Summary:

- I assign a Hold rating despite upbeat Q42023 result and FY2024 forward guidance.

- Upgraded buyback program upgraded to $20 billion is positive.

- Be cautious regarding decade-long use of stock-based compensation to cut reporting costs.

- Ongoing shareholder dilution caused by the upward trend in outstanding shares.

- Salesforce’s stock performance is starting to show diminishing returns.

Sundry Photography

Salesforce’s Stock Performance Shows Diminishing Returns Despite Upbeat Q4 Earnings

Salesforce (NYSE:CRM) has been a successful company, delivering tremendous gains to its investors with over 60X returns at the peak of 2021 since its IPO and 30X returns in 2022 after a pullback. However, it is unlikely that investors will see a 60X gain from CRM stock going forward.

During the most recent Q4 earnings report, Salesforce’s status as a great enterprise and cloud solution company was confirmed. Equity investors are favoring the company as evidenced by an 18% jump in stock price following the report on March 1st, 2023. However, long-term investors may be concerned by the diminishing returns profile of the stock in the past decade. Even with a horizon of 3-5 years, recent dates show decreasing returns. Therefore, it is important to look beyond the surface and consider these nuances when evaluating Salesforce’s performance.

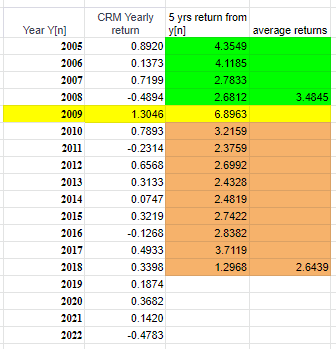

Analysis shows the best year for investment in Salesforce stock was 2009, with diminishing returns for post-2009 investors. Investors looking for a 5-year holding period in Salesforce stock have seen the best return by entering in 2009, with a 6.9x gain since the bullish run commenced in the past decade. Post-2009 investors still see decent returns, with an average 5-year return of 2.64x, but lesser than the pre-2009 average return of 3.48x. In contrast, Netflix (NFLX) stock has an average 5-year return of 3.84x pre-2009 and 6.74x post-2009. The analysis highlights the diminishing returns for post-2009 Salesforce investors, despite the initial success of the stock.

Salesforce stock’s average 5-year return (Table from Author)

