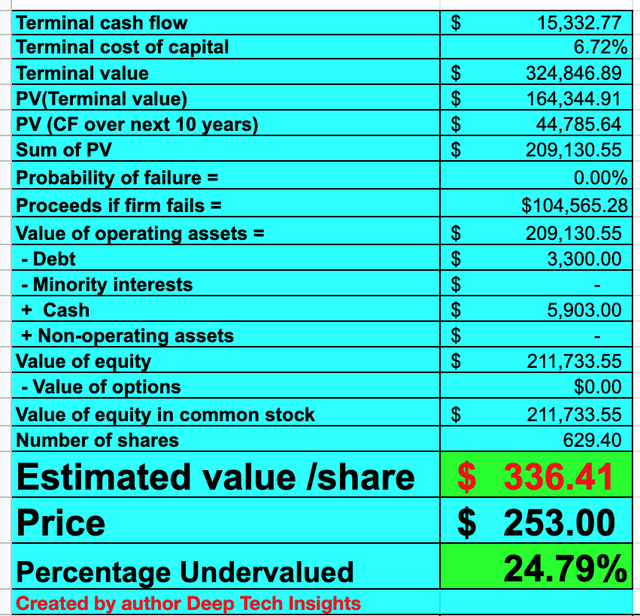

Accenture stock valuation 1 (Created by author Deep Tech Insights)

In terms of the company’s profitability, I forecast a pre-tax operating margin of 17% over the next 8 years, which is just 2% higher than its most recent margin of ~15%. I forecast this to be driven by improved operating leverage as per the current trend and continued economies of scale.

Accenture stock valuation 2 (created by author Deep Tech Insights)

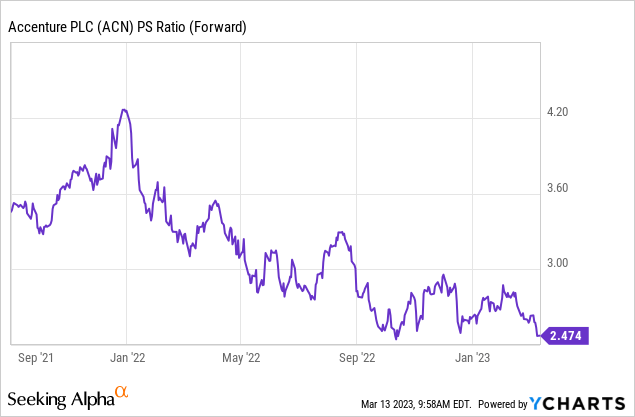

Given these factors, I get a fair value of $336 per share. The stock is trading at ~$253 per share at the time of writing and thus it is ~25% undervalued. As an extra data point, Accenture trades at a forward price to earnings [P/E] ratio = 22, which is 19% cheaper than its 5-year average.

Risks

Recession/Delayed Spending

Consultants are often known to be “expensive” to hire and thus this may put some organizations into splashing the cash given the macroeconomic environment. According to data from Statista, the U.S. has a 57% chance of falling into a recession at the time of writing.

Final Thoughts

Accenture has continued to generate strong financial results despite a tough macroeconomic climate. Ultimately the business focuses on providing 360-degree value to its clients and has built up the substantial skillset to achieve this from the cloud to digital marketing services. Given the company has approximately 8, 200 patents, it has also protected many aspects of its technologies. My valuation model and forecasts indicate the stock is undervalued intrinsically, thus this could be a great long-term investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.