Summary:

- Microsoft’s planned acquisition of Activision Blizzard for $69 billion presents an attractive opportunity for potential investors.

- If the deal fails, MSFT is required to pay ATVI a $3B fee.

- The strategic decision not to make Call of Duty an exclusive title increases the likelihood of the deal being successful.

David Becker

I recently wrote an analysis on Microsoft (MSFT) and the potential they have displayed within the gaming space. The planned acquisition of Activision Blizzard (NASDAQ:ATVI) by Microsoft has garnered significant attention. This would be MSFT’s largest acquisition in the gaming space and I’ll dig into why I believe buying before the acquisition finalizes presents an attractive opportunity.

Deal Details and Complexity

Microsoft’s intention to acquire Activision Blizzard for $95 per share has been a major focus since its announcement in early 2022. This deal, valued at $69 billion, stands as Microsoft’s largest acquisition bid to date. Despite the deal being initially profitable, evolving circumstances have introduced complexities that may affect its outcome.

The completion of the merger hinges on regulatory delays of approval from the UK’s Competition and Markets Authority. The authority demands that Microsoft relinquishes its cloud-based gaming rights in the UK to prevent potential monopoly concerns over the gaming industry. I see this as a buying opportunity and I think this will eventually get worked out as Microsoft and Activision are technically not direct competitors. With the exposure that MSFT will get with this acquisition, I think that it actually increases competition as it opens a brand new category of gaming for MSFT within mobile as their library in mobile is currently limited.

Major Road Block Already Settled – Exclusivity

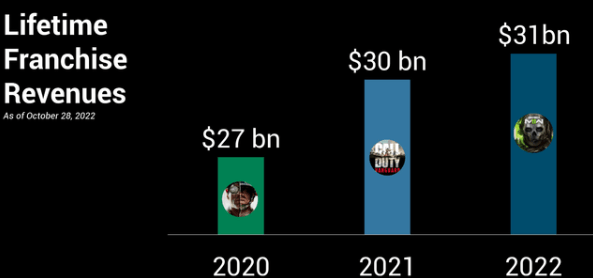

Microsoft has stated they do not plan to take major franchise, Call Of Duty, as an exclusive title to Xbox. Only 3% of players would switch consoles to continue enjoying the franchise. Making the title an exclusive is not a profitable strategic move for Microsoft. As I stated in my previous analysis, Call Of Duty brings in $30+ billion for ATVI. Eliminating a portion of their player base would not be a smart strategic move. Now that this is off the table, I think it increases the likelihood of the deal being successful.

Essentially Sports

Although Call Of Duty won’t become an exclusive title, there are a handful of other titles that are still fall to that possibility and it complexes the merger from closing. Some examples of these games that can go exclusive are:

