Summary:

- Activision Blizzard is a top global video game company, forecasted to yield 23-25% higher returns in 2023.

- That gives 10-15% higher returns than the S&P 500, even if the S&P 500 potentially reverses.

- ATVI is a potential arbitrage trade for Warren Buffett and a good fundamental play for Berkshire Hathaway which already held nearly 15 million ATVI shares before the acquisition announcement.

- MSFT has agreed to an acquisition price of $95 for ATVI, and its business value remains at $95 based on fundamentals even if the acquisition does not go through.

Andrew Burton/Getty Images News

Warren Buffett and Berkshire in ATVI

Warren Buffett and Berkshire (BRK) Invest in ATVI: One for Arbitrage, One for Fundamentals.

Activision Blizzard (NASDAQ:ATVI) has been resilient to macroeconomic downturns. In stark contrast to a YoY and YTD decline of -15.68% and -19.71% respectively for the S&P 500 (SPX) as of December 19th, 2022, ATVI has seen a YoY and YTD surge of $23.73% and 12.84%.

This isn’t surprising why ATVI shares rose due to the possible merger between Microsoft (MSFT) and ATVI expected in mid-2023.

Since the merger proposal announcement in January 2022, ATVI stock has surged to north of $86 from its November 2021 low of around $57-60, resulting in a 35% increase from its all-time low. This decline was, at least in part, due to ATVI’s internal scandal. Since then, the stock has retraced and been trading in a range between $71 and $77.

Despite this, ATVI has demonstrated strong fundamentals and good entry points after the stock slid for BRK. This is what Berkshire Hathaway did; they bought shares of ATVI during its Q4 2021 downtrend prior to the merger announcement. Berkshire purchased 14.66M shares for $975 million, resulting in an average price of $66.53 per share. However, Berkshire Hathaway does not engage in market timing; per the same filing, they acquired Apple at an average price of around $177. Instead, they invest in fundamentals and intrinsic value.

Mindshare

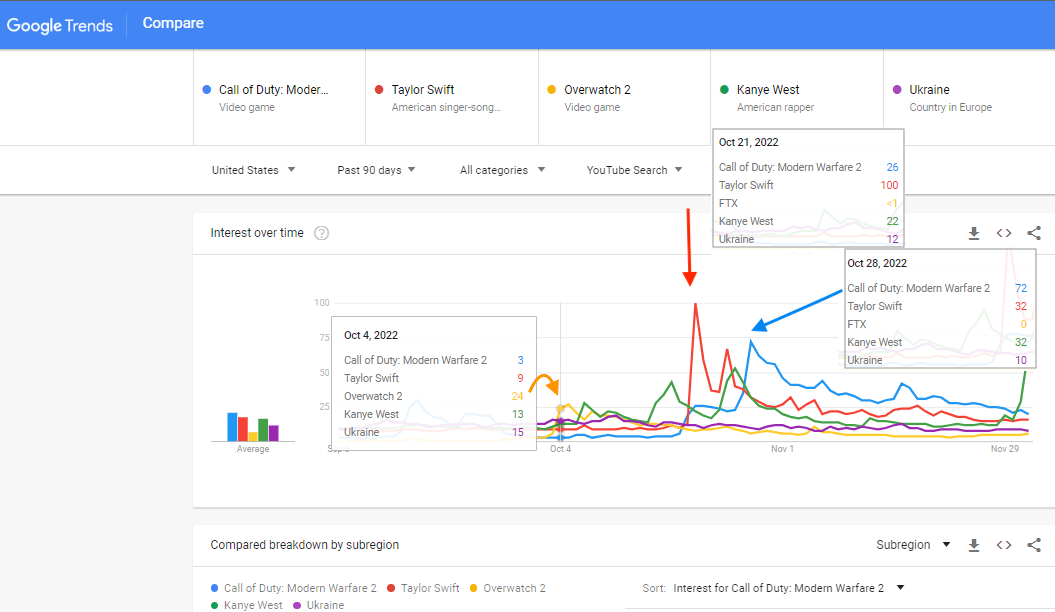

The comparison between gaming and other topics in the mass market, using Taylor Swift as a baseline benchmark, reveals that Call of Duty and Overwatch have strong mindshare, evidenced by their peak search trends on October 28th and October 4th respectively. Meanwhile, Taylor Swift’s tenth studio album release on October 21st has led to an increasing number of Google searches.

