Acuity Brands: High-Quality Company With Favorable Long-Term Prospects And ESG Focus

Summary:

- Acuity has a history of delivering consistently high returns on invested capital (ROIC) above 30%, indicating efficient use of capital to generate profits.

- The trend towards energy-efficient lighting and smart controls, as well as infrastructure spending, are expected to drive growth in the lighting industry. Acuity is well-positioned to capitalize on these trends.

- With a forward P/E of 14 and EV/EBITDA of 9.5, Acuity is currently trading at a discount to its long-term average valuation.

andresr

Executive Summary

Acuity Brands (NYSE:AYI) is an exceptional business that can be purchased at a highly reasonable price point. The company is a dominant force in the reliable lighting and control sector and has demonstrated excellent returns on invested capital over the years. Its management team has a strong track record of delivering significant capital returns to shareholders through buybacks, and this trend is expected to continue. Despite being a top-performing company, Acuity Brands’ trades at a discount to its peers, and below the market average P/E multiple.

Business Overview

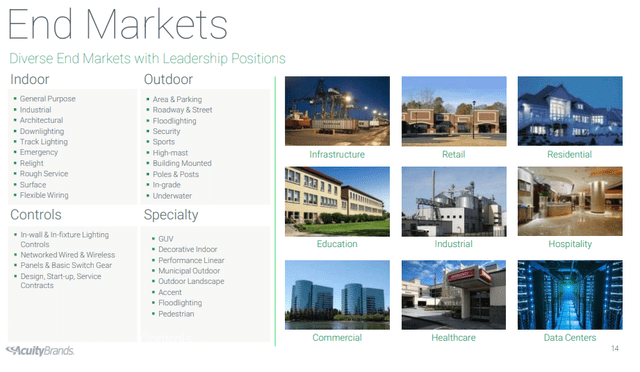

Acuity Brands is a North American-based company that specializes in lighting and lighting control. They produce various light fixtures, lighting controls, and lighting components, and offer systems for managing and controlling lighting, sensors, and HVAC in large facilities such as schools, airports, and warehouses. Their products cover everything from the lights themselves to the fixtures that hold them, the controls that regulate them, and the sensors that provide information. Additionally, their Intelligent Spaces Group supplies systems that allow facility owners to control lighting and other systems, monitor their facility, and track greenhouse emissions.

The majority of Acuity Brands’ sales (98%, with 87% in the US) are focused on the North American market, with a 50/50 split between new construction and renovation projects. 85% of their revenues come from non-residential sales. In the lighting market, they are a leading provider of commercial, outdoor, industrial, and life safety lighting, as well as the fourth-largest provider of residential lighting. They offer both commodity and specialty products and have 22 manufacturing facilities, mostly located in North America, and 12,000 employees (Source: Acuity Form 10-K). Acuity Brands targets independent sales agents, electrical distributors, and retailers through their sales channels and prioritizes increasing service levels to distributors. Architects, builders, and contractors are often the end clients for their products. Acuity Brands boasts an extensive range of brands and products, with around 75 new product families introduced to the market each year.

Acuity Brands operates through two segments: Acuity Brands and Lighting Controls “ABL”, and Intelligent Spaces Group “ISG”.

Acuity Brands and Lighting Controls “ABL”: This segment primarily focuses on the manufacturing and sale of lighting fixtures, lighting control systems, and related products. They offer a wide range of products, including indoor and outdoor lighting fixtures, emergency lighting, decorative lighting, and lighting control systems. Their products are used in both residential and non-residential settings, including commercial, industrial, and institutional applications. Acuity Brands is one of the leading providers of commercial, outdoor, industrial, and life safety lighting in the North American market. They also offer lighting control systems for commercial applications and indoor positioning systems. The ABL segment primarily targets architects, contractors, builders, and electrical distributors.

Intelligent Spaces Group “ISG”: This segment provides lighting and building management systems, including software and services, to help customers improve energy efficiency, reduce operating costs, and enhance the user experience. They offer solutions for controlling lighting, HVAC, security, and other systems, as well as data analytics tools for building performance monitoring. The ISG segment primarily targets building owners, facility managers, and other end customers who are looking to optimize the energy consumption and functionality of their buildings. ISG is a smaller but rapidly growing part of Acuity Brands’ business, and therefore has a relatively minor impact on the company’s overall financial results. In the fiscal year 2022, the segment generated $216 million in revenue, which represents about 5% of the company’s total revenue. The company is forecasting low to mid-teen revenue growth for this segment, with adjusted operating margins in the higher teens to low twenties.

