Google: 5 Reasons To Buy

Summary:

- 1. Google Has A Monopoly On Search.

- 2. Competitive Moat Supports Excellent Profitability.

- 3. Earnings Upside.

- 4. The Buyback Bonanza Continues.

- 5. Google Is Cheaper Than The Market.

Justin Sullivan

Thesis

I remain bullish on Google (NASDAQ:GOOG) (NASDAQ:GOOGL) stock, as I see the weak share price performance in 2022 as a buying opportunity driven by macro concerns. In this article, I highlight five arguments why I believe Google stock should not be missed in an investor’s portfolio: 1) Google has a monopoly on search, 2) competitive moat supports excellent profitability, 3) earnings upside, 4) the buyback bonanza continues, and 5) Google is cheaper than the market.

For reference, Google stock is down about 38% YTD, as compared to a loss of approximately 20% for the S&P 500 (SP500).

1. Google Has A Monopoly On Search

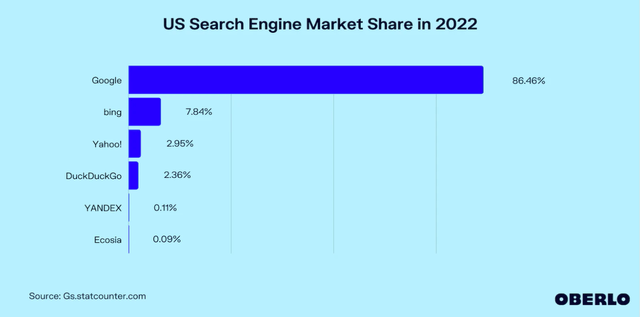

No matter how you dice and slice the market, Google has a monopoly on internet search. According to data compiled by Gs.Statcounter, in 2022 Google enjoyed an 86.46% market share in the US – with similar relative strength across the entire world. Regardless of which language you speak, be it Italian, German or Portuguese, using Google is how you discover information.

For reference, Bing, which is the second largest search engine in the west (excluding China), has only a market share of 7.84%, and Yahoo! has a market share of less than 3%.

Although Google’s dominant position in search makes the company vulnerable to anti-trust campaigns, investors should consider that the superiority of Google’s search results and algorithms defend against the argument that Google would block competition and innovation. Or in other words, Google is not a forced monopoly, but a natural one.

Source: Gs.statcounter; Graph: Oberlo

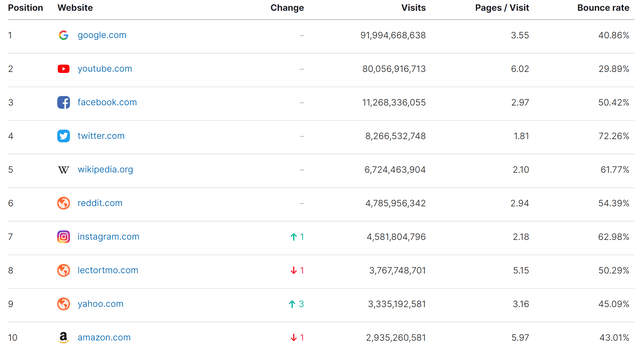

In addition to information search, Google has also the dominant position in video search and entertainment – with YouTube. As of November 2022, Google’s YouTube ranks as the world’s second most visited website – only behind Google itself. And notably, Google has approximately x7 as many website visits as Facebook – with better engagement and a lower bounce rate.