Google trend analysis (Google Trend )

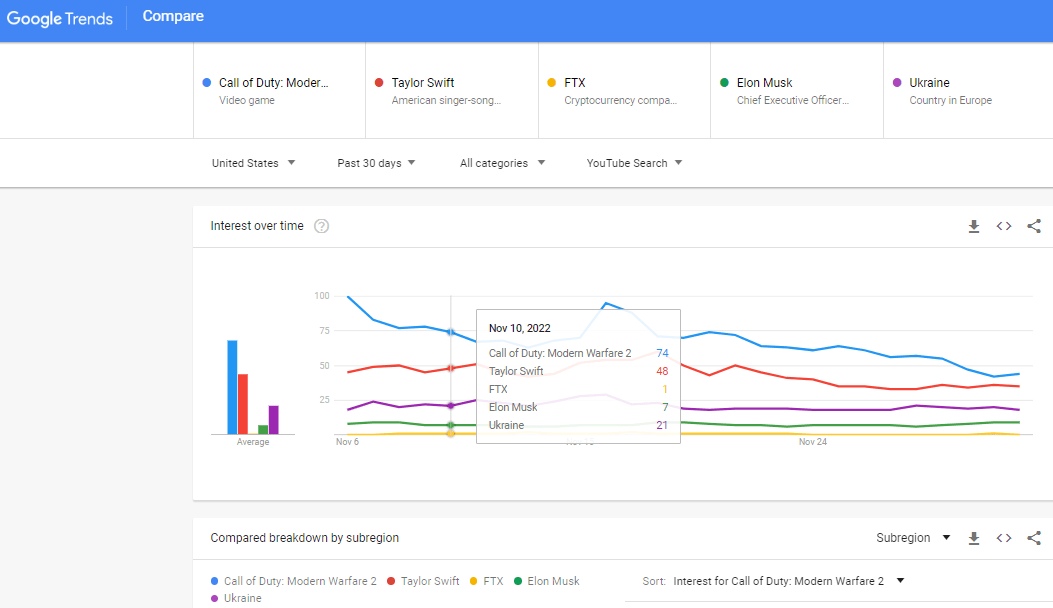

The launch of Call of Duty: Warzone 2.0 on November 16th has generated a lot of excitement, with high search volume and interest ranking demonstrating the strong mindshare held by gaming IPs over other topics. The free-to-play Call of Duty experience is sure to further extend the Modern Warfare universe and its momentum. In contrast, despite the multi-billion collapse of FTX, one of the top crypto exchanges, on November 10th being the talk of the crypto town and capturing headlines in global media, its impact is still largely confined to the crypto community.

Google Trend Analysis (Google Trend)

Gaming market

According to Newzoo’s analytics and research, and data from Statista, the global gaming market and revenue in 2022 has grown to an impressive $196.8B, surpassing PwC‘s forecast of $194.7B by 2025. Despite a slight slump, the console gaming industry has still managed to generate over $52B in revenue in 2022.

MSFT Xbox’s proposed merger with ATVI is no surprise, considering the latter’s success in combining cutting-edge technology with high-quality content creation in AAA games. This has resulted in long-lasting and highly profitable franchises such as Call of Duty, which has made a total of $31 billion. Microsoft is making a strong effort to close the deal, while Sony is trying to put a spanner in the works by lobbying the authorities, arguing that it could lead to an Xbox monopoly and be anti-competitive. Sony has a long history of controlling game distribution through exclusive publishing deals, and they are continuing this trend with the Sony’s PlayStation 5, which features approximately four times as many exclusive titles as MSFT’s Xbox.

Regulatory Risk – false anti-competitive narrative

Regulatory headwinds are getting stronger with the Federal Trade Commission [FTC] in the US suing Microsoft to block the deal, and the UK’s Competition and Markets Authority [CMA] expressing concerns and expanding their investigation. Despite this, many arbitrage ETFs, hedge funds and investors such as Julian Klymochko and Warren Buffett are betting on the deal, and giving it a 70/30 chance of closing. ATVI CEO Bobby Kotick and MSFT Gaming CEO Phil Spencer have both expressed high confidence in completing the deal, indicating that Sony will still retain the highest install base in the console gaming market.

The claim that Call of Duty is anti-competitive is false and lacks credibility.

-

Exclusivity in third-party game publishing deals is an accepted norm across the entertainment and gaming industries. Consequently, Sony’s argument that MSFT would keep Call of Duty exclusive to the Xbox is more hypothetical than valid as MSFT and ATVI could reach a commercial agreement without merging. Additionally, Sony already has a larger selection of exclusive games on their platform than competitors, and MSFT has even agreed to concession deals to provide other companies access to the game IP for 10 years.

-

While ATVI has a talented creative and technical team, they do not have access to any proprietary technologies that separate them from other gaming companies. As such, other game companies still have the potential to create popular games with the right resources and talents. This is in contrast to Nvidia’s proposed acquisition of ARM, which would prevent competitors from accessing the ARM CPU technology.

