Acuity Brands: Sales Growth Recovery Before A More Optimistic Rating

Summary:

- Acuity Brands Inc.’s share price has remained stable, but down 9% in the last 12 months.

- Short interest in AYI has grown to over 7%, potentially weighing on the share price in the short term.

- AYI needs to show top-line improvements quickly and demonstrate strong dividend raises and top-line growth for increased shareholder value.

Bangkok/iStock via Getty Images

Investment Rundown

The share price for Acuity Brands Inc (NYSE:AYI) has been incredibly stable this year as opposed to many other companies. The shares are down around 9% in the last 12 months but have stayed largely the same in the $150 – $170 range it seems. The most recent quarter from the company showed strength in the bottom line as margins expanded and AYI beat EPS estimates. On the top line, the revenues missed estimates and seem to have been a cause for the lackluster share price action over the last few weeks.

Over the last 12 months, it seems that short interest has grown for AYI and it now sits at over 7%. I think that this could weigh on the share price in the short term and the last quarter didn’t necessarily bring enough comfort or encouraging improvements that I can see the company being anything higher than a hold right now. The market it operates in is likely to grow over the coming decade very well, but AYI needs to show top-line improvements quickly. FY2023 resulted in 1% YoY sales declines, but EPS grew 10%. In the face of rising interest rates, this is a good result, but it doesn’t necessarily translate into significant shareholder value as the dividend yield is under 1% and AYI is instead creating value through buybacks. Despite the solid track record of that, the market doesn’t seem to care as the share price hasn’t moved much as discussed. Strong dividend raises and top-line growth are my key areas to watch, and until something major happens there I am sticking with my gut and calling AYI a hold here.

Company Segments

AYI is a leader in delivering cutting-edge lighting and building management solutions, catering to diverse markets across North America and beyond. The company’s operations are structured around two key segments: Acuity Brands Lighting and Lighting Controls (ABL), and the Intelligent Spaces Group (ISG).

Within the ABL segment, AYI offers a comprehensive range of commercial, architectural, and specialty lighting solutions. It’s not limited to just lighting products; the segment also provides an array of lighting controls and components designed for a multitude of indoor and outdoor applications, ensuring the perfect balance of aesthetics, energy efficiency, and functionality in various environments.