- Diablo IV

- World of Warcraft

- Overwatch

- Tony Hawk Series

- Crash Bandicoot

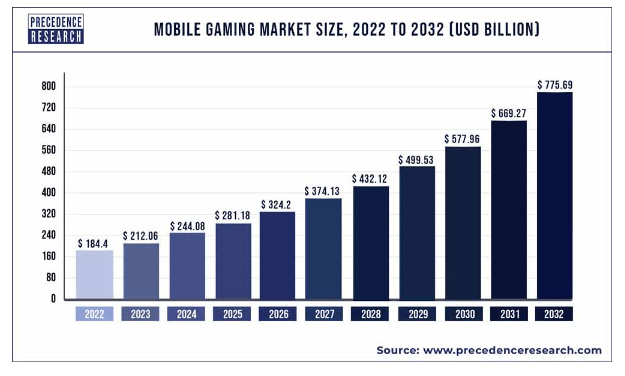

Precedence Research

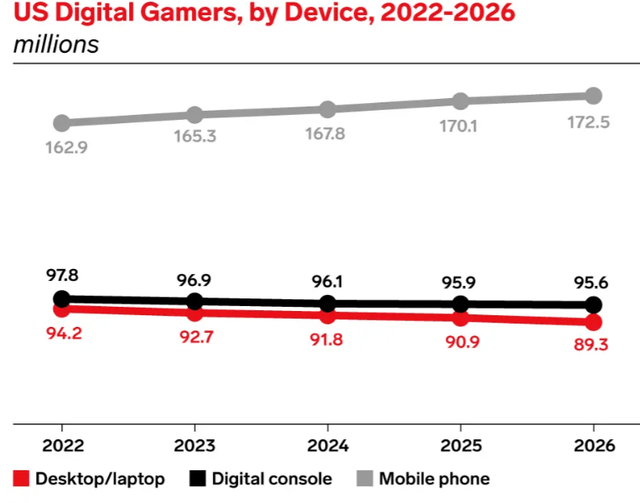

More than half of the gaming industry is now on mobile devices, and Apple (AAPL) and Google (GOOG) are the big players in mobile gaming. Microsoft’s presence in mobile gaming is currently centered around Minecraft, but they’ll have to broaden their offerings to be a real competitor. This is where a game like Candy Crush, acquired by Activision, comes in. In the areas where Microsoft is putting its attention, this merger would actually increase competition in the market, not decrease it. This is once again, another reason I believe the deal will more than likely be closed successfully.

In the unlikely event of the merger falling through, Microsoft could be liable to pay a break-up fee to Activision Blizzard of $3 billion. For Activision Blizzard’s shareholders, two scenarios emerge: the deal’s approval, resulting in a $95 per share payout, or the deal’s failure, resulting in a significant break-up fee of $3.0 billion from Microsoft and the talk of games being exclusive gets taken off the table. In my opinion, either outcome is a win for Activision so I believe entry here would be beneficial for investors. A win/win scenario!

If The Deal Doesn’t Happen

If the deal doesn’t happen, I believe ATVI remains a buy and has the strong financials and market share to succeed regardless.

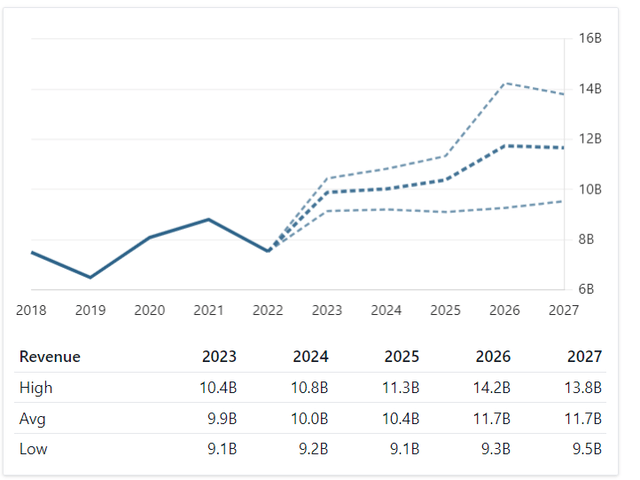

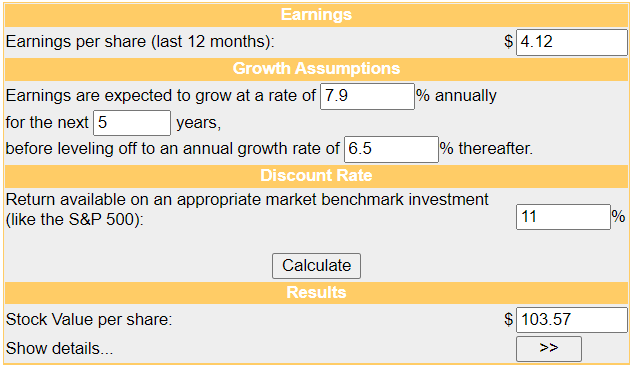

In the second quarter of 2023, their reported revenues were 34% higher compared to the same period last year. This growth was driven by increased sales. Video game sales are expected to rise 7.9% annually until 2027. Additionally, ATVI’s EPS also went up from $0.36 in the second quarter of 2022 to $0.75 per share in 2023, representing an increase of 108%!