-

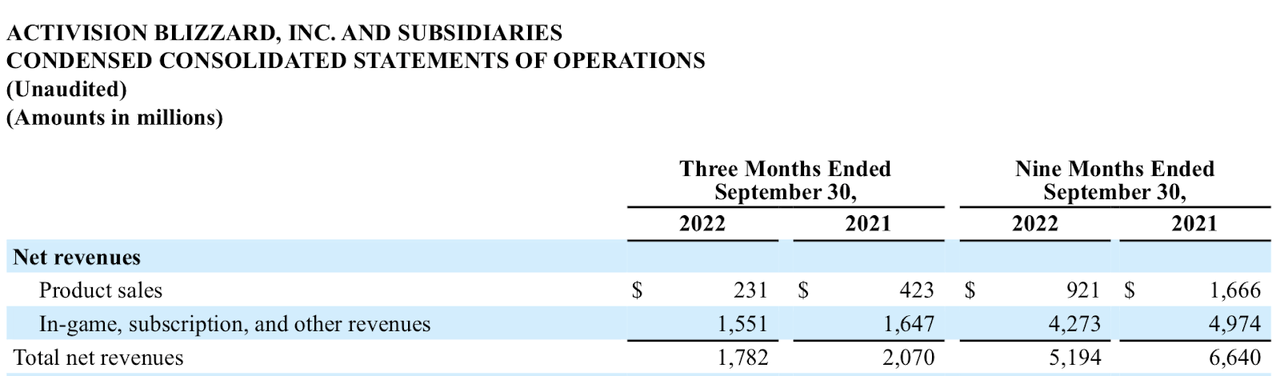

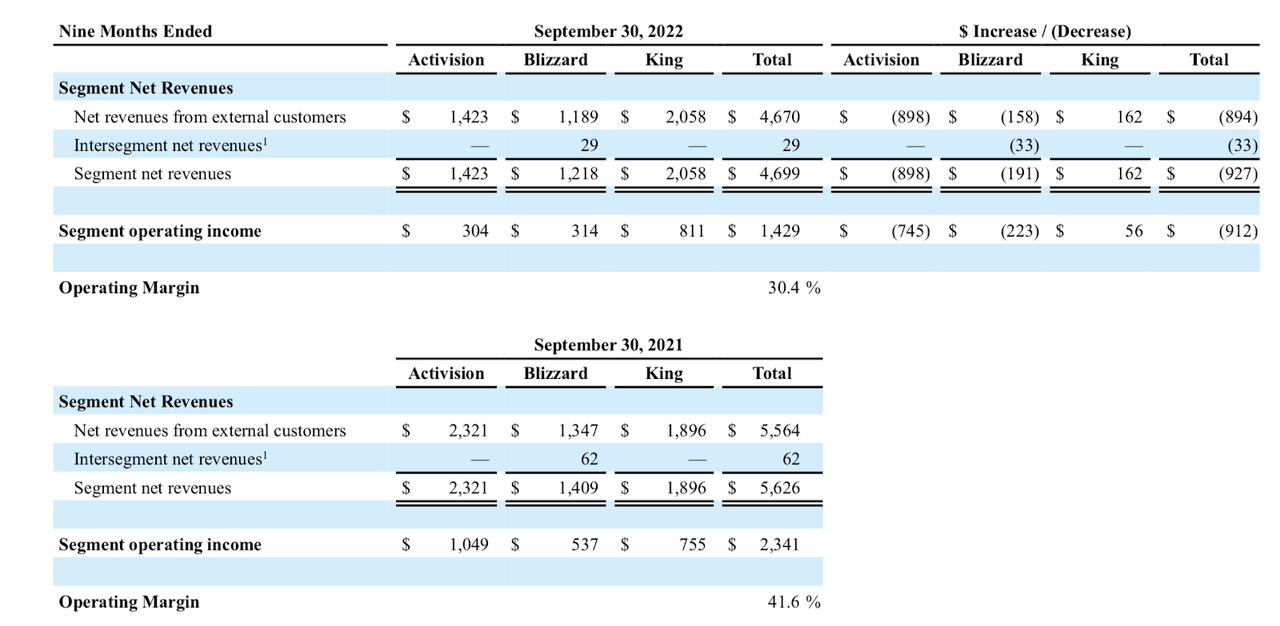

ATVI’s business and revenue have become increasingly diversified over time. During the Q2 and Q3 of 2022, ATVI’s revenue from mobile games surpassed that from PC and console games combined. Mobile accounted for 52% of their third quarter net revenue.

One positive aspect of this situation is that ATVI is set to receive a $3B breakup fee should the deal not complete. This is an indication of how confident and committed Microsoft is to the deal. Furthermore, this new capital will provide ATVI with the opportunity to invest in marketing or other areas to improve their sales and revenue.

