Summary:

- Acuity is seeing strong sales growth.

- While gross margins are down, the company is taking steps to minimize the bottom-line impact through price increases and improving operating efficiency.

- The stock is trading at a discount to its historical levels and can re-rate as the supply chain constraints ease.

monsitj/iStock via Getty Images

Investment Thesis

Acuity Brands (NYSE:AYI) posted strong sales growth in the last two quarters fueled by strong demand across its end markets, as well as price hikes across its product portfolio. The company is navigating the current supply chain disruption well through its supplier relationships, prioritizing access to components over cost, and redesigning its product portfolio based on available components. While the company’s gross margin has been hit, it has been able to minimize operating margin and bottom-line hit through price increases and increasing operating efficiency. The stock is trading at a discount to its historical valuations and is expected to post good EPS growth in the current year and the next. I believe as the supply chain constraints ease, the stock can re-rate in line with historical levels and can see a low double-digit upside. Hence, I have a buy rating on the stock.

Last Quarter Earnings

Acuity Brands reported net sales of $909.1 mn (up ~17% YoY) in Q2 2022, beating the consensus estimate of $884.6 mn. During the quarter, adjusted EPS increased by 21.2% year over year, from $2.12 in Q2 2021 to $2.57 (vs. the consensus estimate of $2.37). The increased demand from end markets, higher price realizations, and ~4% YoY inorganic growth contributed to the increase in net sales during the quarter. Although adjusted operating profit increased 13% year over year, adjusted operating margins fell 50 basis points to 13.5% in Q2 2022 from 14% in Q2 2021 due to lower gross profit margins, which were partially offset by leveraging operating expenses. Despite cost pressures from freight and labour, adjusted EPS increased during the quarter due to sales growth, price hikes, and a $0.06 positive impact from the company’s share repurchase program.

Sales to benefit from higher inventory levels, price increases and strong demand

Acuity has been investing in services to prioritize deliveries to its customers, as well as in product vitality to develop innovative products. This was made possible by the company’s focus on maintaining strategic supplier relationships, prioritizing speed and access over component cost, and redesigning products based on the available components. As a result, the company was able to increase sales despite escalating inflation and logistical constraints. The Acuity Brand Lighting and Lighting Controls (ABL) segment saw a 17% increase in sales for the quarter, due to strong revenue growth across independent sales networks, corporate accounts, indirect sales networks and other channels. This was partially offset by a slight drop in retail sales due to delayed transit, which resulted in longer lead times.

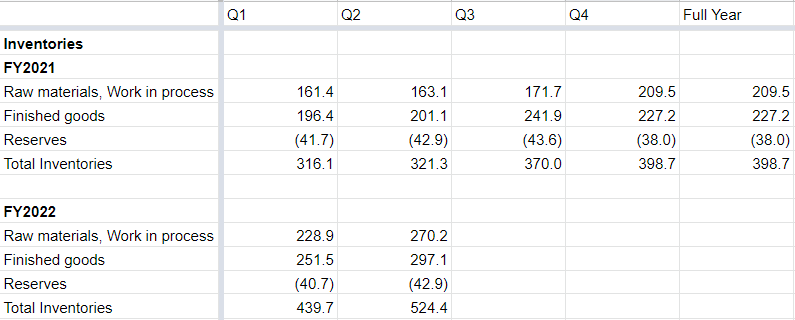

Acuity Brands Inventory Levels (USD millions) (Company Data, GS Analytics Research)

Due to the long lead times associated with finished goods, the company has intentionally increased its inventory levels. The purchased finished goods are taking about 50 days to reach the company’s facilities, compared to 20 days previously. In addition, the company is attempting to secure more electronic components to insulate itself from market unavailability and efficiently service the demand in the end market. In the first half of 2022, cash flow from operations decreased by $85 million as the company increased its investment in working capital, primarily inventory, to support growth and prevent production facilities from experiencing supply shortages.

The company’s financial framework for the fiscal year 2022, which was released at the end of the fiscal year 2021, has remained unchanged. The ABL segment is expected to grow by high single digits, while the ISG (Intelligent Spaces Group) segment is expected to grow by the mid-teens. For the full year 2022, the growth in both segments should result in overall growth in the high single digits and low teens. Strong inventory levels, end-market demand, and price increases are expected to support growth and should offset supply chain constraints and other macro headwinds.

