Summary:

- Acuity Brands’ top line growth is exceptional, owing to significant acquisitions made last year and a continued demand recovery.

- The management is investing heavily in inventory in order to mitigate risks associated with supply chain issues.

- It is facing temporary headwinds affecting its margins, making this stock unattractive at today’s price.

- The management is still on the lookout for a good M&A which is a potential catalyst that could reintroduce some value to this stock.

- Acuity Brands is trading at a weakening support and is trading fairly with no significant discount.

Eoneren/E+ via Getty Images

Acuity Brands, Inc. (NYSE:AYI) is one of the leading technology companies in the industrial sector. The company specializes in providing advanced lightning solutions and designs intelligent space which helps customers achieve cost efficiency. AYI operates under two reportable segments: ABL segment and ISG Segment. The company highlighted a few acquisitions last year such as ams OSRAM’s and Rockpile Ventures, and from there we have seen a positive revision on its top line consensus for next fiscal year which is currently at $3.88 billion compared to $3.45 billion in April last year.

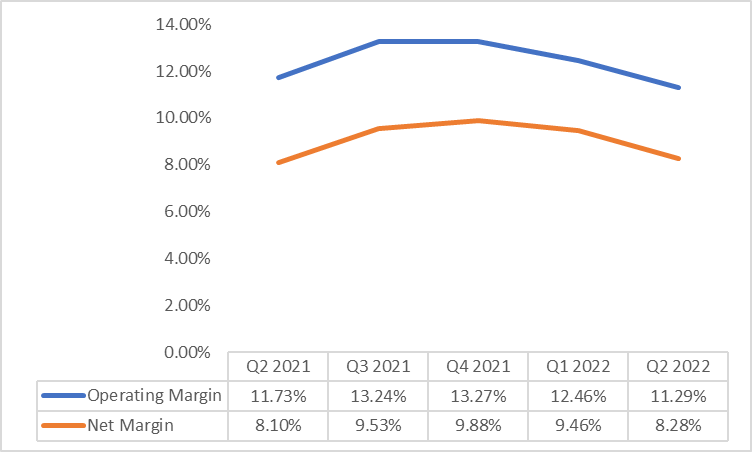

However, AYI is operating in a more challenging environment than ever before, including rising 10-year yields, rising mortgage rates, and rising input costs for steel and aluminum. This resulted in a declining operating margin of 11.29% and a net margin of 8.28% this Q2 2022. Additionally, its short-term risks on its declining profitability are also ignited as the company generated a concerning debt to equity ratio of 0.26x compared to its 5 year average of 0.22x. Although the company remains liquid, with a declining cash flow of $43.6 million in the most recent quarter and an unfavorable valuation, I believe AYI is headed for a new low, which may provide a favorable pullback opportunity.

Posted A Strong Top Line

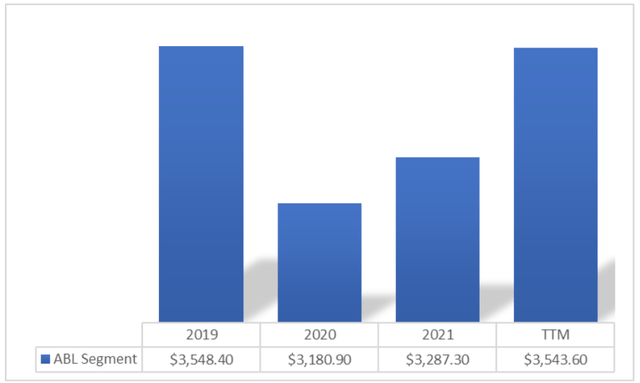

AYI reported a strong total revenue of $909.1 million in Q2 2022, up 17.06% from $776.6 million in the same quarter last year, as management sees continued demand recovery and positive results from its recent acquisitions. Both of its segments experienced positive year-over-year growth this quarter, with the ABL segment generating $863.1 million, up 17% from $736.8 million in the same quarter last year, and the ISG segment generating $50 million, up 15% from $43.3 million last year. However, while looking at its yearly figure, we can see that its main revenue contributor, ABL Segment, is still below its pre-pandemic level of $3,548.40 million recorded last fiscal 2019.

AYI: ABL Segment’s Total Revenue Trend (Source: Company Filings. Prepared by InvestOhTrader. Amounts in Millions)

This is a bit of a concern especially with the increase in its workforce to 13,500 from 12,000 recorded in fiscal 2019. However, the management provided an update about their improving product portfolio, which may help to break its current ABL’s revenue trend.