ATVI fundamentals

While the Microsoft and Activision merger has become a high priority for many investors, investors should also consider the fundamental value of the company beyond any possible arbitrage trades. A thorough fundamental analysis, similar to that conducted for Netflix during its stock price freefall, can help inform investment decisions and generate potentially lucrative returns in 2023.

In terms of suitable peer comparison, Electronic Arts (EA) is a good candidate due to the similarities in size, game IP library, and finances (revenue) with ATVI, as well as its lack of console hardware lines of business like Sony and Nintendo. This makes Electronic Arts a good comparison point for ATVI, allowing for a better analysis of AAA game development and publishing.

Here are some key points to consider:

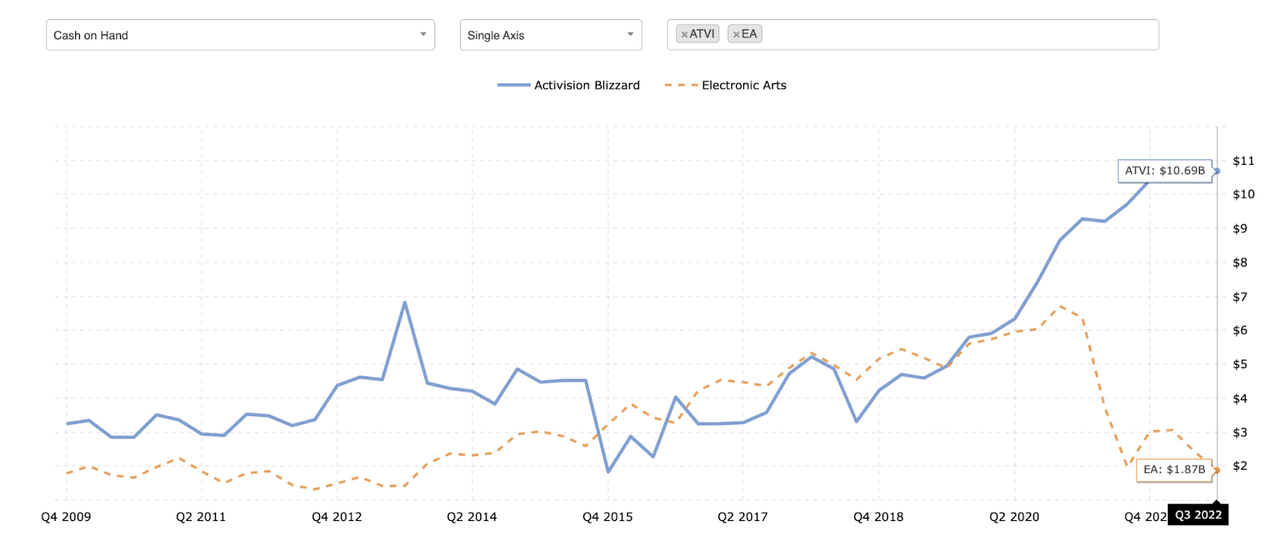

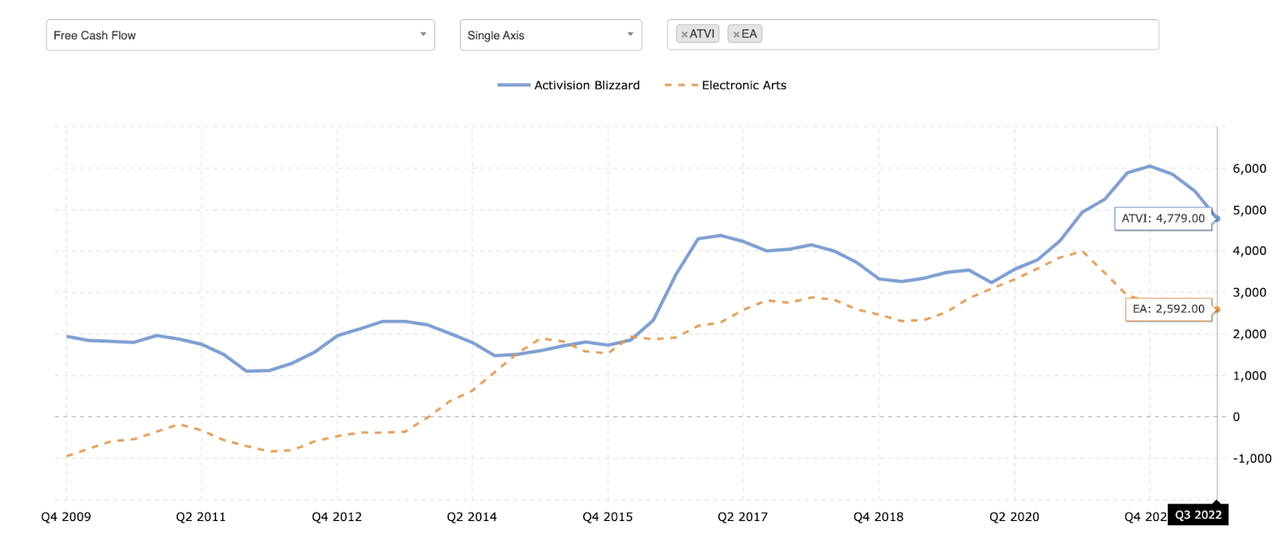

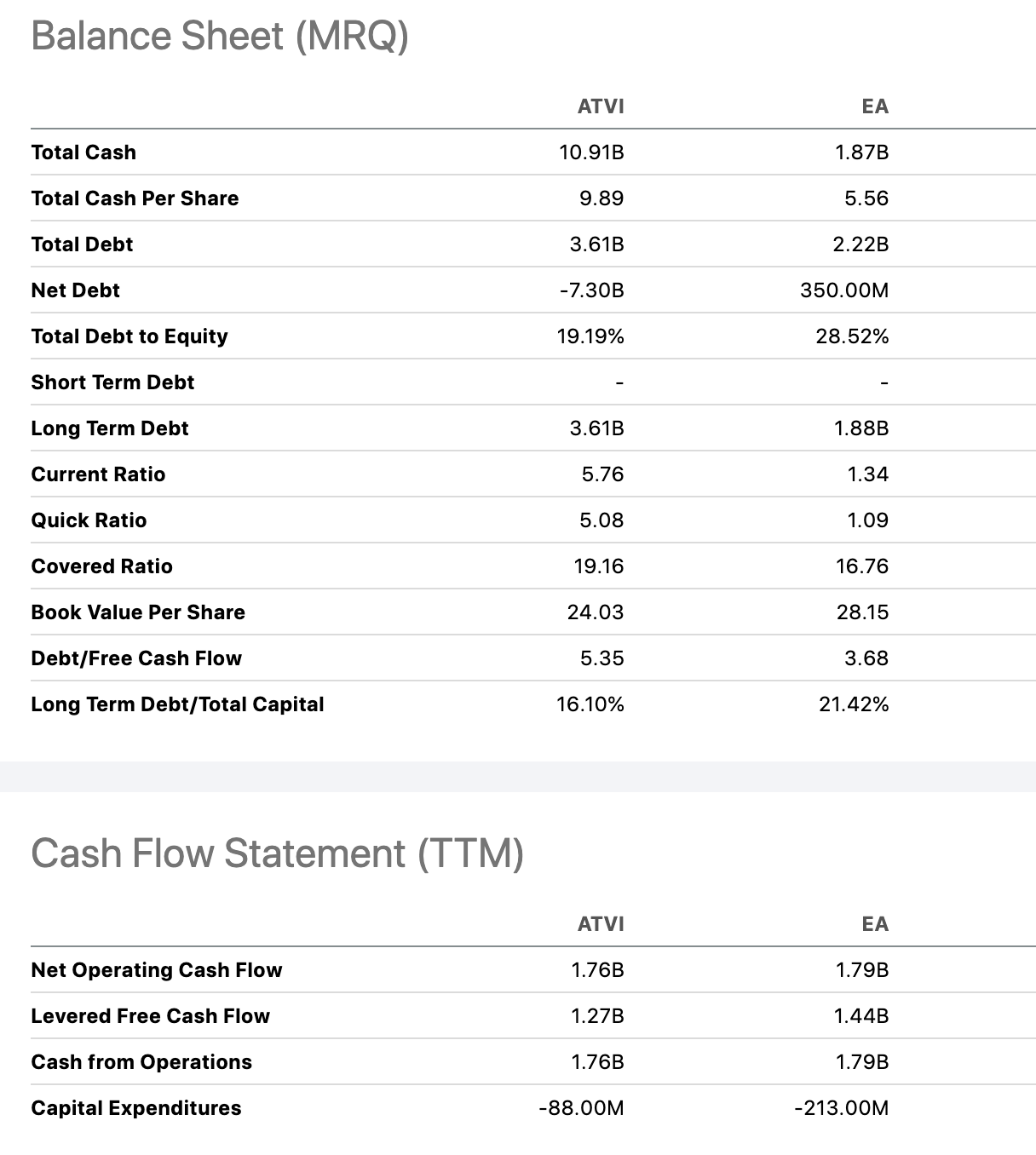

ATVI has a strong financial position and balance sheet, boosting a positive cash flow and impressive cash reserves over the past decade, as well as healthy asset-to-debt and liabilities ratios. This ensures ATVI is well-equipped to handle slower growth and recession periods. Further, its profitability can be utilized to overcome its $3.5B in long-term debt, making its capital assets effectively productive.