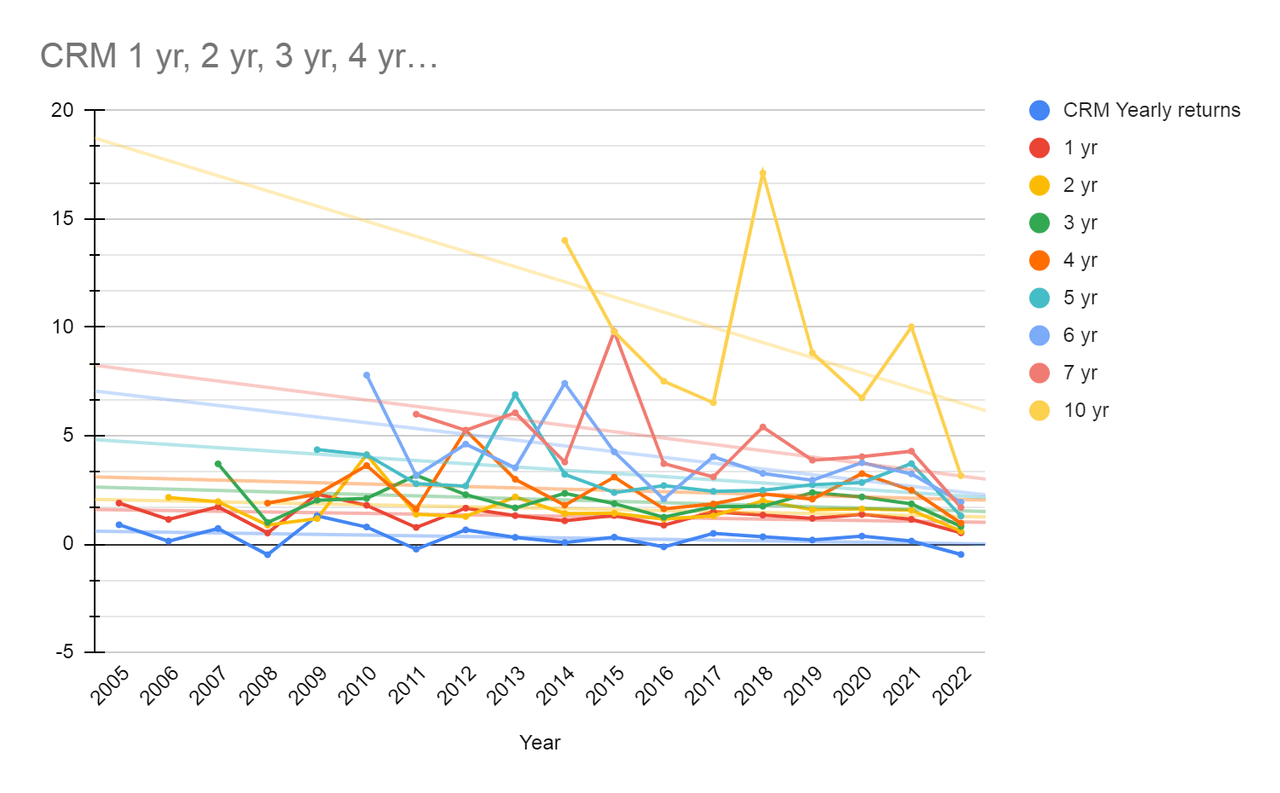

The return yield for investments with a holding time horizon of 1-10 years is declining, as illustrated in the chart. The decline is more pronounced for more recent investments, highlighting the potential risks for those who choose to invest in the current market. It is important for investors to consider this trend when making investment decisions and to balance the potential rewards with the potential risks involved in the current market.

Salesforce stock return for 1-10 years of holding (Data from Seeking Alpha, graph from author)

Declining Yield Trendline for Investment Holding Time Horizon of 1-10 Years

Based on the downward trend of return yield and fundamental analysis, investors looking to acquire positions in the company for the first time with a 5-year timeline horizon should consider further improvements in fundamental metrics, including GAAP EPS and a reduction in stock-based compensation. I believe a sustainable bottom line return trajectory will require these improvements to be made. Based on these findings, the stock currently warrants a hold rating until the necessary improvements can be made to ensure sustained returns for investors.

As a result of ongoing restructuring efforts aimed at improving bottom line returns and cost efficiency in response to pressure from activist investors, there is potential for the stock to receive a buy rating once these efforts bear fruit. The restructuring efforts are aimed at improving the fundamental metrics of the company, which could lead to improved returns for investors. Further details on the status of the ongoing restructuring can provide additional insight into the potential for sustained growth of the stock.

The Good

Despite Strong Q4 and FY2023, Net Income Remains Lacking

(Note: Salesforce’s Fiscal Year 2023 Runs from February 2022 to January 31, 2023.)