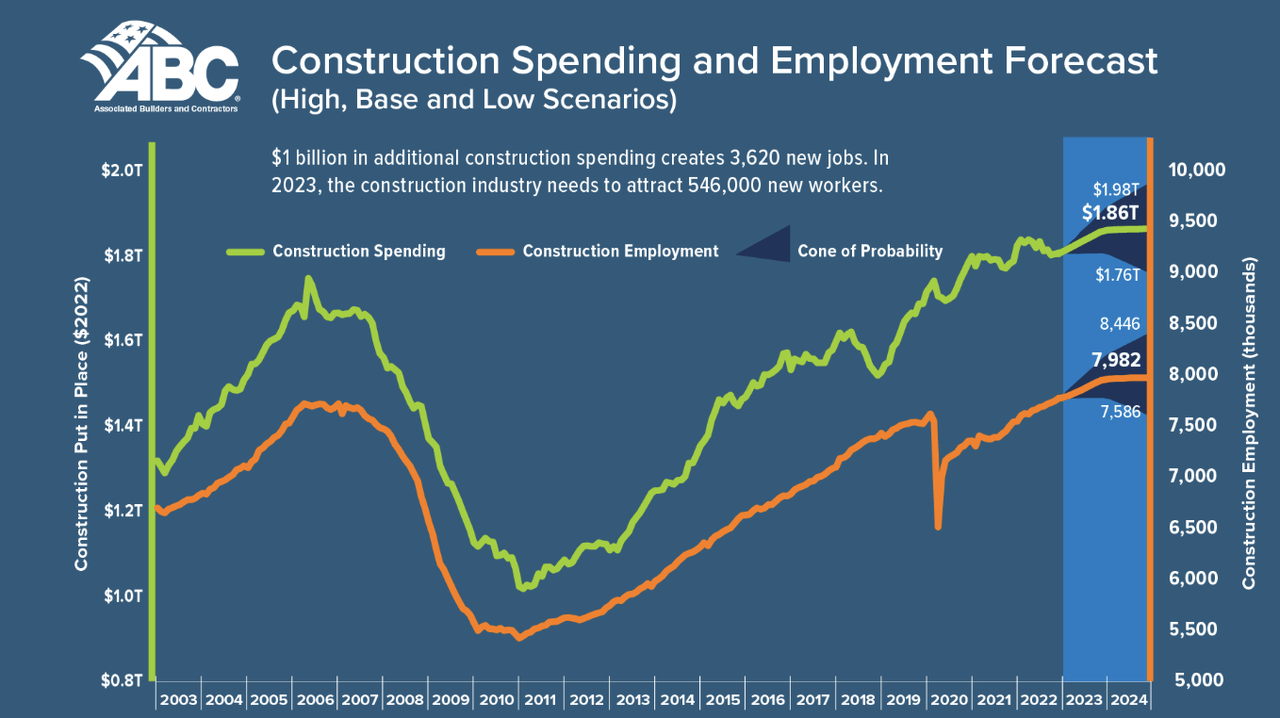

What a lot of investors may have on their mind is a strong recovery in the construction sector as that would likely result in boosted demand for AYI. The contusion and residential sector continues to be under a lot of pressure and I don’t see this as stopping quite soon. The rise in interest rates has caused demand to falter as capital becomes too expensive to acquire. Long-term this is just a bump in the road and not something that will reduce the investment case into something like a sell rating.