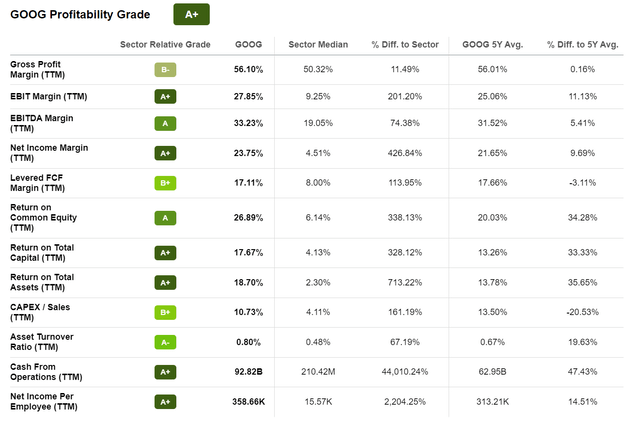

2. Competitive Moat Supports Excellent Profitability

With Google’s superior search algorithms and YouTube’s strong network effects based on social connection and content scale, the company has an almost impenetrable competitive moat, which supports excellent profitability. For the trailing twelve months, Google has managed to claim a gross profit margin of 56%, which is 11% higher than what is the median for the technology sector. Google’s respective operating income margin (EBIT reference) was 27.9%, which is a 200% premium to the technology sector median.

3. Earnings Upside

Google’s net income for Q3 2022 fell by about 26% year over year, to $18.9 billion. This negative growth certainly pressured bullish confidence. But investors should consider that most of this softer than expected performance is attributable to the macro environment, and a stronger focus on cost discipline going forward could support earnings upside. In that context, Google has already announced cost saving programs and overall more financial discipline.

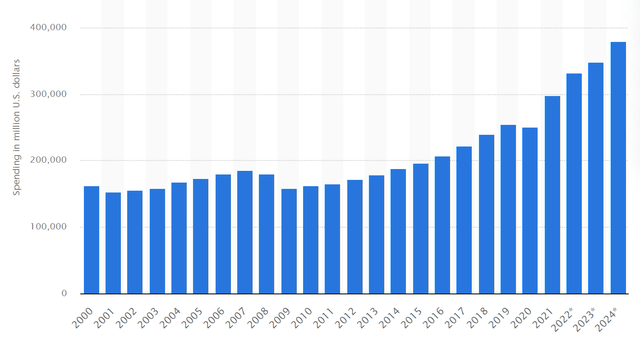

As the graph below highlights, the strength of the advertising market is clearly correlated to the strength of the economy. But taking a long term perspective, advertising spend remains a growth vertical. Accordingly, Google’s earnings should gradually recover once the macro-environment turns more supportive.

4. The Buyback Bonanza Continues

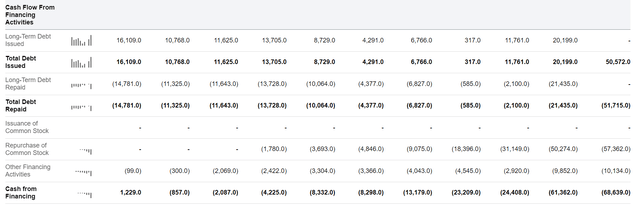

Supported by excellent operating cash flow ($92.8 billion for TTM), investors should consider that Google has repurchased approximately $57.4 billion worth of shares within the trailing twelve months – which implies an equity yield of almost 5% based on a $1.1 trillion billion market capitalization.

In Q3 alone, Google repurchased $15.4 billion worth of shares. And as long as Google’s operating cash flow remains strong, and shares remain priced attractively, I am confident that the share buyback bonanza can continue (Google still has $86.9 billion of net cash on the balance sheet).

5. Google Is Cheaper Than The Market

If an investor would judge a company’s valuation merely based on P/E multiples, then Google – despite the company’s quality – is only slightly more expensive than the S&P 500, priced at a one year forward P/E of approximately x17.5 as compared to x16.7 for the S&P respectively. Note, however, that most companies included in the S&P 500 have a considerable debt position, while Google has almost $90 billion of net cash. Accordingly, Google’s slightly larger earnings multiple is on an unlevered basis actually cheaper than the respective multiple for the S&P 500.