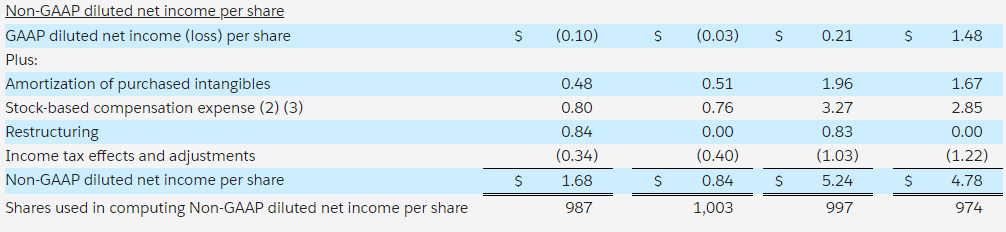

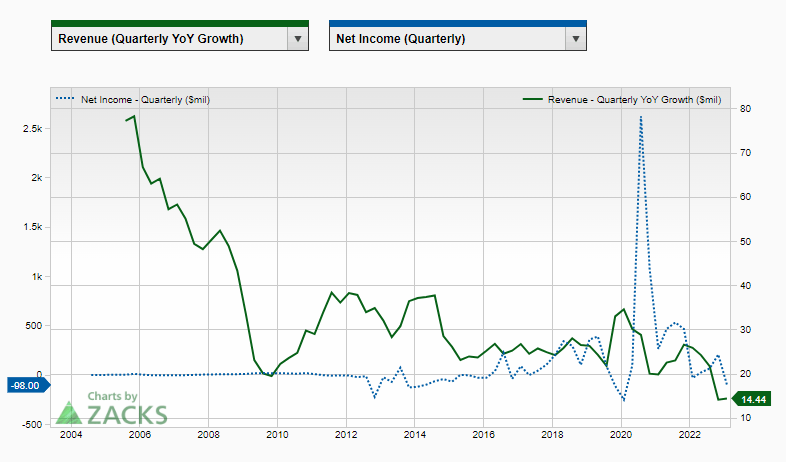

Salesforce reported earnings for the fourth quarter and full year 2022 that exceeded expectations, generating $8.4 billion in revenue and experiencing a year-over-year growth rate of 14.44%. The company’s cloud-based software services and digital transformation solutions drove this growth in demand. GAAP Diluted Loss per Share was $(0.10), but the Non-GAAP Diluted Earnings per Share (“EPS”) of $1.68 was higher than the expected $1.36 per share projected by analysts. Both GAAP EPS and non-GAAP EPS for FY2023 were released at $0.21 and $5.24, respectively. Despite the positive results, it is noted that a considerable gap exists between GAAP and non-GAAP EPS, which has been consistent for longer than just one quarter or year. Further examination into this discrepancy may be necessary to determine its potential impact on long-term growth and profitability.

Salesforce saw a positive response to Q4 earnings despite negative net income, mainly because of the stronger than expected revenue growth and an upgraded share buyback program. The non-GAAP net income for Q4 was $1.656 billion, although the GAAP net loss was $9.8 billion. The negative net income is still a concern. It remains important to continue monitoring the performance metrics of the company to ensure sustained growth and profitability.

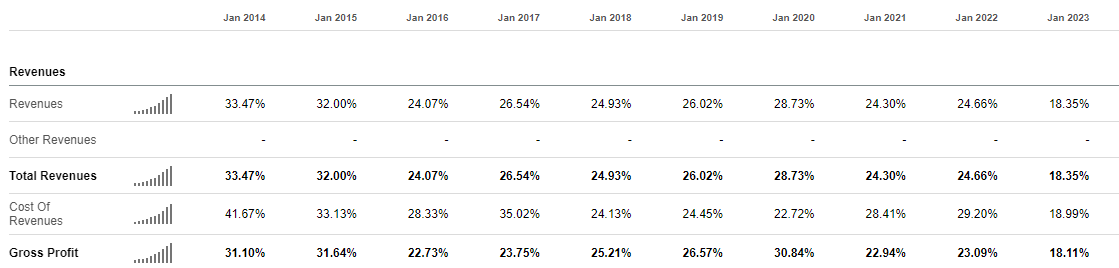

The company’s expansion into new markets, including healthcare and financial services, also contributed to the growth. Although the revenue experienced decent double-digit growth, its fiscal year 2023 growth of 18.35% is the lowest it has been in the past decade. The annual operating income improved notably from $602 million in fiscal year 2022 to $1,858 million in fiscal year 2023, with the exception of one-time restructuring costs. Despite the 200% increase, the net margin remains below 10% at 5.93% compared to 2.27% of revenue in FY2022.

Despite a revenue of $31.35 billion, the net income on a GAAP basis was only $208 million, resulting in a margin of 0.66%. This low GAAP net income margin has been a trend for the past decade, which is likely why activist investors have shown interest in streamlining the company to improve efficiency and profitability. More details on this topic will be covered below.

Salesforce’s 10-year revenue data (Seeking Alpha)

Revenue from other services and platforms has shown healthy growth. For the three and twelve months ended January 31, 2023, the revenue from Platform and Other included approximately $410 million and $1.5 billion of Slack subscription and support revenues. In terms of Slack, it represents 5% of the total revenue from Subscription and Support Revenue by the Company’s service offerings for FY2023, which totaled $29.02 billion. The overall platform and other revenue category, where Slack is a part of, grew 32% YoY for the full year from FY2022. Despite this growth, Slack’s revenue is considered less impactful to the top and bottom line without full integration into Salesforce’s core business. Activist investors might consider divesting Slack more aggressively due to its lack of competitiveness with Microsoft (MSFT) Teams and lack of integration. Investors’ main concern should be the need for major improvement to justify the acquisition cost of $28 billion, given the current environment.