Acuity Investor Day

Strong Financial Profile

Acuity Brands has a history of delivering strong capital returns to its shareholders. One of the key metrics that the company uses to measure its capital efficiency is ROIC, or return on invested capital. Adjusting for excess cash and non-tangible items, Acuity has consistently maintained an ROIC above 30%. This indicates that the company has been able to generate significant returns on the capital it has invested in its business. Additionally, Acuity has consistently generated free cash flow over the past decade, with on average 98% of earnings converting to leveraged free cash flow. Both leveraged and unleveraged free cash flow yields have been around 6% in recent years, which is an attractive valuation for a stable and growing company. These strong capital returns have helped Acuity build a reputation as a solid long-term investment opportunity for investors looking for steady returns.

Acuity’s strong brand recognition and reputation for innovation also set it apart from competitors in the industry, making it less of a commodity business. The company invests heavily in research and development, consistently introducing new and advanced lighting and control technologies. In addition, Acuity has a strong focus on customer service and offers a range of value-added services such as design assistance, project management, and technical support. These factors not only contribute to the company’s ability to differentiate itself in the market but also to its ability to command premium pricing and maintain strong margins. Overall, Acuity’s strategic focus on innovation and customer service helps to insulate the company from being viewed as just another commodity lighting provider and maintain consistently high ROIC.

ESG

Acuity Brands is committed to sustainable and responsible business practices, and has made significant efforts to integrate environmental, social, and governance (ESG) factors into its operations. The company has established several ESG initiatives, including the development of energy-efficient lighting solutions, reducing greenhouse gas emissions, and improving its supply chain sustainability. Acuity has also been recognized for its sustainability efforts, including being named to the Dow Jones Sustainability North America Index for three consecutive years. The company’s ESG efforts are aligned with its business objectives, as they help to drive innovation, reduce costs, and enhance brand reputation. This commitment to ESG is not only beneficial for the environment and society, but it can also help to attract and retain customers and investors who prioritize sustainable and responsible practices.

Secular Tailwinds

The lighting industry is experiencing several secular tailwinds that are expected to drive growth over the coming years. According to a report by MarketsandMarkets, the global smart lighting market is expected to grow at a CAGR of 21.0% from 2020 to 2025, driven by factors such as increasing demand for energy-efficient lighting systems and the growing popularity of home automation systems. Additionally, the LED lighting market is expected to reach $127.9 billion by 2027, growing at a CAGR of 13.4% from 2020 to 2027, according to a report by Grand View Research. This growth is expected to be driven by factors such as the increasing demand for energy-efficient lighting solutions, the reduction in the cost of LED lights, and government initiatives aimed at promoting the adoption of LED lights. Furthermore, the increasing demand for connected lighting solutions, which allow for the integration of lighting systems with other building automation systems, is expected to drive growth in the industry. Overall, these secular tailwinds provide a favorable backdrop for Acuity to continue growing its business in the coming years.

Valuation

Acuity’s current valuation presents an attractive opportunity for investors looking for long-term returns. The company is currently trading at a forward PE of 14, which is below its long-term average of 17.7, and an EV/EBITDA of 9.3, compared to its long-term average of 10.5. Assuming no lift from acquisitions, revenues are expected to grow at 7% while margins stay flat and share repurchases decelerate to 4% a year. With a slight multiple expansion to a 17 PE, which is still below its long-term average, this can result in a high teens IRR or a stock price of $263 in 2024. Overall, this suggests that Acuity is currently undervalued and has the potential for significant future growth.

Risks

Risks associated with an investment in Acuity Brands include:

A slowdown in the economy: Acuity Brands’ performance is closely tied to the health of the economy, and a slowdown or recession could result in reduced demand for its products and services.

Dependence on the construction industry: The company’s revenue is heavily dependent on the construction industry, which can be cyclical in nature and subject to unpredictable changes in demand.

Intense competition: The lighting industry is highly competitive, with numerous players competing on price, quality, and innovation. Acuity Brands may not be able to compete effectively against larger or more established competitors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AYI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.