Summary:

- In my first article for SA, I observed that major trends present opportunities wherein everyday investors can beat the professionals.

- Such is the case with Amazon that is already a “market-share machine” capturing business from competing retailers and delivery service providers.

- Now, with the coming of AI, we see opportunities to layer on another trend that should magnify Amazon’s investment potential.

- Amazon is only the tip of the iceberg; AI holds so much potential that it is now our single biggest collection of holdings.

400tmax/iStock Unreleased via Getty Images

In my very first article for SA, I introduced an investment concept that I hoped would survive the test of time. Namely, I believed then, and still do, that:

“…a more promising approach [to investing] begins with the study of big, developing, scientific, socio-economic, and political patterns and trends that have not yet been reflected in the price of related equities. I will call this approach, “strategic investing””.

Trend #1, Fulfillment & Delivery

We all know it. As opposed to jumping in a car to shop for clothing, furnishings, appliances, supplies, what have you, we can do it all on-line from the comfort of our couch. E-commerce. Take Malva / Mallow, a flower. On a trail walk three weeks ago, my wife and I marveled at a true pink, single-petal species, probably not a cultivar, growing in a forgotten overgrown garden; we had never seen it for sale. Come to find out that it is of English origin. After trying in vain to find a local supplier, I gave up and logged into Amazon (NASDAQ:AMZN), and there it was. I ordered 500 seeds that the company delivered to our doorstep two days later; I’ll plant them next month.

First trend – Retailers of all stripes, (that had previously assaulted Main Street), are having trouble keeping up with Amazon. Moreover, companies that have long been mainstays of delivery services have also found it tough to compete against the company that Jeff Bezos built with its enormous fulfillment centers feeding no end of trucks and planes. Just look at this list of 154 retail bankruptcy filings and ask yourself how many might have been contributed to by in-home shopping / you-know-who. Or harken back two weeks and ponder whether Amazon had anything, however indirectly, to do with Yellow Corporation’s (OTC:YELLQ) demise.

Our feelings notwithstanding, we haven’t quite been able to put our finger on Amazon’s gain in market-share. Reliable shipment / unit numbers are hard to come by and traditional financial analysis is self-referential, that is, it ignores results across competitors. Undeterred, I fetched from SA a few datasets from which to calculate comparative revenue growth rates between Amazon, the three major cartage companies, and a pick of leading big-box retailers – DHL (OTCPK:DHLGY), FedEx (FDX), UPS (UPS), Home Depot (HD), Target (TGT), and Walmart (WMT). Five years of annual financials served my purposes counting back from their current fiscal year-end:

|

Company |

Revenue 5 Yr. Prior |

Revenue Latest |

5-Year Growth |

|

Amazon |

$232.9B |

$514.0B |

121% |

|

Delivery Services |

|||

|

DHL |

$70.8B |

$101.5B |

43% |

|

FedEx |

$69.7B |

$90.2B |

29% |

|

UPS |

$71.9B |

$100.3B |

39% |

|

Big Box Retailer |

|||

|

Home Depot |

$108.2B |

$157.4B |

45% |

|

Target |

$75.4B |

$109.1B |

45% |

|

Walmart |

$514.4B |

$611.3B |

19% |

Here we are close to the proof that we seek. By over two times – 6x in the case of Walmart – on the top line, Amazon is outgrowing its major retail and delivery competitors, a trend that noncomparative internally-focused analyses do not reveal. (For a quick view of the year-by-year growth trends of these companies one only need look to the left of the revenue line on SA’s financial displays.) It’s indisputable that Amazon is a “market share machine” (which, just last week, added insult to injury by announcing that they plan to restart their shipping services unit).

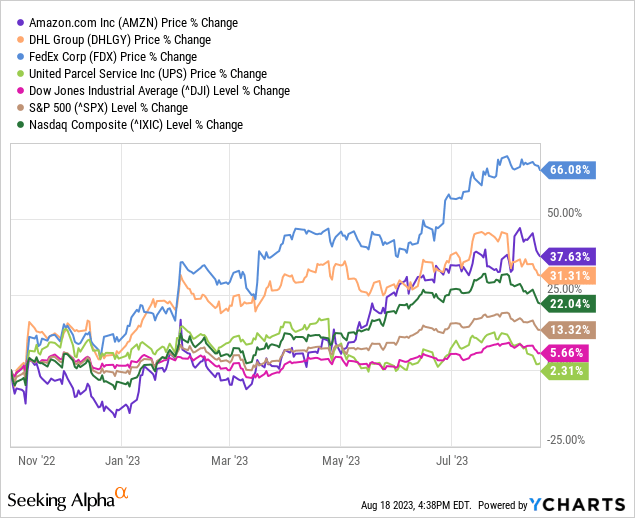

Beyond that, since 11/01/2022 when I made the observation in an SA article, AMZN has outperformed the major equity indexes as well as the two of the three delivery service competitors, FedEx being the exception…

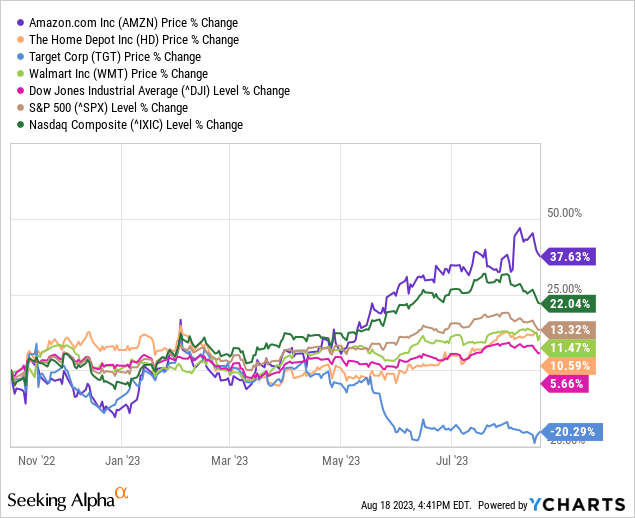

…and here is the same chart for the three big-box retailers where AMZN has outperformed them all.