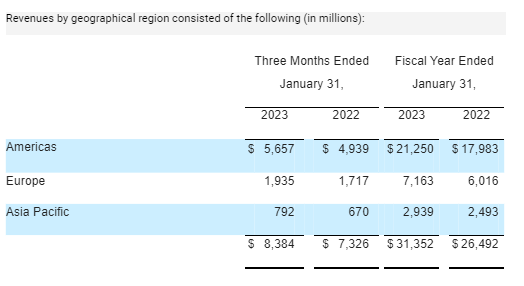

The company’s revenue growth extends geographically across America, Europe, and Asia

Revenues by geographical region consisted of the following (in millions):

Salesforce revenue by geography (Salesforce FY23Q4 earnings report)

Furthermore, the company has increased its fiscal year 2024 guidance with projected GAAP EPS of $2.59 – $2.61, a YoY increase of 11x from $0.21 in FY2023, and non-GAAP EPS of $7.12 – $7.14, a YoY increase of 35.9% to 36.3% from $5.24 in FY2023. If the company delivers the projected outlook for FY2024 and shows promising signs in the upcoming quarters, the stock price could potentially have an upside of 25-35% from the current price of $182.89. It is recommended to wait for a pullback and aim for a lower entry range of $165 to $170, which matches the level before the earnings report jump on March 1st.

From Einstein AI to GPT: Emphasizing Track Record over Hype Train

Salesforce is making headlines with its new partnership with OpenAI and the launch of the Einstein GPT generative AI service. Salesforce has been investing in artificial intelligence since 2016 with the Einstein AI platform, which has been used to improve customer relationship services.

Salesforce has partnered with OpenAI to launch Einstein GPT, a generative AI service that will allow users to automatically generate content, respond to emails, create marketing messages, and develop knowledge base articles to enhance customer experience. This partnership will enable Salesforce to implement Einstein GPT across multiple areas of its portfolio, including Service, Sales, Marketing, and Developers. Einstein GPT for Service will automatically draft relevant responses and create knowledge base articles. Einstein GPT for Sales will generate natural language summaries on account updates and help identify key contacts for salespeople to reach out to. On the other hand, Einstein GPT for Marketing is designed to dynamically generate content for landing pages, email campaigns, and ads based on targeted segments, while Einstein GPT for Developers will automatically generate code snippets for Salesforce applications.

Salesforce Ventures has also launched a $250 million fund to support startups in the generative AI ecosystem. Salesforce’s partnership with OpenAI is an essential part of the Einstein GPT initiative. OpenAI is a customer for Salesforce CRM service and Slack, and they approached Salesforce in 2022 to integrate ChatGPT directly into Slack. According to Clara Shih, the general manager at Salesforce, this partnership is just the beginning, and Salesforce will work with more partners for Einstein GPT.

The potential for use cases and monetization in enterprise applications and SaaS platforms, such as Salesforce, is very promising and practical in the near term. This will strengthen Salesforce’s ability to upsell its package to its already large existing client-base and has the potential to increase recurring revenue by 5% to 15% in a more immediate timeline in my view.

The Bad

The following are some of the concerns:

-

Salesforce is currently facing escalating competition from other software providers, including Microsoft and Oracle (ORCL). The increased competition could potentially result in pricing pressures and impact the company’s revenue growth. Although Salesforce has made acquisitions, such as Slack and Tableau, these have yet to be fully integrated, which may create some short-term challenges. Additionally, the company’s reliance on subscription-based revenue streams creates risks associated with customer retention and churn. Activist investors, including Elliott Management, are pushing for cost-cutting measures and changes to the leadership team. Despite the company’s recent decision to lay off 10% of its workforce, concerns remain regarding whether this will be enough to satisfy these investors.