Cash on Hand comparison: ATVI & EA (Microtrends) FCF comparison: ATVI & EA (Microtrends)

Balance Sheet and CF: ATVI vs EA (Seeking Alpha)

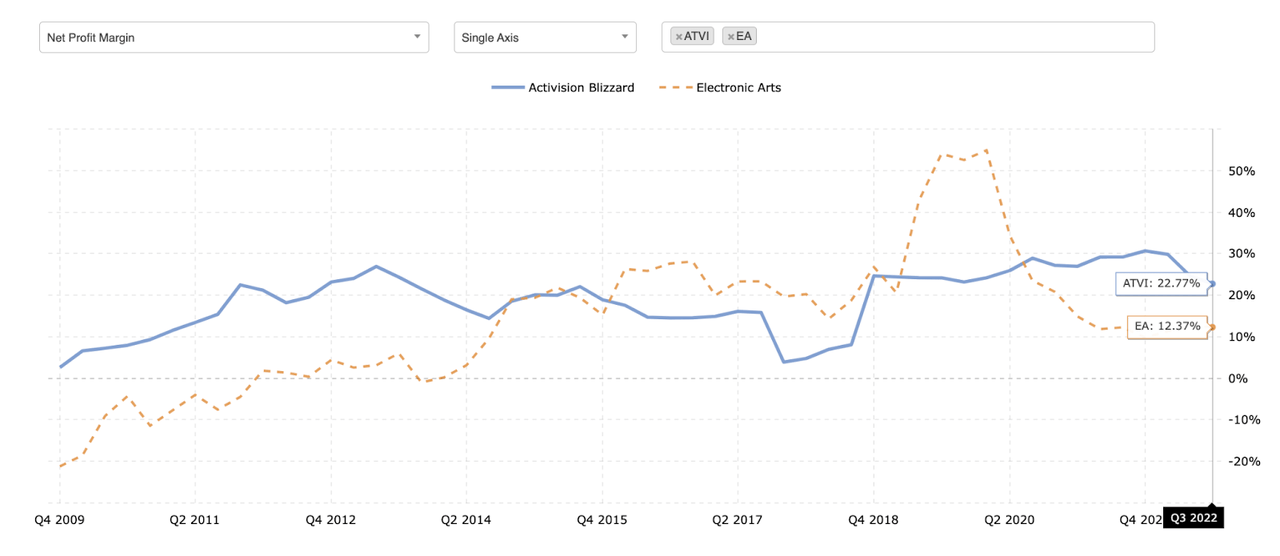

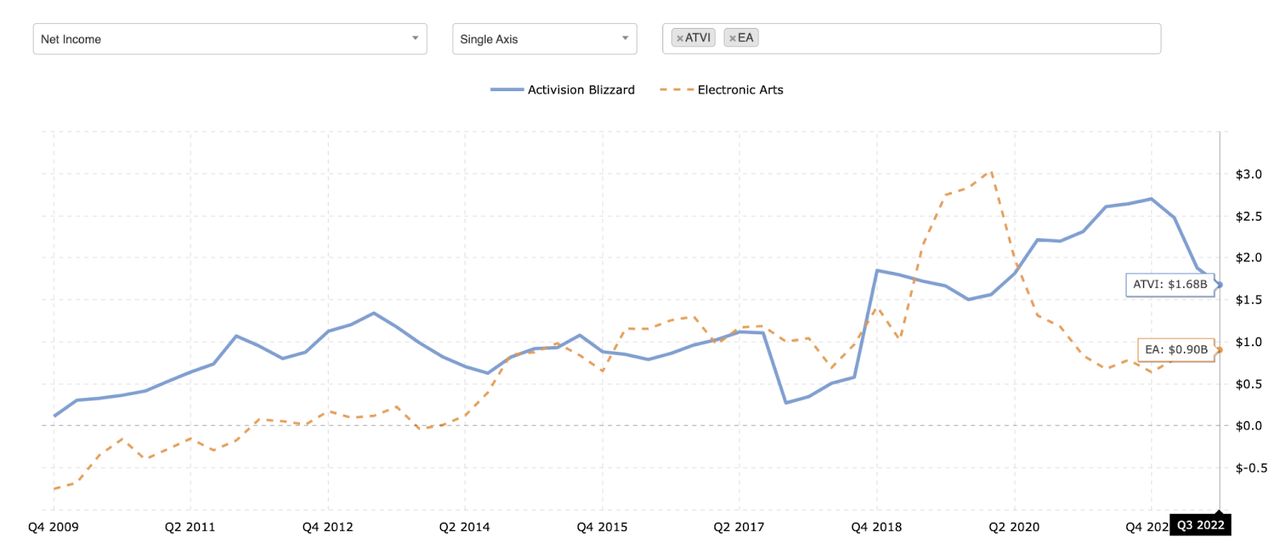

ATVI has shown a more consistent net income margin compared to EA, whose net income margin has gone down to 12.37% from its 5 year average of 24.70%. This decline in margin has had an effect on EA’s growth in net income, resulting in smaller or flat growth.