Finally, as I said last quarter, our engineering teams continue their Herculean efforts to redesign products to the available components. At the same time, these teams have also managed to introduce around 220 new or significantly upgraded lighting and lighting control products over the last two years. Source: Q2 2022 Earnings Call

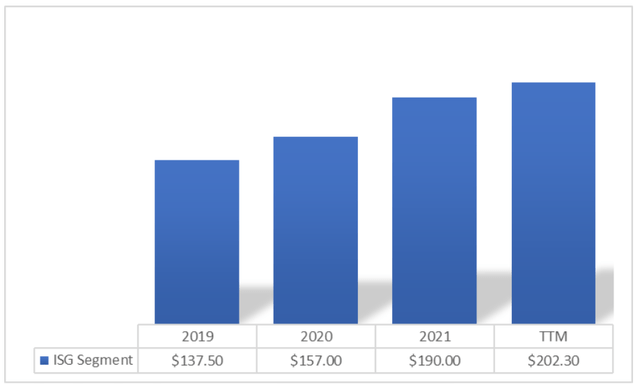

Contrary to its main revenue contributor, its space segment, which accounts for 5% of its total revenue, shows strong momentum and this is thanks to its recent acquisitions.

AYI: ISG Segment’s Total Revenue Trend (Source: Company Filings. Prepared by InvestOhTrader. Amounts in Millions )

According to the management, they are seeing continued growth as a result of one of their brands, Distech One, securing significant projects.

In the last quarter, Distech One projects across North America and Canada and saw significant project wins and key verticals including in education, commercial, infrastructure and data centers. Distech is now a key supplier to two of the largest cloud providers. We also continue to develop the Atrius platform, including progress on Atrius building insights, and we expect to expand the portfolio over time. Source: Q2 2022 Earnings Call

On the Contrary

AYI: Declining Margin Trend (Source: Data from Seeking Alpha. Prepared by InvestOhTrader)

Along with its declining operating and net margins, AYI reported a declining cash flow from operations of $43.6 million, down from $88.7 recorded the same quarter last year. This is due to their investment in inventory, which has reached a record of $546.8, with the goal of resolving their current supply chain issues. Hence, this resulted in the bloating of its cash conversion cycle of 63 days, higher than its 5 year average of 55 days and to its declining FCF margin of 3.17%, down from 10.16% from the same quarter last year. While this inefficiency, in my opinion, is only temporary, this working capital settlement may consume the budget allocated to share buybacks and potential expansion in the future. In fact, there is a risk of tighter competition with GE Current acquiring Hubbell’s Incorporated’s commercial and industrial (C&I) lighting business, which may potentially gain share in the company’s TAM amounting to $20 billion. This is especially concerning for the company, as it has no meaningful M&A this H1 2022.

Fairly Valued

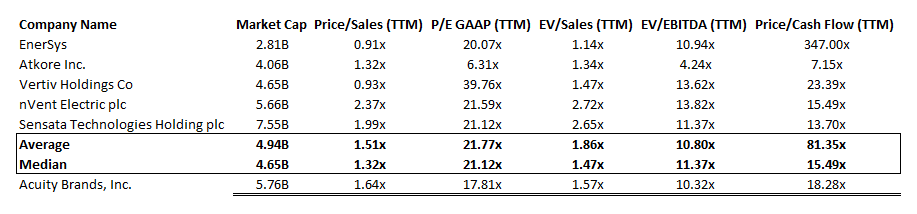

AYI: Relative Valuation (Source: Data from Seeking Alpha. Prepared by InvestOhTrader)

Looking at the table above, we can see that the AYI’s current multiples sentiment varies from its P/S ratio to its P/CF ratio. While its trailing P/S of 1.64x is higher than the average of its peers, it is slightly lower than the 5-year average of 1.64x. Moving forward to its P/E ratio of 17.81x, it is considered to be cheap compared to its peers’ average, however, it seems to be just fairly valued compared to its 5-year average of 18.87x, despite a significant drop in its price. Additionally, both of its trailing EV/Sales of 1.57x and EV/EBITDA ratio of 10.32x tells the same story with their respective 5-year averages of 1.60x and 10.40x that the company does not provide a significant discount at today’s price. Lastly, AYI generated a concerning P/CF ratio of 18.28x which is currently expensive compared to both its peers’ mean of 15.49x and 5 year average of 13.83x.

