Activision Blizzard: Buy The Upward Surge (Technical Analysis)

Summary:

- Activision Blizzard’s stock has surged in value from its 2019 lows, indicating a robust bullish outlook in the short and long run.

- Berkshire Hathaway’s investment in Activision Blizzard and subsequent reduction of its stake highlight the stock’s attractiveness among investors.

- Technical analysis shows a bullish trajectory for Activision Blizzard’s stock, with potential for further price growth and buying opportunities.

David Becker

Activision Blizzard, Inc. (NASDAQ:ATVI) is a premier developer and publisher of interactive entertainment offerings, celebrated for its top-tier franchises. Lately, there’s been notable movement in Activision Blizzard’s stock price, marked by heightened volatility. The stock has surged by a substantial 166.15% from its 2019 lows. Analyzing its price trajectory, the formation of an ascending broadening wedge and a rounding bottom suggests a robust bullish outlook in both the short and long run, pointing towards continued positive momentum. This piece delves into a technical examination of Activision Blizzard’s stock trajectory, aiming to discern its future direction and spotlight potential avenues for long-term investors.

Berkshire Hathaway’s Journey with Activision Blizzard

When Berkshire Hathaway (BRK.A) (BRK.B) announced its investment in Activision Blizzard, the investment world watched with bated breath, the surprise was further intensified by Microsoft’s subsequent revelation of its intention to acquire the gaming giant in a colossal $68.7 billion cash deal. While the market was rife with speculations and rumors, Warren Buffett, Berkshire’s legendary CEO, quickly stopped the narratives, clarifying that they were in the dark about Microsoft’s impending plans. As the dust settled on these announcements, the focus shifted to the stock market’s daily ebb and flow.

Looking back, Berkshire’s move to invest in Activision Blizzard appears astoundingly foresightful, especially considering the subsequent appreciation of its position in the firm. However, many were caught off guard when Buffett, often championing a long-term investment stance, opted to liquidate a significant portion of this winning stake sooner than anticipated. The latest figures tell: Berkshire’s share in Activision Blizzard plummeted from 6.7% to a modest 1.9%. This substantial shift was timed around a pivotal court decision that rejected the Federal Trade Commission’s bid to stall Microsoft’s acquisition endeavors. Following this sell-off, Activision Blizzard’s stock price surged by 10%, mirroring the market’s favorable response to the judicial verdict.

Buffett’s decision to pare down the stake stands in stark contrast to his well-known philosophy of holding stocks for the long haul. Notably, the original choice to invest in Activision Blizzard wasn’t a Buffett original but likely the handiwork of Todd Combs or Ted Weschler, two influential figures at Berkshire. Recognizing an opportunity, Buffett bolstered the position to capitalize on merger arbitrage potential. This tactic seeks to exploit price discrepancies during acquisition processes, especially given the inherent uncertainties of deal consummations. With Microsoft’s bid to acquire Activision Blizzard facing regulatory hurdles, the stage was set for Buffett to capitalize on this arbitrage opportunity.

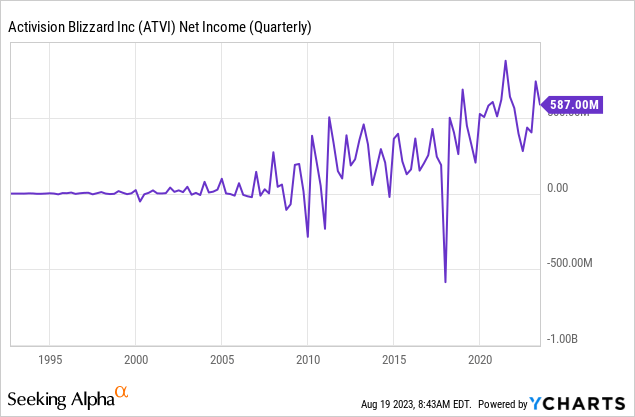

Despite ongoing uncertainties in the market, the company’s forward-looking approach to tapping into the burgeoning esports arena, coupled with its strategic expansions into mobile gaming, positions it well in the rapidly evolving gaming industry. Additionally, the recent interest from major investors and potential acquisition interest reflects heightened market confidence in its future prospects. Given these factors, Activision Blizzard presents a compelling bullish case for investors, making it a prime buy in the current market landscape. The following chart showcases Activision Blizzard’s net income, standing at $587 million and displaying an upward trend, indicative of the company’s robust profit trajectory.