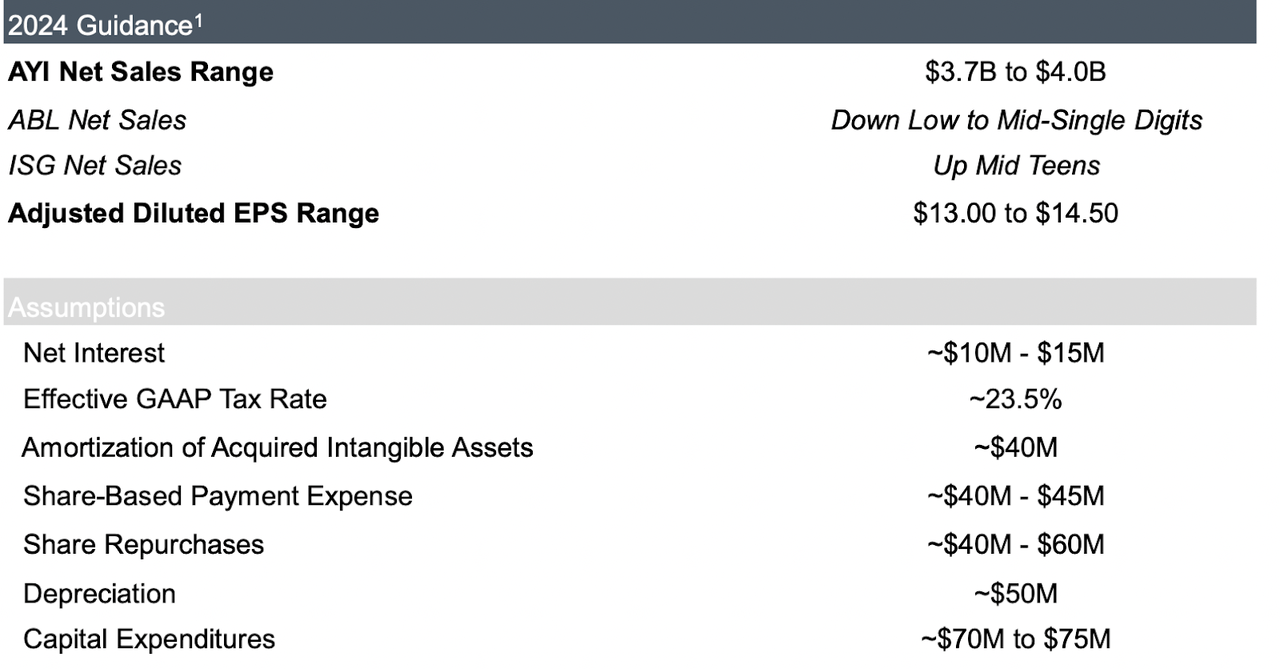

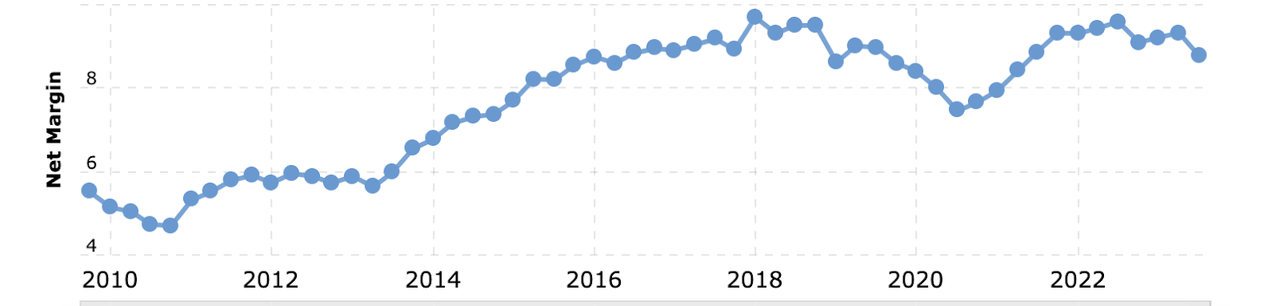

As far as the outlook goes for AYI right now it seems quite lackluster. FY2024 seems unlikely to post a YoY growth on overall sales as estimates come in at $3.85 billion. With the market cap at just over $5 billion, AYI is now trading at an FWD p/s of 1.3 which is a premium of 6% to the broader industrial sector. This is another factor that supports a hold right now, the fact that AYI doesn’t necessarily provide enough of a discount on some metrics. I may trade 28% below based on earnings, but that doesn’t help when the top line isn’t growing. Net margins topped out last year at 9.59% and I don’t think AYI is going to surpass that in the short term. Not when the demand for the sector is declining.