Waiting for a Better Brand

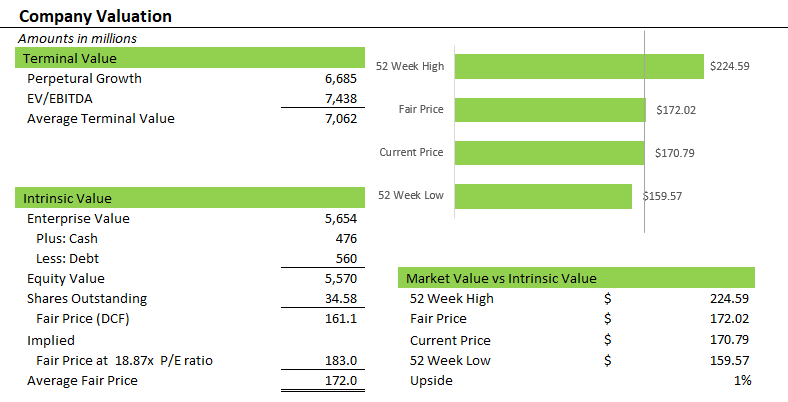

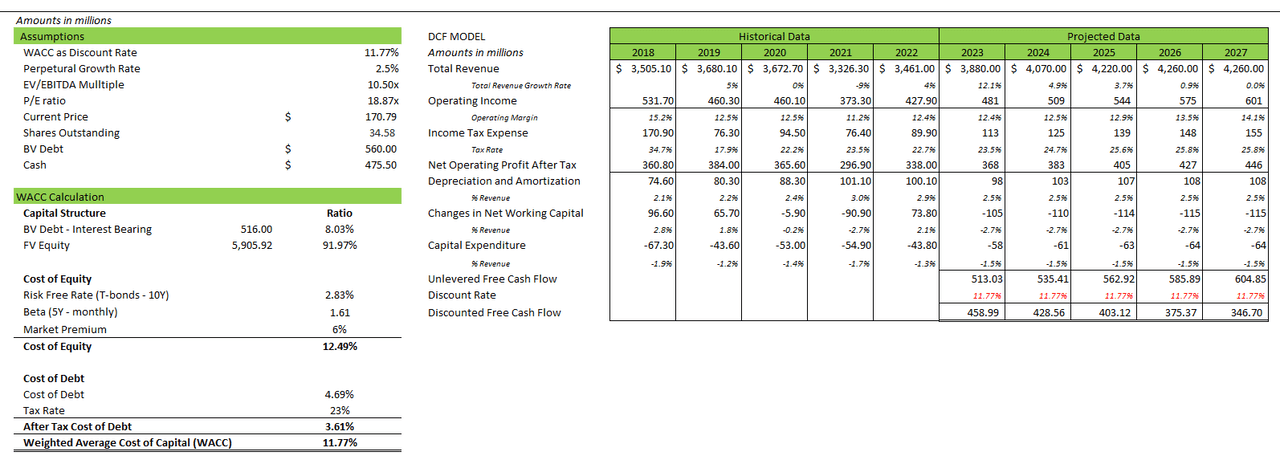

AYI: DCF Model (Source: Prepared by InvestOhTrader)

When I examined AYI’s intrinsic value based on its projected future cash flow, it appears that it is due for a correction; however, when I integrated simple relative valuation and averaged both valuation metrics, I discovered that the stock has very little upside potential at today’s price.

AYI:DCF Model (Source: Data from Seeking Alpha and Yahoo! Finance. Prepared by InvestOhtrader)

The image above are my assumptions that I used to complete my DCF model. My model assumes a revenue growth 5 year CAGR growth of 4.24%, based on analysts’ estimates. I started my estimated operating margin with flat growth and growing up to 14.1% by the end of the model. Although the company is investing heavily on its inventory, I changed the trajectory of its changes in working capital, as shown in the image above, and used its fiscal 2021 figure to project a change in net working capital of -$115 million by the end of the model. Despite generous assumptions, I came up with unfavorable sentiment using DCF analysis due to rising yield which affected my WACC calculation. However, AYI is pursuing an M&A opportunity and with its current market leadership and strong partnerships with large corporations such as Microsoft (NASDAQ:MSFT), I believe that one meaningful acquisition will alter the revenue trajectory, rendering this model obsolete.