Adding to the bullish sentiment around Activision Blizzard, David Einhorn’s Greenlight Capital’s recent portfolio inclusion of Activision Blizzard, as divulged in its latest 13F filing, underscores a positive stance towards the gaming firm. The company’s addition and increased stakes in other enterprises signify a possible tactical pivot that could further amplify Activision Blizzard’s attractiveness among investors.

Unveiling the Bullish Price Surge

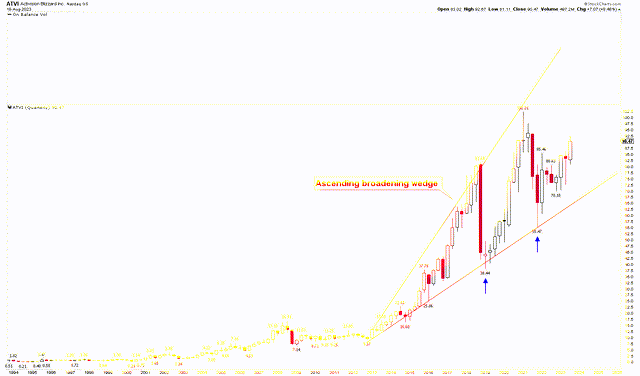

The ensuing quarterly chart presents a compelling narrative of Activision Blizzard’s enduring bullish trajectory spanning an extended duration. Beginning from its low point of $9.57 in 2012, the stock has showcased remarkable momentum, ascending to an unparalleled pinnacle of $102.31. Nonetheless, this pronounced upward drive has been accompanied by heightened volatility, giving rise to an ascending broadening wedge pattern in its aftermath. It’s noteworthy that the most substantial quarterly drop in the stock transpired in 2018, aligning with the support line of this pattern. This downturn can be attributed to many factors: concerns regarding market saturation within specific gaming genres, uncertainties surrounding Activision Blizzard’s capacity to sustain growth amidst intense competition, and evolving gaming preferences. The decision to introduce “Diablo Immortal” for mobile devices rather than a new PC/console iteration met disapproval from the loyal player base, further contributing to the industry-specific turbulence. The broader instability of the stock market towards the end of that year exacerbated this situation, exerting added downward pressure on various equities, including Activision Blizzard.

Nevertheless, despite these setbacks, the market demonstrated a resilient rebound, propelling the stock to its historical zenith. This heightened volatility while increasing overall market risk, also amplifies the potential for future price growth. A significant market decline in 2021 set the stage for another remarkable ascent in prices. At present, the stock is undergoing a phase of broad consolidation, suggestive of a positive trajectory ahead. This sentiment is reaffirmed by the notably favorable performance of the third quarter of 2023, as indicated by the quarterly candle, pointing towards a potential upward surge.

ATVI Quarterly Chart (StockCharts.com)

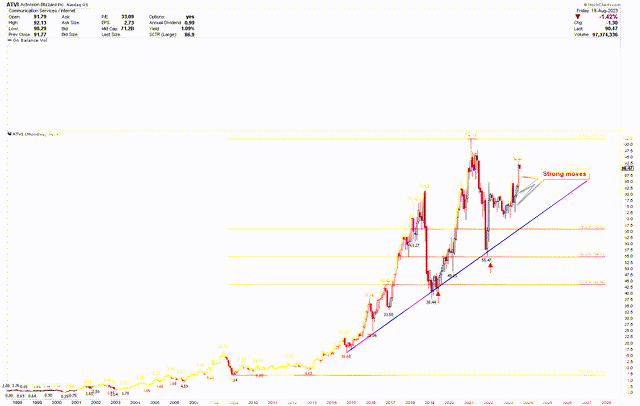

In addition to this viewpoint, the following monthly chart provides a detailed explanation of the Fibonacci retracement, which spans from the lowest point of the Great Recession at $7.14 to the highest point of the stock. The decline from this peak found strong support at the 50% retracement level, marked at $55.47. This observation is reinforced by a blue trendline, emphasizing the sustained bullish momentum and indicating a potential continuation of the upward price trend. Further supporting this analysis are the significant events of the June monthly candle, signifying a pivotal turning point, along with the notably positive price movements in July and August. Collectively, these factors suggest a market primed for an upward movement.