Near term margin headwinds but good execution

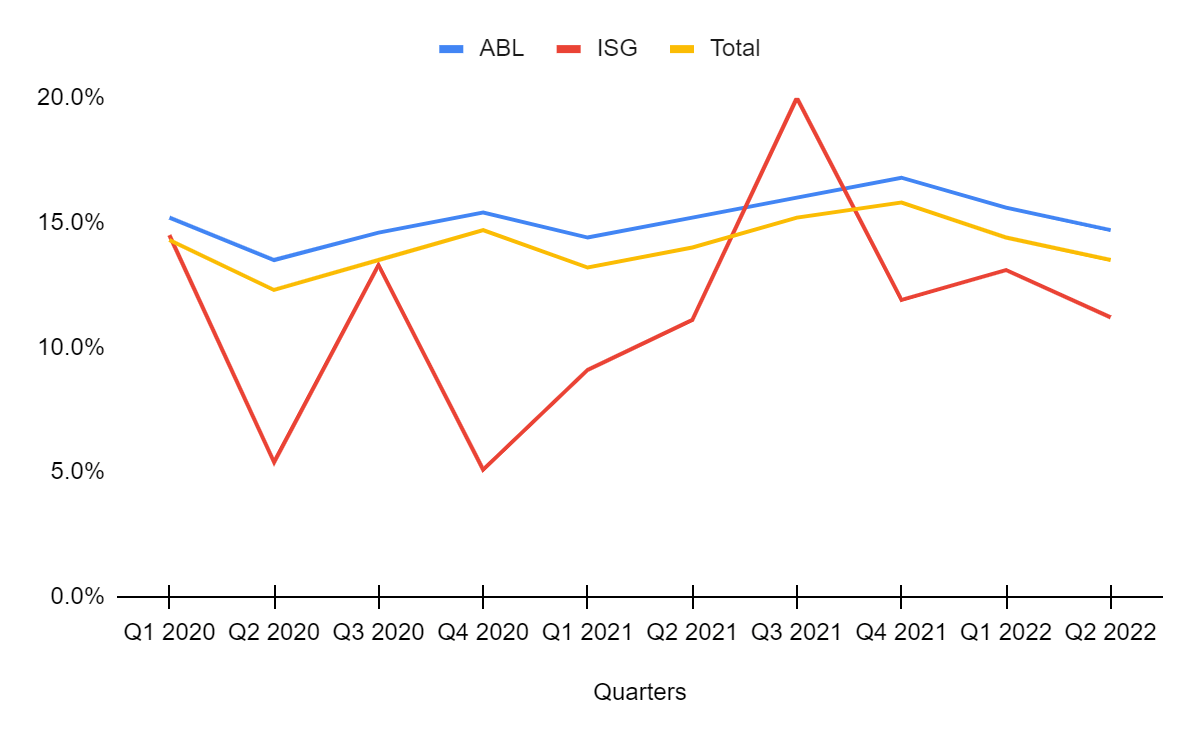

Post-Covid, Acuity’s adjusted operating margin increased from 12.3% in Q2 2020 to 15.8% in Q4 2021. However, the company’s adjusted operating margin has seen a decline over the last two quarters as a result of inflation and supply chain headwinds. Due to the impact of freight, commodity, and labour costs the gross margin decreased from 43.4% in Q2 2021 to 41.7% in Q2 2022. To compensate, the company has been raising prices in tandem with productivity gains and leveraging operating expenses. This year, the company was able to strategically implement six price increases. The adjusted operating profit increased by 13% YoY in Q2 2022, from $109 million in Q2 2021 to $123 million in Q2 2022 whereas the operating profit margin declined 50 bps from 14% in Q2 2021 to 13.5%.

Acuity Brands Segment and Total Margins (Company Data, GS Analytics Estimates)

Looking forward, while the company is planning additional price increases to offset inflationary headwinds to some extent, gross margins should remain under pressure in the second half of 2022. This story has been consistent across most of the industrial sector. However, one thing interesting about Acuity Brands is how it was able to take steps like improving operating efficiency as well as increasing prices to minimize the bottom-line impact.

While supply chain constraints and extraordinarily high inflation are near term concerns, they cannot continue forever. Given the company’s excellent execution in limiting its bottom-line impact and raising prices, I believe the company will emerge stronger once these headwinds subside.

Valuation and Conclusion

Over the last five years, Acuity Brands has traded at an average forward adjusted P/E of ~15.65x. The stock is trading at a slight discount to these levels due to near term margin concerns. However, once these concerns fade, I believe the stock can trade in line with its historical levels. According to consensus estimates, the company is expected to post an EPS of $11.79 for FY22 and $12.74 for FY23. If we assume, the stock is able to get a P/E multiple of 15.65x on its FY23 earnings of $12.74, we get a target price of ~$199 or ~12.6% upside from the current levels. I believe Acuity Brands is a quality company and the risk-reward is favourable at the current levels. Hence, I have a buy rating on the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.