Activision Blizzard: A Hold Whether The Deal Closes Or Not

Summary:

- Acquiring Activision Blizzard is not as profitable as it seemed 18 months ago for Microsoft.

- The completion of the deal is contingent on receiving approval from the UK’s Competition and Markets Authority. Microsoft might sell its could-based gaming rights in the UK to another company.

- According to ATVI’s current stock price, if the merger happens, the company’s shareholders will profit by 4%.

- If the deal fails, Activision Blizzard could receive a break-up fee of $3.0 to $4.5 billion from Microsoft, which is significant. The company’s operating income in 1H 2023 was $1.4 billion.

- If the merger fails, I don’t expect ATVI’s stock price to change significantly except for the first few days.

Sascha Schuermann/Getty Images News

Investment Thesis

Since the announcement of the merger, the most important thing about Activision Blizzard (NASDAQ:ATVI) is Microsoft (MSFT) plans to acquire Activision Blizzard for $95 per share. Even all the past articles on ATVI on Seeking Alpha are focused on the deal between Microsoft and Activision Blizzard (see Figure 1). There is a reason for that. If this $69 billion worth of acquisition completes, it would be Microsoft’s biggest takeover ever. From 12 January 2022 (a few days before Microsoft announced its plans to acquire Activision Blizzard) to 16 August 2023, ATVI’s stock price increased from $75 to $91, up 40%. In the past few months, regarding the deal, lots of things have happened, and finally, on 18 October 2023, the Microsoft-Activision Blizzard deal is expected to complete, as they extended the merger agreement to get UK’s approval on the deal.

Figure 1 – All the past articles on ATVI are focused on the Microsoft-Activision deal

SA

Microsoft must pay $3.5 billion to Activision Blizzard if the transaction is terminated after 29 August 2023 and also must pay $4.5 billion if the transaction is terminated after 15 September 2023. For now, it seems that the United States and European Union support the deal. However, Microsoft hasn’t been successful to get UK’s Competition and Markets Authority (CMA) approval yet. CMA wants Microsoft to sell its cloud gaming rights in the United Kingdom to another company, to make sure it is not going to turn to a monopoly. A month ago, Microsoft offered to sell off its cloud-based market rights for games in the UK. By 29 August 2023, CMA is expected to issue a legally final order on the deal. Now, Microsoft has to decide to sell its cloud-based gaming rights in the UK and get CMA’s approval on the deal, or keep its cloud-based gaming rights in the UK, forget about the acquisition of ATVI, and pay a huge break-up fee to Activision Blizzard. Also, Microsoft has already lost the war on Call of Duty to Sony. Microsoft and Sony signed a deal to keep Activision’s Call of Duty on PlayStation for 10 years a month ago. It simply means that acquiring Activision Blizzard, may not be as profitable as it could be earlier. Before signing a contract with Sony, Microsoft had the right to ban Sony from accessing Call of Duty, which could be a great thing for Xbox. However, now, if the deal between Microsoft and Activision happens closes, Microsoft is not able to make Call of Duty exclusive to its consoles.

On the other hand, from my perspective, Microsoft and Sony’s recent agreement is good for Activision Blizzard’s revenue, which will belong to Microsoft after the merger (if the deal closes). Xbox is not as favored as PlayStation in the world. Thus, assuming that the deal between Microsoft and Activision Blizzard is going to be completed, if Microsoft was able to exclude PlayStation from Call of Duty and other ATVI games, it could hurt Activision’s revenue in a significant way. One might argue that due to this, Microsoft didn’t have the plan to exclude PlayStation from Activision’s games at all. However, to improve Xbox’s competitiveness against PlayStation, sacrificing Activision’s revenue could be a strategy at certain times. Also, there are other games like Diablo IV, World of Warcraft, and Candy Crush that Microsoft might decide to make exclusives for its consoles (assuming that the acquisition of Activision completes), to improve the competitiveness of Xbox against PlayStation. Also, Microsoft is fighting another war with Meta Platforms (META). By acquiring Activision Blizzard, Microsoft can improve its presence in the gaming industry and the metaverse, and increase its competitiveness against META. Thus, even though acquiring Activision Blizzard has been turned into a less profitable deal for Microsoft after the announcement, the company still wants to close the deal as the break-up fee is significant, and Microsoft still can earn a lot if the merger succeeds. In this situation, I decide to see it as a 50-50.

Thus, for Activision Blizzard’s shareholders, I think two things can happen: 1) Microsoft may get CMA’s approval and close the deal, and ATVI’s shareholders will receive $95 per share; 2) The deal may fail, and Activision Blizzard may receive between $3.0 to $4.5 billion from Microsoft. According to its second-quarter financial results, Activision’s operating income in 2Q 2023 and 1H 2023 was $583 million, and $1383 million, respectively. Thus, receiving $3.0 to $4.5 billion from Microsoft (if the deal fails), means a lot for Activision. Also, it is worth noting that Activision’s higher stock prices in the past year cannot be entirely linked to the merger, as the company’s financial results improved significantly.