ATVI Monthly Chart (StockCharts.com)

Key Action for Investors

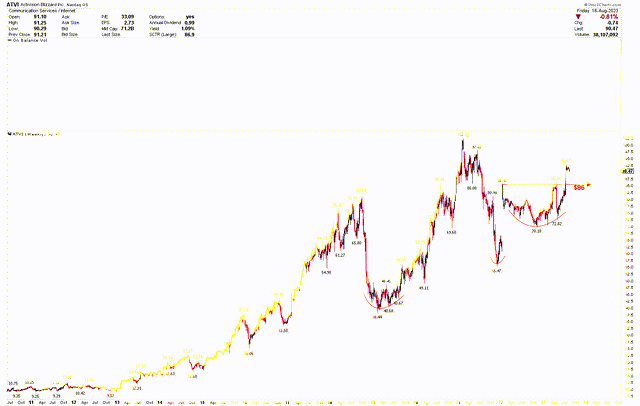

The analysis above shows that the stock’s long-term and short-term perspectives are bullish. Delving deeper into the short-term outlook, the weekly chart highlights the robust bullish momentum characterized by multiple rounding bottoms. The swift recovery in 2019 took shape as a rounding bottom, and intriguingly, a similar rounding bottom pattern is evident in 2023, anchored at the $70.18 low, as illustrated in the chart below. The crucial neckline for this pattern stood at $86, which has since been surpassed, hinting at a potential upward trajectory. Any price pullback to the $86 mark may be considered a prime buying opportunity for long-term investors. Investors might contemplate entering at the current price levels and consider accumulating more positions if any price corrections develop.

Activision Blizzard Weekly Chart (StockCharts.com)

Market Risk

Microsoft’s acquisition plans for Activision Blizzard face numerous regulatory challenges. Any setbacks could influence the stock’s performance, introducing doubts about integration, value capture, and synergistic opportunities. Significant investments from entities such as Berkshire Hathaway have affected the stock’s fluctuations. Depending too much on high-profile investors’ decisions might skew market perceptions, causing unstable price movements.

The gaming sector is marked by its swift transformations, fueled by changing gamer demands and tech advancements. This dynamism and concern about market saturation for specific game categories can challenge Activision Blizzard’s growth. While being seen as a lucrative merger arbitrage prospect, Activision Blizzard isn’t without its risks due to uncertainties tied to deal finalizations. Any disruptions or delays in the merger could spur short-lived price variances. From a technical perspective, the highlighted ascending broadening wedge pattern suggests a possibility for heightened price volatility. While such a pattern could usher in notable price hikes, there’s also a risk of sharp downturns, especially if prices fall below the critical $55.47 support point.

Bottom Line

The ongoing narrative surrounding Berkshire Hathaway’s investment in Activision Blizzard and the subsequent acquisition plans by Microsoft casts a revealing light on the intricacies of the investment arena. Warren Buffett’s unconventional decision to reduce holdings earlier than expected, along with legal verdicts and market responses, has given rise to a dynamic milieu for investors. While Berkshire’s actions provide a valuable strategic lesson, individual investors must use comprehensive research and meticulous analysis. Prominent investments, exemplified by Greenlight Capital and Third Point, demonstrate an optimistic sentiment towards Activision Blizzard, an attitude further accentuated by the stock’s favorable trajectory over time.

Looking through a technical lens, the stock’s price exhibits robust signs of a bullish pattern, evident in the ascending broadening wedge and rounding bottoms formations. An upward breach beyond the $86 mark signifies an additional bullish stride, making the current juncture opportune for investors to acquire the stock. In the event of potential market corrections, investors can progressively build up their positions, augmenting their investment in Activision Blizzard.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.