Summary:

- The company’s revenue in 2023 should benefit from strong backlog levels, higher price realization, and investments in product vitality and service levels.

- The margins should benefit from the higher price realization, improvement in the supply chain, and better service levels but increased commission costs is a headwind.

- The stock is currently trading at a lower valuation compared to its historical levels.

niphon

Investment Thesis

Acuity Brands (NYSE:AYI) is seeing improvements in supply chain constraints, which should help lower lead times and complete its order backlog. This, along with the pricing actions taken over the last few quarters, should benefit revenue growth in 2023. The company should also benefit from investments in product vitality and improvements in service levels. Additionally, the company is making investments in its direct sales team to better position itself to take advantage of the U.S. infrastructure act. This should benefit the company’s revenue in 2023 and beyond. The stock is currently trading at 12.67x FY23 consensus EPS of $13.78 and 12.13x FY24 consensus EPS estimate of $14.39, which is lower than its five-year average forward P/E of 14.60x. I believe the stock offers good growth prospects at attractive valuations.

AYI’s Q1 FY23 Earnings

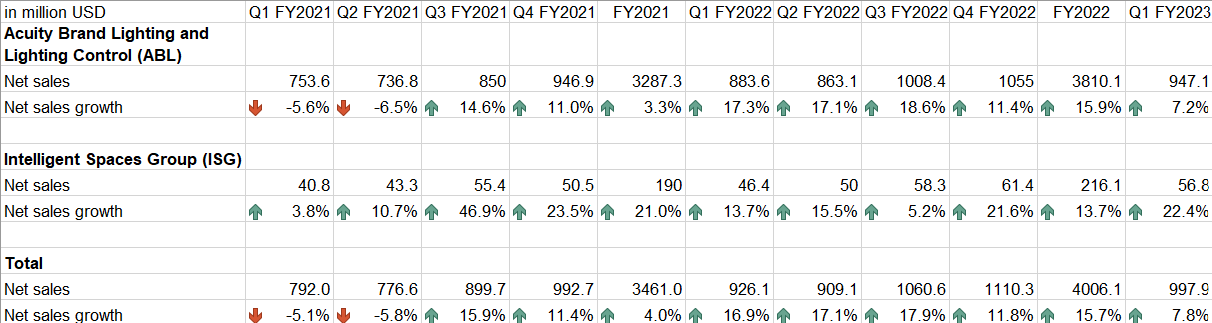

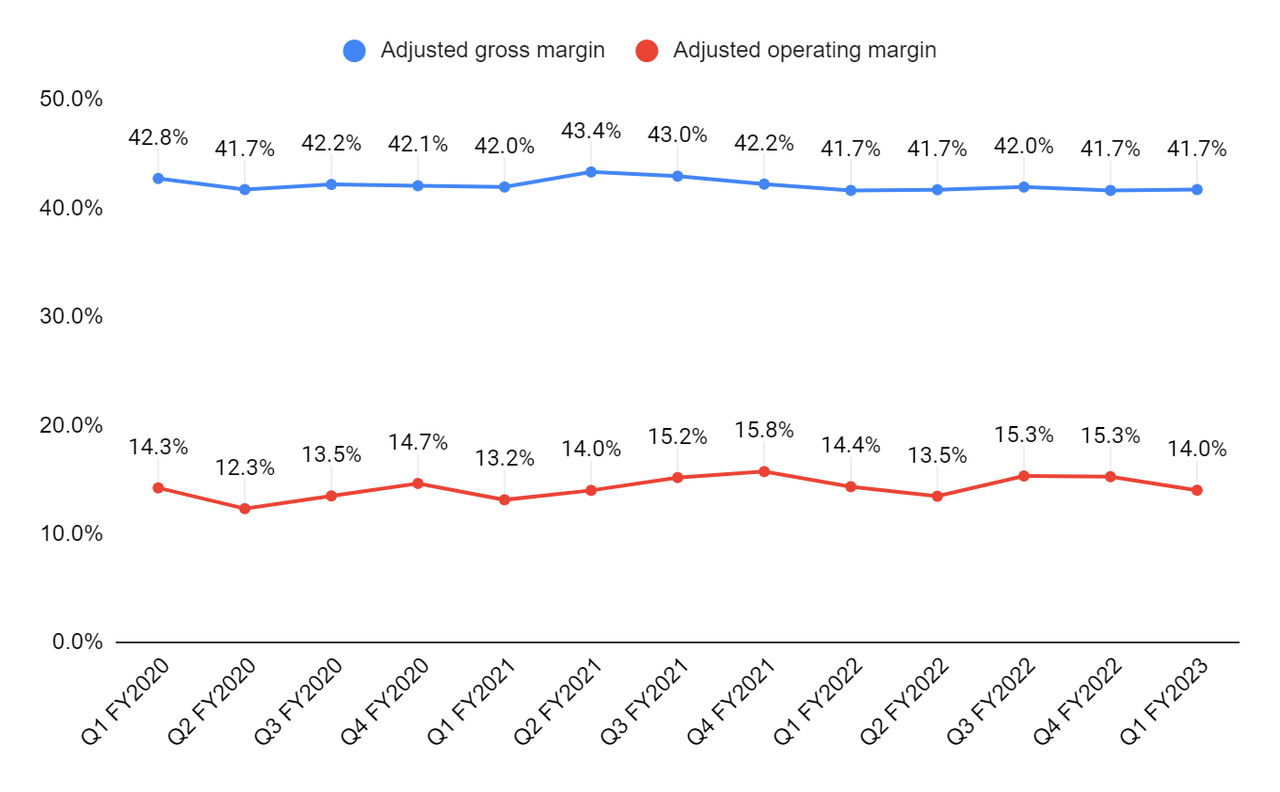

Recently, AYI reported its first quarter FY23 financial results, which were better than expected. The revenue in the quarter increased 8% Y/Y to $997.9 mn (vs. the consensus estimate of $984.46). The adjusted EPS grew 15% Y/Y to $3.29 (vs. the consensus estimate of $3.02). The revenue growth was driven by price increases and a favorable product mix. The adjusted operating margin was down 40 bps Y/Y to 14% due to an increase in SG&A expenses as a percentage of revenue, partially offset by a flattish gross margin. The adjusted EPS in the quarter benefitted from higher revenues and a lower share count.

Revenue Outlook

AYI’s product vitality initiatives and improved service in both the lighting and space businesses supported the healthy revenue growth in the quarter. The Acuity Brand Lighting and Lighting Controls (ABL) segment’s sales increased 7% Y/Y due to higher price realization and a favorable mix. The Intelligent Spaces Group (ISG) segment’s sales increased 22.4% Y/Y driven by strong demand for building management controls, improvements in the supply chain, and price increases.

AYI’s historical sales growth (Company data, GS Analytics Research)

In the ABL segment, the company is working on its strategy to increase product vitality and service levels through the Contractor Select Portfolio. This portfolio is a collection of the most important everyday lighting and lighting control products and has a selection of products with high product vitality (i.e. improvements to the existing products and the introduction of new products in the market). Some of the brands in this portfolio include Lithonia Lighting, Juno, SensorSwitch, and IOTA. Within this portfolio, the company recently reintroduced an upgraded DSX family of outdoor lighting with superior uniformity and better corner and backlight cutoff control for its commercial clients including schools, retail, and other everyday workspaces. Apart from vitality initiatives, the company is also making progress in improving its service levels, especially with regard to decreasing its lead times and improving backlog conversion rates.