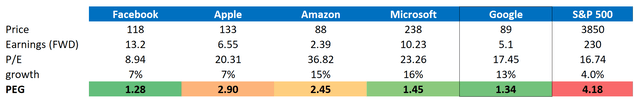

Moreover, as compared to the FAAMG universe (I do not include Netflix (NFLX)), Google’s P/E of x17.5 is the second lowest, only behind Meta Platforms (META).

But, as I pointed out previously:

[merely] looking at [P/E] multiples is a very superficial analysis. And I argue it doesn’t hold much value …

… To get an accurate relative multiple comparison, a valuation model should account for a company’s growth. And I argue the PEG ratio does an excellent job to capture the relative tradeoff between a company’s current stock price, current earnings and expected growth. As defined by Investopedia:

The PEG ratio is used to determine a stock’s value while also factoring in the company’s expected earnings growth, and it is thought to provide a more complete picture than the more standard P/E ratio.

The PEG ratio is calculated by simply dividing a company’s one-year forward P/E ratio by the 3-year CAGR expectation. To estimate the CAGR expectation, I believe an analyst should anchor on analyst consensus estimates.

Most notably, Google’s ratio of x1.34 is the second lowest amongst the FAAMG peers and looks very attractive. When compared to the x4.18 PEG for the S&P 500, Google’s valuation looks incredibly cheap.

Analyst Consensus EPS; Author’s Calculation

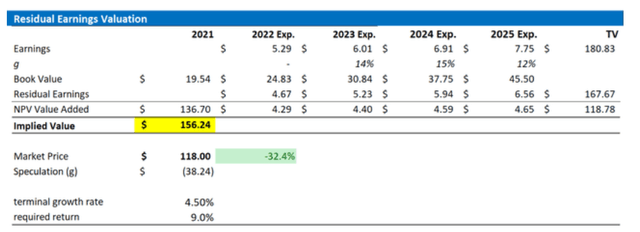

Long term, I remain bullish on Google stock, and I continue to estimate a $156.24/share implied valuation.

Analyst Consensus EPS; Author’s Calculation

Risks

As I see it, there has been no major risk-updated since I have last covered GOOG stock. Thus, I would like to highlight what I have written before:

First, a worsening macro environment could negatively impact Google’s advertising business. However, I personally see any recessionary impact on advertising as transitory. Perhaps, a recession could even help Google’s advertising business, as marketers are pressured to think about advertising ROI – where search has an undisputed advantage over traditional advertising. With regard to Google’s Cloud business, I do not see any material slowdown as likely – even in a recession.

Second, investors should monitor competitive forces in the cloud industry. I highlighted Google’s operating margins for cloud are significantly lower than margins for AWS and Azure. Personally, I believe the margin gap will be closed, as Google’s PaaS focus is a high-margin business opportunity. However, as competition amongst Cloud competitors intensifies, there’s reason to doubt that >30% operating margins are unsustainable.

Third, arguably most of Google’s current share price volatility – especially to the downside – is driven by investor sentiment towards stocks. Thus, it’s likely that Google stock experiences significant volatility even though Google’s business outlook remains unchanged. Furthermore, higher inflation and rising-real yields impact Google’s stock price, as the higher discount rates decrease the net present value of long-dated cash flows.

Fourth, Alphabet’s size and scale are too difficult to ignore for antitrust officials. While the company has managed to defend past lawsuits in the EU and the U.S., the anti-competition allegations against Alphabet could accelerate. For interested readers, there was an amazing article written by a Seeking Alpha analyst: Google Stock: This Regulatory Pressure Is A Disaster (NASDAQ:GOOG). I highly advise reading the article.

In addition, I have written a more detailed article on Google’s risk profile here.

Conclusion

Buying Google stock below $100/share is an excellent deal, in my opinion. And in this article, I highlighted five arguments why I believe Google stock should not be missed in an investor’s portfolio: 1) Google has a monopoly on search, 2) competitive moat supports excellent profitability, 3) earnings upside, 4) the buyback bonanza continues, and 5) Google is cheaper than the market. Google is a Strong Buy.

Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.