-

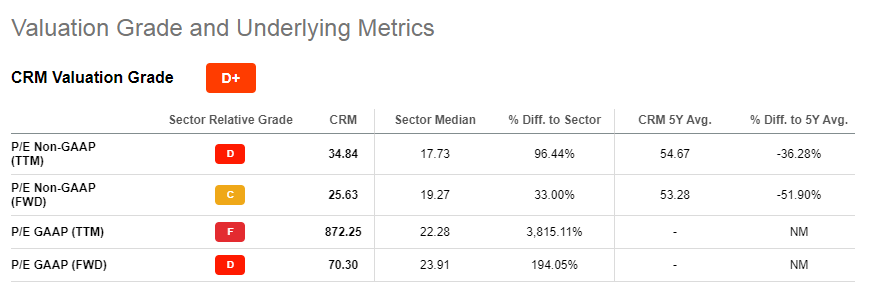

Over the past few decades, Salesforce has consistently reported positive and respectable non-GAAP EPS figures. However, its GAAP EPS, net income, and net income margin have all remained relatively low. There has been a significant difference between the GAAP and non-GAAP EPS figures over the years, including in FY2023, where the GAAP EPS was 0.21 compared to the non-GAAP EPS of 5.24.

Disparity in GAAP and non-GAAP EPS (Salesforce FY23Q4 earnings report)