Earnings Highlights

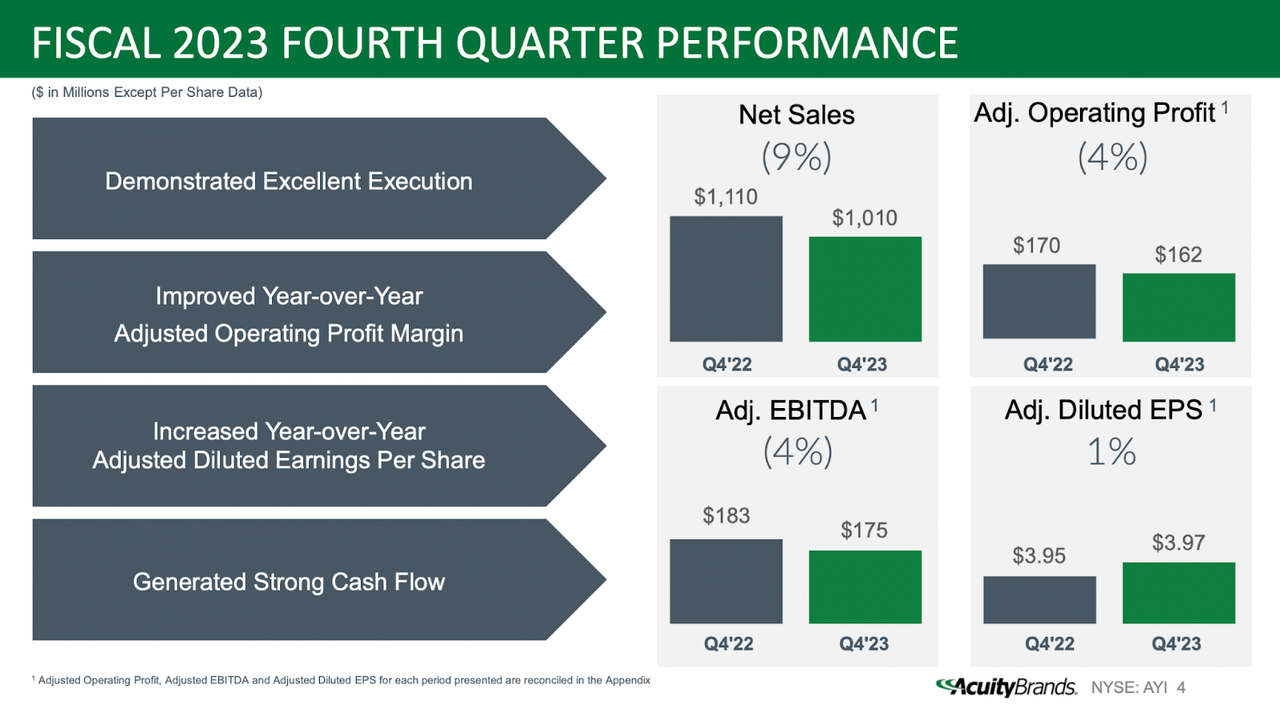

During the third quarter of 2023, AYI faced significant hurdles due to persistent lead-time normalization trends and challenging macroeconomic conditions, which led to a notable 5.7% year-over-year reduction in sales, amounting to $1 billion. Within the Acuity Brands Lighting and Lighting Controls (ABL) segment, sales saw a decline of 6.7% year-over-year, totaling $940.7 million. For the fourth quarter of 2023, it seems there is some recovery at least for the bottom line as it grew to $3.97 and beat out estimates. Revenues was largely stagnant at $1 billion. This isn’t necessarily a bad thing, the company may have seasonal results sometimes, and seeing a lack of that makes for one case future revenues a little easier to predict.

From the last quarter, I think that the results weren’t perhaps where one would have hoped. Lacking sales growth showed what most were expecting from a softer market environment in construction. The positives came in the retention of EPS at least which was aided by the number of buybacks the company is doing. FCF has however been solid which has further aided the flexibility of the company, but I don’t think it’s enough to raise the investment case yet. In coming reports, I will be looking for sales growth at first, once that is clearly improving then it’s a matter of growing margins even more.

Risks

While their dedication to improving operational efficiencies is evident, it’s important not to overlook the significant 9% decline in their annual net sales. This decrease in sales volume, influenced by a combination of reduced demand and macroeconomic factors, underscores the need for a thorough evaluation of the company’s path to growth. This assessment should encompass strategies to navigate and adapt to the evolving market landscape while capitalizing on opportunities to enhance both revenue and overall performance.

While the previous quarter witnessed robust margin expansions for the company, the looming question arises: will this trend persist in the face of potentially rising interest rates? If these margins begin to contract as interest rates climb further, it’s conceivable that the market could relegate AYI to a lower valuation multiple, akin to the range of 10 to 13 where it has remained in recent months. This scenario may constrain immediate upside potential, underscoring the rationale for maintaining a “hold” position until a discernible trajectory of sustained margin growth becomes evident. Careful monitoring of margin performance in the changing economic landscape will be pivotal in guiding investment decisions.

Final Words

The construction sector has been under a lot of pressure as the interest rates rose in the US. This seems to have hurt the top line of AYI, which has seen stagnating and even declining results. The bottom line seems to have continued to be resilient though and I think he is a guiding light in the short-term, but not necessarily one that enhances the rating to something above a hold. Until there is a reversal in the sales trend and further fundamental improvements in the sector demand I will be viewing AYI as a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.