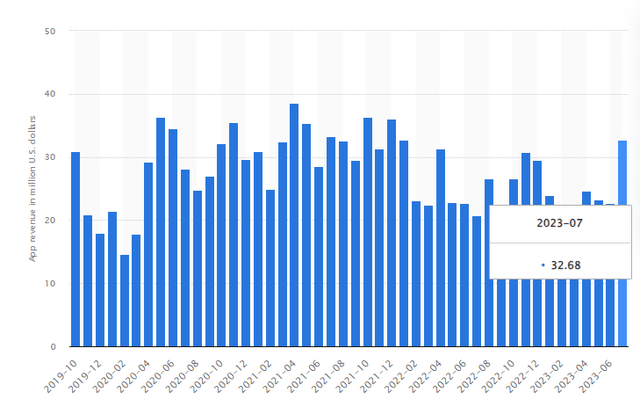

As mentioned, the annual release of Call of Duty brings in large amount of revenue for ATVI. Even the free to play mobile version of Call of Duty performs extremely well because of the sales of microtransactions. We can see that sales revenue totaled $32M in June on a free to play title. As previously mentioned, the mobile gaming space is estimated to grow at huge numbers and ATVI as a well-suited product diversity to benefit from each avenue of gaming including mobile, consoles, PC, physical copy revenue.

In fact, 43% of ATVI’s revenue last quarter came from the mobile space. Even though they saw growth in all areas, mobile gaming remains their strongest performer, bringing in $943 million, which is 43% of their total revenue. This is a 13% increase from the $831 million they earned in Q2 2022. All of this is to say, I strongly believe ATVI has positioned themselves to be totally fine regardless if the deal is successful or not.

ATVI’s revenue is projected to hit $12B and grow right alongside the gaming industry as a whole. ATVI’s strong portfolio of video game products will be the reason they capture the growth of the gaming industry. Considering all this, if the Microsoft-Activision Blizzard deal doesn’t go through, I don’t expect ATVI’s stock price to be significantly affected because of the break-up fee that ATVI would receive from Microsoft, combined with the company’s improved financial results, could offset any negative impact from the merger’s failure. The $3B that ATVI would receive, can be used to further develop future popular franchise releases.

We can see that mobile gaming has the largest active player base at the moment and is also projected to have the largest growing player base. We have already established that Activision’s mobile games bring in a majority of their revenue but some of these popular titles are:

- Call of Duty Mobile – $32M in revenue as of June 2023

- Diablo: Immortal – $525M in the first year

- Hearthstone – earned $660M since launch

- Warcraft Arclight Rumble

- Call Of Duty Warzone Mobile

- Candy Crush – $607M annually

Because of these strong portfolio of mobile and console games, I believe ATVI is a buy regardless of the deal being successful or not.

Valuation

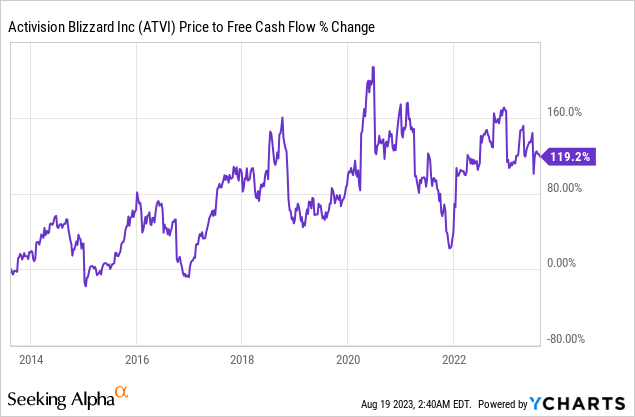

Merger talk aside, let’s take a more level-headed look at the current valuation of ATVI. EBITDA Margin sits at 26% and significantly outperforms the sector median of 18%. Also, net income margin sits at 24.8% compared to the sector median of only 3.6%. ATVI is extremely profitable from a cash flow perspective as they also produce $2.5B in cash from operations.