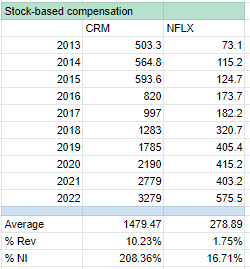

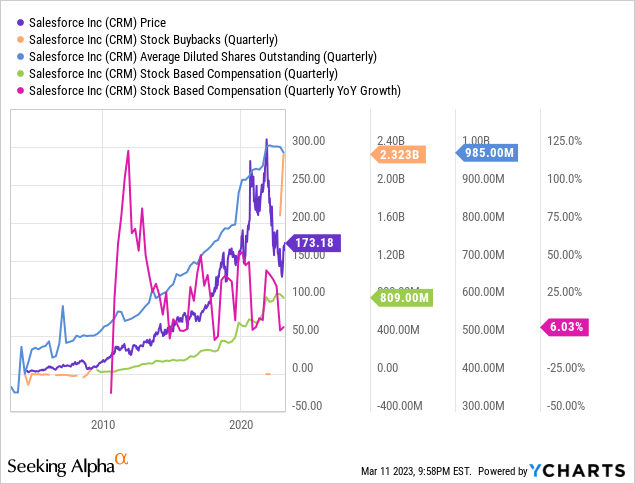

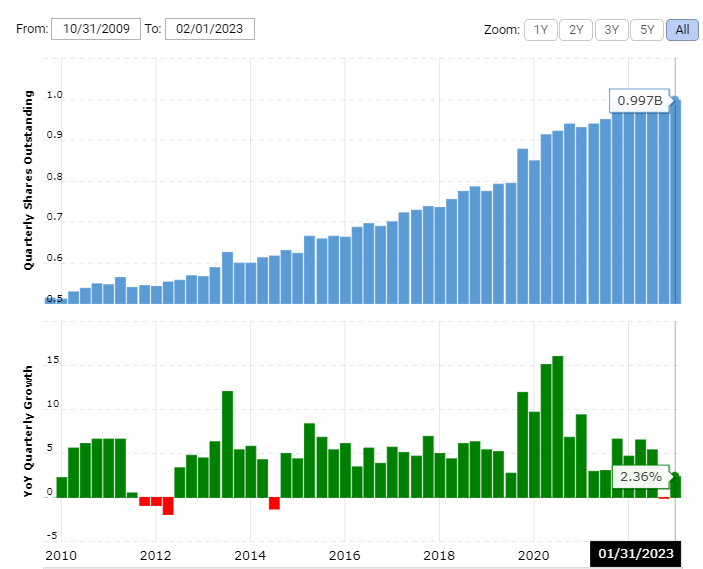

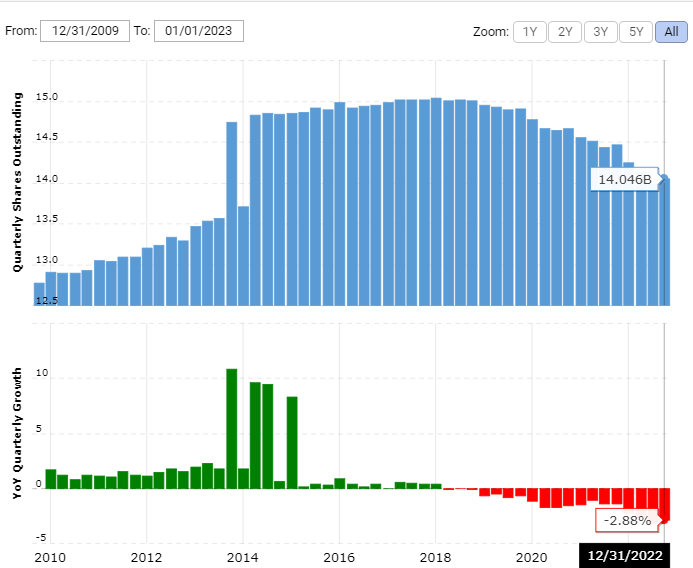

Apart from subtracting the Amortization of purchased intangibles and one-time restructuring costs, there has been a consistently high amount of stock-based compensation on an annual basis for the past decade. This is partly reflected in the trend of increasing outstanding shares, which has resulted in the dilution of shareholders. However, since the stock price return has been performing well, it has offset the dilution. While the pace of increase in stock-based compensation has been decreasing in recent years, it still accounted for $3.279 billion worth of expenses, equivalent to over 10% of total revenue in FY2023 and 208% of GAAP net income.

This is in stark contrast to Netflix, which, while having a fundamentally different business model, also boasts a revenue level of over $30 billion. However, their annual stock-based compensation is much more modest, and there is less disparity between their GAAP and non-GAAP earnings.

Salesforce and Netflix Stock-based compensation comparison (Seeking Alpha data, table from Author)

The announced buyback program, which started in August of last year and plans to boost the amount from $10 to $20 billion by 2023, will help mitigate the dilution from past years. The total buyback will comprise approximately 10% of the market capitalization. In comparison, some large-cap tech companies, such as Google (GOOG, GOOGL), have seen a decline in the number of outstanding shares over the years.

Salesforce’s charts on Stock-based compensation and outstanding shares (Seeking Alpha Ycharts)

Seeking Alpha Ycharts

Salesforce outstanding shares over the decade (Macrotrends)

Google outstanding shares over the decade (Macrotrends)

-

In addition, for a number of years, Salesforce’s YoY growth in topline revenue has shown a declining trend.

Salesforce’s declining revenue (Zacks)

Although the forward GAAP P/E has improved significantly from the GAAP P/E (‘TTM’) of 872, it is still over 70.

Salesforce non-GAAP and GAAP P/E ratios (Seeking alpha)

The outlook and key Takeaways

While there are several factors that offer optimism to investors, effective execution will be crucial for the management in FY 2024.

-

CRM’s revenue growth increased in both Q4 and FY2023.

-

Buyback program upgraded from $10 billion in August last year to $20 billion per announcement on March 1st, 2023.

-

Upbeat FY2024 forward guidance.

In an environment of Quantitative Tightening, high interest rates and low liquidity, there may be further compression of price-to-earnings ratios. Under these conditions, Salesforce will be challenged by the following weaknesses.

-

High expenses.

-

Low net income margin.

-

Utilization of significant stock-based compensation to reduce reporting costs.

-

Ongoing shareholder dilution caused by the upward trend in outstanding shares.

Concerns seem to have also arisen over the historical inflation of positive earnings, casting doubt on Salesforce’s financial sustainability in the current economic climate. Despite performing well in 2009 during a decade-long bull run era, the company’s recent challenges with low net income margin, declining revenue trend, and limited operational efficiency suggest that its optimistic outlook may not fully materialize. Moreover, the collapse of Silicon Valley Bank and broader concerns about the banking industry add further uncertainty. Activist investors calling for management and board restructuring could exacerbate the situation and create uncertainty within the organization’s workforce.

Despite recent challenges, Salesforce remains a strong cloud-based enterprise solution company with a sizable client base. If the company can deliver on its projected outlook for FY2024 with clear evidence in the coming quarters, the stock price could see a 25-35% increase from its current value of $182.89. It is recommended to wait for a pullback and a lower entry range of $165 to $170, which was the level before the price jumped following the March 1st earning reports. In fact, the price dropped to $170 on March 10th and March 13th following the collapse of Silicon Valley Bank (SIVB).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.