The Struggles Continue

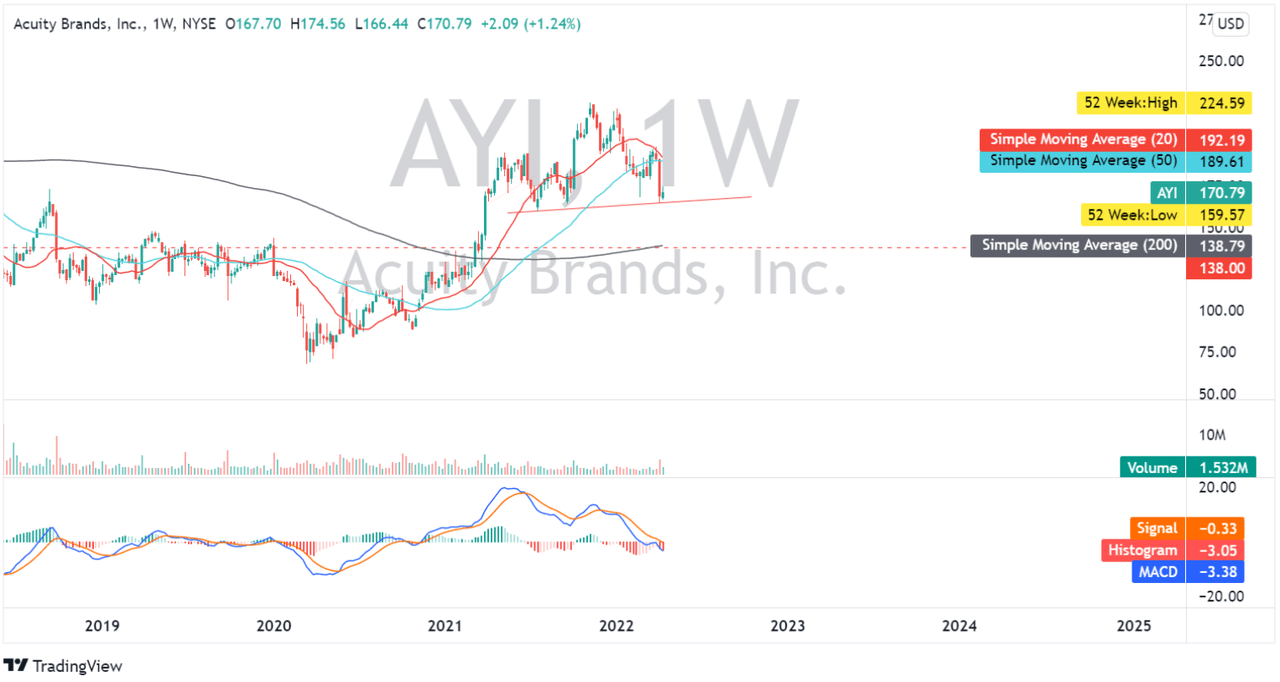

AYI: Weekly Chart (Source: TradingView.com)

As illustrated in the chart above, AYI is currently testing its multi-month support trendline. I anticipate a breakdown in its current sentiment from its valuation, providing an opportunity to purchase AYI at a discount. Additionally, the price has already breached its 50-day simple moving average, and a bearish crossover from the 20-day SMA could indicate short-term bearish price action. I believe that below $160, investors and traders will provide a reasonable entry point and a favorable margin of safety at the $138 level.

Conclusive Thoughts

AYI shows temporary headwinds which affects its current valuations. Despite the bearish catalyst mentioned in this article, the management continued to reassure investors that their capital allocation strategy prioritizes both horizontal and vertical M&A and shareholder value appreciation through dividends and share buybacks, as detailed below.

…our capital allocation priorities are pretty straightforward. One, we want to grow the businesses, we already have two, we want to expand the company via acquisition, both investments in our current businesses, lighting and spaces, as well as add additional businesses over time. The third is to maintain our dividend. And then the fourth is when we see an opportunity to create permanent value through share repurchase. Source: Q2 2022 Earnings Call

To summarize, AYI is trading near a weakening support zone and has valuation concerns, but a potential M&A catalyst could reintroduce light to this stock. AYI is a stock worth keeping an eye on.

Thank you for reading!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.