ATVI’s second-quarter financial results show that the company is now in a significantly better financial position compared to a year ago. In the second quarter of 2023, ATVI reported GAAP net revenues of $2207 million, compared with $1644 million in the same period last year, driven by higher sales in the Americas, EMEA, and Asia Pacific. Also, ATVI’s diluted earnings per common share increased from $0.36 in 2Q 2022 to $0.75 per share in 2Q 2023. Furthermore, in the second quarter of 2023, Blizzard delivered its first $1 billion net bookings, driven by the successful launch of Diablo IV. Diablo IV crossed $666 million sell within five days of launch. Over 10 million players experienced Diablo IV in June 2023, playing for over 700 million hours. Furthermore, Activision segment revenue grew 17% YoY in 2Q 2023 as a result of higher Call of Duty revenues across the Call of Duty franchise. Also, King segment revenue grew 9% YoY in 2Q 2023 driven by strong revenue across Candy Crush live operations.

Thus, if the Microsoft-Activision Blizzard deal fails, I don’t expect the price of ATVI to change significantly. The break-up fee (which ATVI receives from Microsoft) and the company’s improved financial results that have been overshadowed by the merger news in the past few quarters can entirely compensate for the negative effects of the failure of the merger.

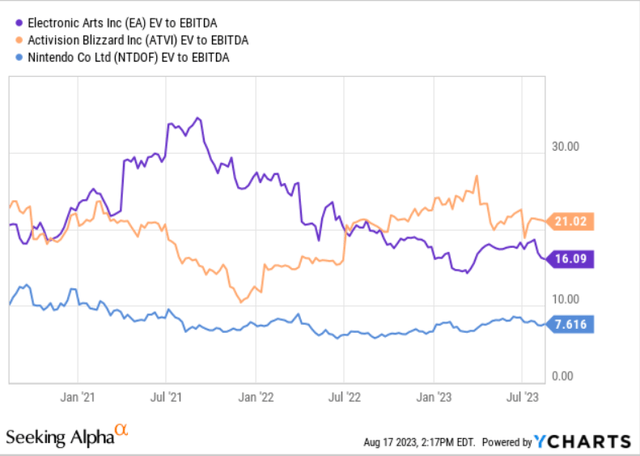

Valuation

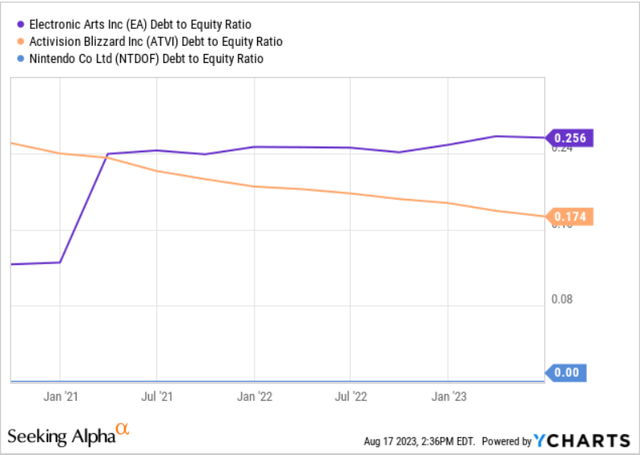

We can see in Figure 2 that ATVI’s EV-to-EBITDA is significantly higher than Electronic Arts (EA) and Nintendo’s EV-to-EBITDA (OTCPK:NTDOF). ATVI’s EV-to-EBITDA started increasing in January 2022, while EA’s EV-to-EBITDA decreased. Also, we can see that Nintendo’s EV-to-EBITDA almost remained flat, and significantly lower than its peers in the past two years. Thus, based on EV-to-EBITDA, Activision Blizzard is not in a good position compared to its peers. However, if the deal fails, the break-up fee of between $3.0 billion to $4.5 billion can prevent the stock price to drop. Furthermore, ATVI’s debt-to-equity is better than EA’s debt-to-equity. A better leverage ratio can somehow support Activision Blizzard’s higher EV-to-EBITDA, as ATVI’s investors can be less worried about the debt of the company. Also, with a lower debt-to-equity ratio, ATVI can invest more in new games and get more competitive.

Figure 2 – ATVI’s EV-to-EBITDA vs. peers

Ycharts

Figure 3 – ATVI’s debt-to-equity vs. peers

Ycharts

Why I might be wrong

As I explained earlier, if the deal fails, I don’t expect Activision Blizzard’s stock price to drop as I think the break-up fee from Microsoft, Activision Blizzard’s improved financial results, and its good debt position may have the ability to support its current stock price. However, as almost in the past two years, the merger with Microsoft has been the most important thing about ATVI, the negative effects of the failure of the merger can be stronger than I expect. At prices of around $90 per share, ATVI might not be attractive to investors, and they might say goodbye to Activision Blizzard after almost two years of struggling with news about the merger.

Conclusion

The stock is now trading at about $91 per share. If you buy it now, and if the deal closes, there could be a 4% profit (you will not get the dividend of $0.99 per share as it is payable on August 17th just to shareholders of record at the close of business on 2 August 2023). If the deal fails, I don’t expect ATVI’s stock price to fall (the stock’s price might decrease in the first few days after announcing the failure of the deal) as the break-up fee of $3.0 billion (if Microsoft terminates the deal after 29 August), $3.5 billion (if Microsoft terminates the deal after 29 August and before 16 September), and $4.5 billion (if Microsoft terminates the deal after 15 September), means a lot to Activision Blizzard. However, I don’t expect ATVI’s stock price to jump if the deal fails. Thus, from my point of view, ATVI is a hold. However, you might like a profit of 4% if you think that the deal is going to succeed. In that case, you can buy the stock, and if the deal fails, you might not get hurt. But a profit of 4% is not enough to put a buy rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.