In the ISG segment, the Distech Controls brand is successfully winning new customers and expanding services to its existing customers. The Distech portfolio is winning projects in North America and France. Given the healthy demand for its products, AYI plans to increase the addressable market of Distech by expanding in both existing and new geographies.

Looking forward, I believe the company should be able to grow its revenue during this weakening macroeconomic environment, given its strong backlog levels. AYI’s business is usually not backlog driven but given the strong demand and supply chain disruptions, it currently has built quite a bit of backlog. As the supply chain constraints continue to ease, the company should be able to improve its lead time and convert its backlog into sales. Additionally, the pricing actions taken over the last few quarters should benefit the company’s revenue in 2023. The company is also continuing to invest in product vitality and services, which should help it gain market share in this dynamic environment. Further, the company’s revenue should also benefit from the U.S. Infrastructure Investments and Jobs act over the next few years as the projects related to the ~$1.2 trillion funding starts getting executed. AYI is working with its direct sales force to better position its Holophane brand to take advantage of the infrastructure funding. So, I am optimistic about the company’s revenue outlook despite tough macros.

Margin Outlook

The adjusted gross profit margin in Q1 FY23 was flat Y/Y as the company was able to completely offset the material, labor, and other cost increases with price and a favorable mix. The adjusted operating margin declined in the quarter by 40 bps Y/Y due to the impact of strategic decisions regarding commissions. The company increased its direct sales force commissions to position them for the future infrastructure business and secure certain project businesses.

AYI’s adjusted gross margin and adjusted operating margin (Company data, GS Analytics Research)

Looking forward, the company is expected to incur increased commission costs over the next few quarters as it plans to continue its investments in its direct sales force. However, I believe this margin headwind should be offset by higher price realization and the volume leverage from the higher backlog conversion. The company’s investments in product vitality should help it strategically price its products based on their value and improve the product mix. Additionally, the improvement in supply chain constraints should help improve operational efficiency at its production facilities. Overall, I believe the company’s margin can be flat to slightly up in FY23.

Valuation & Conclusion

The stock is currently trading at 12.67x FY23 consensus EPS of $13.78 and 12.13x FY24 consensus EPS estimate of $14.39, which is lower than its five-year average forward P/E of 14.60x. The company’s revenue in 2023 should benefit from strong backlog levels, higher price realization, and investments in product vitality and service levels. It should also benefit from the projects related to the U.S. infrastructure act in 2023 and beyond. The margins should benefit from the higher price realization, volume leverage, improvement in the supply chain, and better service levels, partially offset by commission costs. Given the good growth prospects and lower-than-historical valuations, I believe the stock is a good buy at the current levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written by Sanket B.