Net profit margin: ATVI vs EA (Microtrends) Net income margin: ATVI vs EA (Microtrends)

ATVI has had an exceptional year-end due to the releases of Call of Duty: Modern Warfare 2 and Overwatch in October. This record-breaking performance drove ATVI sales to a new high, generating $1B of revenue before any microtransactions. This success is likely to reverse the downward trend in 2022’s revenue and will result in growth for 2023’s revenue. Additionally, Call of Duty has become the top-10 ranking game since its launch, further cementing ATVI’s success. The CoD revenue generated in Q4 will be reported in the company’s earnings and projected to increase further in 2023. This increase is especially anticipated for Call of Duty, where an extra $2-3B is estimated to come from in-game microtransactions, based on the ratio between product and in-game sales.

ATVI net revenue breakdown in Q3 (ATVI Q3 earnings)

Aside from the success of Call of Duty, ATVI has also seen major releases under the Blizzard umbrella. This includes Overwatch 2 with a free-to-play model released in October, as well as Diablo II: Resurrected and Diablo Immortal games on mobile and other platforms in June 2022. The Diablo title has already generated $300m in revenue, creating anticipation for the release of Diablo 4 in June 2023. Diablo III, released in 2012, sold 30 million copies by 2015 and is one of the top 5 PC games. As a result, this highly anticipated 2023 release has the potential to generate top revenue for ATVI.

Mobile is still the King

In Q3, mobile accounted for 52% of ATVI’s net revenue. According to the Q3 earnings, the revenue from King’s mobile games have been growing: “King’s in-game net bookings increased 8% year-over-year, driven by the Candy Crush franchise” and “King’s third quarter segment revenue grew 6% year-over-year, equivalent to low double-digit growth on a constant currency basis. Advertising revenue was consistent year-over-year despite a challenging macro environment.”

ATVI’s diversification and cross-platform strategy has enabled them to take advantage of the high growth in the mobile gaming market, which accounts for $103b out of the global games market of $196b in 2022. Additionally, ATVI owns strong IPs such as Candy Crush. As highlighted in ATVI’s Q3 earnings report, “This November marks the 10-year anniversary of Candy Crush SagaTM, the original and largest title in the Candy Crush franchise. Candy Crush enters its second decade in strong health, with over 200 million monthly active users”.

Net revenue breakdown: ATVI vs Blizzard vs King (ATVI Q3 earnings )

Gaming is recession proof

Electronic Arts is a large-cap gaming company and it’s a peer to ATVI. In 2022, EA stock’s 1-year performance decreased by -8.32% compared to larger drawdowns of the S&P 500 and other large technology companies (FAANG stocks) as of December 23rd, demonstrating gaming’s overall strength and resilience.