Trend #2, Artificial Intelligence

In his thought-provoking book, “Notes on Complexity”, Neil Theise discusses a simple metaphor that illustrates the power of merging trends.

[To paraphrase], where the peaks and valleys of two waves combine, they make the valleys deeper and the peaks higher.

Second trend – Amazon AI is built around what is likely the largest database ever assembled of supplier / consumer / product linkages. AWS ranks #1 among cloud providers with a reported 32% market-share ahead of Microsoft (MSFT) Azure and Alphabet Google (GOOGL) with 23% and 10%, respectively. As Amazon expands its fulfillment and delivery footprint it is also expanding its database as evidenced by the data centers it is opening including recently in Phoenix and Israel.

This database already “knows” that my wife and like unusual plant seeds, a certain type of garage racking, hard-to-find deodorants, books, kitchen products, movies, you name it. Multiply little ‘ol us times Amazon’s massive current / potential, supplier / customer base, and it is easy to see no end of expanding permutations and combinations of ‘connections’ upon which Amazon can capitalize with AI. With that in mind, the company has created various teams to:

- Make Alexa smarter.

- Summarize product reviews.

- Optimize supply-chains.

- Predict product popularity.

- Analyze customer needs.

- Detect and prevent fraud.

- Answer service inquiries.

- Help maintain equipment.

Anything to deliver productivity, meaning more output per unit of input, anything. Moreover, to meet its related infrastructure needs, Amazon is considering being the lead IPO investor in ARM Ltd., already one of its cloud technology providers.

At this early point in its evolution, the concept of AI is difficult for some of us to grasp. Therefore, I’ll draw on an out-of-industry example to help illustrate its power. Specifically, News Corp. (NWSA) / Fox is using the technology to produce 3,000 stories a week in Australia. Machine learning and generative AI may bring to an end the days of needing fleets of writers and journalists. As unsettling as it is, the industrial and information revolutions may give way to an “intellectual revolution.”

Trend, Meet Trend

Again, the trend drivers for Amazon are a) Its clear dominance in fulfillment / delivery, coupled with b) Its various efforts to deliver the power of AI as extensions from its enormous and expanding supplier / product / buyer (cloud) database. These two trends and the company’s actual performance compared to its peers foreshadow what lies ahead for its shareholders putting aside the company’s choppy financials:

|

Q3 2022 |

Q4 2022 |

Q1 2023 |

Q2 2023 |

|

|

Revenue |

$127.1B |

$149.2B |

$127.4B |

$134.4B |

|

Gross Profit / Margin |

$56.8B/45% |

$63.6B/43% |

$59.6B/47% |

$65.0B/48% |

|

Operating Income / Margin |

$2.5B/2% |

$2.7B/2% |

$5.0B/4% |

$7.7B/6% |

|

Net Income / Margin |

$2.9B/2% |

$0.3B/0% |

$3.2B/3% |

$6.7B/5% |

|

Operating Cash Flow |

$11.4B |

$29.2B |

$4.8B |

$16.4B |

|

Working Capital |

-$8.9B |

-$8.6B |

-$11.3B |

-$7.8B |

|

Current Ratio |

0.9x |

0.9x |

0.9x |

0.9x |

|

Liabilities to Equity |

2.1x |

2.2x |

2.0x |

1.8x |

As to risks, the biggest one I can foresee is that Amazon draws serious attention from antitrust enforcers. Accordingly, the company should pay attention, IMO, to not directly squeezing its competitors to hard.

I spent part of my career delivering “operating leverage” to major companies, absorbing variable expenses into fixed costs before eliminating the former. Shareholders, and the people who drove these changes, benefited enormously. Today, over twenty years later, that strategy in part informs my excitement about AI. Among just a few other examples:

- Alphabet / Google whose Waymo / AI robotaxis have now been authorized in San Francisco without “safety drivers”; Baidu (BIDU) is doing the same in China.

- Alibaba (BABA) China’s answer to Amazon on whose site one cannot only purchase the standard retail stuff but also industrial products such as locomotives – Amazon, pay attention.

- Leaders in chip fabrication technology and quantum computing such as Lam Research (LRCX) and IBM (IBM) whose solutions are essential for the processing power required by AI.

AI “applications” and the supporting technologies will come to pervade most everything we do. For this reason, it now represents our largest strategic collection of holdings. I don’t like AMZN’s high multiple but I’m looking past it as are many professional analysts; 46 out of 55 have the stock as a “Buy” with an average price target of $170. SA’s quants have it as a “strong buy”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT, GOOGL, BABA, BIDU, LRCX, IBM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Like I do when investing, always do your own due diligence in consultation with a licensed and competent financial/investment advisor who understands your unique needs and puts your interests ahead of their own. Remember, the added considerations in owning foreign securities including those associated with geopolitical risks, ADR sponsorship, foreign withholding taxes on dividends, and higher fees. (All my proceeds from contributing to SA go to charity.)

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.