ATVI’s last dividend raise was quite large and the average 5 year dividend growth rate is 23.8%. The yield is very low at only 1% and payments are scheduled annually. While this doesn’t fit well into a dividend investors portfolio, I mention it because it shows how cash flow positive ATVI has been and how the cash flow continues to grow. This isn’t surprising when the Call of Duty franchise alone is worth over $30B and rakes in $1B a quarter from in-game microtransactions.

Using the last 12 months EPS data, we can input a DCF (Discounted Cash Flow) analysis to get a fair value stock price estimate for ATVI. If we use the estimated growth rate of 7.9 that the gaming industry is projected to grow, alongside the last 12 months earnings per share of 4.12, we can see that the fair value comes to $103.57 per share. The EPS estimate based on Seeking Alpha’s earnings tab, is 4.34 for the year of 2024. Using this EPS number, the projected fair value for ATVI in 2024 comes to $109 per share. This would represent an approximate 20% upside from the current price of $90/share.

Money Chimp

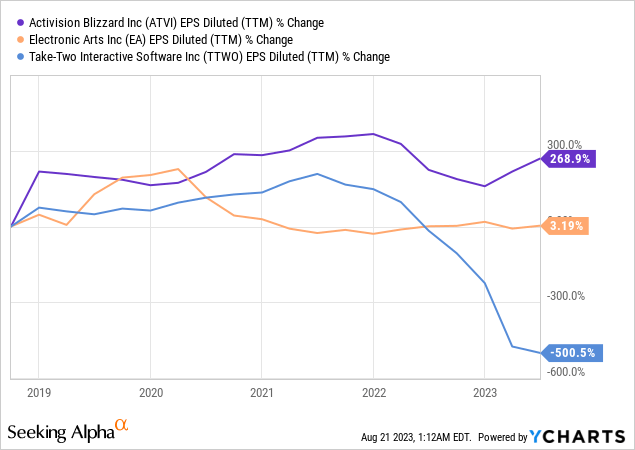

Lastly, let’s compare ATVI against some of the competing game companies. We can see that over the last 5 year period, ATVI has the healthiest EPS diluted growth of 268% compared to both Electronic Arts (EA) as well as Take-Two Interactive (TTWO). This further reinforces the idea that ATVI has a strong portfolio of products that are bringing in an increasing level of cash flow and are set to thrive along the rising growth of the gaming industry. Being that the current price is below both the deal buyout price ($95/share) and the DCF fair value estimate, we rate ATVI as a buy to capture the future upside here.

Risk

An obvious risk would be that the acquisition fails and the stock price takes a temporary dip downward. Since the deal has been on-going for so long though, I wouldn’t be surprised if the stock reacts a lot more dramatically and falls to $85/share support. I do think the risk is mitigated by the substantial fee that MSFT will have to pay to ATVI though.

Conclusion

The buzz surrounding Microsoft’s potential acquisition of Activision Blizzard underscores its significance within the gaming landscape. Despite regulatory complexities and hurdles, this presents an attractive opportunity for potential investors. The strategic decision not to confine Call of Duty to Xbox exclusively increases the merger’s likelihood.

In the unlikely event of a merger breakdown, Activision Blizzard shareholders could gain from a substantial $3 billion break-up fee. Furthermore, Activision’s solid financial standing is underscored by an EBITDA Margin of 26%, surpassing the sector median by a considerable margin. With a positive cash flow perspective and impressive dividend growth, ATVI’s resilience is evident.

Lastly, if the Microsoft-Activision Blizzard deal falls through, ATVI remains a solid buy. Their Q2 2023 revenues surged by 34% year-on-year due to increased sales, with EPS growing by 108%. Call of Duty’s annual release is a major revenue driver, including the successful mobile version with $32M in June sales. Mobile gaming accounts for 43% of ATVI’s revenue, totaling $943 million, a 13% increase from Q2 2022. These strengths position ATVI well across gaming avenues—mobile, consoles, PC. Hence, regardless of the deal outcome, ATVI’s financials and market presence offer stability, helped by a potential $3B break-up fee from Microsoft. This could fund future franchise releases and offset any negative merger impact.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ATVI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.