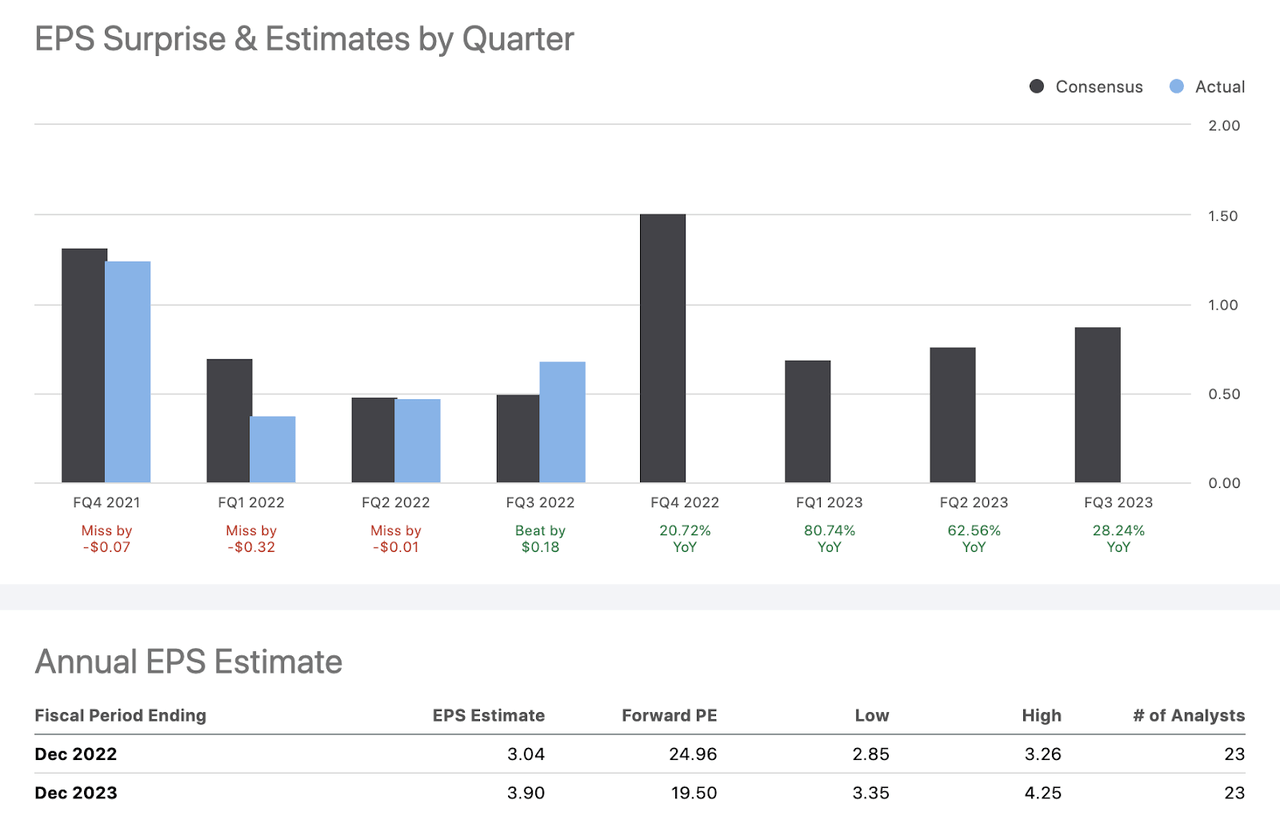

Increased estimated earnings per share in 2023

Based on the information provided, estimated EPS is expected to reach 3.9 in 2023 – a 13% increase from 2021’s EPS of 3.47 and a 28% jump from 2022’s estimated EPS of 3.04. With ATVI’s 5 year average P/E ratio of 24.37, this could lead to a target price of $95 in 2023, although a contraction of P/E due to the economic recession may decrease this by 10% to a target price of $85.

ATVI EPS estimate for 2022 and 2023 (Seeking Alpha)

Due to the pandemic, the growth rate and demand seen in 2020 and 2021 were higher than expected and therefore not expected to be sustained. As a reference, ATVI’s 10-year compound annual growth rate [TTM] is 10.63%. To ensure a more even distribution of growth, the estimated EPS can be adjusted by reducing the growth rate of 2020.

|

2019 |

2020 |

2021 |

2022 est |

2023 est |

|

|

EPS |

1.96 |

2.82 |

3.44 |

3.04 |

3.9 |

|

YoY |

– |

44.62% |

21.99% |

-11.63% |

28.28% |

|

Adj EPS |

1.96 |

2.646 |

3.175 |

3.493 |

3.9 |

|

Adj YoY [EST] |

– |

35% |

20% |

10.2% |

11.5% |

In the event that the acquisition deal does not go through, ATVI will receive a breakup fee of $3B which could be used to fund marketing and product development for up to 2-3 years. This could lead to an estimated additional revenue of $6-7B, but in order to achieve this goal, the funds must be allocated carefully to match the game release cycle. Even if the merger fails, the relationship between ATVI and MSFT could still grow stronger, resulting in more strategic partnerships that could further increase ATVI’s revenue.

Takeaways:

ATVI stands to gain great returns due to its mobile market growth and library of IPs. As such, the current price target of $95 is based largely on the Microsoft acquisition deal, making it an attractive merger arbitrage opportunity. The deal has been estimated to have a 75% chance of closing, but there remain political and regulatory risks associated with the US, UK, and EU that could prevent the deal from going through.

Some analysts are predicting that if the deal does not close, ATVI’s stock price could drop by 20%, back to the pre-merger announcement levels of $60-68. This could be seen as a good buying opportunity for investors interested in the business fundamentals, as there is predicted to be a solid revenue growth trajectory in 2023 based on the game launch pipeline. However, investors should carefully consider their investment goals and whether they are more interested in the merger arb trade or the fundamentals of the business. Warren Buffett has obviously taken into account both aspects before investing such a large sum of money, so investors should do the same.

That said, with the many macro uncertainties that could affect ATVI’s revenue growth in 2023, such as rising interest rates, inflation, the potential for a recession, and the ongoing war in Ukraine, it’s important for investors to consider all of these factors before making any investments. They should only invest in stocks and assets with a high level of confidence and conviction, and should be prepared for volatility and large drawdowns in 2023.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition.

Disclosure: I/we have a beneficial long position in the shares of ATVI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.